June Update: Danger Zone

As referenced on our recent podcast, there is a modicum of excitement around Top Gun: Maverick. The original is iconic, in part due to its legendary soundtrack, including Danger Zone, by the unofficial king of soundtracks, Kenny Loggins.

It was a mere two week ago that the S&P 500 was in the danger zone, i.e., a bear market. And then, just like Maverick pulling out of a potentially deadly run-in with jet wash, the market arrested its slide, soaring into Memorial Day Weekend before finishing the month as level as the flight deck on the USS Enterprise. Crisis averted? That remains to be seen.

I can see it’s dangerous for you, but if the government trusts me, maybe you could.

Having just been approved for another term as Fed Chair, not to mention joining President Biden at the White House the same day as K-pop sensation BTS, it seems the government trusts Jerome Powell.

With inflation running rampant, it is likely the message to Powell was clear: do something to cool inflation before November’s mid-term elections. Unfortunately, fixing the problem is easier said than done. One, the Fed (and the Treasury, per a stunning admission from former Fed Chair and current Treasury Secretary Janet Yellen) were too late to acknowledge inflation was anything but transitory. Accordingly, they are playing catch-up. Two, the weapons at the Fed’s disposal (increasing rates and/or decreasing its balance sheet) are obtuse in a world where supply chains and energy infrastructure issues are parts of the inflation equation. It is like needing a precision, laser-guided missile fired from an F-14 but all you have is a World War II-era B-52 loaded with dumb bombs. They may do the job, but with a lot of collateral damage.

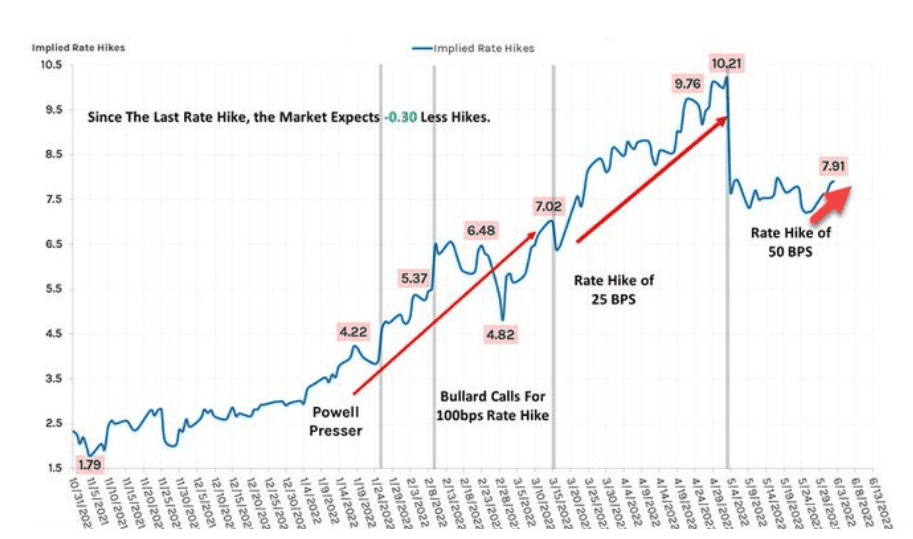

Not to belabor the point, but the Fed is under tremendous pressure to do something. Even historically dovish Fed officials like Vice Chair Lael Brainerd have stated that the Fed should not pause its interest rate increases, and that it is targeting an inflation rate of 2%, which seems ambitious, given current inflation is running over 8%.

