January 2026 Update: Calvin and Hobbes

Part I – Summary

January 2026 Update: Calvin and Hobbes

As a child, I remember reading comics in the newspaper. My favorite was Calvin and Hobbes, which told the story of an imaginative six-year-old boy, the former, and his stuffed tiger/best friend, the latter. Having just celebrated 30 years since its last publication, we will look to it as inspiration for our 2025 recap and 2026 outlook. Out of respect for the Watterson estate and copyright laws—there are no actual comics in this post. We strongly recommend you taking few minutes to check them out online if you never have before…

Key Takeaways:

- Happiness isn’t good enough for me! I demand euphoria!

- Three consecutive years of double-digit gains have made investors euphoric.

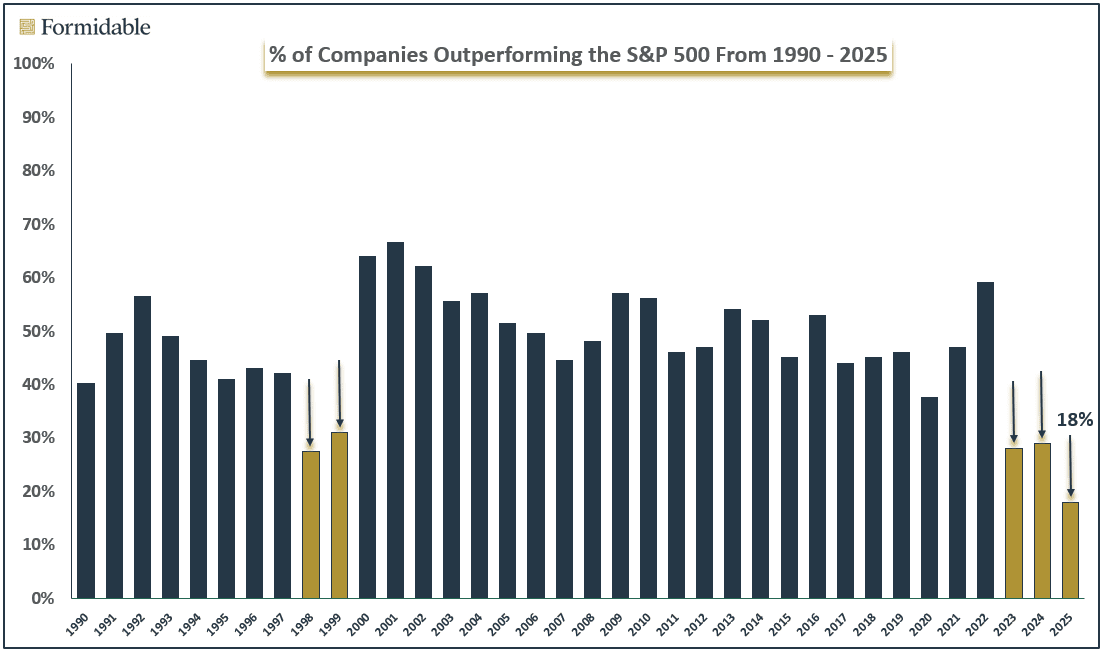

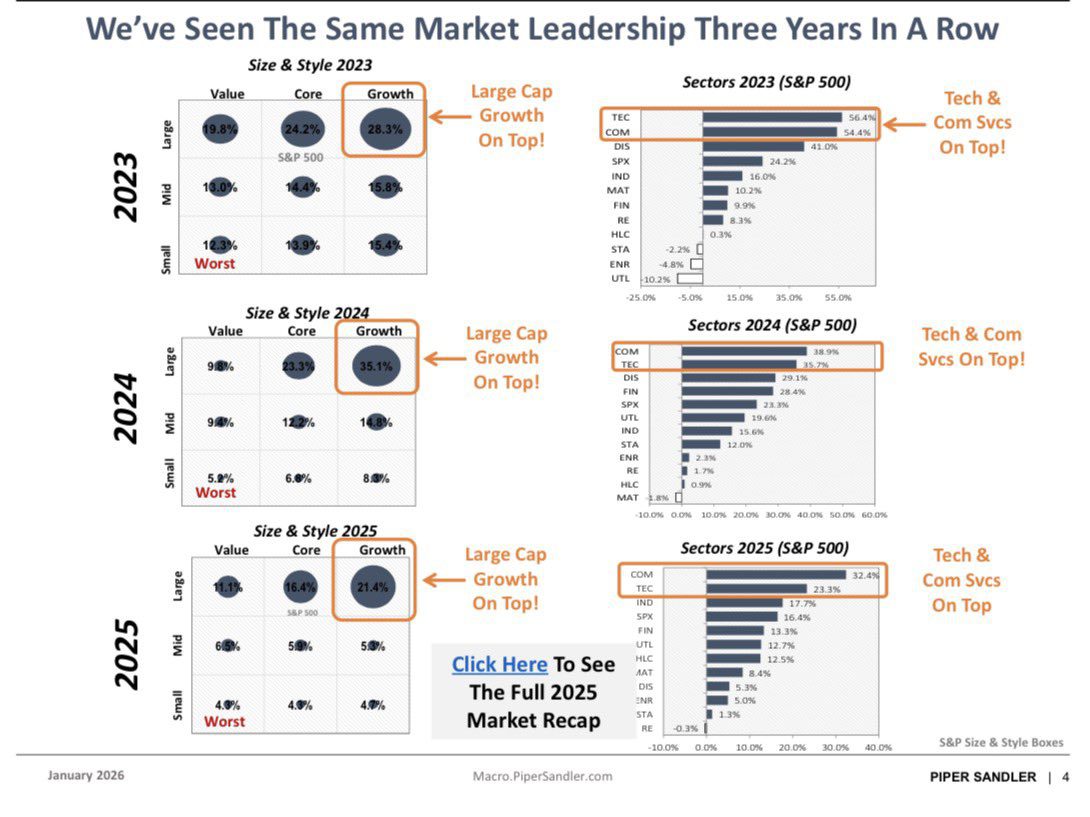

- After two calendar years where only one in three stocks outperformed, 2025 saw fewer than one in five outperform.

