March Update: Charge of the Light Brigade

What a difference a month makes. Last month, we used the potential for a Bengals Super Bowl win as our backdrop; sadly, the orange and black fell just short. This month, we are writing as the world and, less importantly, markets, are focused on the blue and yellow of the Ukrainian flag. This region is not new to conflict, having inspired one of history’s most famous martial poems, Tennyson’s The Charge of the Light Brigade.

All in the valley of Death

At this point, no one has a firm grasp on the reality of what is happening on the ground in Ukraine. The pervasive fog of war has not changed much since the same gloom hung over the valley of death during the Crimean War battle of Balaclava that inspired the poem. Opining on the root causes and historical context of the conflict are beyond the purview of this piece, though we will evaluate the financial response to Russia’s aggression and put the event into a broader market context.

The financial response, after initially being limited, escalated significantly. First, Russia was banned from the SWIFT system, which is the plumbing for the global payments. Second, assets of the Russian central bank were frozen, causing the ruble to lose approximately one-third of its value at one point on 2/28/22; this came after the ruble reached an all-time low versus the dollar last week. Additionally, Russia’s private banks and oligarchs have been targeted by sanctions, access to foreign debt markets eliminated, certain exports to Russia have been banned, and air travel has been curtailed.

Militarily, the conflict remains contained, with NATO beginning to provide defense supplies to support Ukraine, but no personnel. However, Russia did escalate its nuclear preparedness to indicate its displeasure with both the economic sanctions and the support being provided by NATO.

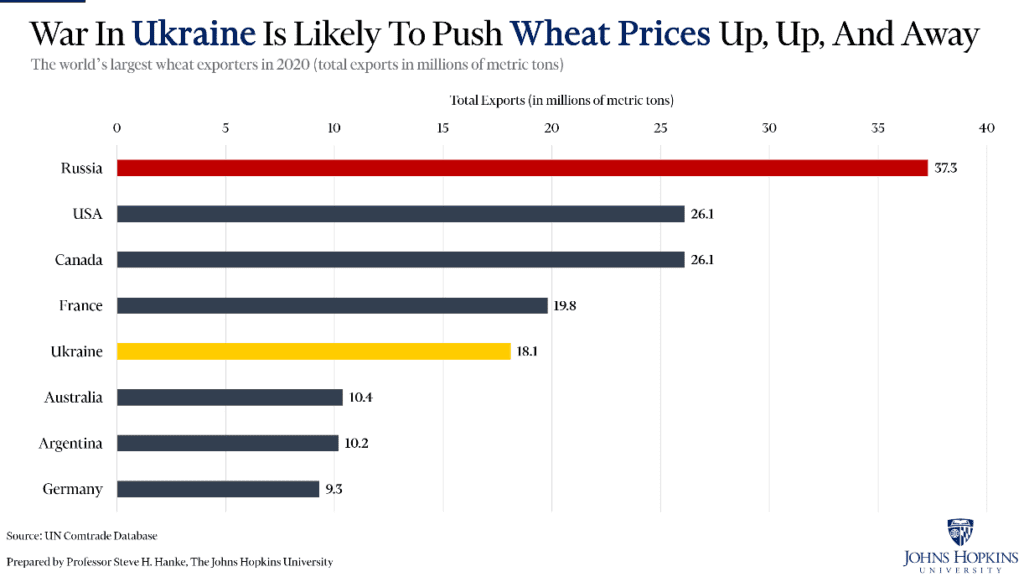

With Russia and Ukraine accounting for less than 2% of global GDP in aggregate, the impact on the global economy of this conflagration would be limited, if not for the backdrop against which it is taking place. Specifically, the elevated inflation readings as a result of the exit from Covid can only be exacerbated by sanctions levied against one of the world’s largest energy producers, not to mention two of the largest wheat exporters.

While sanctions, heretofore, have excluded energy, either side could choose to escalate by either imposing sanctions in the case of the western allies or pulling supply in the case of the Russians.

Forward, the Light Brigade

For those unfamiliar, the Light Brigade was a British cavalry unit whose charge is legendary because it was both heroic and futile. Given the choice between disobeying a suicidal (and apparently miscommunicated) order and death, they chose the latter. As Tennyson writes, “Was there a man dismayed? Not though the soldier knew Someone had blundered. Theirs not to make reply, Theirs not to reason why, Theirs but to do and die.”

In our estimation, the Fed faces a similar conundrum, and one that is far more important than any headline regarding Ukraine (barring a cataclysmic escalation, in which case the market’s reaction would be a secondary consideration at best). The Fed’s battle is against inflation, and although the Fed is theoretically independent, its orders to fight inflation come from the top. As President Biden stated in January, “The critical job in making sure that the elevated prices don’t become entrenched rests with the Federal Reserve.”