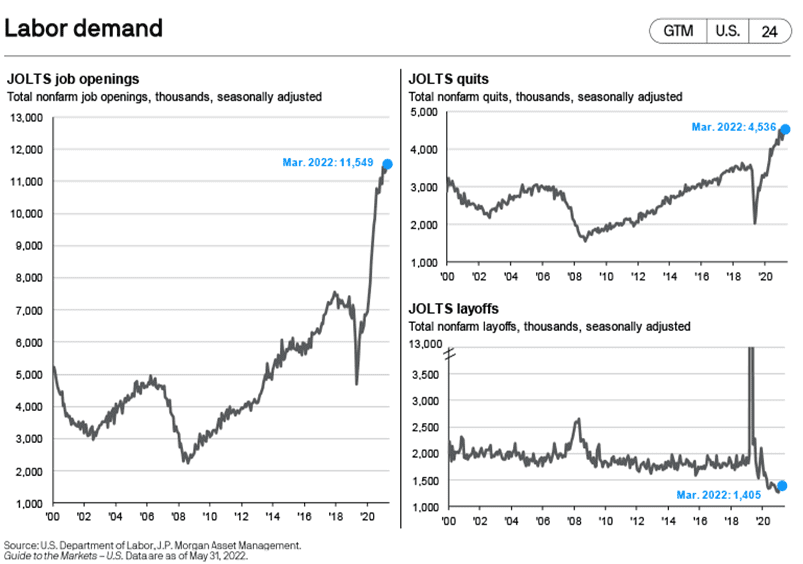

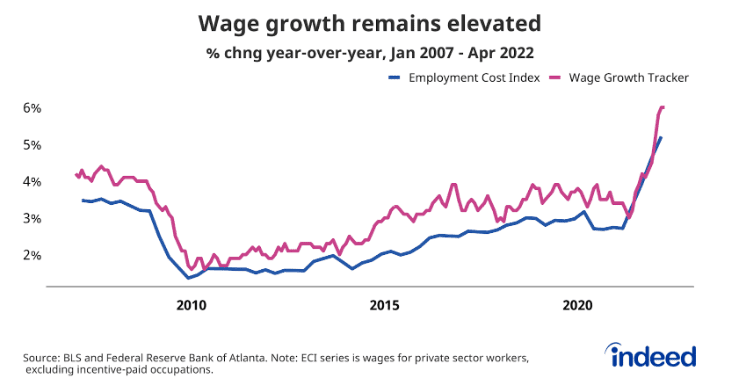

The other part of the Fed’s mandate, employment, remains too rosy, and is pushing wage inflation into the economy. The rearward looking metrics used by the Fed show room to cool labor markets, which is something it is trying to do. Anecdotally, we are starting just recently to see hiring freezes and reductions from several large companies, e.g., Tesla, Coinbase, Facebook.

In terms of interest rates, the Fed has raised 0.75% so far; expectations are for eight more 0.25% hikes, which would put the Fed Funds rate at 2.75%.

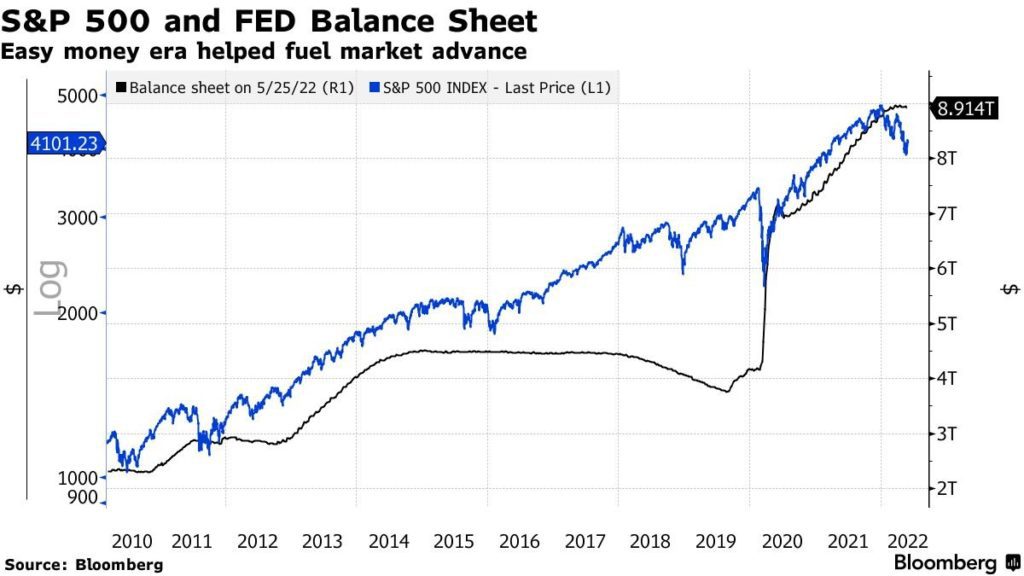

Moreover, on June 1, the Fed was supposed to start the process of shrinking its balance sheet, a.k.a. quantitative tightening. Though we are reticent to ascribe the level of the S&P 500 Index to the growth in the Fed’s balance sheet since 2010, it certainly is one factor that has served as a tailwind for equities. To be fair, earnings growth has been strong during this period as well, and the market performed well during the last decade even during periods when the balance sheet was stable or slightly contracting. Having said that, a material reduction in the size of the Fed’s balance sheet will, at best, eliminate the tailwind experienced by U.S. equities and, worst case, become a headwind.