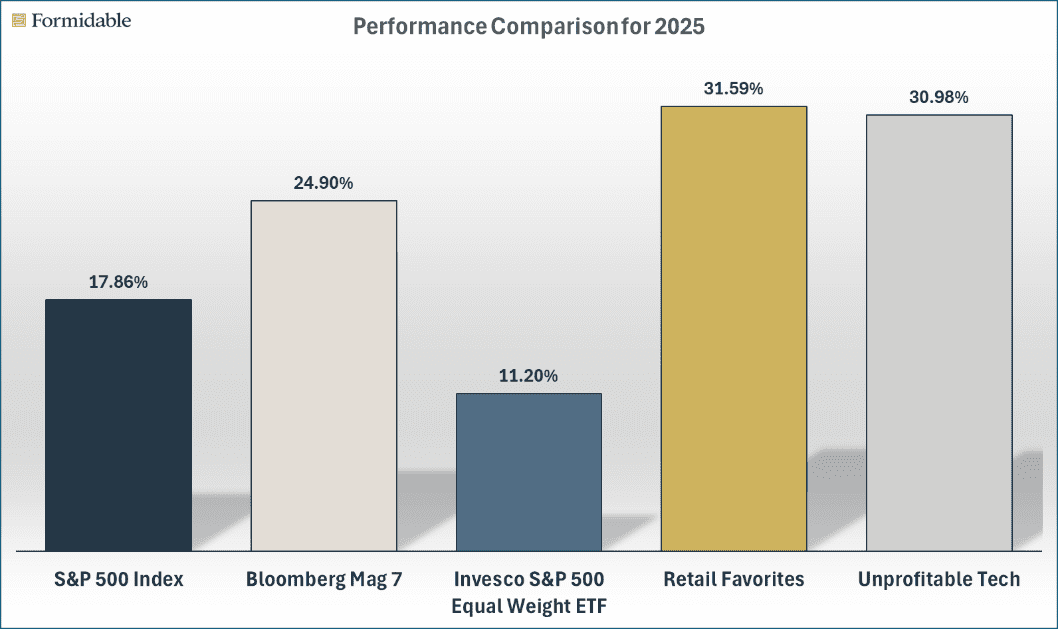

- While much was made of the outperformance of the so-called Magnificent Seven, the best performers were actually the lowest quality, most speculative companies.

- It’s not denial. I’m just selective about the reality I accept.

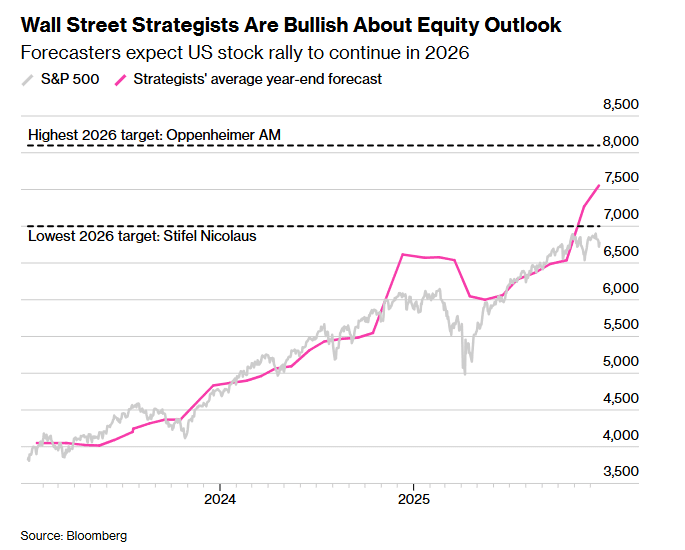

- Wall Street strategists are universally bullish on 2026.

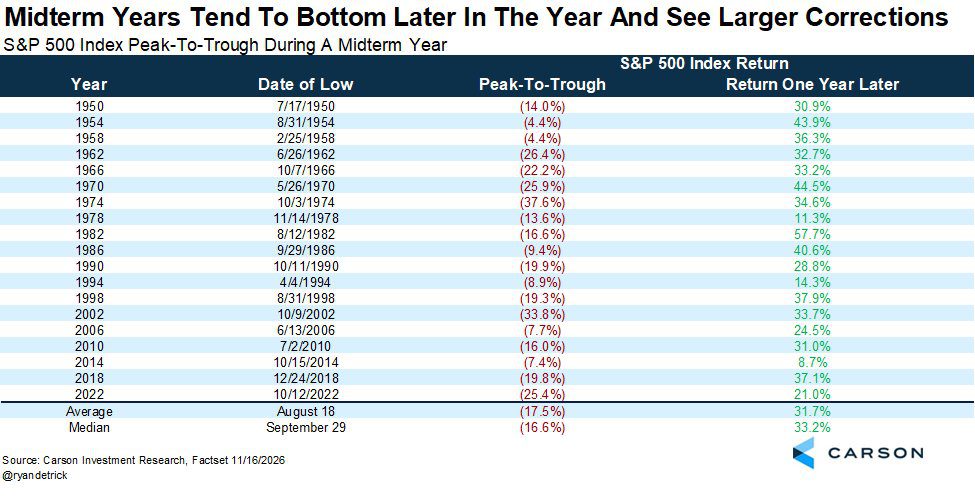

- However, mid-term election years are notoriously volatile.