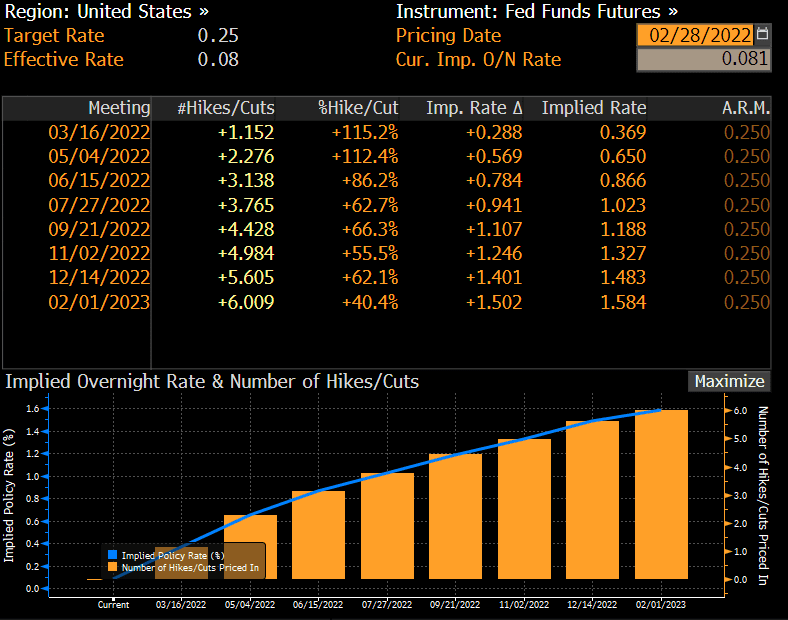

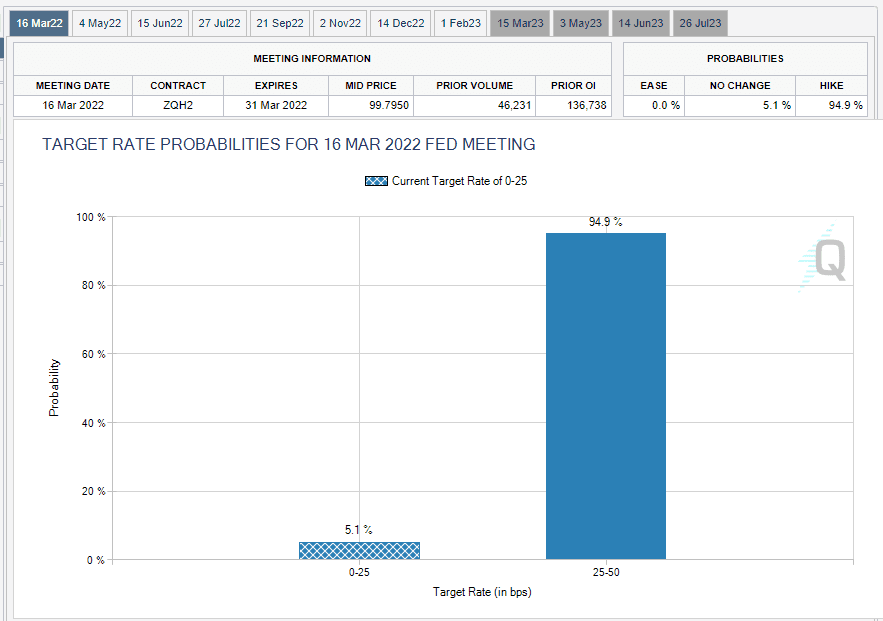

Moreover, current Fed Chair Jerome Powell has not been reconfirmed, and could face a vote of no confidence if he fails to deliver what the Biden administration deems appropriate actions to mitigate higher prices. The Fed has few tools in its arsenal, and given the current geopolitical unrest, the expected magnitude of the first hike has been reduced from 50 bps in March to 25 bps on 2/28 to zero on 3/1.

