June Update: Embracing “The Story” by Brandi Carlile

As we reflect on the financial landscape of May 2023 and the overall Year-to-Date (YTD) performance, it’s impossible to ignore the profound impact of Brandi Carlile’s timeless ballad, “The Story.” Just like the song’s poignant lyrics, the investment markets have been on a journey of ups and downs, embracing uncertainty, resilience, and the power of a compelling narrative. Let us delve into the tale of the investment world through the lens of “The Story.”

Key Takeaways

- 2023 has been all about AI.

- Seven (7) stocks account for all of the market’s return.

- The behavior we are seeing is reminiscent of the early 2000s, though clearly can continue. We continue to find opportunities outside the usual megacap tech suspects.

“Oh Yoshimi, they don’t believe me. But you won’t let those robots defeat me.” The Flaming Lips, Yoshimi Battles the Pink Robots

In the spirit of Yoshimi Battles the Pink Robots, you should know that the incredibly mediocre intro to the June update was written using Chat GPT, which was tasked to write a market update for May using a song (The Story) by my wife’s favorite musical artist (Brandi Carlile) for inspiration. As an author, it confirms my contention that these robots won’t defeat me, at least today.

Before we jump into what happened in the market, let’s evaluate the AI-generated drivel you just read. Our original plan was to include the full AI-generated commentary at the outset of our update, but our editors deemed it so awful that they feared no one would read far enough to understand the joke.

Allow me to critique what Chat GPT produced (we have appended the full text at the end of the commentary for the masochists among us).

- As you can tell from the first paragraph, no actual insight is provided. It is mostly platitudes that one could use any time in any market.

- It missed the biggest story (ironically enough), which was the debt ceiling squabble; zero words there.

- It also stated the “market’s visage bore the marks of volatility”, which is entirely false as volatility fell sharply.

- It did mention artificial intelligence as being a “protagonist”, but the narrow nature of the market’s returns being generated by a handful of AI-oriented stocks was completely ignored.

- It threw in some ESG commentary for no apparent reason.

- The closing lines it cited are not contained in the song anywhere.

To put it succinctly, it provides the appearance of providing insight without providing any actual insight while simultaneously being quite inaccurate. Maybe it’s more like the average person than I first thought…

May Recap – Let ‘em laugh

“Let ’em laugh while they can, Let ’em spin, let ’em scatter in the wind, I have been to the movies, I’ve seen how it ends, And the joke’s on them” Brandi Carlile, The Joke

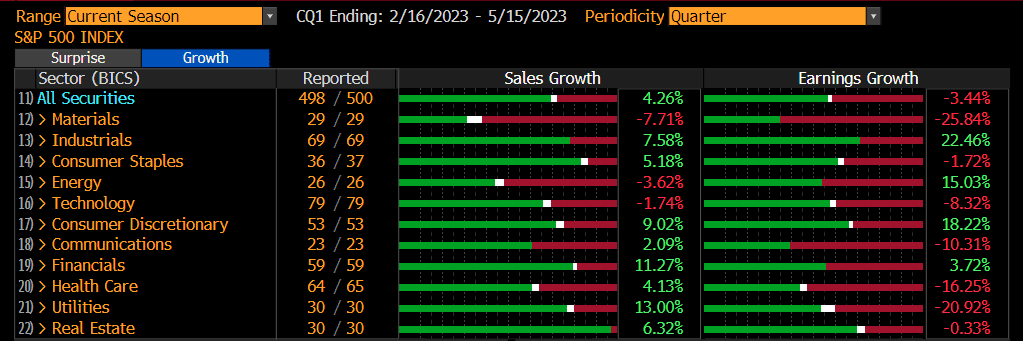

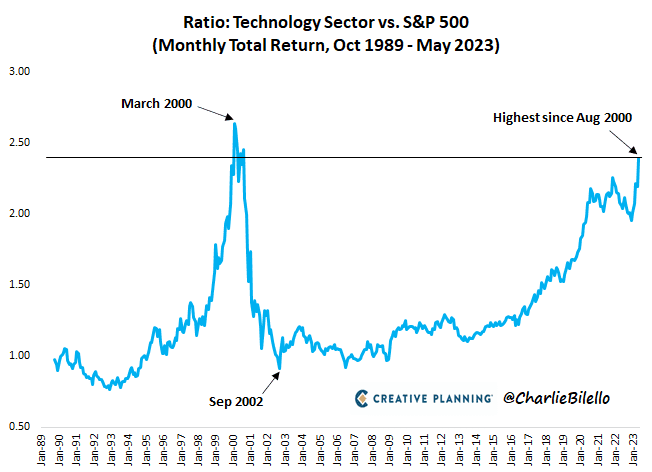

Despite my criticisms, speculators in AI stocks are laughing all the way to the bank at this point. After roaring higher in May, the Technology sector is outperforming the remainder of the S&P 500 by levels last seen in 2000. Could it go higher? If history is a guide, absolutely, at least for a while.

