July 2025 Update: Or

Part I – Summary

July 2025 Update: Or

For those who need a nostalgic reminder, conjunctions are used for hooking up words and phrases and clauses. Several authors and filmmakers have used or to provide context or nuance to what in many cases are legendary works of film or literature. We will look at several of these as we discuss whether this epic stock market recovery is likely to persist or fade.

Key Takeaways:

- The Unexpected Virtue of Ignorance

- Since its nadir in early April, the S&P 500 has staged a historic comeback.

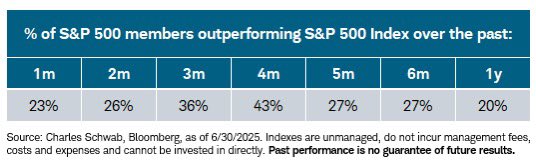

- However, only about one in four stocks has outperformed, with big winners a handful of technology stocks and speculative retail favorites.

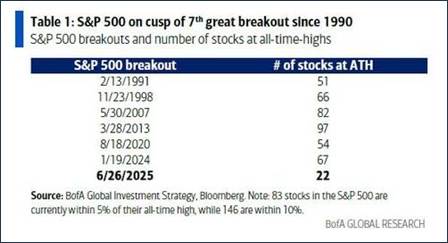

- Only 22 stocks have broken out to new highs, a historically low level of participation.

- The Modern Prometheus

- Sparking the rally to life is the anticipation of a powerful combination of fiscal stimulus via the recently signed “One Big, Beautiful Bill” and monetary stimulus via pressure on the Fed.

- The S&P 500 is at or near peak levels of concentration among the biggest stocks, as well as valuation.

- All of the factors we track are firmly in the negative camp at this point.

- How I Learned to Stop Worrying and Love the Bomb

- Historically, this type of momentum in stocks continues.

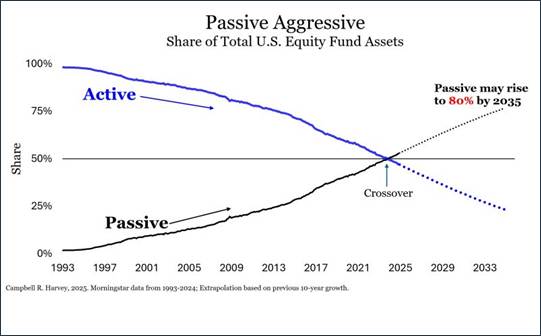

- Between the rise of passive investing, momentum investing, and a focus on nominal growth (along with a sharply declining dollar) perhaps investors should stop worrying and love the bull.

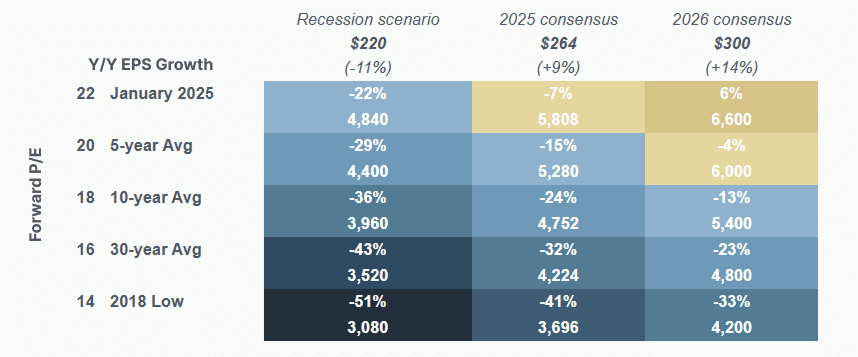

- However, the earnings and multiples required to support a sustained advance from the current index levels are challenging, demanding both peak multiples and growth well above what the market typically provides.

For those who prefer not to read further, before you close the email, please know these three things.

- The rally from the April low to a new high in June was the fastest and largest rebound in history, BUT was led by only a handful of stocks.