To put it succinctly, the climate for U.S. equities may not be as favorable as it has been for the last decade-plus.

You’re everyone’s problem. That’s because every time you go up in the air, you’re unsafe.

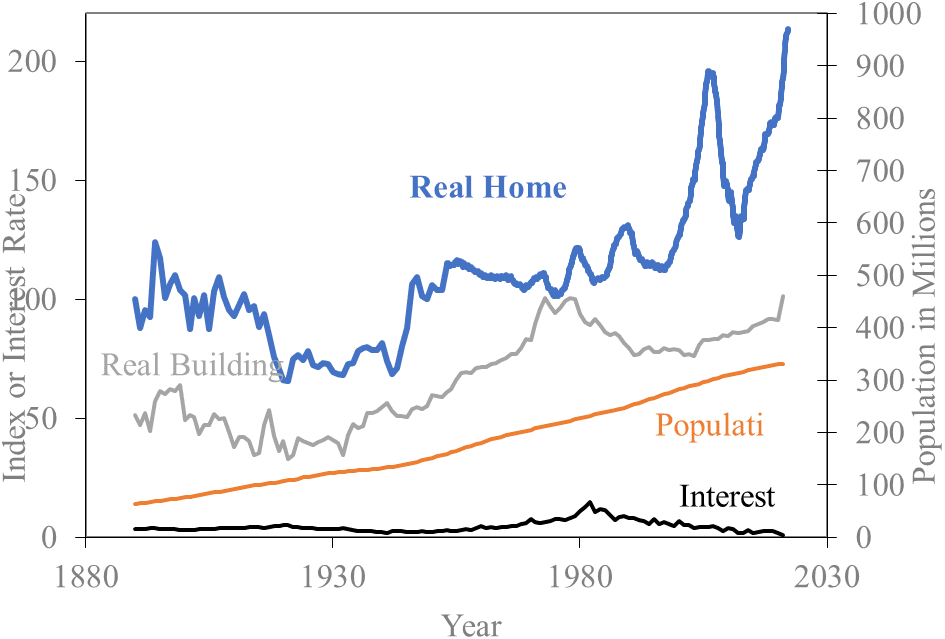

The impact of Fed policy does not stop at financial markets. With its balance sheet full of mortgage-backed securities, the Fed has contributed to the rise in home prices as well. According to data from economists Case and Shiller, real home prices are now in excess of where they were during the so-called housing bubble.