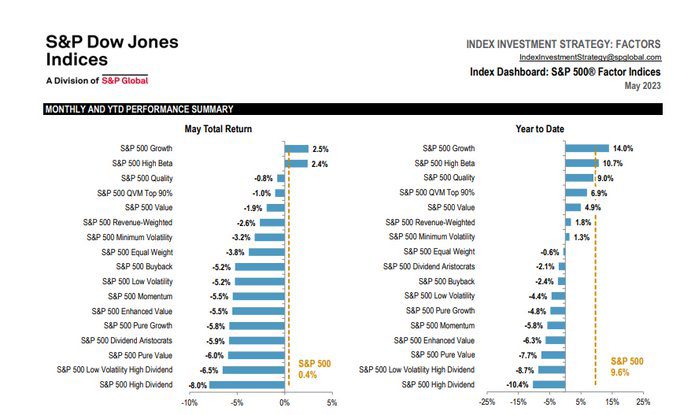

Both in May and year-to-date, growth and high beta have been the best places to be, while dividend and value stocks have fared the worst. These divergences amplified in May, as even dividend aristocrats, i.e., those companies that have increased dividends for 25 consecutive years and would generally be considered of superior quality, fell almost 6%.

| Index | 1-Month | 3-Month | YTD | 1-Year |

| S&P 500 INDEX | 0.43 | 5.75 | 9.64 | 2.89 |

| Invesco S&P 500 Equal Weight E | -3.81 | -4.29 | -0.67 | -4.47 |

| NASDAQ Composite Index | 5.93 | 13.19 | 24.07 | 8.06 |

| Russell 2000 Index | -0.93 | -7.37 | -0.06 | -4.71 |

| MSCI EAFE Index | -4.12 | 1.28 | 7.25 | 3.72 |

| MSCI Emerging Markets Index | -1.66 | 0.24 | 1.15 | -8.12 |

| Bloomberg US Treasury Total Re | -1.16 | 2.24 | 2.35 | -2.26 |

| Bloomberg US Agg Total Return | -1.09 | 2.04 | 2.46 | -2.14 |

| Invesco DB Commodity Index | -6.41 | -7.20 | -10.55 | -22.98 |

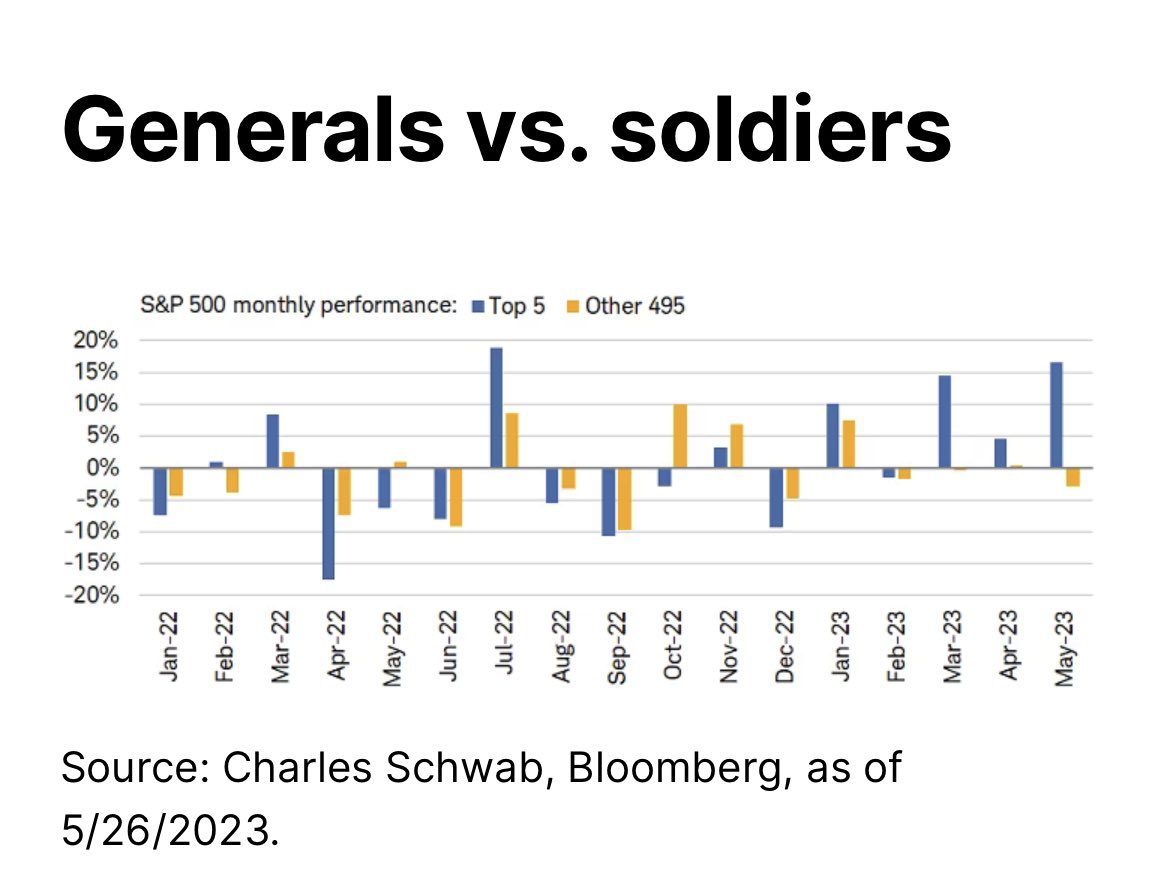

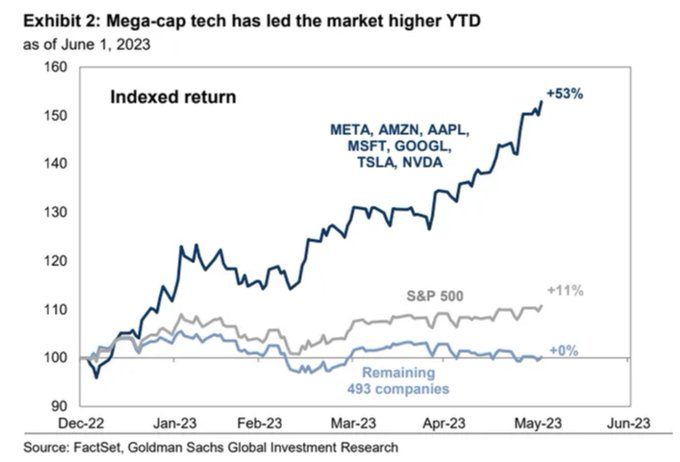

While the YTD performance of the S&P 500 appears strong, seven megacap stocks have been the only real winners; the remaining 493 companies have returned 0%:

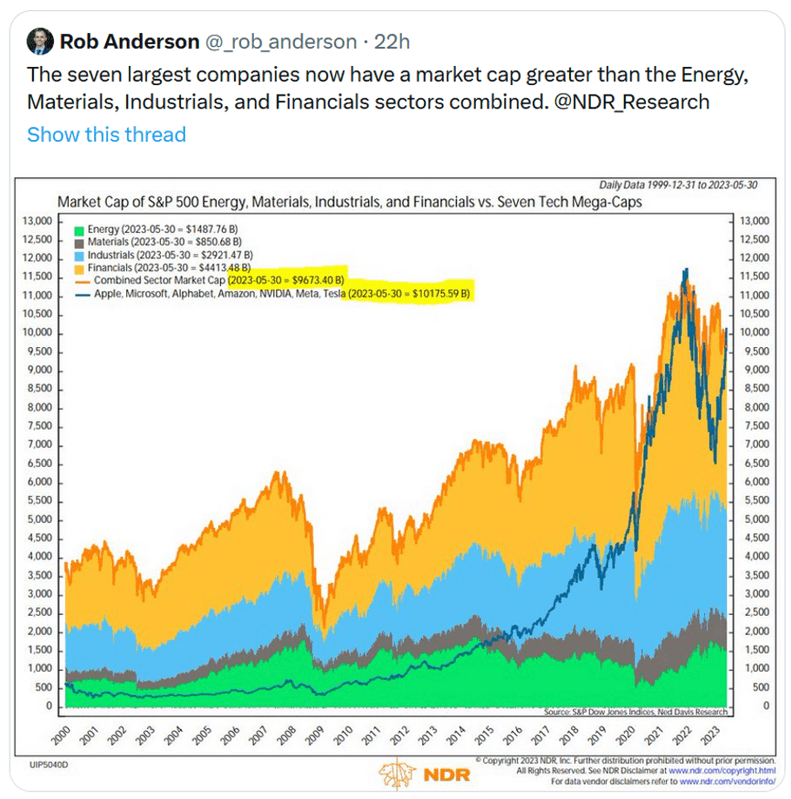

The concentration of the S&P 500 in these seven names is staggering, as a great find by our Tim Begley shows. Apple, in and of itself, was larger than the entire Russell 2000 Index at one point.

June Outlook – Any Shimmering Fad

“But I’m on to you, And you will pour your heart into, Any shimmering fad, Throwin’ good after bad.” Brandi Carlile, Throwing Good After Bad

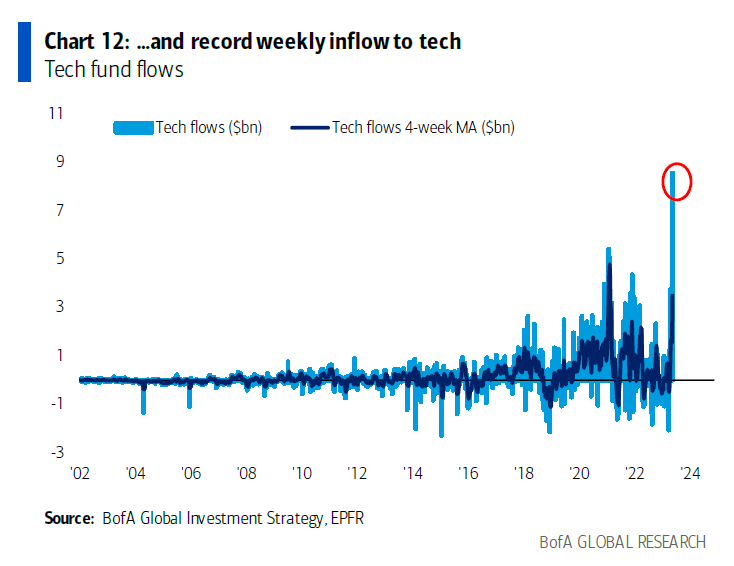

So, is AI a shimmering fad? At this point, no one knows. Was the internet a fad? Clearly not. Was investing in hype-driven internet companies in March 2000 profitable? Also, clearly not. However, flows into tech remind us of the late 90s/early 2000s:

Bulls cite strong, almost infinite, growth potential, for AI stocks, though we believe the primary reason, and what inspired this newsletter, is the story, the case for which is well-stated in this FT article. “The narrative, roughly speaking, is that AI is going to be a bigger deal than the internet, the PC, the printing press, the wheel, and fire combined, and that the mega-techs are best positioned to take advantage of this. I don’t know anything about AI, but I have some experience with market narratives. They are not tightly linked to the facts, and they don’t last forever.”