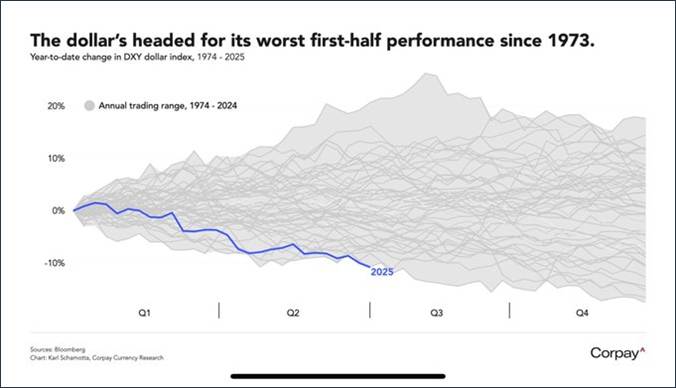

- Despite this stock market rebound and escalating tensions in the Middle East, the dollar has lost 10% of its value this year AND is on pace for its worst year since 1973.

- Although momentum favors further gains, multiple expansion (from already elevated levels) AND earnings growth in excess of current estimates would be required (at least fundamentally) to move the market higher.

Part II: Q2 2025 Recap –Birdman OR the Unexpected Virtue of Ignorance

“That’s what I’m talking about. Bones rattling! Big, loud, fast! Look at these people, at their eyes… they’re sparkling. They love this ****. They love blood. They love action.”

The Best Picture winner of 2015 was widely known as just Birdman. The market’s action in Q2 was congruent with both the second part of the title (the Unexpected Virtue of Ignorance), and the quote from the movie. Actions from political leaders and equity market participants (we are reticent to use the word investors here) were bone rattling, big, loud, and fast. There was both blood and action, though in the case of tariffs, a stunning lack of it. Retail dip buying, especially of the Magnificent Seven and other retail favorites, led to the biggest rebound markets have seen. Blindly (ignorantly?) buying the dip has never been more rewarded, despite high valuations and escalating military conflict between Israel and Iran (with the U.S. playing a small part as well).

The favorable trends we noted for asset managers in general, and our style in particular, that occurred in Q1, all unwound in Q2. The tech-heavy, market cap-weighted S&P 500 beat the equal weight S&P 500; the NASDAQ trounced small-caps. Value stocks lagged growth stocks by wide margins across the market cap spectrum; in large-cap, it was the biggest outperformance for growth over value since the inception of the indices in the mid-1990s, i.e., bigger than during the tech bubble.

| Fund/Index | 1-Month | 3-Month | YTD | 1-Year |

| S&P 500 INDEX | 5.08 | 10.94 | 6.20 | 15.14 |

| Invesco S&P 500 Equal Weight E | 3.43 | 5.34 | 4.63 | 12.43 |

| Russell 2000 Index | 5.43 | 8.50 | -1.79 | 7.66 |

| NASDAQ Composite Index | 6.64 | 17.97 | 5.86 | 15.70 |

| MSCI EAFE Index | 2.22 | 12.04 | 19.94 | 18.42 |

| MSCI Emerging Markets Index | 6.12 | 12.17 | 15.52 | 15.89 |

| Bloomberg US Treasury Total Re | 1.25 | 0.85 | 3.79 | 5.30 |

| Bloomberg US Agg Total Return | 1.54 | 1.21 | 4.02 | 6.08 |

| Invesco DB Commodity Index Tra | 4.45 | -3.07 | 2.01 | -1.11 |

Source: Bloomberg (as of most recent month end)

| Fund/Index | 1-Month | 3-Month | YTD | 1-Year |

| Vanguard Russell 1000 Value | 3.39 | 3.73 | 5.87 | 13.54 |

| Vanguard Russell 1000 Growth E | 6.35 | 17.84 | 6.00 | 17.04 |

| Vanguard Mid-Cap Value ETF | 2.43 | 2.98 | 2.87 | 11.84 |

| Vanguard Mid-Cap Growth ETF | 6.17 | 16.42 | 12.45 | 24.74 |

| Vanguard Russell 2000 Value | 4.93 | 4.93 | -3.06 | 5.74 |

| Vanguard Russell 2000 Growth | 5.89 | 12.07 | -0.50 | 9.78 |

Source: Bloomberg (as of most recent month end)