- Moreover, valuations, though not at bubble levels, are elevated versus history (and not just for the Magnificent Seven).

- Let’s go exploring.

- The main topic investors are exploring is whether the popularity of AI stocks has peaked or can continue.

- 2026 is off to a frenetic start in terms of the news cycle (Venezuela, Fed DoJ probe, Iran, executive action on affordability) with more to come, e.g., tariff ruling.

- Gains so far this year have been led by a broader swath of stocks, with smaller and value companies outperforming for the first time in years, which is a favorable tailwind for our style of investing.

SUMMARY: before you close the email, please know these three things.

- Only 18% of the stocks in the S&P 500 outperformed in 2025, the narrowest market going back to 1990 (see graph below).

- While there is universal consensus around continued economic and market strength in 2026, mid-term election years have historically been volatile.

- While stocks have so far proven impervious to a litany of major headlines and announcements to start the year, further gains at the index level require unabated earnings growth and a continuation of elevated valuations supported by the promise of further Fed rate cuts.

Source: BofA, Bloomberg, Schwab

Part II: Q4 and 2025 Recap – “Happiness isn’t good enough for me! I demand euphoria!”

As we begin 2026, investors are demanding, and getting, euphoria. Three consecutive years of double-digit gains for the S&P 500 have been followed by a strong start to this year.

| Fund/Index | 1-Month | 3-Month | YTD |

| S&P 500 INDEX | 0.06 | 2.65 | 17.86 |

| Invesco S&P 500 Equal Weight E | 0.41 | 1.38 | 11.20 |

| Russell 2000 Index | -0.58 | 2.19 | 12.79 |

| NASDAQ Composite Index | -0.47 | 2.72 | 21.17 |

| MSCI EAFE Index | 3.01 | 4.91 | 32.03 |

| MSCI Emerging Markets Index | 3.00 | 4.76 | 34.29 |

| Bloomberg US Treasury Total Re | -0.33 | 0.90 | 6.32 |

| Bloomberg US Agg Total Return | -0.15 | 1.10 | 7.30 |

| Invesco DB Commodity Index Tra | 0.19 | 2.54 | 8.06 |

Source: Bloomberg (as of most recent month end)

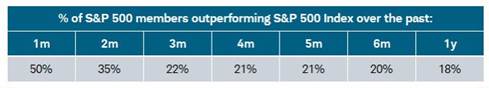

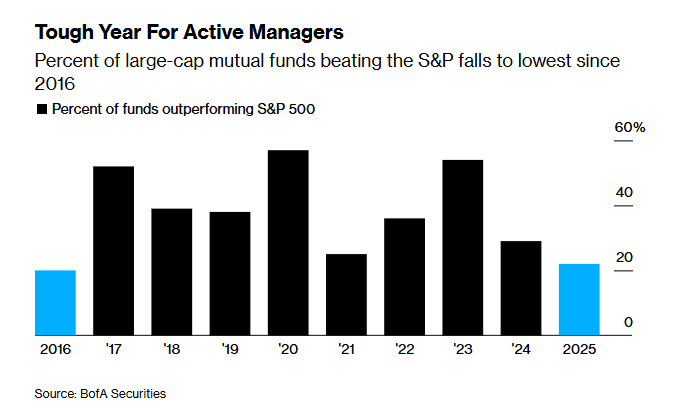

However, not all stocks have been rewarded equally. Over the last 12 months, only 18% of the stocks in the S&P 500 have outperformed the index, contributing to an environment that has been the most challenging time for active managers since 2016, with only around one in five outperforming.

Source: Charles Schwab, Bloomberg (as of January 2, 2026)

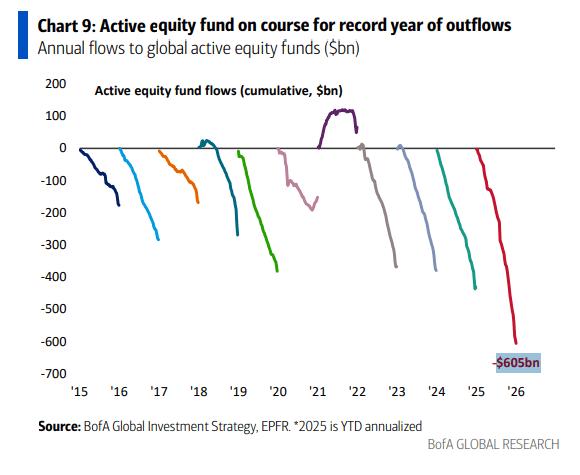

Additionally, outflows from active funds have been at record levels, with most of those dollars flowing into passive equities, further fueling market narrowness.

In addition to passive investments, the best performers have been the most speculative stocks, specifically stocks favored by retail investors and unprofitable technology stocks, many of which have no revenue, either.

Q1 and 2026 Outlook – “It’s not denial. I’m just selective about the reality I accept.”

It seems that a fair number of market experts are being selective in the reality they accept. To wit, from Bloomberg, “Every Wall Street Analyst Now Predicts a Stock Rally in 2026”. Per the article, the average forecast is for a 9% gain next year. Not a single one of the 21 prognosticators surveyed by Bloomberg News is predicting a decline.

