Acacia Research Corporation (NASDAQ: ACTG)

In this research note, Formidable provides an update on its prior research on Acacia Research Corporation (NASDAQ: ACTG), which represents an investment opportunity in secondary private equity, as well as patent litigation (its historical bailiwick). Previously, we cited the following potential catalysts as helping close the gap between our base case price target and the company’s share price, which was approximately $6.76 at the time of our publication and was $6.30 as of market close on 9/9/2021.

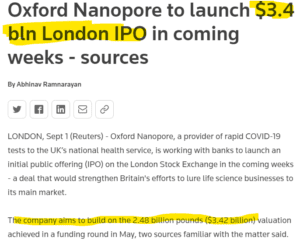

- Upcoming Oxford Nanopore IPO

- New acquisitions

- Additional sell side analyst coverage

- Portfolio development of life sciences assets

- Additional patent litigation wins

We have seen material developments on three of the five items. We will take each in turn, but first want to address some unpleasant news from an 8-K filed on September 10, 2021:

“(O)n September 9, 2021, Acacia Research Corporation (“the Company”) accepted the resignation of Alfred V. Tobia, Jr., President and Chief Investment Officer and member of the Board of Directors. Mr. Tobia resigned from serving as an officer and director of the Company following his disclosure to the Company of trading in the securities of the Company and certain investments of the Company by a member of Mr. Tobia’s family. The Company has commenced a review into the trading. Mr. Tobia did not hold a position on any committee of the board of directors at the time of his resignation. Clifford Press, the Company’s Chief Executive Officer, will assume the role of President and, in connection with him assuming such role, his compensation will not change.

While unfortunate, we do not believe this is indicative of any systemic issue within the company and reflects an isolated incident the company addressed appropriately. Mr. Tobia’s expertise will be missed but ACTG has time to find a replacement, given it is currently pursuing its first major operating company acquisition.

Now, on to the positive developments.

- Upcoming Oxford Nanopore IPO. If ever there was a shoddy headline, it is this.

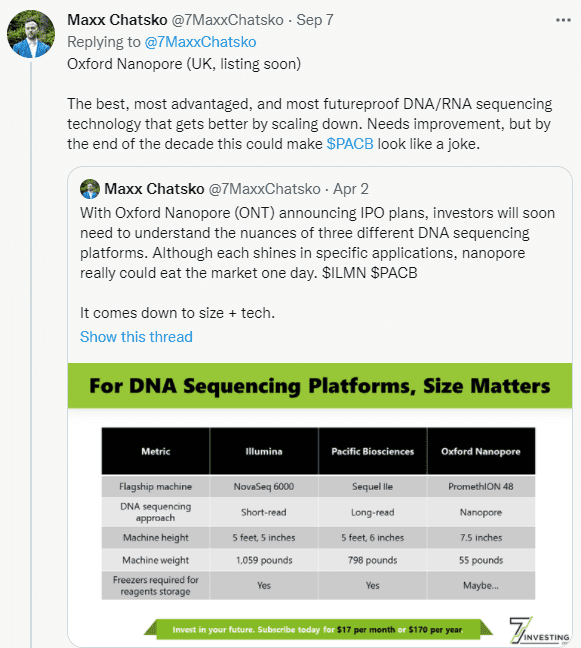

The company was valued at this level during a private round in May. Publicly traded peer Pacific Biosciences of California, Inc. (NASDAQ: PACB) trades at approximately $6.3 billion. Oxford’s revenue in 2020 was $158M, up over 100% versus prior year whereas PACB earned less than Oxford in 2020 and grew more slowly; https://www.genomeweb.com/business-news/oxford-nanopore-technologies-2020-revenues-more-double#.YTEezY5KiUk. We believe Oxford Nanopore would look to IPO at or near PACB’s $6 billion valuation versus the headline $3.4 billion figure most rubes did not read past.