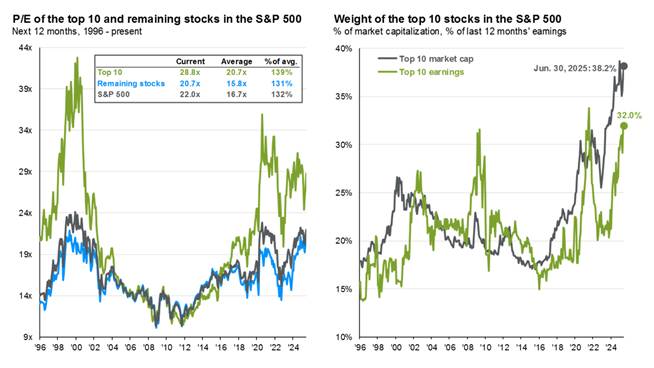

Year-to-date, only about one in four stocks has outperformed the S&P 500. Over 80% of the index’s returns were from 10 stocks, which sport an average P/E of around 43x. Over the past year, only one in five stocks outperformed the index.

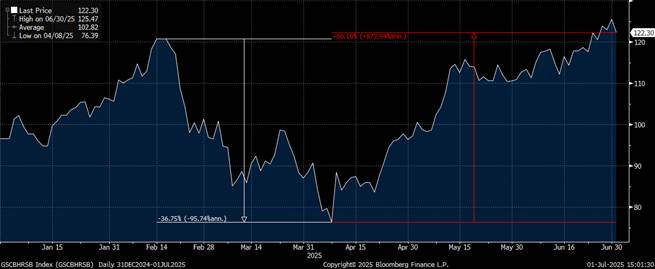

After falling almost 37% between February and early April, the stocks most popular among retail “investors” gained over 60% and are closing in on their levels from the 2021 peak. As an FYI, these companies, in the aggregate, lose money, so this is a proxy for low quality. We saw similar performance for highly shorted stocks.

As we closed the quarter at a new all-time high, we saw less participation in the new high than at any time in recent history, with a mere 22 stocks participating in the breakout.

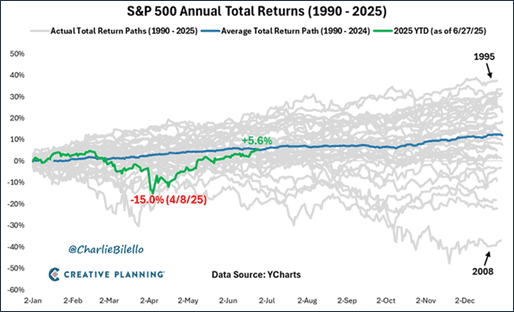

It is interesting to note that after all of this tumult, year-to-date, 2025 could not be much more average:

Q2 and 2025 Outlook – Frankenstein, OR The Modern Prometheus

“Beware; for I am fearless, and therefore powerful.”

Written as part of an impromptu contest among 19th century literary luminaries, Frankenstein still resides in the popular imagination and is set for another retelling in November. Less well known is the “or The Modern Prometheus” appendage to the title. The original Prometheus created mankind, which was fine, then gave man fire, for which he was eternally punished by Zeus. Frankenstein, who is the creator, not the monster, as my son loves to note, was also punished for sparking his creation to life.