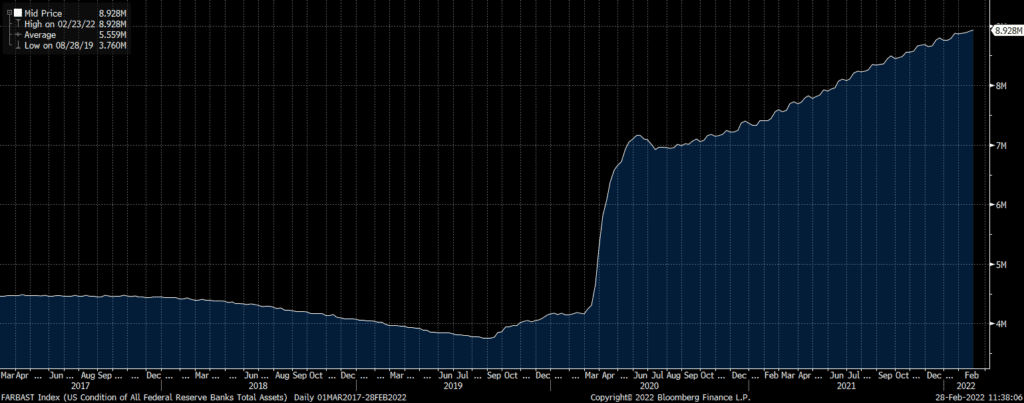

The other tool the Fed has, reduction in its balance sheet, is nowhere near being employed, and despite talk about inflation and interest rate increases, the size of the Fed’s balance sheet has consistently increased this year.

In our estimation, six rate increases over the next 12 months would be a tremendous blunder, and something equity markets simply could not digest; it would be tantamount to a charge into certain death for the so-called Fed put. Goldman Sachs, in apparent homage to Spinal Tap, sees 11 increases.

Cannon to the right of them

The charge was indeed into a valley, specifically one with Russian artillery on three sides. Similarly, we think the Fed faces challenges on three sides. In political terms, the right, i.e., Republicans, though broadly supportive of Powell, are delaying his confirmation due to issues with one of the other nominees. This delay could prove problematic if he fails to deliver on his promise to fight inflation, which could erode support from the left. In other words, he could be the scapegoat for high inflation in a political mid-term year.

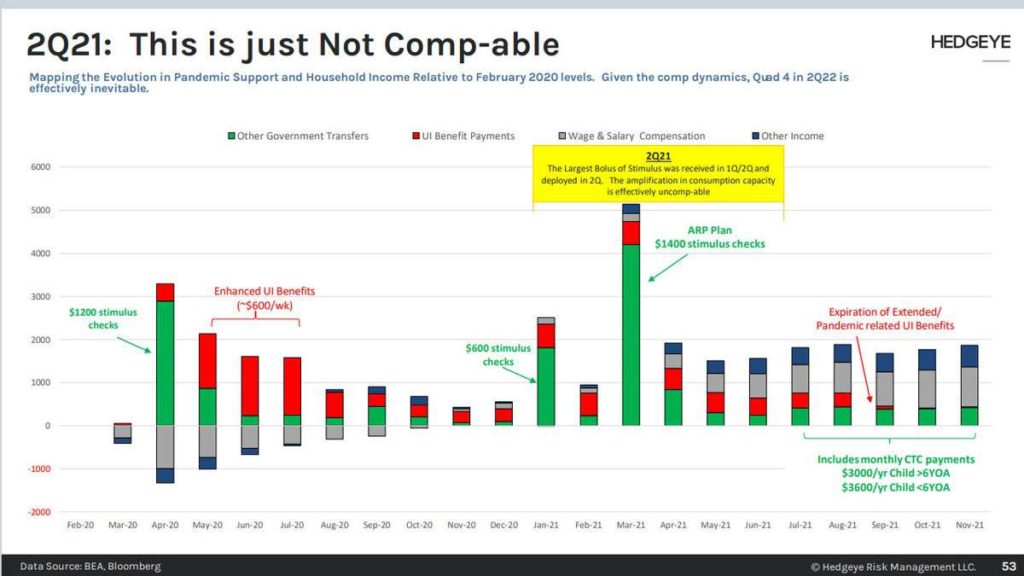

Secondarily, the GOP, and a few Democratic holdouts, have pumped the brakes on further fiscal stimulus. The height of government transfer payments was March 2021, meaning we are going to see a significant headwind to GDP growth from government spending in Q1 2022. In fact, 2022 will see an incremental $1.3 trillion dollar reduction in government spending, good for about 6% of GDP. In other words, Powell is being compelled to increase rates just as fiscal stimulus is withdrawn. More on this later.