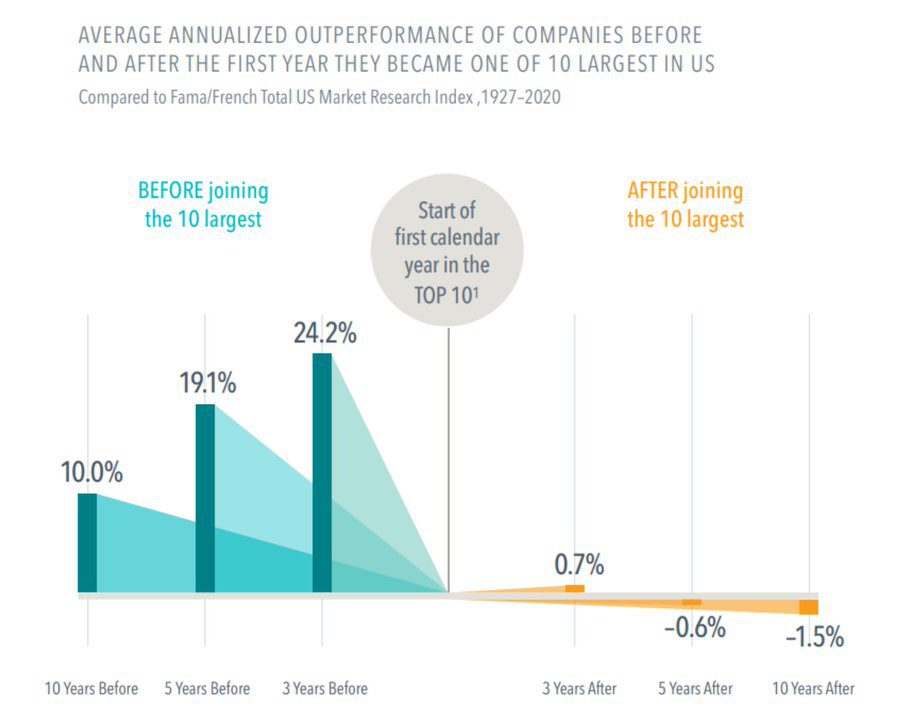

Many of the AI darlings are now among the 10 largest stocks in the U.S., not to mention the world. Has owning the biggest names this year worked? Absolutely.

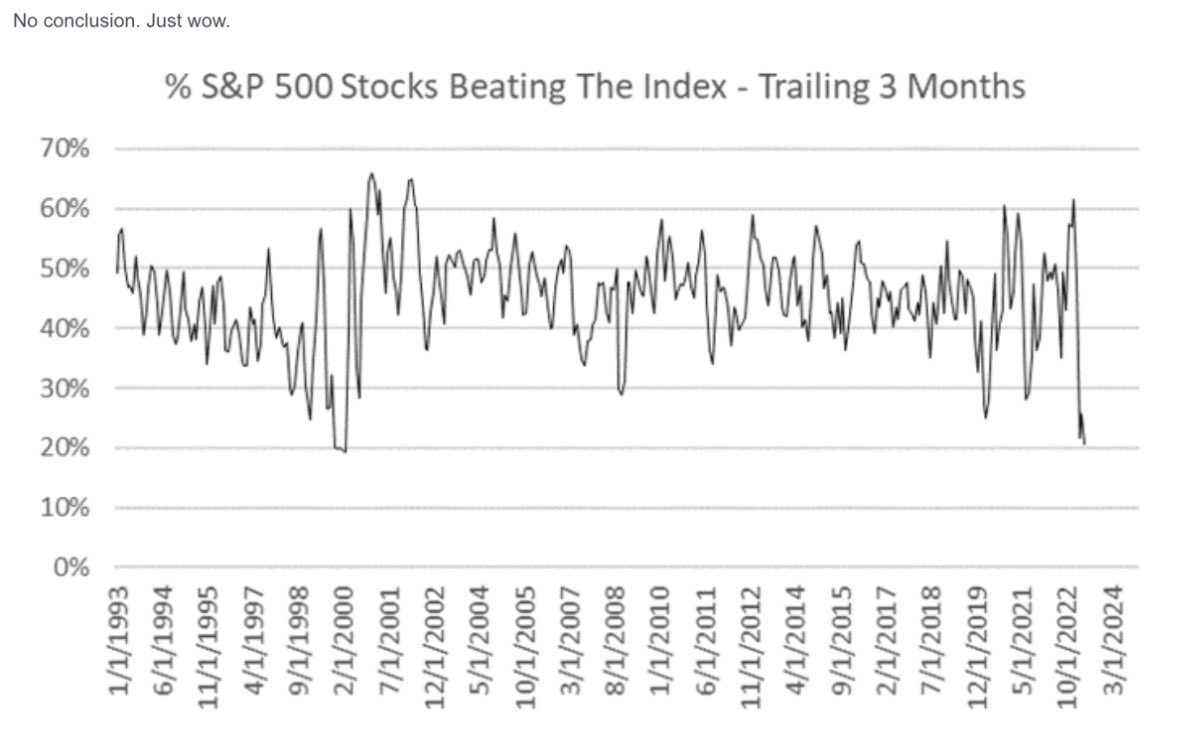

Moreover, only about 20% of stocks in the S&P 500 have outperformed over the last three months, near historic lows. Again, back to tech bubble levels of narrowness.

However, historically (at least from 1927 through 2020), the largest stocks were not positioned for strong future appreciation. This has nothing to do with how well the business may fare or how strong earnings growth may be. It just means that 1) the valuation already takes into account the likely business momentum, and 2) trees don’t grow to the sky. It is mathematically much more difficult for a giant company to generate outsized growth as it becomes larger. In other words, chasing the top 10 is often a case of throwing good after bad.

While the market often focuses on stories, we rely on a process. The seven key factors we track showed no change month over month, but we will spend a little time on each. Moreover, we are evaluating another factor that looks more closely at market sentiment to improve our process.

| More Negative | Neutral | More Positive | |||

| Inflation | ≈ | ||||

| GDP Growth | ≈ | ||||

| Fed Policy | ≈ | ||||

| Interest Rates | ≈ | ||||

| Credit Spreads | ≈ | ||||

| Stock Multiples | ≈ | ||||

| Earnings Growth | ≈ | ||||

| Deteriorating | ← | ||||

| Status Quo | ≈ | ||||

| Improving | → | ||||

1. Inflation – Negative but stable. April core CI came in at 0.4%, which would annualize to around 5%, well above the Fed’s 2% target. However, as Mike Ashton, a.k.a., the Inflation Guy, notes, “But here is something that seems very weird to me. Prices of short-dated inflation swaps in the interbank market suggest that NSA headline inflation is going to rise less than 0.9% for the entire balance of 2023 (a 1.45% annualized rate). And actually, most of that rise will be in the next 2 months. The market is pricing that between June’s CPI print and December’s CPI print the overall price level will rise 0.23%…less than ½% annualized!”