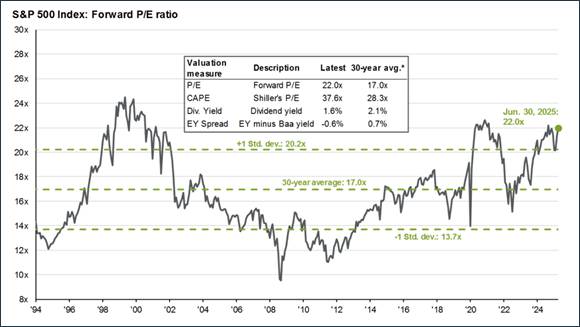

In terms of the factors that we track most closely, everything remains in the negative camp, with multiples getting even higher into the stratosphere. Will investors ever be punished for sparking a bull market to life against such a backdrop?

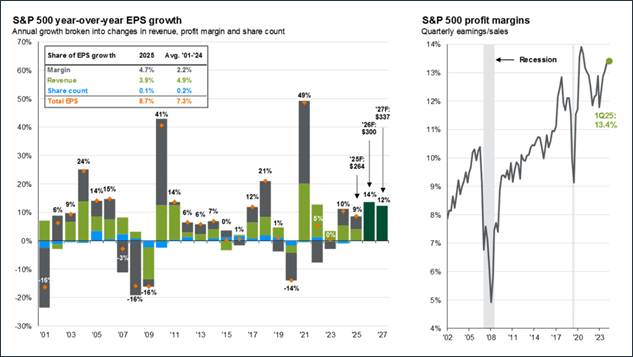

While the top 10 stocks are more expensive (both versus their own history and the other 490), so are the other 490, but at least the top 10 (well, at least the Magnificent Seven) are forecast to grow earnings over twice as fast as the rest of the market (16% versus 7% during 2025).

Source: JP Morgan

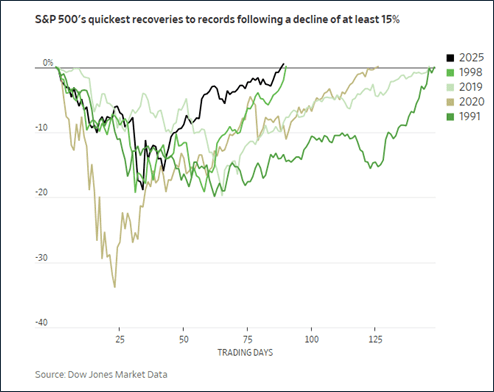

Investors of all stripes, but especially retail, are fearless (and therefore powerful), thanks in part to how quickly recent dips have recovered, with the most recent the fastest recovery on record; 2020 and 2019 are also high on the list:

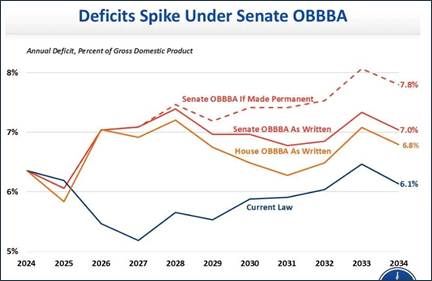

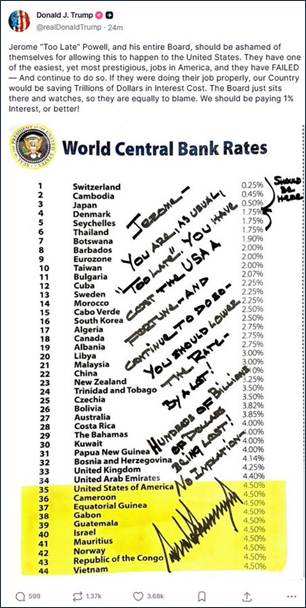

What has sparked the rally to life in our estimation is the notion that the Trump administration is going to unleash:

- fiscal stimulus (via the so-called Big, Beautiful Bill), which increases the deficit (and, according to Keynesian economics, boosts growth) by around 1% of GDP each year for the next 10 years; AND,

- monetary stimulus (via incessant pressure on the Fed to cut rates and for the Treasury to focus on issuing shorter term bonds)