Cannon to the left of them

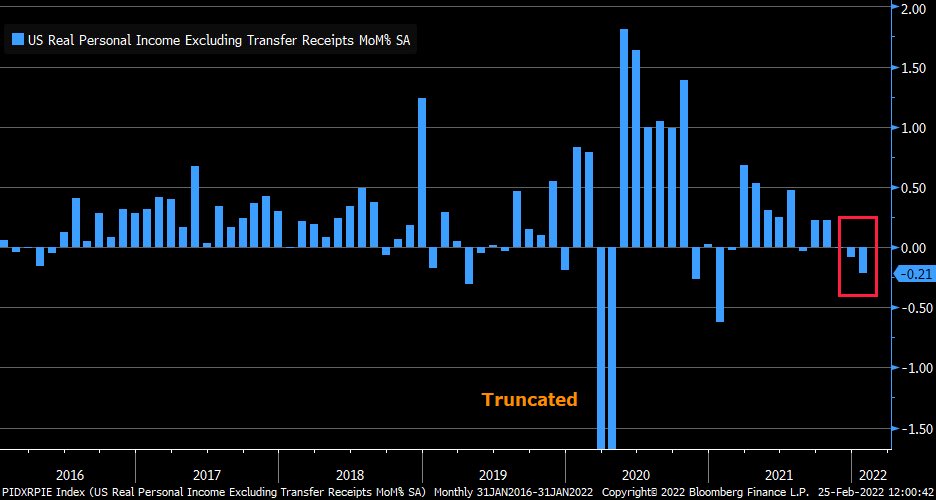

Now, to the pressure from the left of the political spectrum. Setting aside the headwind from expiring fiscal stimulus, real personal income excluding government transfers are contracting. In other words, inflation is outstripping wage gains.

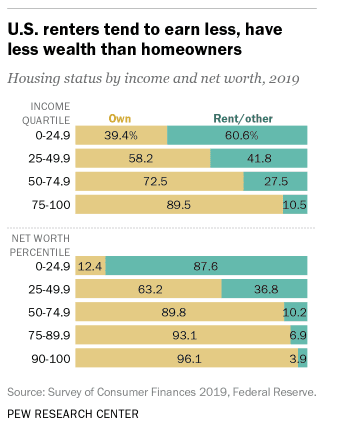

Moreover, not to sound supercilious, but most readers of the newsletter own securities and tend to be more affected by fluctuations in assets prices than the average American. Accordingly, we tend to view Fed action through the lens of its effect on values for assets (stocks and bonds) and liabilities (mortgage payments) that we own or owe. However, renters account for a disproportionate share of certain income and net worth groups:

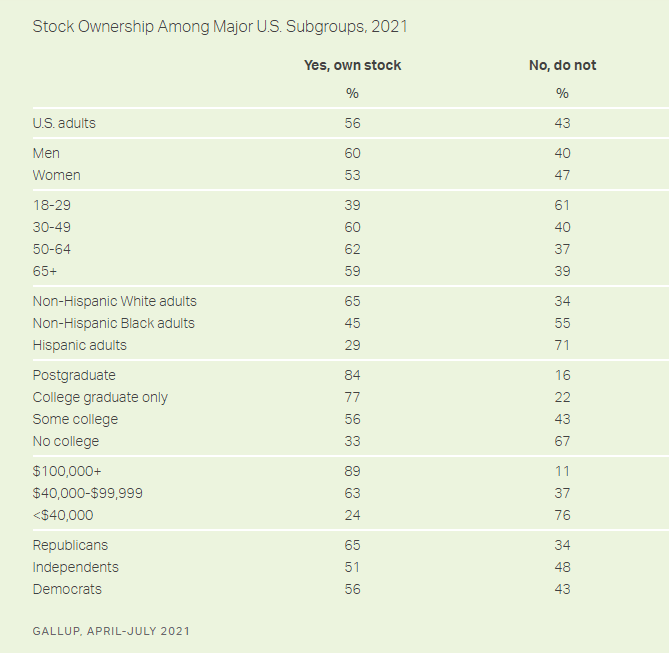

Similarly, stock ownership is skewed demographically, not to mention is top-heavy, according to NYU professor Edward Wolff, whose research, as cited in a Forbes article, indicates although almost 50% of households own stocks that the richest 10% of households own over 80% of the value.