In other words, the market is anticipating a sharp drop in inflation despite absolutely no move in the trend toward those levels.

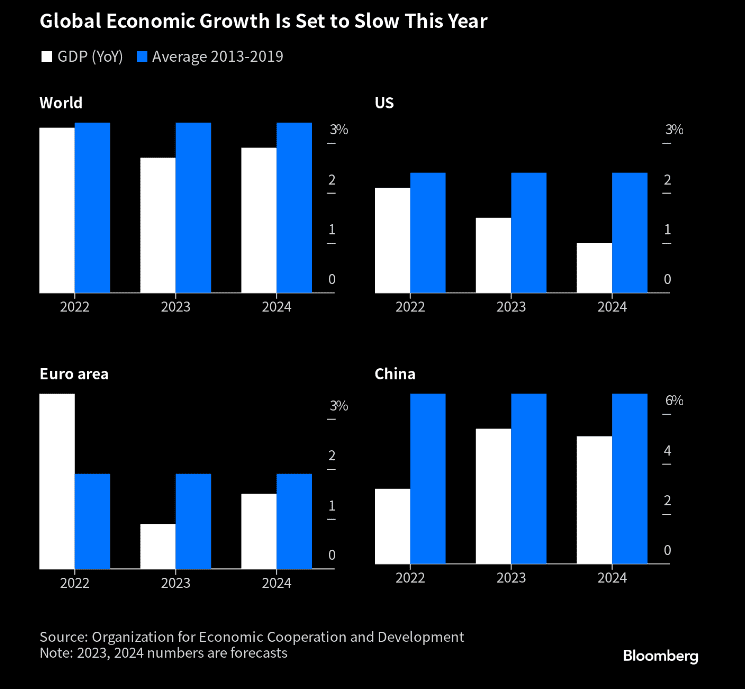

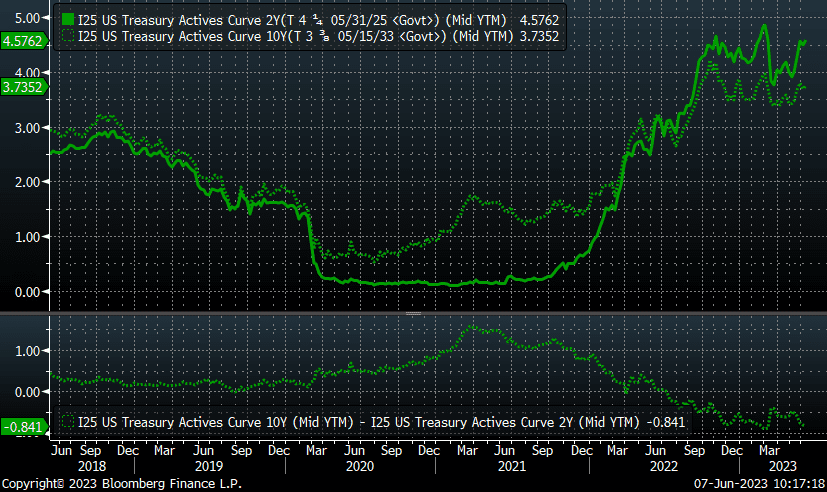

2. GDP Growth – Negative but stable. Is a recession imminent? Not necessarily, though the inverted yield curve remains a problem; the 2-10 inversion has sunk to 84 basis points, which is relatively deep. The only thing worse will be if this curve un-inverts due to a collapse in the two-year treasury. The OECD projects below-average growth globally for the next two years, with the U.S. particularly weak on a relative basis.