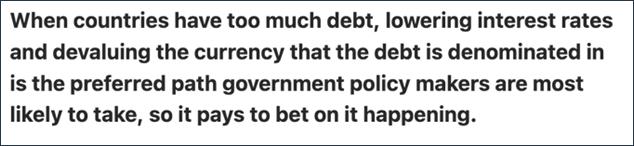

In other words, the administration plans to run the economy hot in hopes of strong nominal growth helping the government outrun the increasingly large deficits forecast. As Ray Dalio puts it:

For more details on all of our factors, click here.

| More Negative | Neutral | More Positive | |||

| Inflation | ≈ | ||||

| GDP Growth | ≈ | ||||

| Fed Policy | ≈ | ||||

| Interest Rates | ≈ | ||||

| Credit Spreads | ≈ | ||||

| Stock Multiples | ← | ||||

| Earnings Growth | ≈ | ||||

| Deteriorating | ← | ||||

| Stable | ≈ | ||||

| Improving | → | ||||

Conclusion – Dr. Strangelove OR: How I Learned to Stop Worrying and Love the Bomb

“Deterrence is the art of producing in the mind of the enemy… the FEAR to attack. And so, because of the automated and irrevocable decision-making process which rules out human meddling, the Doomsday machine is terrifying and simple to understand… and completely credible and convincing.”

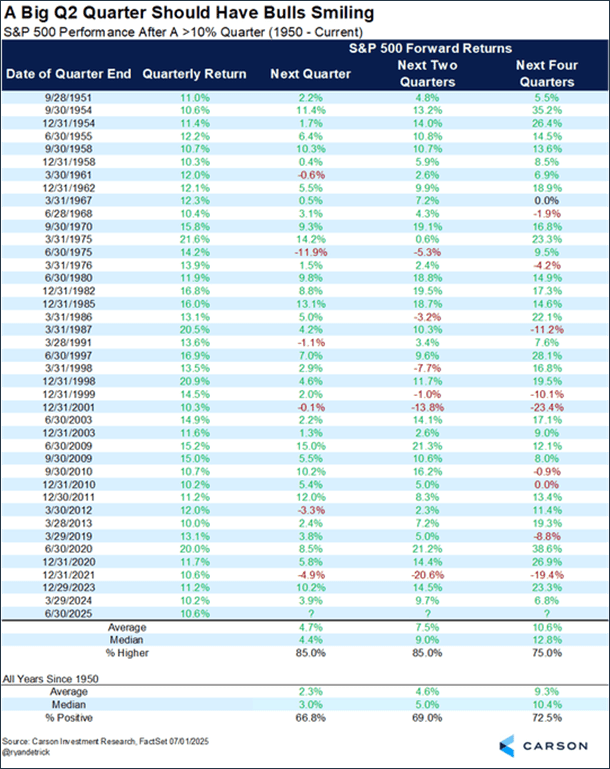

While the movie’s most iconic quote, “you can’t fight in here. This is the war room.” is better, we will focus on what comes after the or in the movie’s title. To that end, perhaps we should stop worrying and love the bull. After a huge quarter, typically the momentum continues.

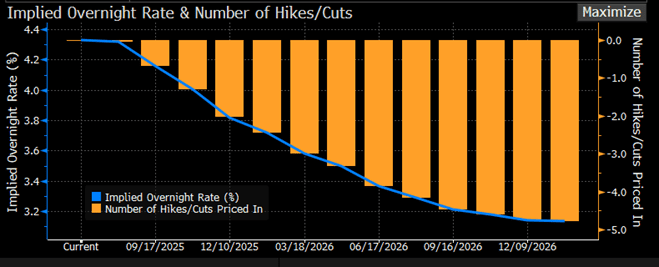

Also, as mentioned, between adding almost a percent to GDP through fiscal policy and the market anticipating five rate cuts by the end of next year along with no recession, why not be bullish on stocks?

One thing it is important to note is that stocks (really, all assets) are priced in dollars. Accordingly, as the dollar becomes worth less, i.e., declines, the value of something denominated in dollars should increase because the dollar is in the denominator. I know; we opened with a grammar lesson and are closing with a math lesson. Apologies. Why is the dollar decreasing? For the exact reasons we cited as the catalyst for bulls; more spending and lower interest rates.