One item of particular note as it relates to reality is the mid-term election cycle. Since 1950, the market has suffered a drawdown of, on average, around 17% during mid-term years. Think back no further than the last mid-term, 2022, for a reminder. However, the good news is that unlike in 2022, we are unlikely to be facing Fed rate increases (more later on that front), and returns in the subsequent year have historically been strong.

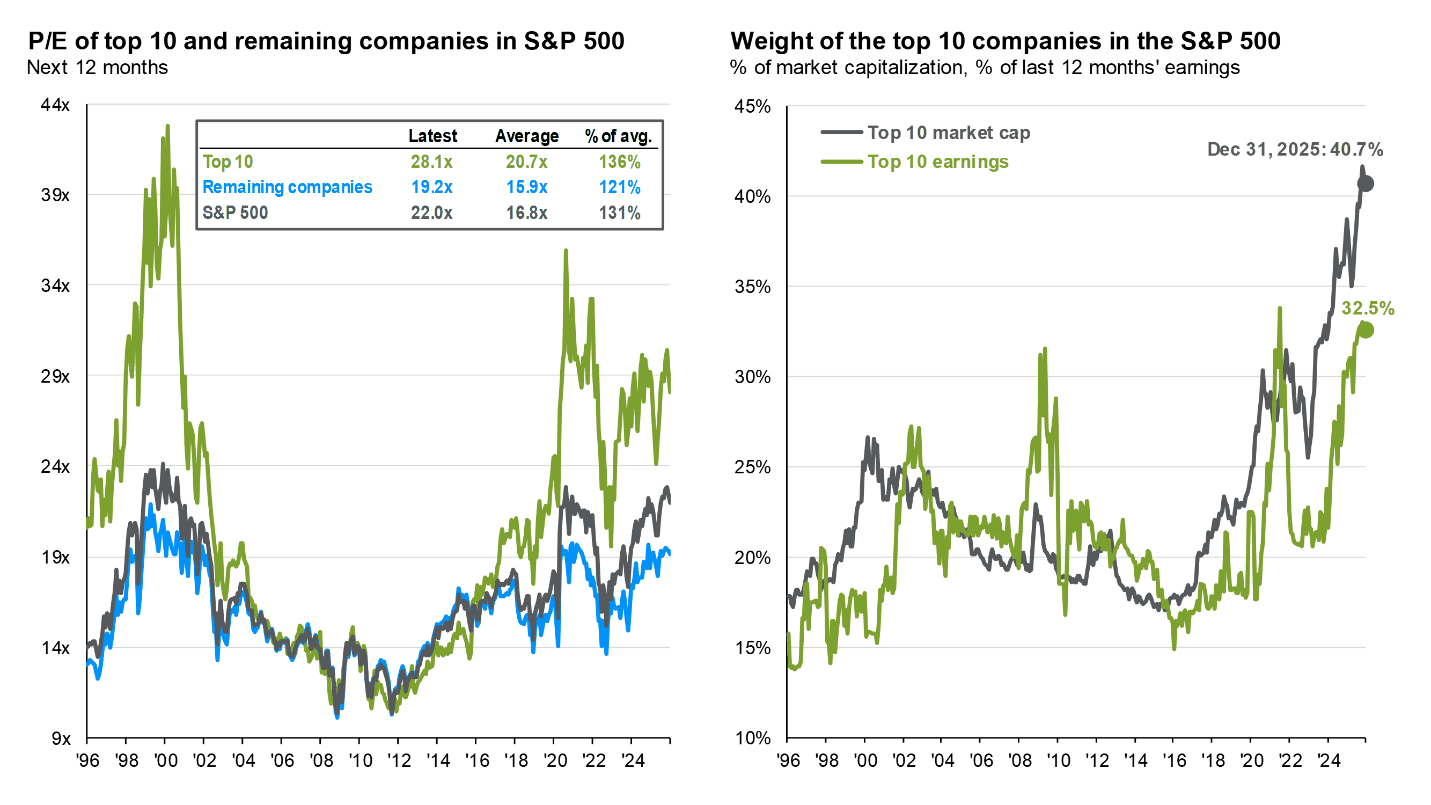

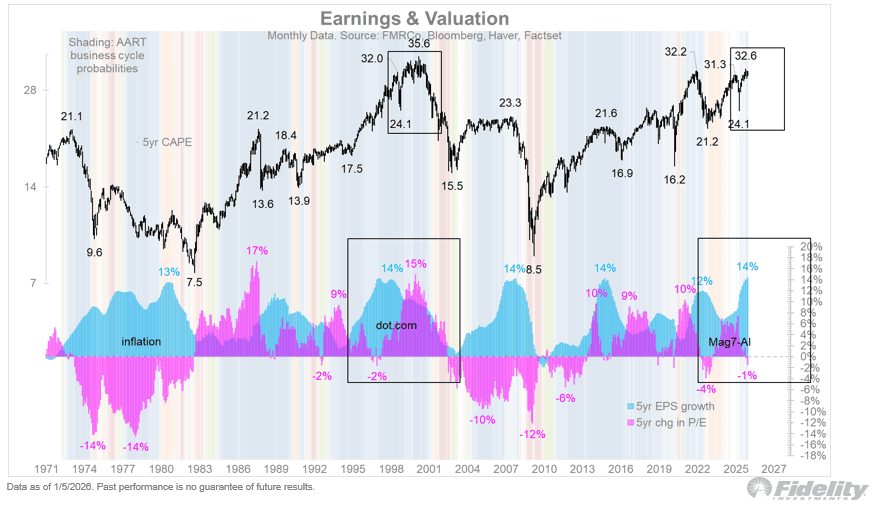

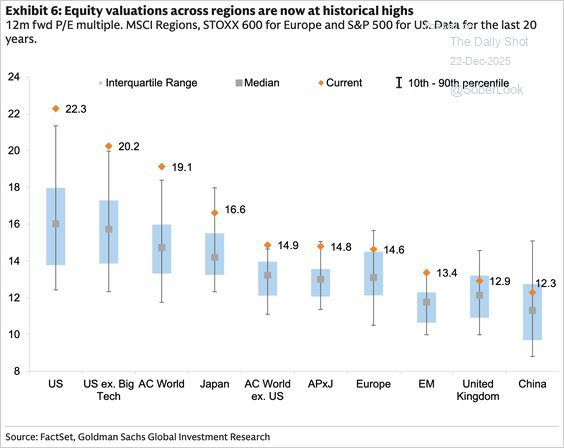

Another is valuation. While it is easy to point to extreme valuations for the biggest companies (28x versus long-term average of 21x), the fact is that the other 490 are also pricy versus history (19x versus 16x long-term average). However, the influence of the largest companies in terms of market cap has never been larger (around 41% of the market cap of the S&P 500). Having said that, it is important to note that the use of the word bubble does not seem too apt at this point. Valuations were far frothier at the height of the internet bubble, and are roughly where they were five years ago, despite the S&P 500 gaining over 80% during that time, albeit both earnings and appreciation have been driven by a handful of stocks.

In terms of the factors we track, three improved into the neutral category (GDP growth, earnings growth, and Fed Policy) while valuations deteriorated. For more details on all of our factors, click here.

| More Negative | Neutral | More Positive | |||

| Inflation | ≈ | ||||

| GDP Growth | → | ||||

| Fed Policy | → | ||||

| Interest Rates | ≈ | ||||

| Credit Spreads | ≈ | ||||

| Stock Multiples | ← | ||||

| Earnings Growth | → | ||||

| Deteriorating | ← | ||||

| Stable | ≈ | ||||

| Improving | → | ||||

Conclusion – “Let’s go exploring.”

