Quick Take for March 17th, 2020

The markets have recently reminded all that volatility is always right around the corner. Volatility, sudden corrections, uncertainty—all part of the price we pay to participate.

Context, however, is what’s missing from most things today. We are so fixated on right now—we forget where we were, and lose sight of where we want to go.

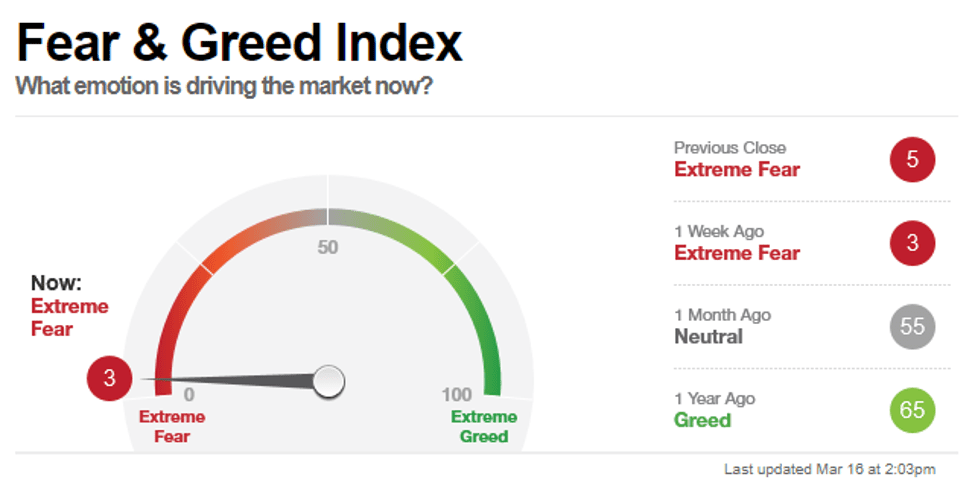

Nowhere is this more prevalent than in the stock market. We need look no further than the “Fear and Greed Index” to see how quickly things change.

A month ago, things were neutral. Now, investors are feeling extreme fear, and that relates only to the market, setting aside the huge unknowns looming as we feel our way through a situation we have not previously faced as it relates to the short- and long-term impact of the coronavirus.

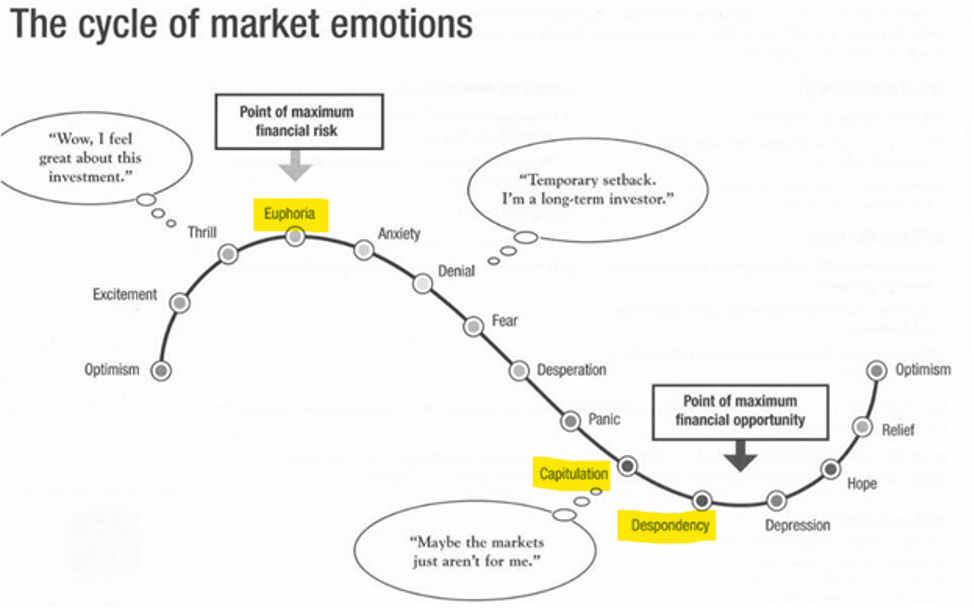

From a market perspective, we have gone from the top of the rollercoaster (or close to it) to what feels like somewhere near capitulation or despondency in a little less than a month (we were at all-time high a little over a month ago, in case you don’t recall). Unfortunately, this type of rapid change could be the “new normal” for the markets in this age of direct investment at the retail level by those investors who choose not to work with an experienced financial advisor.