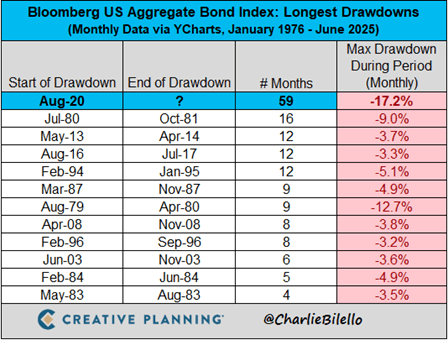

Be that as it may, where else are you going to go? Bonds are on their worst run in history.

So, should we just stop worrying? After all, the market’s version of the Doomsday machine continues to chug along in the form of passive investing, which also possesses “automated and irrevocable decision-making process which rules out human meddling.” If the index states put 1/3 of your portfolio in tech stocks at a P/E of 29 versus their 20-year average of 18, you do it. Is 1/3 of a portfolio in one sector appropriate for a retiree? The index does not care.

However, we do. Are we deterred by the relentless shift to passive strategies on one end and retail speculation on the other? It would be dishonest to say it is not frustrating.

Is it going to deter us from executing our approach? No, and here is why.

One, if you look back at the momentum table, there are a few instances where a big quarter was followed by a difficult 12 months (10% or more decline). The three most recent:

- 12/31/1999 (29.1)

- 12/31/2001 (24.2)

- 12/31/2021 (23.3)

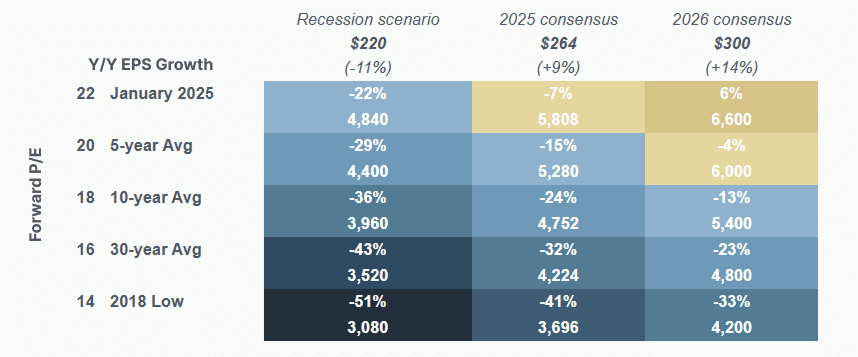

What do these have in common? The number to the right is the P/E of the index at that time. Where are we currently? 23.7 as of this writing. Can the market post a 10% gain over the next 12 months from here? Obviously, anything is possible, but the math is difficult. We need a bubblier P/E and earnings growth above the current estimates, which themselves are well above the long-term average growth rate of around 7%.

Second is that diversification and risk do matter. Although many have forgotten 2022 (you know, the year that followed 12/31/21 and its 23.3x P/E from the last paragraph), we have not. It was a painful decline led by the biggest companies in the index. It proved the merits of diversification and looking outside the biggest names in the index.

Third, we have barely talked about tariffs. The 90-day pause that the market celebrated is expiring (albeit with some extensions) as we type, and letters are being sent to major trading partners like Japan and South Korea announcing 25% tariffs, which are in-line with what was announced on Liberation Day. Few, if any, deals have been reached.