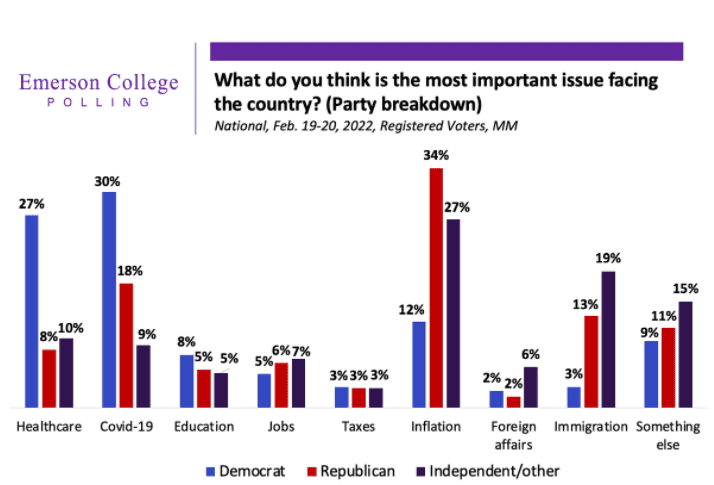

In other words, key constituencies that historically have skewed toward the left have less of a personal stake in asset values and are much more concerned with taming inflation. However, politically polling data shows concern over inflation is more prevalent for Republicans and Independents, at least at present:

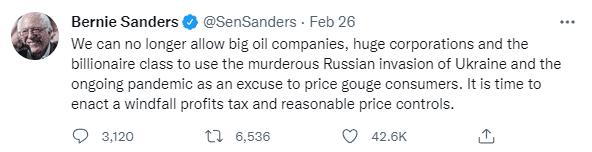

Finally, from the left, both here and in Europe, we are hearing noises about windfall profit taxes and price controls, specifically targeting energy.

Adding fuel to the fire is too much of a paradox here, but let’s say the supply issues we are experiencing may only be amplified not only by profit taxes and price controls, but also by a pause on new drilling that further diminishes the ability of domestic production to meet increasing global demand as Covid wanes.

This is not to say we oppose efforts to switch to renewables, just that the process to do so is likely to be longer and more arduous than most anticipate.

Cannon in front of them

We alluded to this briefly earlier, but the largest barrel aimed at the Fed is, unlike in the poem, not the cannon in front of them but rather behind them. Specifically, the Fed drives in the rear-view mirror when looking at data points on inflation, employment, etc.

Read these comments from the Atlanta Fed’s Raphael Bostic, who is quoted in a Bloomberg article, “One data point that I am looking at in particular is month-to-month change in inflation. To the extent we start to see that trend down, then I will be comfortable pretty much with a 25 basis-point move. If that continues to persist at elevated levels, or even moves in the other direction, then I am really going to have to look at a 50-basis-point move for March.”

The issue we have here is that rearward analysis fails to consider the base effects we cited in our analysis of the fiscal stimulus turning into a drag in March. Real GDP growth in Q1 2021 was a mere 0.6% year-over-year; Q2 2021 was a staggering 12.2%. Because of such an easy comp in Q1, the fed is likely to see the economy demonstrating rapid growth, making rate hikes more acceptable. However, mathematically it is almost impossible to beat the comp in Q2 2022, though the Fed will not “know” this until well into Q3. By that time, it could be raising rates into a slowing economy.

Inflation is facing similar base effects. CPI was a mere 1.9% in Q 2021, setting up a leap for CPI once Q1 2022 is in the books. It jumped to 4.85% in Q2 2021 as fiscal stimulus began coursing through the economy (we will set aside supply chain issues for now).