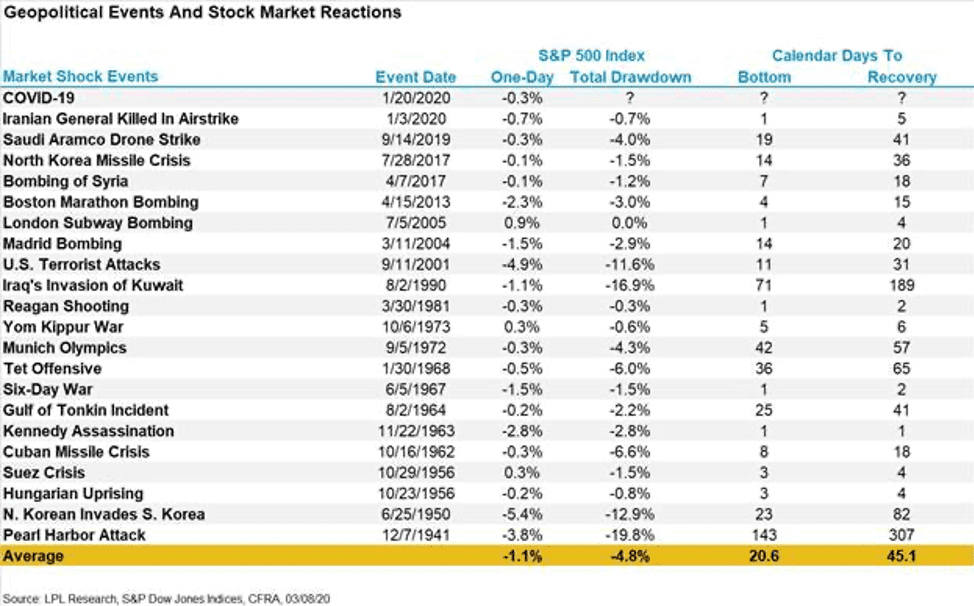

The action we are seeing in the markets is truly historic. The S&P’s current drawdown (as of today) is worse than any on record from these types of exogenous events. Think of where the world was 143 days after Pearl Harbor (Germany conquering most of Europe and Japan running amok in the Pacific) and that drawdown was “only” 19.8%. As of the close on Monday, March 16th, the S&P 500 was over 30% below its highs!

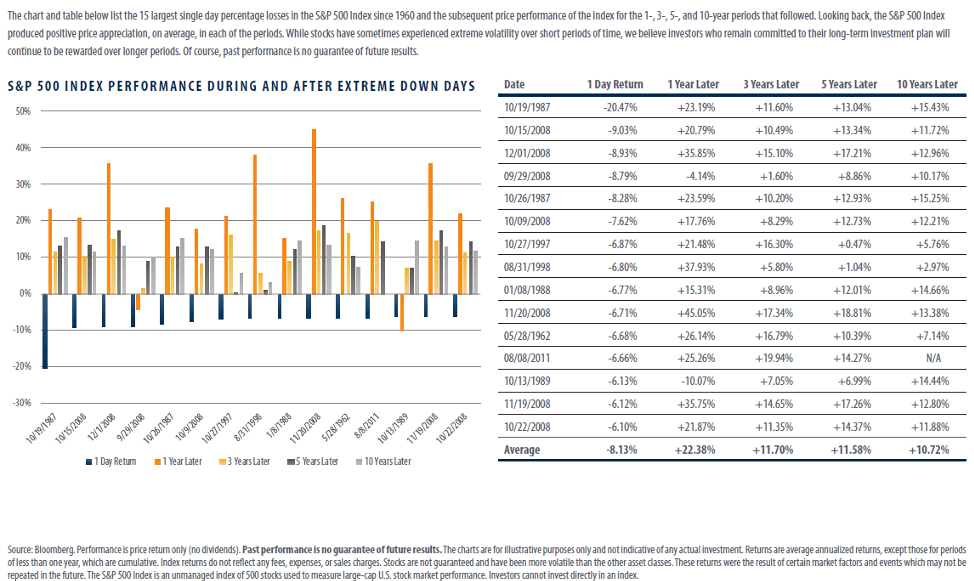

The following graph and table show how markets have historically responded from steep declines. What transpires this time may be different, but at least we have some context for the long term at a time when it is in short supply.

The response from policymakers is evolving. The Federal Reserve has reduced its overnight borrowing rate for banks to zero in an effort to alleviate strain on the financial system. It has also increased its purchases of bonds, commonly referred to as quantitative easing. The other method of economic stimulation, fiscal policy, is murkier, though measures aimed at helping employees and businesses through a challenging time are being considered.

We don’t know what will happen next—nobody does. The current market decline is the result of a confluence of events. There is the obvious uncertainty over the impact of the virus, both socially and economically. On top of that (and often overlooked) is the effect of Saudi Arabia’s decision to begin an oil price war, which, in our opinion, is being funded by its liquidation of U.S. dollar assets, i.e., stocks and bonds; this has exacerbated selling pressure on the markets. Finally, we are dealing with the madness of crowds. Whereas this is often associated with outrageous bubbles, in can just as well apply to panicked selling by speculators.

We prepare for different scenarios, and we prepare to act when necessary. If the markets are making you uneasy—call your advisor and talk it through.

READY TO TALK?