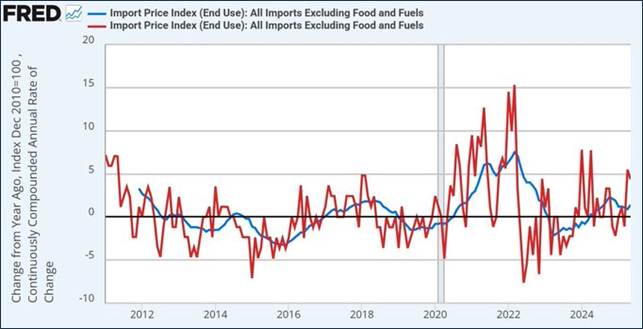

Per Bloomberg, “Trump initially announced the higher reciprocal rates on over 50 trading partners on April 2, but lowered those rates temporarily to 10% for 90-days, allowing time for negotiations. That deadline was set to expire this week, but Trump signed an executive order on Monday pushing implementation until Aug. 1.” Best case, it seems like we get 10% or greater tariffs on a lot of countries, and in some cases much higher. Import prices are already increasing, which has to affect either prices, i.e., inflation goes higher, or margins, which would be at risk.

So (also a conjunction) is the combination of fiscal and monetary stimulus, not to mention the market’s own momentum, powerful enough to sustain the rally? Or, will the combination of high valuation and outsized earnings expectations bring a dose of reality? The answer may not be clear for some time, but we like to avoid that type of binary risk and will continue to dynamically search for opportunities for our clients whether we get the former or the latter.

Part III: In-depth analysis of Key Factors

- Inflation – Negative but stable. In recapping May’s consumer price reading, Mike Ashton stated, “money supply growth has re-accelerated to a level that’s not likely to be consistent with inflation at 2%. Underlying trend median inflation is running about 3.5% or so, and is unlikely to fall a lot further given the current configuration of fiscal and monetary policy.”

On July 1st, Chair Powell stated, “In effect, we went on hold when we saw the size of the tariffs and essentially all inflation forecasts for the United States went up materially as a consequence of the tariffs.” It is important to note we have not seen any meaningful tariff effect on the CPI data so far, though prices paid for imports are starting to move higher:

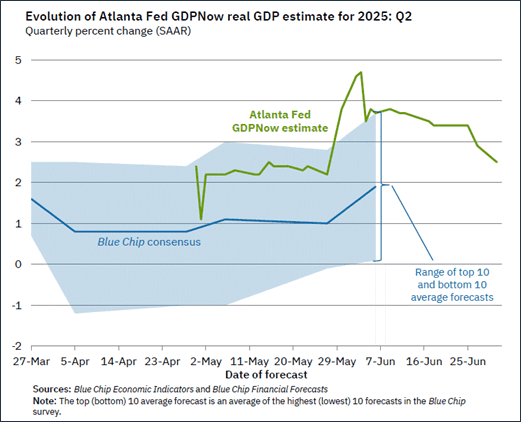

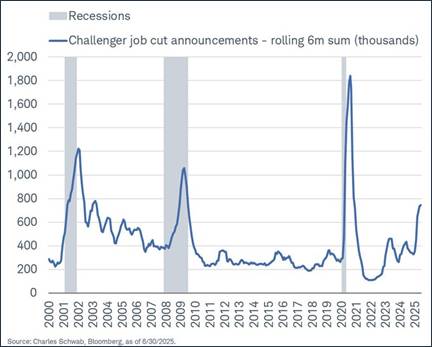

- GDP Growth – Negative but stable. The Atlanta Fed’s volatile GDPNow estimate for Q2 has fallen sharply but remains positive, converging toward the economist forecast of around 2%, which is okay but not above trend by any stretch. Employment data shows worrying signs of weakness.

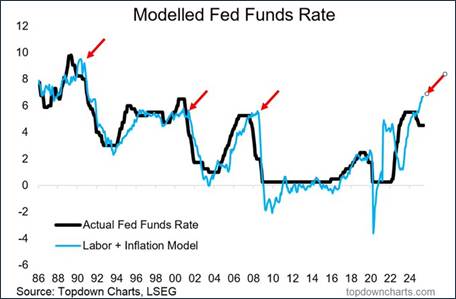

- Fed Policy – Negative but stable. As mentioned, the Fed has put rate cuts on hold as it waits for data on tariffs. In true Fed-speak, Powell stated the effect of tariffs on inflation could be “higher or lower, or later or sooner than we expected.” Odds for a cut at the July meeting are about 23%.