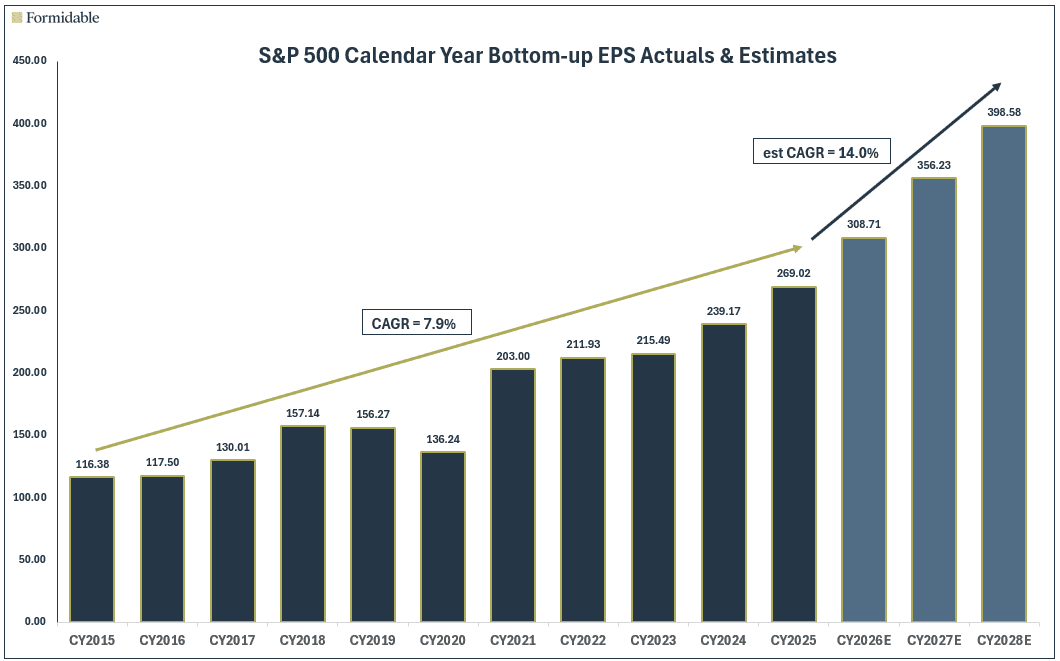

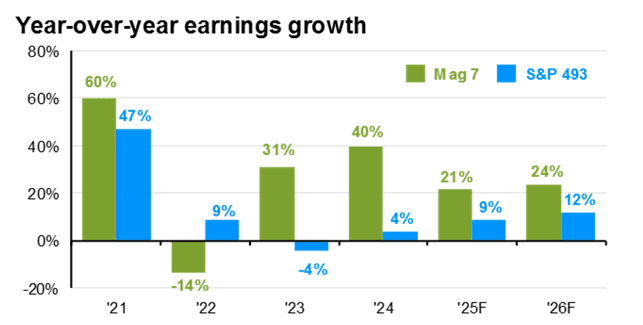

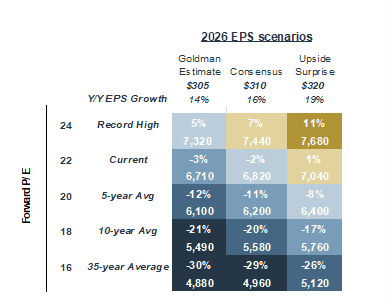

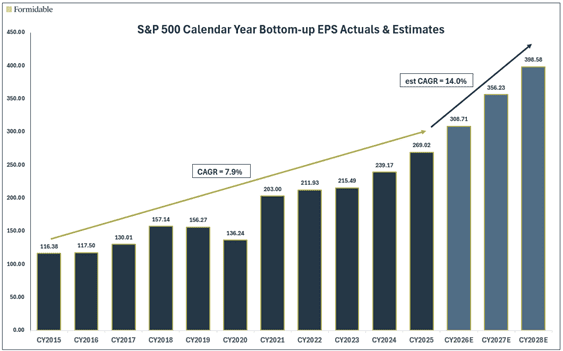

Are AI stocks at the height of their popularity? After all, it has been an incredible run for large growth stocks, where most of the AI-related names reside. Additionally, as mentioned, multiples for these companies are stretched, but earnings (+24%) have also been far better than those posted by the rest of the market (+12%).

Moreover, the five-year growth rate for the S&P 500’s earnings has been about as good as it gets, and those good times are expected to continue, if not get better.

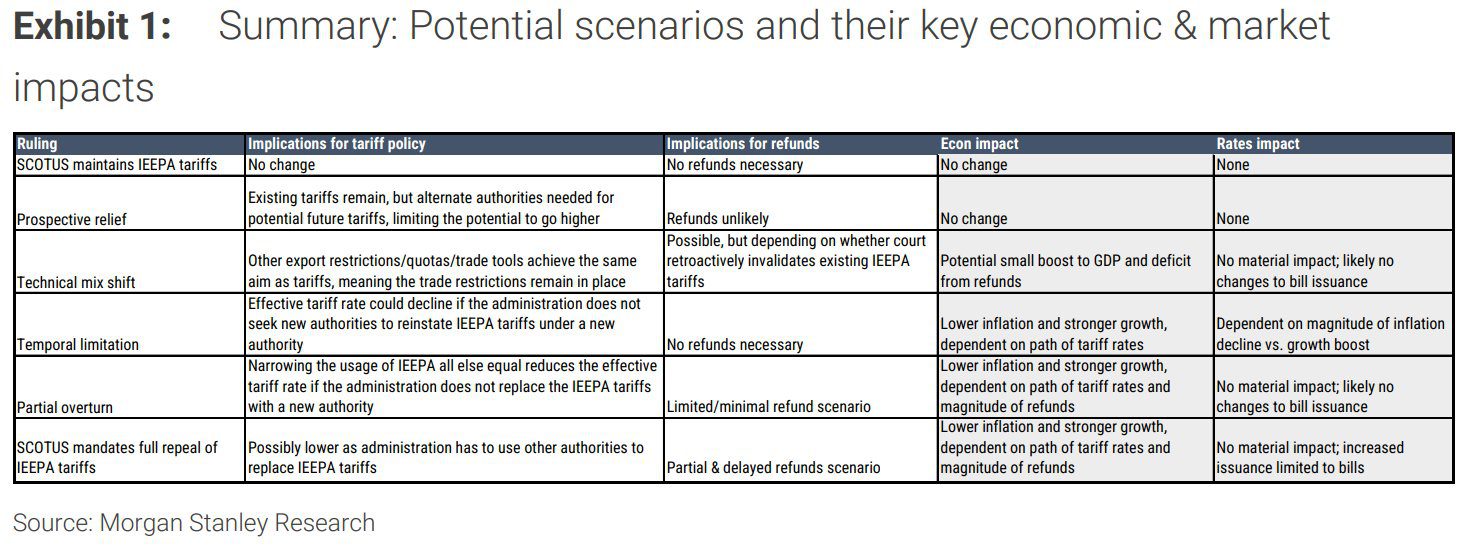

As 2026 begins, investors are being forced to explore their news feeds and history books. On the news front, we have the Supreme Court ruling on tariffs soon (we have pushed out our newsletter twice waiting for the ruling, but still, we wait). However, potential outcomes are well summarized here:

We also have the President tweeting about housing affordability, defense spending, and credit card interest rate caps, not to mention intervening in Venezuela as part of the so-called Trump corollary to the Monroe Doctrine. In the spirit of intervening, domestically we have the Department of Justice taking the unprecedented step of probing the Fed, and the normally apolitical Fed chair Jerome Powell responding.