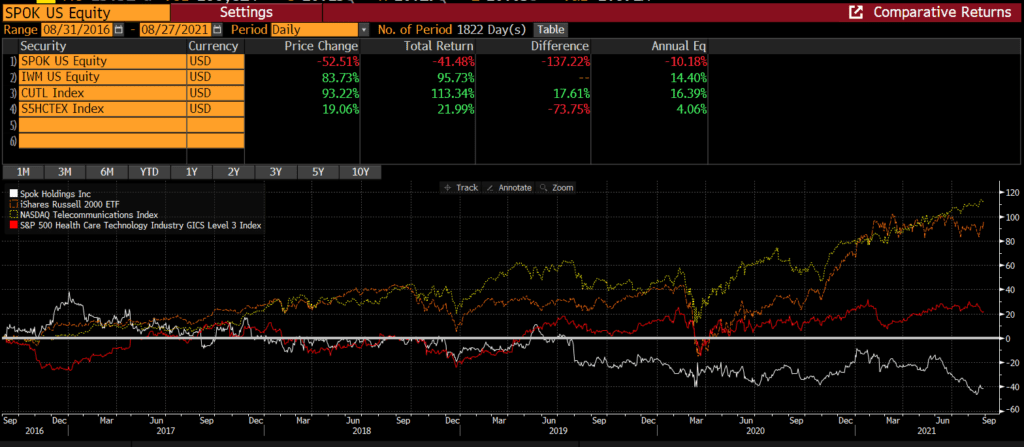

- New acquisitions. ACTG announced on 8/30/21 that it was proposing an acquisition of Spok Holdings, Inc. (NASDAQ: SPOK). While not the scintillating growth name some may have hoped for the company, it fits the profile of the type of underperforming asset ACTG and its friends at Starboard Value can repair and resell.

Our quick take: the company has no sell side coverage and has massively underperformed small cap stocks, the NASDAQ telecommunications index, and the S&P health care technology industry over the last five years (the following graph excludes the bump in SPOK after ACTG’s offer of $10.75 per share). The company blames index selling for its recent underperformance, which we acknowledge has not helped. However, this is really a self-inflicted wound. The company’s declining market cap due to poor execution is largely the reason for its elimination from indices such as the Russell 2000 and 3000.

Here is our analysis of the company’s relative performance over the last five years (excluding its recent bump due to ACTG’s offer):

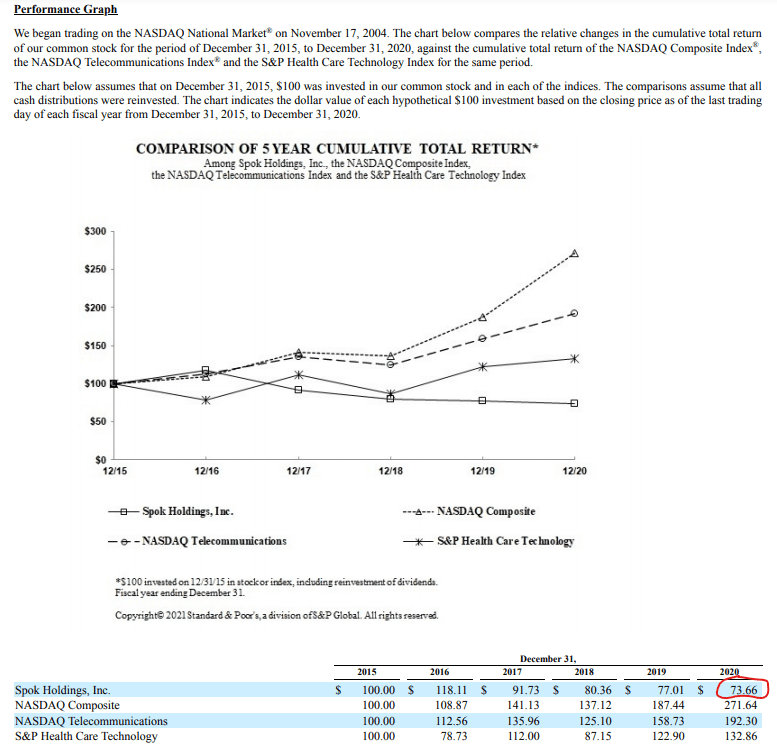

Here is what the company shows in its 2020 annual report:

The board turned down an offer from B. Riley Financials (NASDAQ: RILY) at $12 per share in March 2020. Given insiders own fewer than 4% of the company and both management and the board are entrenched, the refusal was unsurprising. The CEO/President, who has been with the company since 2004, owns little more than 1%, and has been an aggressive seller since Q3 2020.