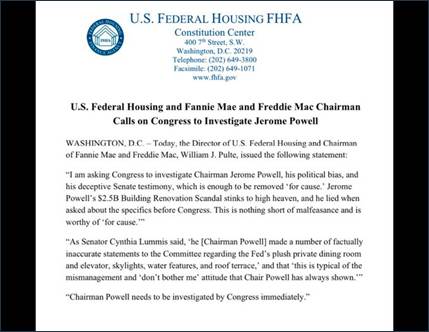

However, to say that the political pressure to cut is mounting would be an understatement, with President Trump posting what we noted in the body of the update and Secretary Bessent stating Powell’s successor could be coming in a matter of weeks, and then this from the U.S. Federal Housing FHFA:

Arguably, rates should be higher, given the combination of low unemployment and persistent above-trend inflation, but a Fed rate increase would be stunning.

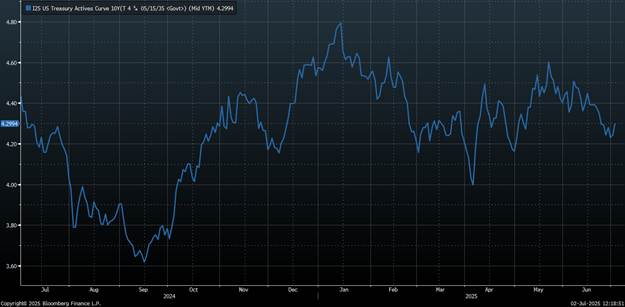

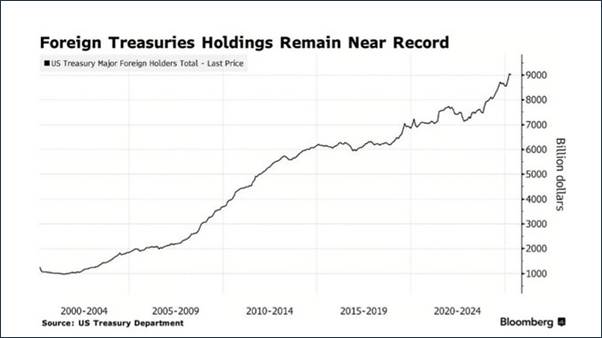

- Interest rates – Negative but stable. At around 4.3%, the 10-year yield is a little lower than where it was six or 12 months ago (around 4.4%), and a little higher than where it was to start Q2 (around 4.2%). In the interim, it has been volatile and is persistently above where the administration would like it to be for the purpose of lowering mortgage rates. However, against the backdrop of increasing fiscal deficits, a substantially lower rate may be difficult to achieve. One noteworthy item is that, despite all of the headlines, foreign ownership of Treasuries remains high.

- Credit spreads – Negative but stable. A reminder we use this as a contrarian indicator. In other words, if we see spreads widening into the area above the green line, we may start to view risk/reward more favorably. Both high-yield spreads and investment grade spreads are approaching record tight levels. In other words, there has almost never been a time when the risk/reward has been worse in credit. We did not even reach an above-average level of risk during the April tariff tantrum. If you have an interest in learning more about our take on credit, feel free to listen to our recent appearance on Credit Events.

- Stock multiples – Negative and deteriorating. Markets have rebounded right back toward their recent peaks. From current levels, the risks are skewed to the downside in the absence of multiples moving even higher, i.e., back to tech bubble levels, or earnings exceeding bottom-up consensus by a wide margin.

Source: J.P. Morgan

- Earnings growth – Negative but stable. As goes GDP, so go earnings. Can earnings grow 9% this year and 14% next year (both above long-term average) at around 2% GDP growth (below average) with margins already close to peak? Perhaps on the margin side with a boost from AI, but there are other consequences there.

Source: J.P. Morgan

READY TO TALK?