FLUX November 2022 Update – Electrifying Commerce

On November 10, 2022, Flux Power, Inc. (NASDAQ: FLUX) reported its fiscal year 2023 Q1 earnings. Following is a recap, along with our insights on Flux’s current valuation.

Earnings Recap

As long-term investors in Flux, we are believers in the company’s value proposition, i.e., providing sustainable lithium-ion battery solutions for materials handling and related businesses. This quarter, we saw the company introduce its new tagline, “Electrifying Commerce”, which is an apt description of both Flux’s core business as well as future adjacencies.

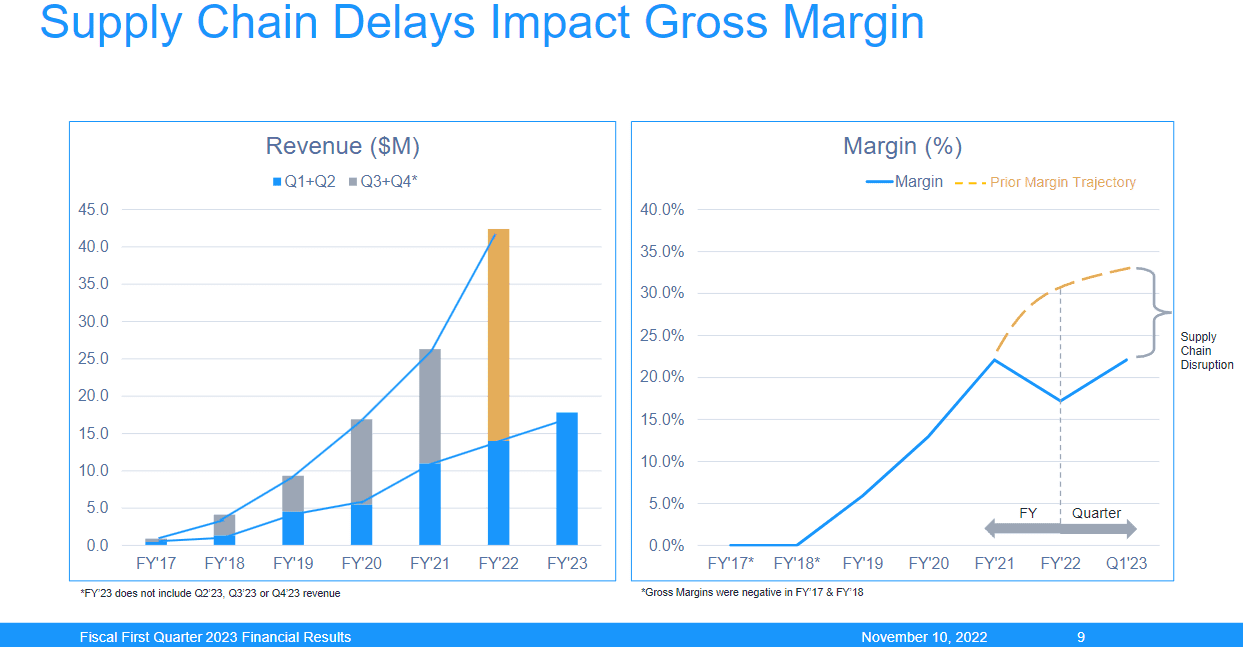

Q1 saw Flux continue to demonstrate strong revenue growth (185% versus Q1 2022), its 17th consecutive quarter of year-over-year revenue growth. Despite rising input costs and supply chain disruptions, gross margins also improved, albeit modestly, from 21% to 22%. The company is working diligently to get its gross margin trajectory back on track:

The company’s order backlog decreased in Q3 (from $35M to $27M), which we view as a positive as the company fulfilled more orders. However, inventory slightly increased, stretching the company’s working capital, which is a negative.

The company’s order backlog decreased in Q3 (from $35M to $27M), which we view as a positive as the company fulfilled more orders. However, inventory slightly increased, stretching the company’s working capital, which is a negative.

In terms of capital, the company reiterated its ability to fund growth without accessing the equity capital markets; here is Chuck Scheiwe, CFO, per the transcript: “We believe that our existing cash and additional funding available under the credit facility from SVB and our subordinated LOC will be sufficient to meet our anticipated capital resources to fund the planned operations for the next 12 months. We fully intend to avoid raising equity capital prior to reaching profitability. We are on track executing to our gross margin improvement and our cost control initiatives. We’re also exploring increases to our working capital availability.”

Valuation

We are encouraged by the company’s revenue trajectory and focus on margin improvement to drive it towards profitability. Moreover, we are optimistic that the company’s increased access to credit will encourage continued restraint as it relates to equity issuance; this has been a significant overhang on the stock.