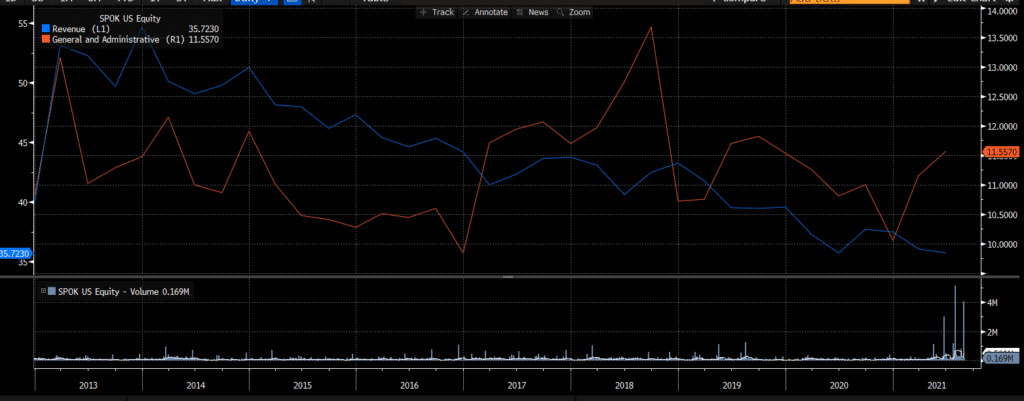

Revenue has steadily declined while general and administrative expenses, like executive and board compensation, have stayed the same. While we acknowledge COVID’s impact on revenues for 2020 and 2021, which management cites as the company’s primary reason for its lack of revenue growth, the fact is revenue has been in a downtrend for an extended period:

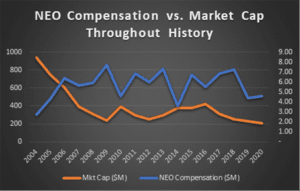

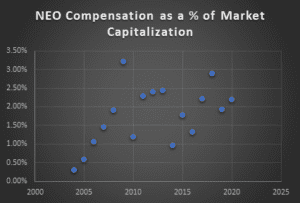

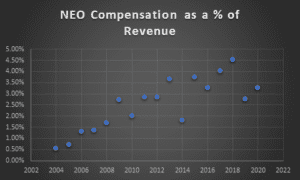

If we compare executive compensation to market cap or revenue, their pay remains the same as revenues drop and shareholder value is destroyed:

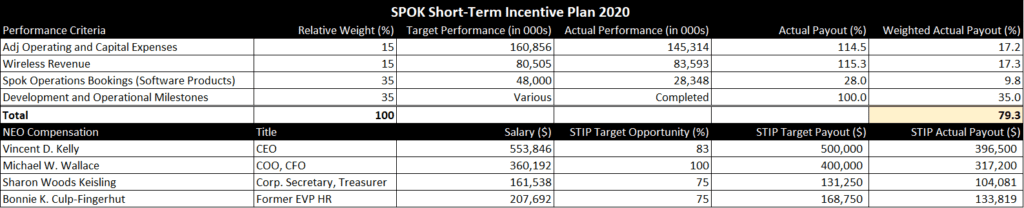

To gain a clearer understanding of how management rewards executives—and to determine if compensation is, in fact, consistent with shareholder interests—we dissected the company’s historical payouts under the short-term incentive plan, i.e., STIP. On average, STIP compensation accounted for 23% of total NEO compensation from 2018—2020. Performance indicators under the STIP vary throughout history and have typically included a measure of operational efficiency (e.g., cash flow or expenditures), segment revenue (separate or consolidated), software bookings (to support the transition), and more recently, development milestones. The Committee establishes a baseline weight for each measure based on its perceived relevance to overall company performance, and it calculates a Weighted Actual Payout for each metric reflecting the company’s execution in that area. To determine the STIP cash bonus for the period, the Committee adds the adjusted segment weights together and multiples them by a predetermined percentage of the NEO’s base salary, or STIP Target Opportunity. See below for STIP compensation for 2020:

Since SPOK implemented software revenue and/or bookings as a measure of performance in 2011, the company has failed to reach target software revenue/bookings in eight of the ten years. While 2020 was particularly poor due to constrained hospital budgets resulting from the pandemic, the company has failed to execute its transition since the beginning. Conversely, wireless revenue has exceeded targets each year it was measured (reported as “consolidated revenue” from 2014–2016), which rewards executives for surplus wireless sales. While positive in most cases, we believe this reflects poorly on the company’s transition, which is management declared is “still several years from completion” in its 2020 Annual Report.