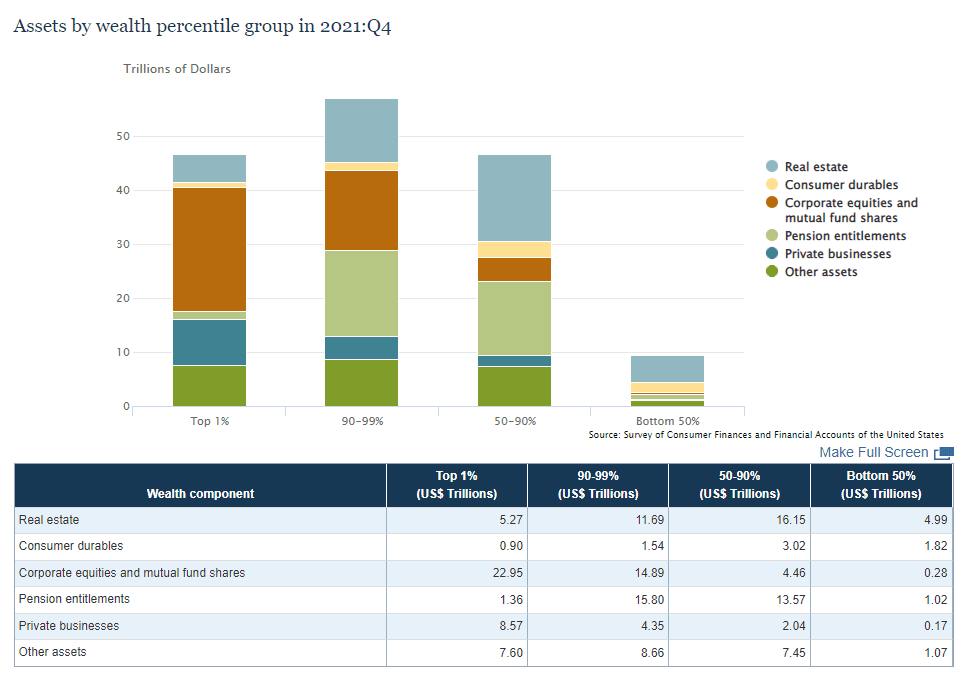

Moreover, for the majority, real estate, i.e., home values, comprise a much larger percentage of their wealth than stocks.

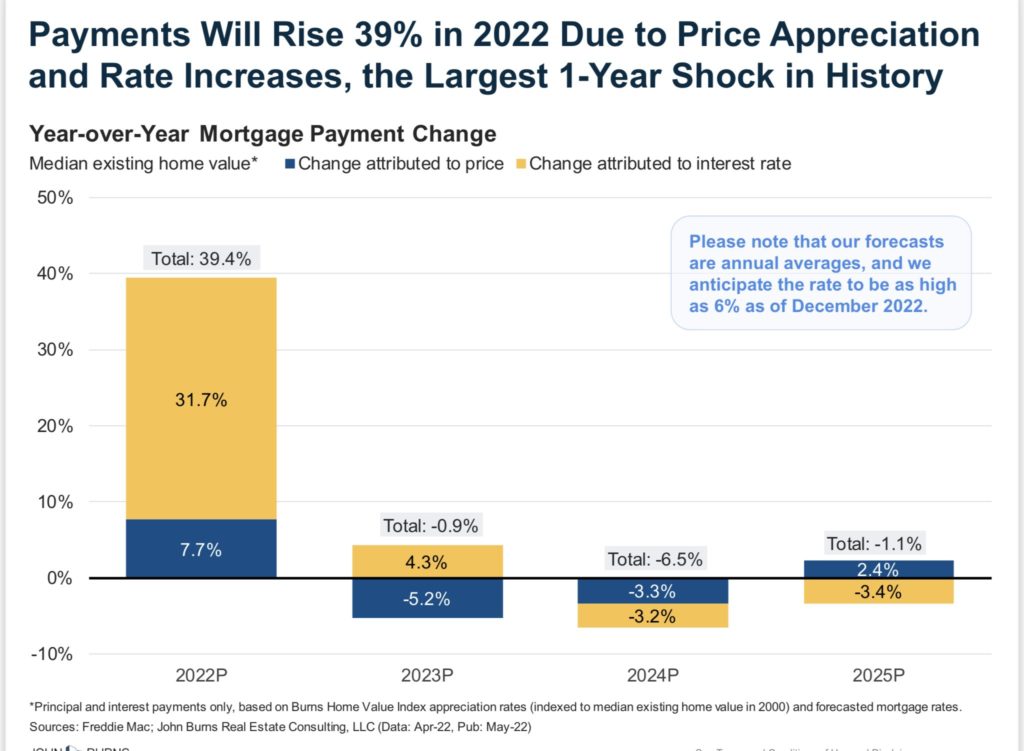

Will tightening Fed policy start to put a damper on home prices, thereby reducing the wealth effect that has buoyed many consumers? Only time will tell, but the move in mortgage rates this year has been nothing short of startling, going from less than 3% up to the current level of almost 5.5%. Admittedly, this is modest in the grand scheme of rates for those who remember the early 1980s, but when combined with increasing home prices, affordability is becoming an issue. This could be the first step toward demand destruction, and in reading earnings calls from myriad home builders, is causing concern.

That was some of the best flying I’ve seen to date — right up to the part where you got killed.