Boldly they rode and well

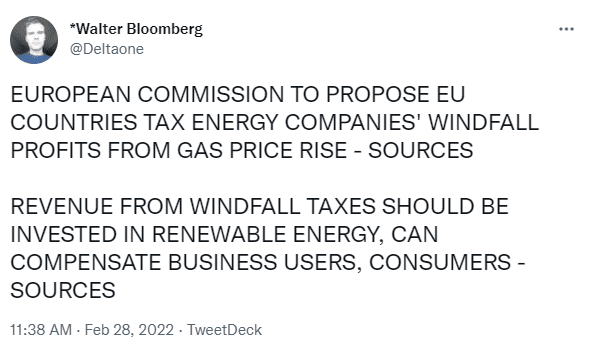

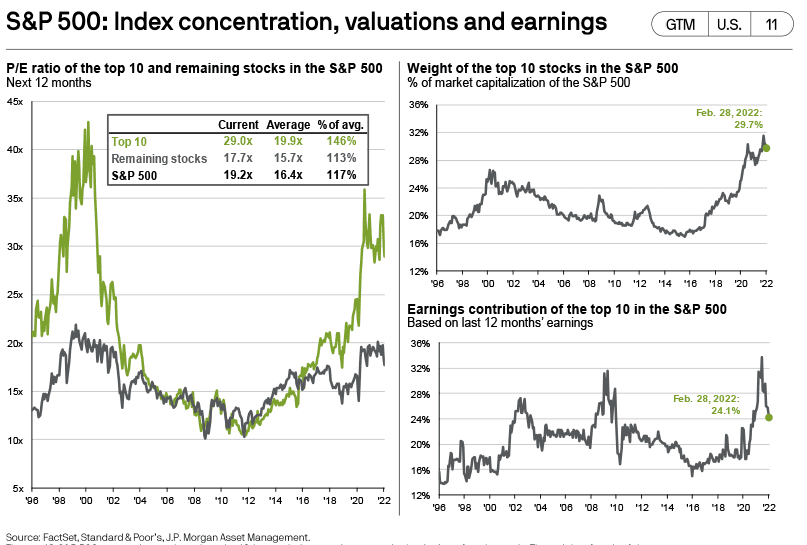

As we often joke, if we were gamblers, we would take the under on the six-plus hikes over the next 12 months. However, due to the aforementioned cannons, we believe the Fed may ride boldly into a blunder, at least in part. While we take with a grain of salt value metrics such as normalized P/E ratios, it is informative to see where valuations reside for the index despite what has been to this point a drawdown below historical average:

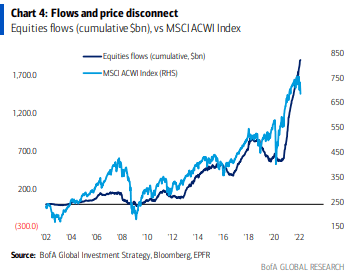

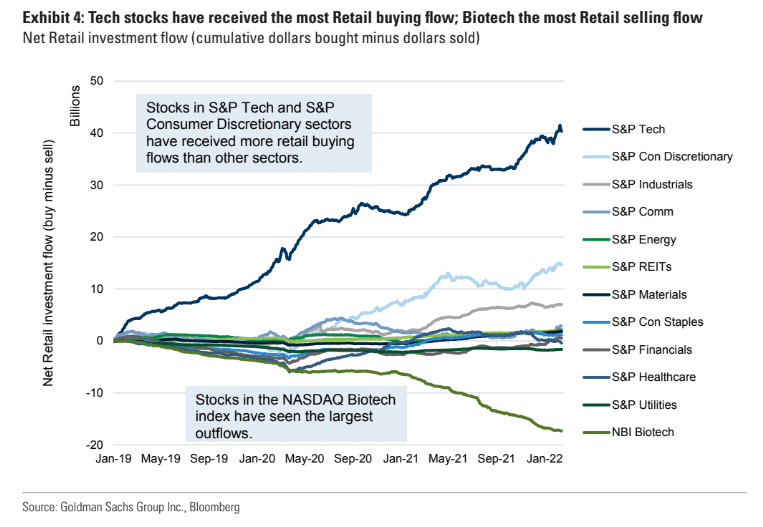

As mentioned in prior pieces, flows into equities have continued unabated despite the recent decline, and are focused, specifically from a retail perspective, predominantly, in one sector: information technology.

Right through the line they broke

The Light Brigade reached the far end of the valley, getting in some saber strokes on the Russian artillery men who had been raining death upon them. However, they soon turned tail and headed back through the valley of death, this time in retreat.

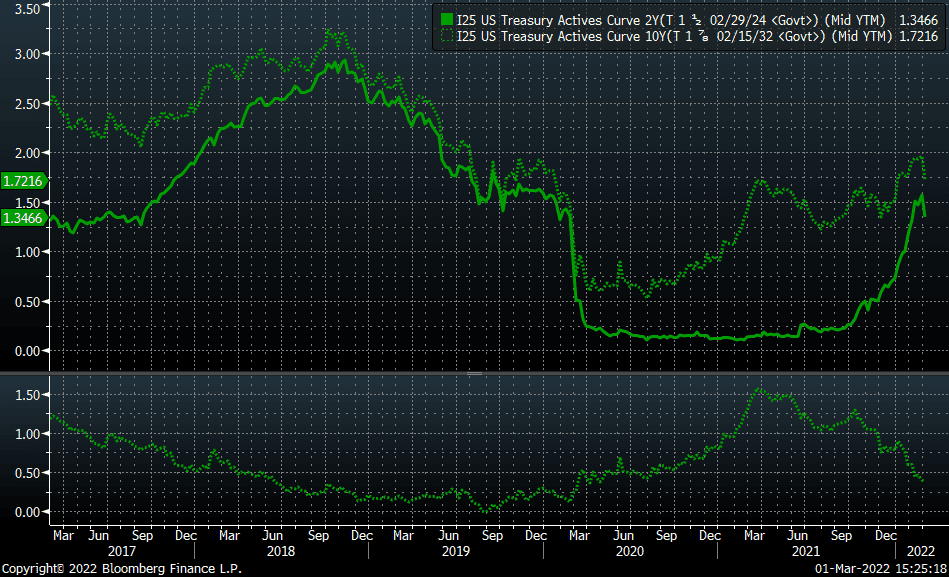

In terms of breaking lines, the most important line we track is the spread between 10-year Treasuries and 2-year Treasuries. The easiest way to look at this relationship is through static yields, which show a current spread of around 39 basis points, i.e., 0.38%, with the 10-year at 1.72% and the 2-year at 1.35%. Both have declined as tensions have escalated. Though both have retreated sharply over the last week, the spread remains narrow.