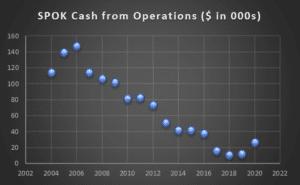

Another major component of executive compensation is cash from operations (2006–2016) and adjusted operating and capital expenses (2017–present). Despite declining every year since 2007 (Figure 1), SPOK’s cash from operations has substantially driven NEO compensation, exceeding target cash flows in all but one year and accounting for an average of 53% of STIP compensation annually—until the metric was eliminated in 2017. In other words, it appears SPOK established trivial cash flow targets that the company could easily meet, and in most cases exceed, to inflate executive compensation in prior years. Then, when cash flow further degraded, it changed the metric. Of course, we would expect cash from operations to decline during such a transition, but to compensate so heavily for a declining, unreliable metric is dubious, in our opinion.

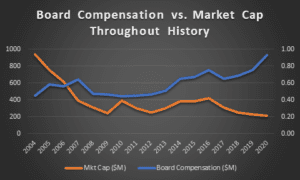

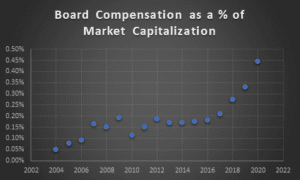

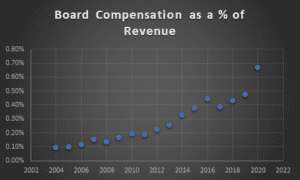

The Board has also seen its compensation increase (as has its size) despite the company’s shrinking market cap and declining revenue.

The company has ten board members; they earn almost $1m per year. The company pays its auditor approximately $1.4 million annually. Executive management received almost $14 million in compensation between 2018 and 2020, with the CEO compensation comprising almost half of that figure, despite faltering sales.