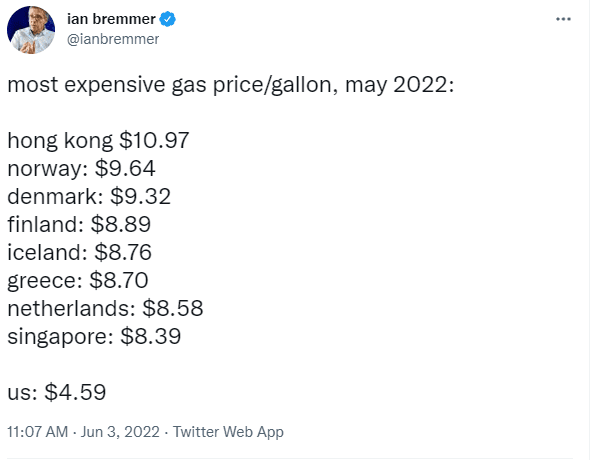

No discussion of markets or inflation would be complete without discussing oil. The above quote represents the experience many retail traders have with energy (a few professionals as well) and how the economy reacts to higher prices, too. Again, we come back to the concept of demand destruction. At some point, prices simply become too high for consumers to endure. At least we are not in Hong Kong or Norway…

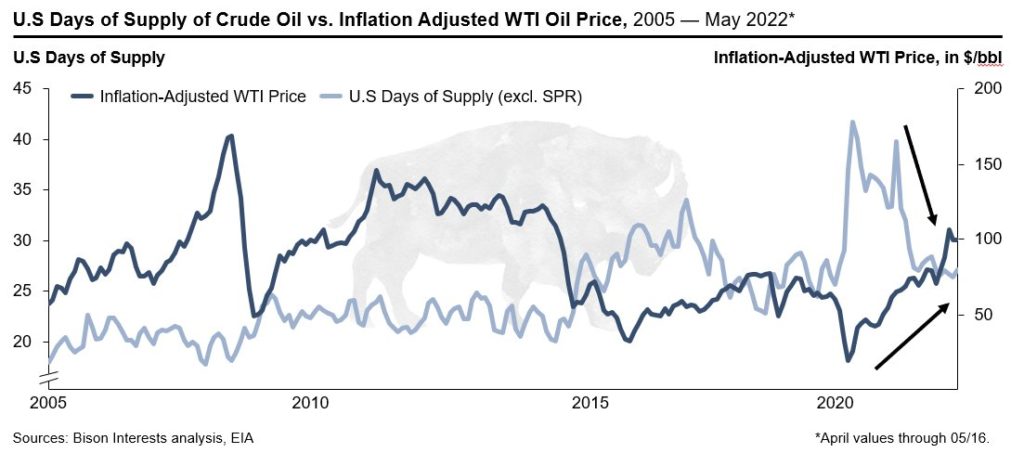

Before we delve into supply and demand dynamics, let us look compare today’s high nominal prices (around $115 per barrel) with prior levels after adjusting for inflation. Are we well above the Covid lows? Absolutely. Are we anywhere close to the pre-financial crisis levels? No; about $75 more inflation-adjusted dollars to go, which would put nominal prices closer to $200.

Let us be clear. We are not predicting such a price movement, just stating it is important not to anchor exclusively on nominal prices when stating oil (or gasoline) is expensive or cheap. Unfortunately, because of its preeminence at present as the primary source of energy, the influence of the price of oil (and associated products) on consumers, sentiment, and inflation is massive.