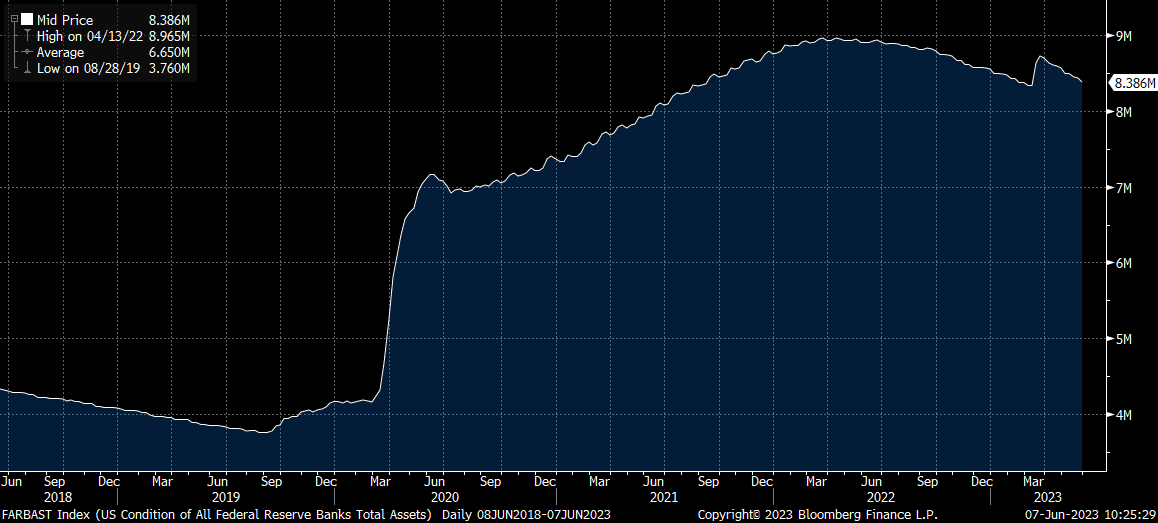

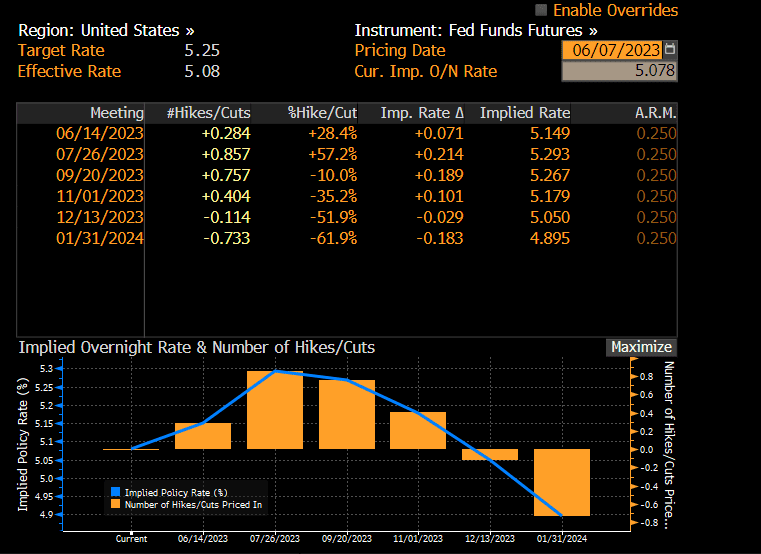

3. Fed Policy – Negative but stable. Quantitative tightening has resumed post the spring banking tumult, i.e., the Fed is reducing the size of its balance sheet, though odds have increased for a pause in rate increases, at least until July. Note how elevated the balance sheet is versus pre-Covid levels.

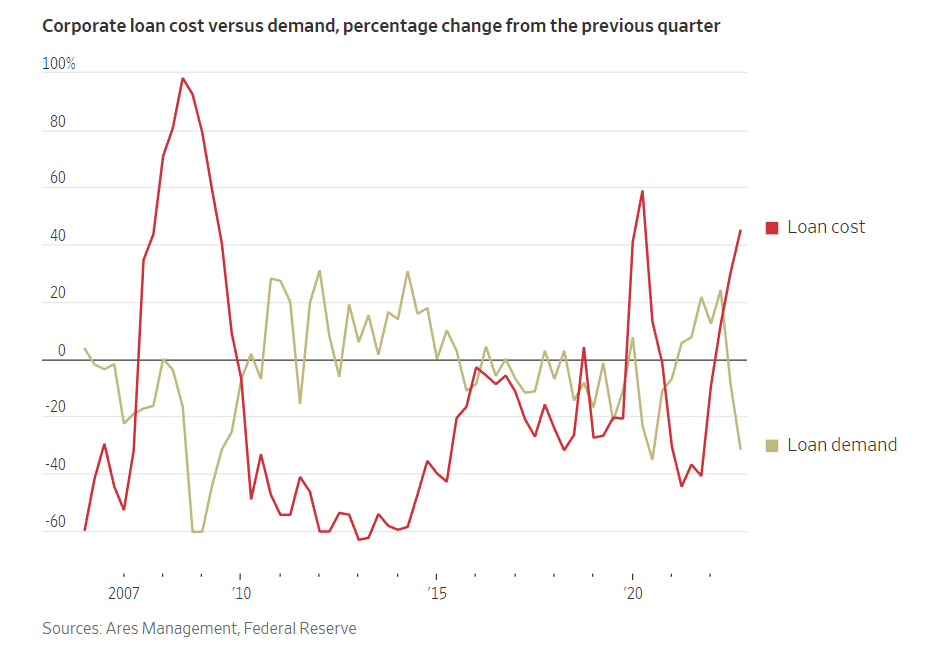

4. Interest rates – Negative but stable. The 10-year Treasury increased slightly in May, and effective rates on both credit cards and mortgages remain elevated in absolute terms and versus treasuries. The cumulative debt burden on consumers is a concern, and student debt repayments are scheduled to resume in August. Higher rates are impacting corporate borrowing, too.

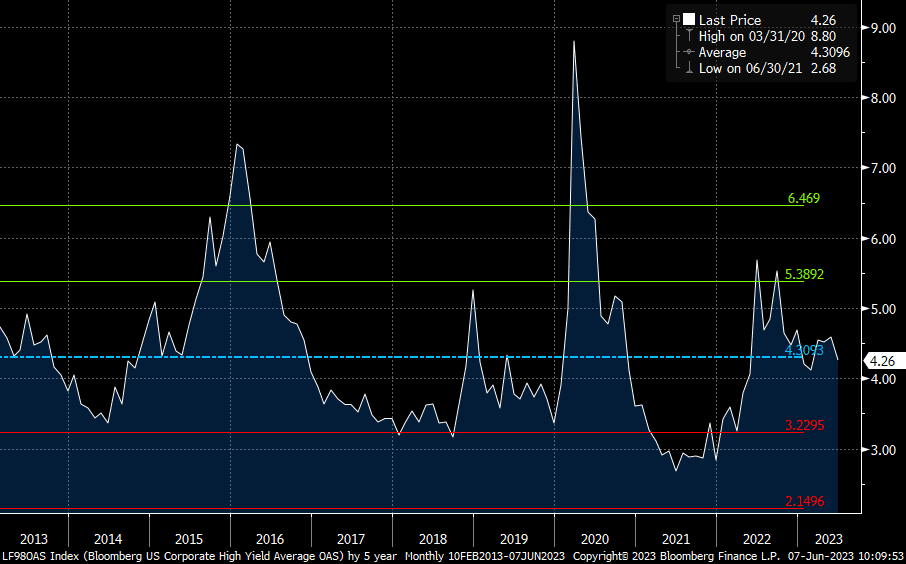

5. Credit spreads – Negative but stable. Spreads do not reflect the likelihood of an economic slowdown. High-yield spreads are in-line with their long-term average and have not widened despite banking tumult.