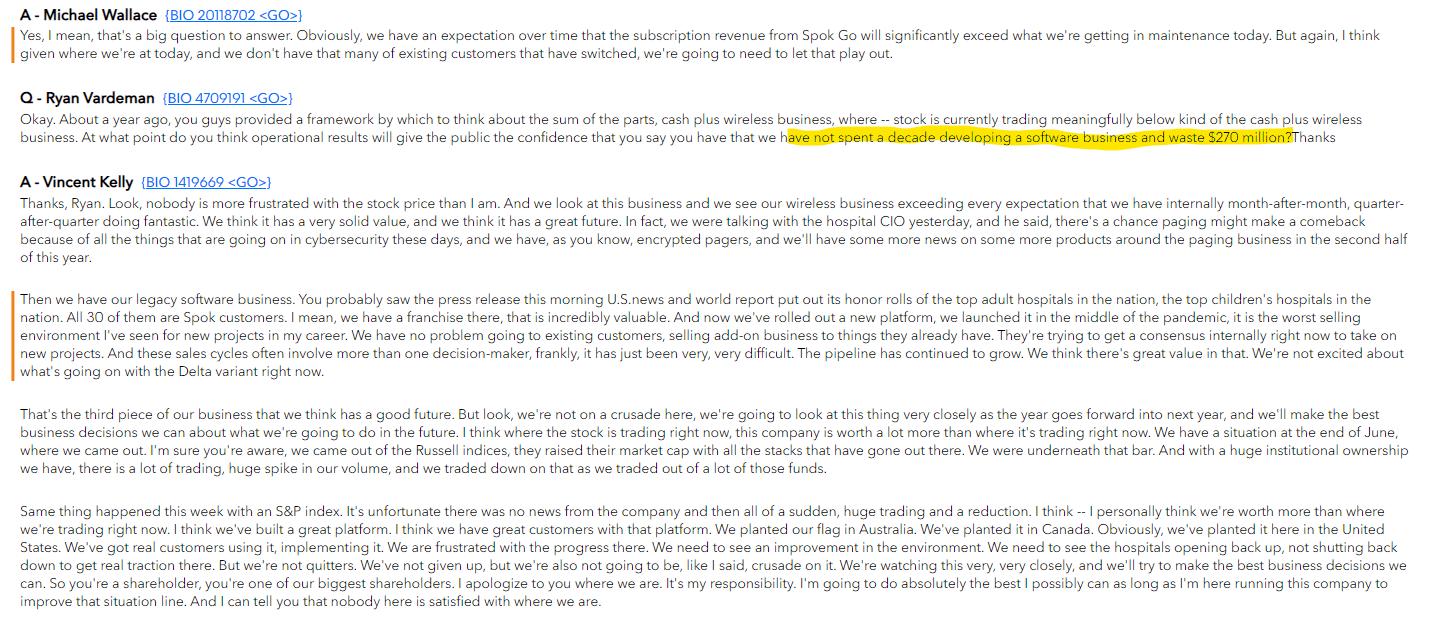

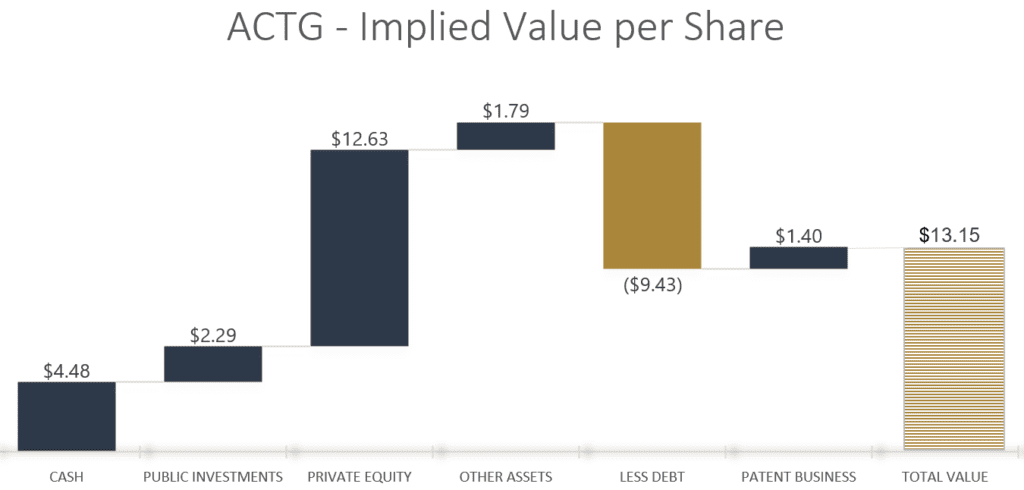

Ultimately, our take is the company has failed to successfully pivot from its legacy hardware business, despite spending significant dollars (perhaps as much as $270 million per the Q2 earnings call) on R&D over the past ten years. Management and the Board prefer to milk the company as a cash cow as opposed to do what is in the best interest of shareholders, so we think this is a great spot for ACTG and Starboard to do what is necessary.

Unfortunately, and unsurprisingly, the company and board announced a “rights plan” to protect themselves. We hope other investors see this for what it is:

- Additional sell-side coverage. Nothing to report here. Still only one analyst.

- Portfolio development of life science assets: Without getting into too much detail, we have seen positive developments from four of the life sciences companies. FDA priority reviews for both IMCR and Mycovia reflect large potential addressable markets. Such approvals typically de-risk drug development and warrant a higher valuation.

- IMCR: Priority review for melanoma drug announced August 24, 2021. https://www.globenewswire.com/news-release/2021/08/24/2285396/0/en/Immunocore-Announces-that-U-S-Food-and-Drug-Administration-and-European-Medicines-Agency-accept-Biologics-License-Application-and-Marketing-Authorization-Application-for-Tebentafus.html

- Viamet (now known as Mycovia): U.S. FDA Acceptance and Priority Review of New Drug Application for Oteseconazole for the Treatment of Recurrent Vulvovaginal Candidiasis announced July 28, 2021. https://static1.squarespace.com/static/5ab958c5e749401d7a2ed988/t/61008a49003cdb5936823cc3/1627425353834/Mycovia+Oteseconazole+NDA+acceptance+release_+7.27.21_MLR+approved_FINAL.pdf

- AMO Pharma Limited: Received innovative licensing and access pathway (ILAP) designation from the UK Medicines and Healthcare products Regulatory Agency (MHRA) for AMO-02 (tideglusib), an investigational therapy in development for the treatment of congenital myotonic dystrophy type 1 (CDM1) on August 17, 2021. https://www.amo-pharma.com/news/Press_Release_210817.htm

- Novabiotics: Announced Cysteamine Bitartrate (NM002) included in REMAP-CAP Phase 3 Clinical Trial for Community Acquired Pneumonia. NovaBiotics Announces Cysteamine Bitartrate (NM002) Included in REMAP-CAP Phase 3 Clinical Trial for Community Acquired Pneumonia – Novabiotics

- Additional patent litigation wins: Nothing we have seen in terms of wins, though ACTG has been active recently, with new suits against Samsung in August, per @TheIPHawk.