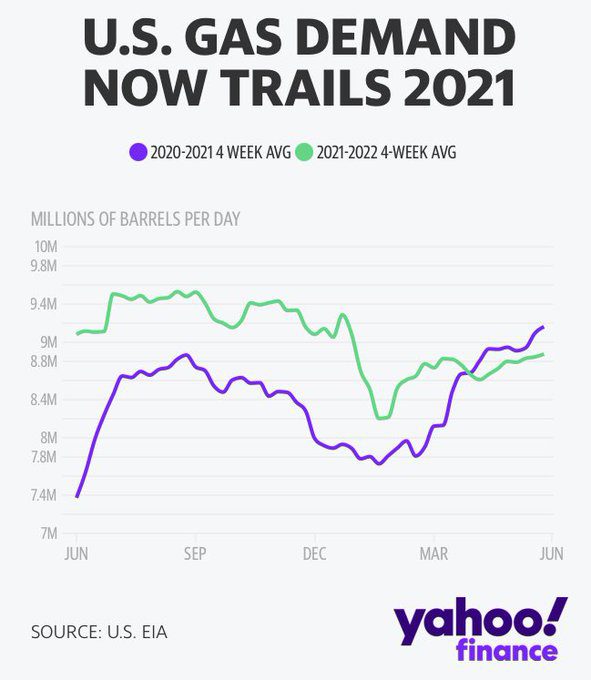

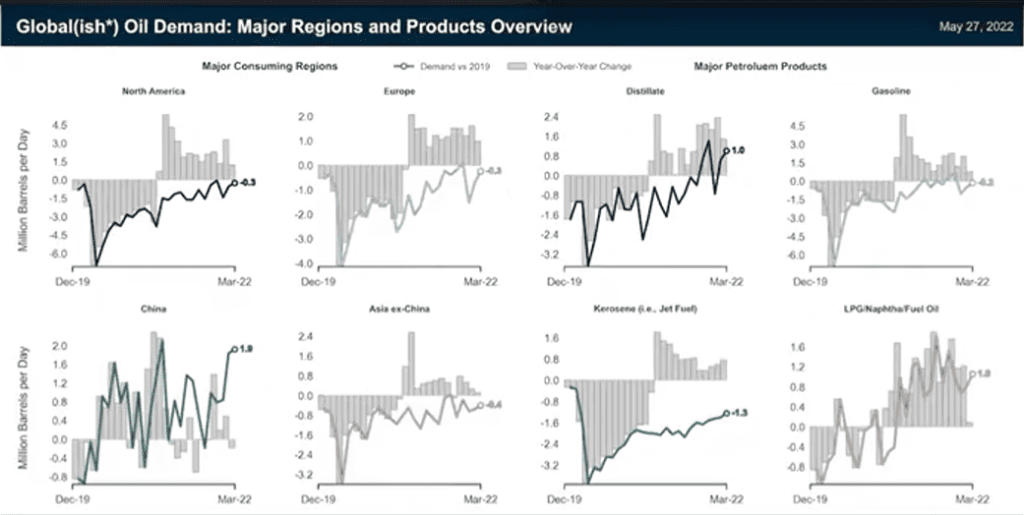

There are no simple solutions. However, what we are seeing proposed so far is unlikely to solve either the demand or supply side. At least five states have implemented or proposed gasoline tax holidays, which obviously do not help curb demand. North Carolina is proposing giving everyone driver $200. Germany is throwing $5 billion euros to energy-intensive companies. Big picture, demand has not yet returned to 2019 levels, with jet fuel the most below trend. China re-opening and/or jet fuel returning to “normal” would help offset any retail demand destruction from higher petrol prices at the pump, as do these programs aimed at mitigating the effect of higher prices.

On the supply side, the U.K. imposed a “windfall profits” tax. Doubt that really encourages more activity by oil companies. Moreover, this tax revenue will be funneled to households, theoretically allowing them to consume more energy, i.e., putting a leg under demand. Not to be outdone, the White House is now considering congressional proposals for similar measures here. While the Strategic Petroleum Reserve has been tapped several times, it is now at a 20-year low, and has failed to material affect prices.

As the only sector in the S&P 500 that has posted a meaningful gain year-to-date, investors clearly have demonstrated an affinity for energy shares. However, the sector represents less than 5% of the S&P 500 Index, and inflows into S&P Energy Sector ETF (XLE) have been slightly over $1 billion, nowhere near the top 50 in terms of year-to-date inflows, and below the $1.5 billion taken in year-to-date by the ARK Innovation ETF (ARKK), which is down over 50% year-to-date and a fund we consider the poster child for retail speculation. To “fix” the supply side of the oil equation, we need to see capital flow into the sector, and we are just not seeing the kind of reckless behavior that torpedoed oil prices in 2015/2016 from either investors or management teams.

No. No, Mav, this is not a good idea.