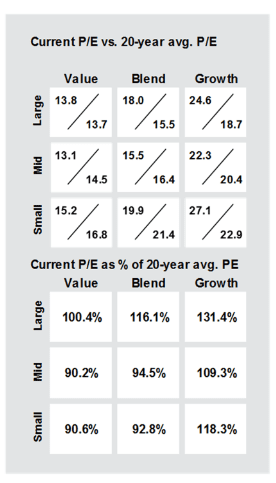

6. Stock multiples – Negative but stable. Stocks are moderately expensive on an index basis versus recent history, i.e., the last 25 years, on every metric. Growth stocks, especially large cap, are the most overvalued, according to J.P. Morgan, while the megacap tech stocks are trading at almost 34x forward earnings, higher than at the 2021 peak. Value stocks, especially in the mid and small cap arena, are inexpensive.

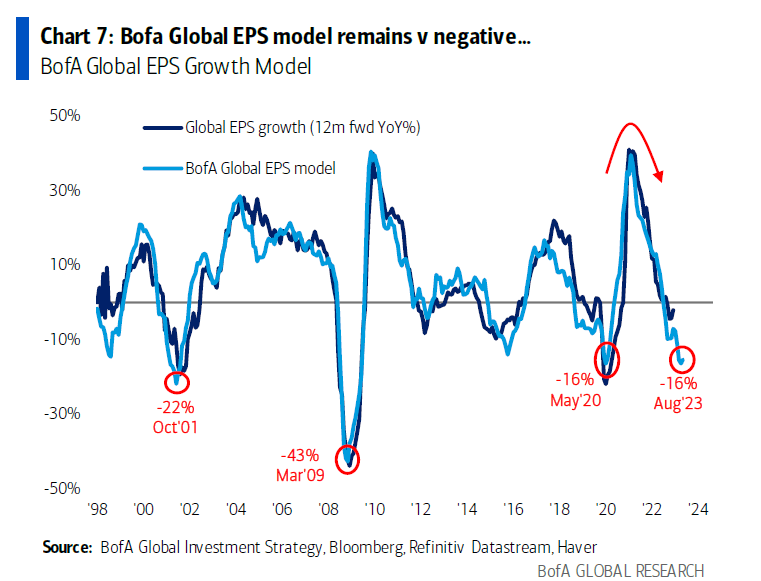

7. Earnings growth – Negative but stable. While better than expected, earnings growth was poor for the S&P 500. We find it difficult to reconcile tepid economic growth projections with margins remaining at the elevated level required to allow for earnings growth over the intermediate term. BofA’s model is targeting a 16% decline in earnings. That seems draconian to us, but even if directionally accurate the market is too optimistic at present.

Conclusion – I was made for you

“But these stories don’t mean anything, when you’ve got no one to tell them to, it’s true, I was made for you.” Brandi Carlile, The Story

In an interview, Citadel’s legendary founder Ken Griffin stated, “If you listen to the CEOs of tech companies, it’s going to eliminate millions of white-collar jobs. I say, ‘Not that fast.’ Some professions are accepting of errors, but you have to be really accurate in finance. You have to be really accurate as a lawyer.” As a finance practitioner, I strongly concur. As it relates to the law, look no further than this article for how using AI can go awry, with six non-existent cases cited in an AI-driven legal brief.

On the other hand, famed investor Stan Druckenmiller is in on the story:

Even Forbes is in on the craze. Full disclosure, the article is from 2016, and this cover is from 1998, but you get the idea. The concept has been around since at least Jonathan Swift’s Laputa in Gulliver’s Travels. The CEO on the cover here, Christy Jones of PCorder.com, was unable to use AI to beat Dell, as the bottom half of the cover states she aspired to do.

Our point in noting these items is simply to show that the promise of AI is longstanding, though its actual impact remains unknown.

Can we control the mania around these stocks? No. does our process indicate a favorable risk/reward around many of these names? Also, no.

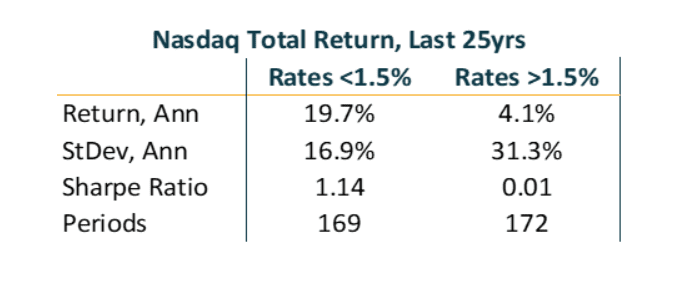

Our job is to create portfolios that, to quote The Story, are made for you. The portfolios we are making for clients at this point focus on areas of the market we find less efficient and more attractive. One area that is attractive right now is smaller cap; alternatively, you could say that the NASDAQ 100 is unattractive.

Similarly, if you think we are simply going to return to the era of easy money, the NASDAQ may be attractive. If not, perhaps you should look elsewhere, which we are.