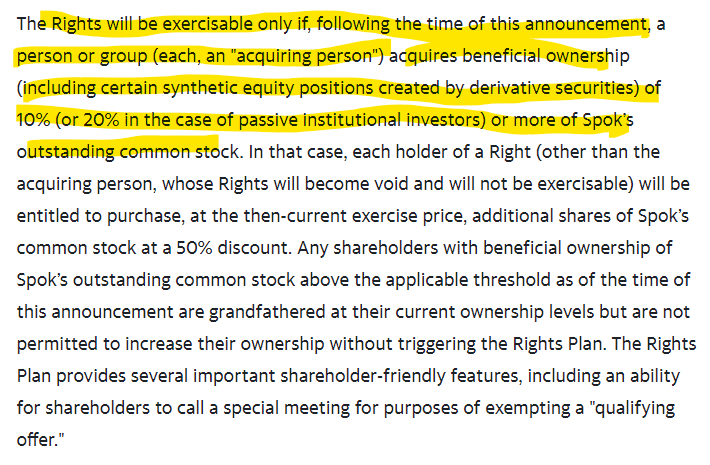

As a reminder, Formidable’s base case estimates the unrealized value of ACTG’S private equity investments materially exceeds the company’s book value accounting for these investments. The body of our previous whitepaper provides insight into the methodology applied to arrive at the Formidable base case estimated value for each investment. For more information on each individual investment, readers are encouraged to visit the whitepaper.

After updating our models for the recent developments as well as ACTG’s Q2 earnings, Formidable concludes ACTG currently trades at over a 50% discount to the fair value of its assets.

Our updated base case price target of $13 considers the undervaluation of its investment portfolio as well as improved momentum for its patent litigation business and the potential acquisition of SPOK.

DISCLOSURES

General Firm

Formidable Asset Management, LLC (Formidable) is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. Although taken from reliable sources, Formidable cannot guarantee the accuracy of the information received from third parties.

The opinions expressed herein are those of Formidable and may not actually come to pass. This information is current as of the date of this material and is subject to change at any time, based on market and other conditions. Any index performance cited or used throughout is intended to illustrate historical market trends and performance. Indexes are managed and do not incur investment management fees. An investor is unable to invest in an index. The performance shown may not reflect a Formidable portfolio.

Past performance is no guarantee of future results.

Reader should assume that future performance of any specific investment or investment strategy (including the investments and/or investment strategies discussed in these materials) made reference to directly or indirectly in these materials will be profitable or equal the corresponding indicated performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable. Historical performance results for investment indices and/or categories generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results.

Specific Securities

The mention of specific securities and sectors illustrates the application of our investment approach only and is not to be considered a recommendation by Formidable. The specific securities identified and described above do not represent all the securities purchased and sold for the portfolio, and it should not be assumed that investment in these securities were or will be profitable. There is no assurance that the securities purchased remain in the portfolio or that securities sold have not been repurchased. Charts, diagrams and graphs, by themselves, cannot be used to make investment decisions. You may contact Formidable Asset Management, LLC for a full list of recommendations made during the preceding period one year.

Not an Offer

These materials do not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or any other product or service by Formidable or any other third party regardless of whether such security, product or service is referenced here. Furthermore, nothing in these materials is intended to provide tax, legal, or investment advice and nothing in these materials should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. Formidable does not represent that the securities, products, or services discussed here are suitable for any particular investor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your personal investment objectives, financial circumstances and risk tolerance. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation.

The opinions expressed here are those of Will Brown and Adam Eagleston are not intended as investment advice. They are also subject to change with changing market conditions. Clients of Formidable may have positions in securities discussed in this article. This writing is for informational purposes only; Formidable and the authors expressly disclaim all liability in respect to actions taken based on any or all of the information from this writing.

READY TO TALK?