So far this year, investors have ignored all of these headlines and markets have continued higher. However, based on the following framework, the path to further meaningful gains is predicated on earnings growth exceeding expectations (supported by continued GDP growth, fiscal stimulus from the OBBBA, and elevated margins from AI) and stocks achieving record valuations (supported by more Fed rate cuts).

JP Morgan’s CEO, Jamie Dimon, summarized the situation well on the company’s earnings call, “The U.S. economy has remained resilient. While labor markets have softened, conditions do not appear to be worsening. Meanwhile, consumers continue to spend, and businesses generally remain healthy. These conditions could persist for some time, particularly with ongoing fiscal stimulus, the benefits of deregulation and the Fed’s recent monetary policy. However, as usual, we remain vigilant, and markets seem to underappreciate the potential hazards—including from complex geopolitical conditions, the risk of sticky inflation and elevated asset prices.”

Data as of January 6, 2026; Source: Bloomberg

On the other side of the equation, sometimes there is too much math. From Akre Capital, “According to Durable Capital, 80-90% of the institutional trading that takes place when a company reports earnings is now driven by “pod shops” such as Citadel or Point72 that incentivize investors on one-to-three-month time horizons, or quant firms whose trading algorithms may not be based on fundamental analysis. AI will only accelerate this trend.”