The only thing better than a story is a Choose Your Own Adventure. Let’s pretend that Fed chair Jay Powell is the author here and we are on page 38. Turn to page 51 if you raise rates until you cause a recession, or page 79 if you pause and let the economy run hot.

Page 51 – as always, the Fed drives in the rearview mirror too long. Liquidity tightens too much, lending craters, and unemployment rises. Lofty earnings expectations for large caps are not met, and the S&P 500 declines, led lower by the prior leaders as deleveraging occurs.

Yikes. That’s no good. Thankfully, we left our thumb on page 38, so we can flip back and choose the other path.

Page 79 – The strength we have seen in employment portends continued economic health, which the Fed lets run. This begets higher than normal inflation, but a broader market rally fueled by rotation into smaller stocks and lagging sectors.

Historically, employment is a trailing indicator and the last component to show weakness, but perhaps this time it is different. We have seen a modicum of this rotational behavior to start June, with smaller cap and value stocks outperforming the S&P 500 and the NASDAQ.

Regardless of which adventure we choose to end this part of the story, we think the continued unabated dominance of large caps is near its conclusion, and we are positioned to participate in any meaningful rotation as well as defend in a significant downturn.

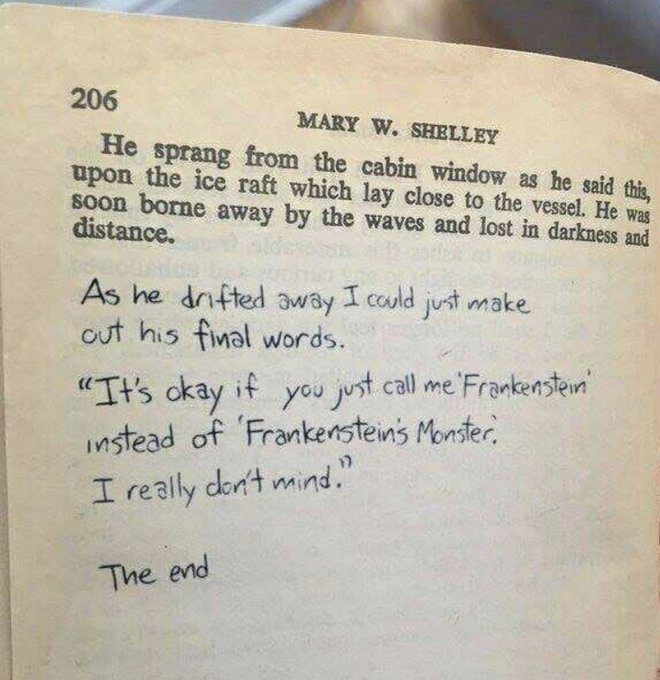

As any good story should conclude, we finish with “The End”. Except for Frankenstein, which should have ended like this:

Chat GPT-Written Version of June Update: Embracing “The Story” by Brandi Carlile

As we reflect on the financial landscape of May 2023 and the overall Year-to-Date (YTD) performance, it’s impossible to ignore the profound impact of Brandi Carlile’s timeless ballad, “The Story.” Just like the song’s poignant lyrics, the investment markets have been on a journey of ups and downs, embracing uncertainty, resilience, and the power of a compelling narrative. Let us delve into the tale of the investment world through the lens of “The Story.”

May, much like the song’s heartfelt melodies, carried a bittersweet melody for investors. Global equities experienced a period of mixed performances as markets grappled with shifting narratives. The opening lines of “The Story” perfectly encapsulate the mood: “All of these lines across my face tell you the story of who I am.” Indeed, the market’s visage bore the marks of volatility, revealing the essence of its ever-changing nature.

Some chapters of May were marked by geopolitical tensions, trade uncertainties, and concerns over inflationary pressures. These factors played their part in injecting a dose of caution into investors’ sentiments. Yet, just as the song’s chorus assures us, “But these stories don’t mean anything when you’ve got no one to tell them to,” it is crucial to remember that an investment portfolio is a long-term endeavor. Short-term narratives may sway the markets, but it is the underlying fundamentals that truly shape the tale.

Looking back on the broader YTD performance, the investment story unfolds with more optimism. Despite the twists and turns encountered along the way, global equity markets have managed to weather storms and show resilience. The refrain, “I climbed across the mountain tops, swam all across the ocean blue,” echoes the perseverance and determination of investors in the face of adversity. A diversified approach and a focus on long-term goals have proven to be valuable assets in navigating this journey.

Throughout the year, certain sectors and regions have emerged as protagonists in this narrative. Technology and innovation continue to be a driving force, with advancements in artificial intelligence, clean energy, and digital transformation capturing the attention of investors. The refrain of “I saw my reflection in the snow-covered hills,” speaks to the potential for self-reflection, adaptability, and the embrace of change.

Furthermore, sustainable investing has gained significant traction, with environmental, social, and governance (ESG) considerations playing an increasingly important role in shaping investment decisions. The line, “All of these lines across my face tell you the story of who I am,” takes on a broader meaning, as investors seek to align their portfolios with their values and contribute to positive change in the world.

As we continue through 2023, it is important to remain attuned to the ongoing narrative. The markets will undoubtedly face further challenges and unexpected plot twists. However, by staying true to our long-term investment strategies, remaining flexible in the face of change, and embracing the power of diversification, we can confidently navigate the ever-unfolding story of the investment landscape.

Just as Brandi Carlile’s “The Story” concludes, “To the ones who’ve always been there, you’re the ones that I have kissed,” we extend our gratitude to our clients and investors for their trust and resilience. Together, we author the tale of investment success, guided by the wisdom and spirit of “The Story.”

READY TO TALK?