However, a more nuanced approach to this data uses something called overnight index swap (OIS). This shows the market is pricing an inversion in this spread 12 months from today; the prior analog of 2018 is not a particularly favorable portent.

Shattered and sundered

Stock indices have been shattered and sundered so far this year. In fact, over the last 12 months, large cap stocks have been the only spot for meaningful real returns, i.e., net of inflation. Small caps and emerging market stocks are both negative even in nominal terms, as are bonds.

| Index | 1-Month | 3-Month | YTD | 1-Year |

| S&P 500 INDEX | -3.00 | -3.90 | -8.02 | 16.37 |

| Invesco S&P 500 Equal Weight E | -0.89 | 0.72 | -5.22 | 16.57 |

| NASDAQ Composite Index | -3.35 | -11.35 | -12.00 | 4.95 |

| Russell 2000 Index | 1.07 | -6.63 | -8.67 | -6.04 |

| MSCI EAFE Index | -1.72 | -1.65 | -6.46 | 3.41 |

| MSCI Emerging Markets Index | -3.01 | -2.98 | -4.85 | -10.44 |

| Bloomberg US Agg Total Return | -1.12 | -3.49 | -3.25 | -2.64 |

| Bloomberg US Treasury Total Re | -0.66 | -3.04 | -2.54 | -2.11 |

Source: Bloomberg (as of most recent month end)

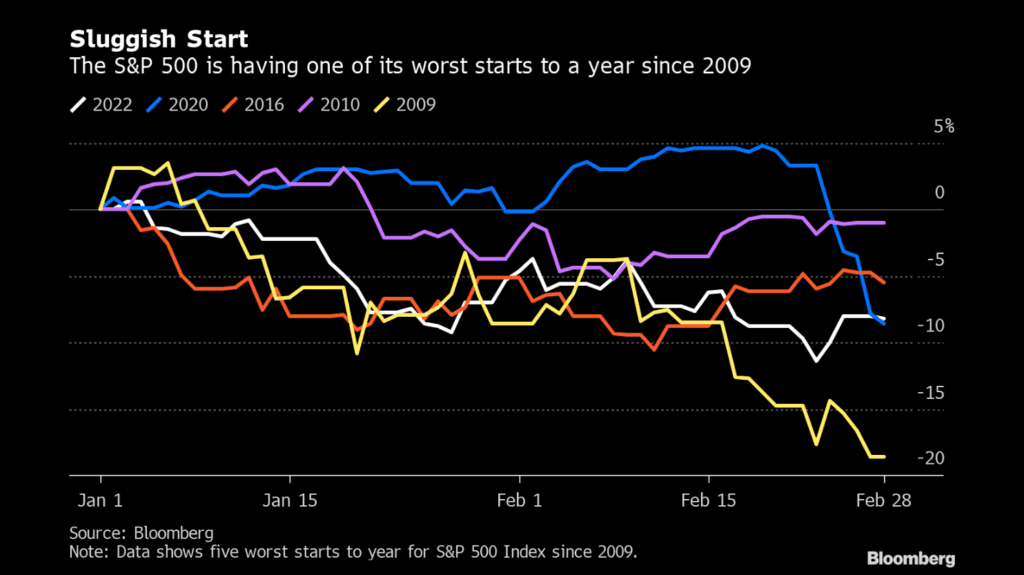

With 482 of 499 companies in the S&P 500 reporting, sales growth was over 17%, while EPS growth was over 30%. However, despite this strong earnings season, 2022 is off to a poor start versus prior years.