Despite a significant increase in its share price, both in the leadup to earnings as well as subsequently, the company trades at 1.3 times trailing revenue versus over eight (8) times average ratio for peers.

| Trailing 12 Month Sales ($M) | Market cap ($M) | P/S | |

| FLUX | 54 | 71 | 1.3 |

| FCEL | 105 | 1,419 | 13.5 |

| STEM | 260 | 2,056 | 7.9 |

| PLUG | 643 | 9,104 | 14.2 |

| ENS | 3,549 | 3,181 | 0.9 |

| SHLS | 280 | 5,026 | 17.9 |

| Average | 8.4 | ||

| Median | 10.7 |

Looking at estimates for 2023, the company trades at 1.1 times revenue versus peers at approximately five (5) times.

| 2023 Sales Estimate ($M) | Market cap ($M) | P/S | |

| FLUX | 63 | 71 | 1.1 |

| FCEL | 146 | 1,419 | 9.7 |

| STEM | 632 | 2,056 | 3.3 |

| PLUG | 1400 | 9,104 | 6.5 |

| ENS | 3600 | 3,181 | 0.9 |

| SHLS | 509 | 5,026 | 9.9 |

| Average | 5.2 | ||

| Median | 4.9 |

As we think through valuation, the asymmetry appears favorable. Trading at the lower end of the peer group (excluding traditional battery maker Enersys (NASDAQ: ENS), which is a low growth, legacy maker) would put the multiple at around three times on estimated 2023 revenue of approximately $60M, or around $11 per share. If revenue estimates are met but the market compresses multiples due to further rate hikes, downside is a little under $4; failure to achieve revenue combined with compression would see even further downside. If revenue targets are exceeded and the stock is re-rated toward its peers’ multiples, upside is significant. As a point of reference, the stock is covered by three (3) sell-side research firms; price targets for these firms are $6, $8, and $15.

| P/S vs. 2023 Revenue ($M) | 50 | 60 | 70 | 80 |

| 1 | 3.12 | 3.74 | 4.37 | 4.99 |

| 3 | 9.36 | 11.23 | 13.10 | 14.97 |

| 5 | 15.60 | 18.72 | 21.84 | 24.95 |

| 7 | 21.84 | 26.20 | 30.57 | 34.94 |

| 9 | 28.07 | 33.69 | 39.30 | 44.92 |

| 10 | 31.19 | 37.43 | 43.67 | 49.91 |

FLUX peer group. Source: Bloomberg, Formidable estimates.

| Scenario | Price | Downside/Upside |

| Current | 4.44 | 0% |

| Worst | 3.74 | -16% |

| Base | 11.23 | 153% |

| Best | 21.84 | 392% |

| Sell-Side (Low) | 6.00 | 35% |

| Sell-Side (High) | 15.00 | 238% |

| Sell-Side (Average) | 9.67 | 118% |

Current as of 11/18/2022

Our prior research provided a deeper dive on the secular tailwinds we think position Flux for success. However, its clients face the same macroeconomic headwinds we see daily (high inflation, Fed tightening, weakening demand). Risks remain as the company must find ways to fund its continued growth using existing sources of capital against a backdrop where borrowing is becoming more expensive. Achieving cash flow breakeven and profitability are of paramount importance to the company and its investors.

* * *

DISCLOSURES AND IMPORTANT INFORMATION

Formidable Asset Management, LLC (Formidable) is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. Although taken from reliable sources, Formidable cannot guarantee the accuracy of the information received from third parties.

The opinions expressed herein are those of Formidable and may not actually come to pass. This information is current as of the date of this material and is subject to change at any time, based on market and other conditions. Any index performance cited or used throughout is intended to illustrate historical market trends and performance. Indexes are managed and do not incur investment management fees. An investor is unable to invest in an index. The performance shown may not reflect a Formidable portfolio.

Past performance is no guarantee of future results.

Reader should assume that future performance of any specific investment or investment strategy (including the investments and/or investment strategies discussed in these materials) made reference to directly or indirectly in these materials will be profitable or equal the corresponding indicated performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable. Historical performance results for investment indices and/or categories generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results.

Specific Securities

The mention of specific securities and sectors illustrates the application of our investment approach only and is not to be considered a recommendation by Formidable. The specific securities identified and described above do not represent all the securities purchased and sold for the portfolio, and it should not be assumed that investment in these securities were or will be profitable. There is no assurance that the securities purchased remain in the portfolio or that securities sold have not been repurchased. Charts, diagrams and graphs, by themselves, cannot be used to make investment decisions. You may contact Formidable Asset Management, LLC for a full list of recommendations made during the preceding period one year.

Not an Offer

These materials do not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or any other product or service by Formidable or any other third party regardless of whether such security, product or service is referenced here. Furthermore, nothing in these materials is intended to provide tax, legal, or investment advice and nothing in these materials should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. Formidable does not represent that the securities, products, or services discussed here are suitable for any particular investor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your personal investment objectives, financial circumstances and risk tolerance. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation.

The opinions expressed here are those of Will Brown and Adam Eagleston and are not intended as investment advice. They are also subject to change with changing market conditions. Clients of Formidable may have positions in securities discussed in this article. This writing is for informational purposes only; Formidable and the authors expressly disclaim all liability in respect to actions taken based on any or all of the information from this writing.

READY TO TALK?