We believe our approach, focused on a strong combination of yield, growth, and reasonable valuation, is a solid middle ground. To paraphrase Calvin, 2026 is a year full of possibilities. We have started with a modicum of broadening, with the average stock gaining ground on the top-heavy index. Smaller and mid-cap stocks, quality, and value are showing signs of outperformance to start the year, and we are optimistic that after years of trudging uphill we may finally have some momentum with us. As always, our job is to keep our hands on the sled and steer around any obstacles put in front of us.

Part III: In-depth analysis of Key Factors

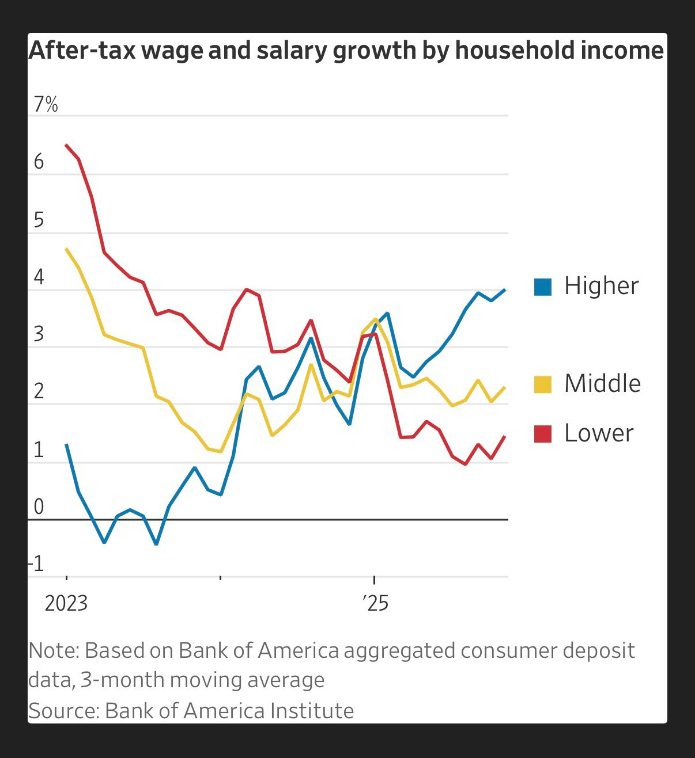

- Inflation – Negative but stable. We have to leave this metric here. The stats for November were largely made up due to the government shutdown, so despite a lower headline number we are incredulous. Also, we are still at a point where inflation for key goods and services is outpacing wage growth, putting pressure on lower end consumers.

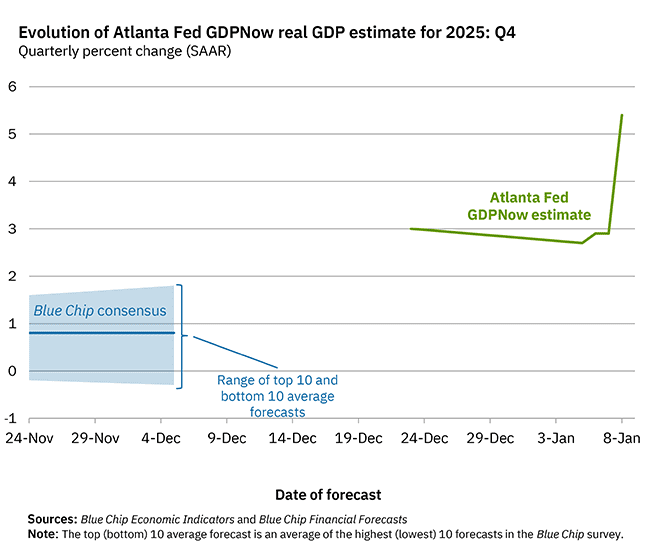

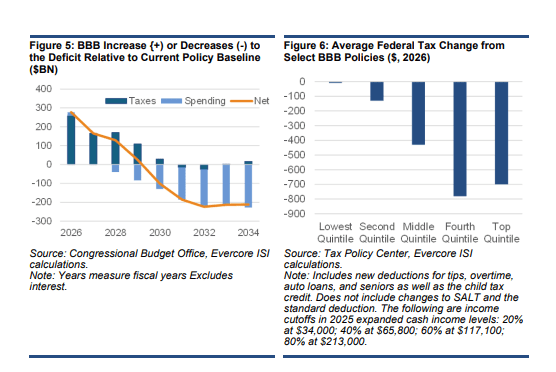

- GDP Growth – Improving and neutral. Headline GDP for Q3 was strong to quite strong. Some have criticized the outsized influence of health care spending, and we would note perhaps that real GDP is overstated because of understated inflation, but just the same the economy has proven resilient in the fact of myriad challenges. However, a 5% growth rate seems a tad aggressive, not to mention widely divergent from consensus forecasts. Future growth may be buoyed by fiscal stimulus from the Republican tax legislation (OBBBA) passed in 2025.

- Fed Policy – Improving and neutral. After a brief period when a cut looked unlikely, the Fed delivered a 25-basis point cut in December. There was quite a bit of dissent, with one Fed governor calling for 50 bps and two for no cut, but 25 was enough to satisfy the market. The path forward will become clearer as (hopefully) the quality of data improves. A new Fed chair will take the helm in May, and the primary job requirement seems to be a willingness to cut rates. Current Fed Governor Stephen Miran is calling for 150 basis points of cuts in 2026; his term ends this month but the four candidates under consideration will certainly be mindful of the administration’s expectations.