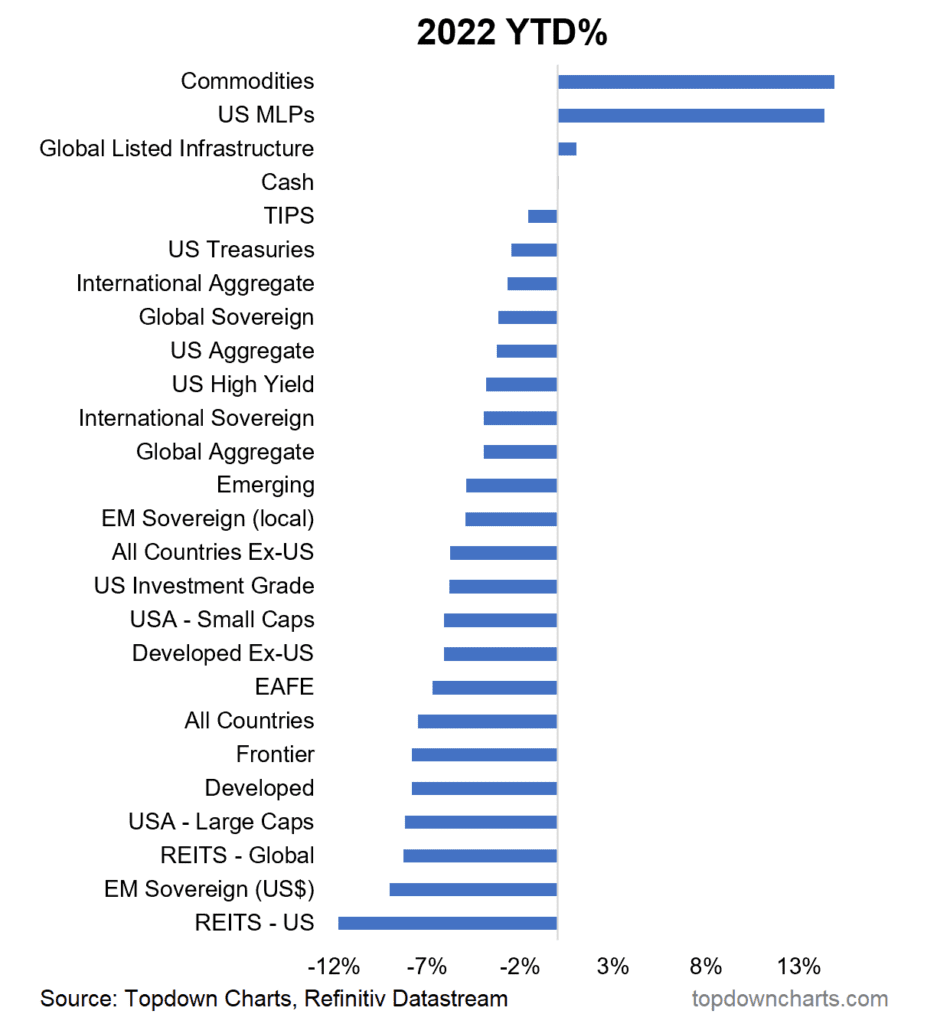

What has won? Commodities and MLPs. Everything else varying shades of red.

When can their glory fade?

The Fed, in all its glory, with an assist from fiscal largesse, rescued the economy (and the capital markets) starting around two years ago. Market indices like the S&P 500 reveled in that glory until the start of the year, though other parts of the market started to fade earlier.

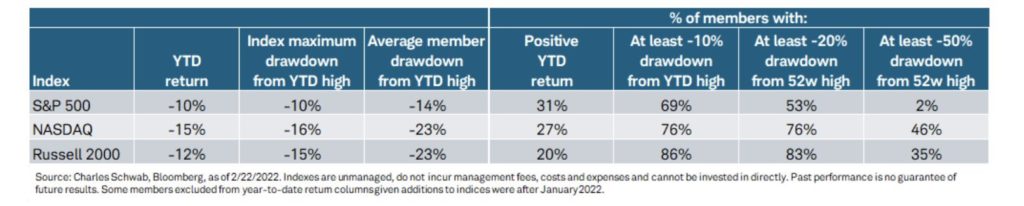

As we have discussed previously, the damage has been worse at the individual stock level:

The poem was written by Tennyson’s months after the event, as news was not the instant type we have now. As this conflict unfolds in real time, markets will react, and possibly overreact, even as the battery-smoke hangs over the war zone.

With that as the backdrop, and to summarize our thinking in military terms, there is a time to charge and a time to dig a foxhole, and we are more in the foxhole camp right now. That is not to say that there will not be pockets of strength, but rather that from a mathematical perspective the set up for riskier assets, especially for the index as a whole and specifically the most highly valued sectors, is not favorable even in the absence of geopolitical tumult.

Moreover, we anticipate we may see continued dislocations in certain market segments we find undervalued, i.e., smaller cap stocks, though patience will be required as broader sentiment has the potential to continue to trump fundamentals as the world comes to terms with the returns of geopolitical turmoil, inflation, and volatility.

READY TO TALK?