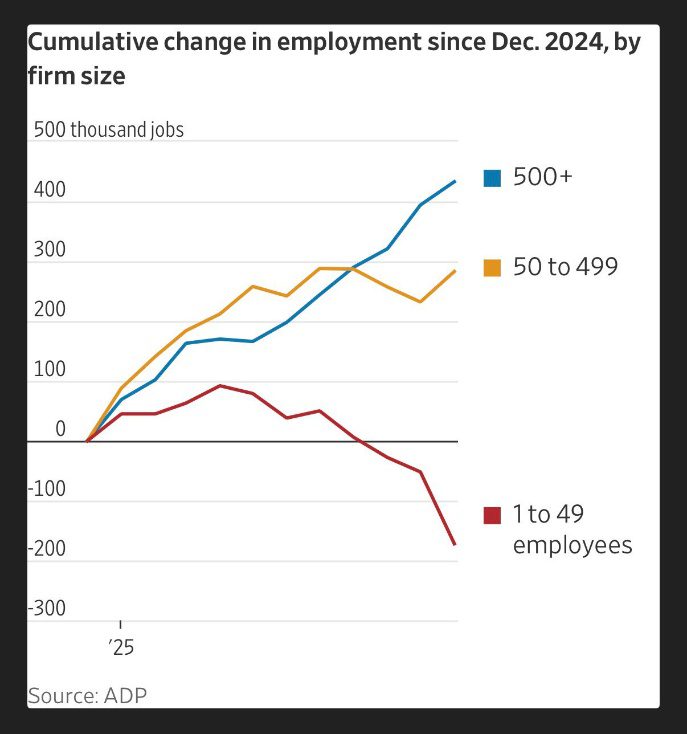

The employment struggles we are seeing, especially for small businesses, bolster the argument for rate cuts, but Miran is more focused on inflation, which he sees as contained.

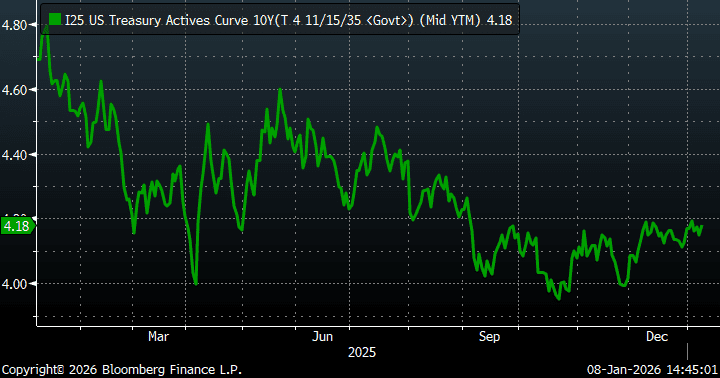

- Interest rates – Negative but stable. At 4.18%, the 10-year yield is lower than where it was to start 2025. Despite the Fed’s rate cut, rates remain above where the administration would like them to be for the purpose of lowering mortgage rates. However, against the backdrop of increasing fiscal deficits, a substantially lower rate may be difficult to achieve.

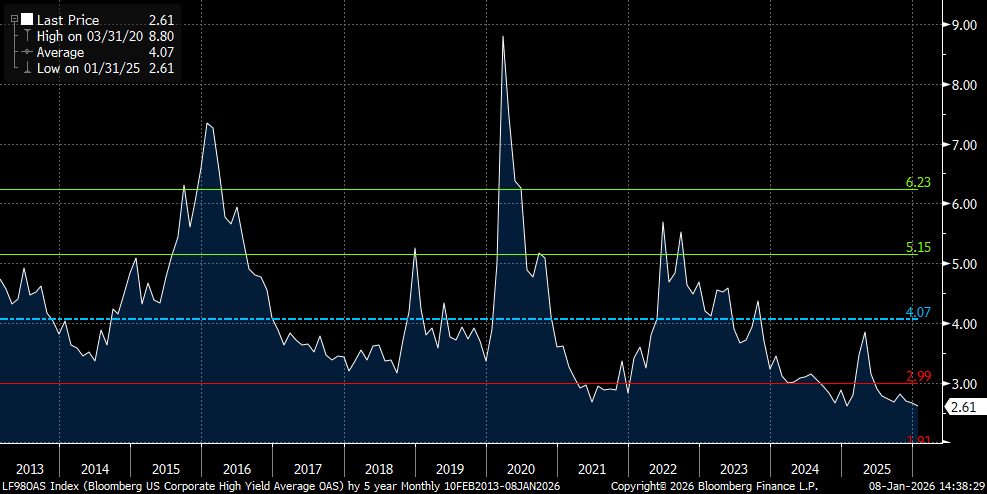

- Credit spreads – Negative but stable. A reminder we use this as a contrarian indicator. In other words, if we see spreads widening into the area above the green line, we may start to view risk/reward more favorably. Both high-yield spreads and investment grade spreads were near record lows at the end of Q4. The market is paying little heed to several high-profile bankruptcies or widening spreads for some AI-related companies.

- Stock multiples – Negative and deteriorating. S&P 500 has approached its 2021 peak. The top 10 stocks are overvalued versus their longer-term history, but below both their 2021 peak and their all-time highs from 2000. The other 490, despite on balance underperforming, are not inexpensive, either. Similar for non-U.S. stocks.

- Earnings growth – Positive and improving. Earnings growth is expected to continue to outpace its historical average. Margins are already close to peak, but perhaps the combination of strong GDP growth with above average inflation can help nominal earnings grow double-digits.

Source: FactSet

READY TO TALK?