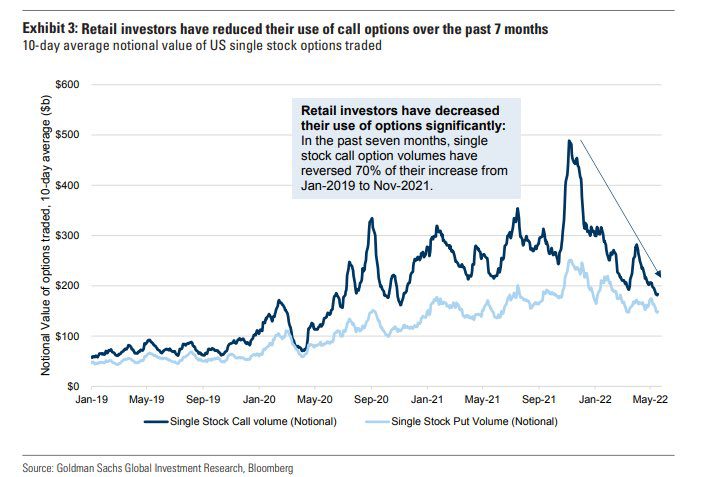

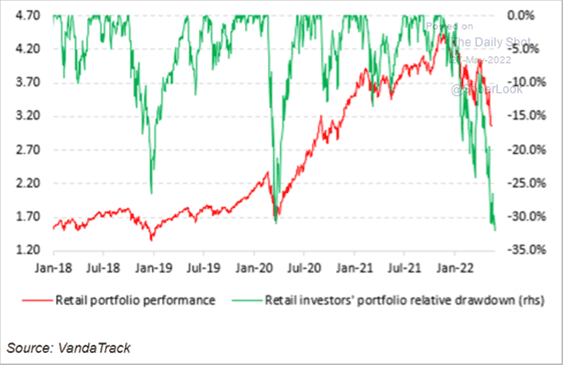

Since we mentioned retail investors, let us look at how they are responding to the drawdown. We have discussed retail investors’ speculative behavior in past in past letters; like buzzing the tower, speculation is also not a good idea. While the data shows a decline in this type of behavior, it remains well above pre-Covid levels. Anecdotally, we continue to see massive speculation in weekly, single stock options for companies we consider retail favorites.

We continue to see conflicting data on fund flows from retail investors, with some data providers showing recent inflows among the strongest since February 2021 while other data indicates cumulative net buying by retail investors has ended. One thing is clear: retail investors have suffered significant drawdowns of late.

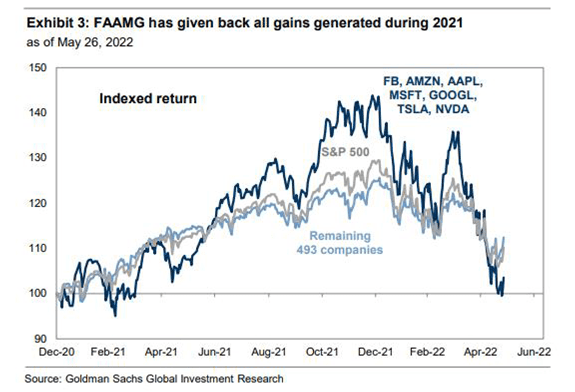

Additionally, the outperformance of megacap growth, a retail favorite, so pronounced as we started 2022, has ended.

Son, your ego is writing checks your body can’t cash!

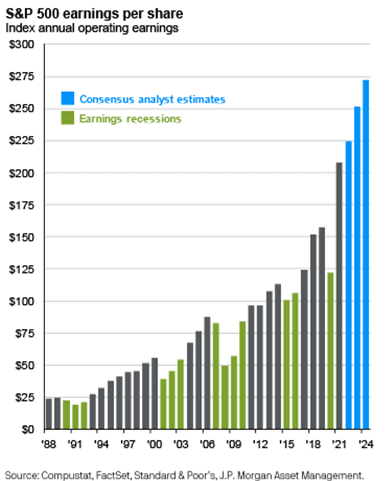

We think the same could be said of market strategists. Against a backdrop of waning fiscal and monetary stimulus, sales growth for the S&P 500 is estimated to be 10% in 2022, as is earnings growth. The out years are equally ambitious:

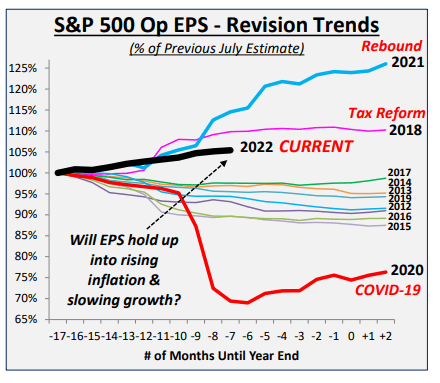

Historically, in the absence of exogenous (positive) events, earnings growth estimates have tended to decline throughout the year, but we have bucked the trend in 2022:

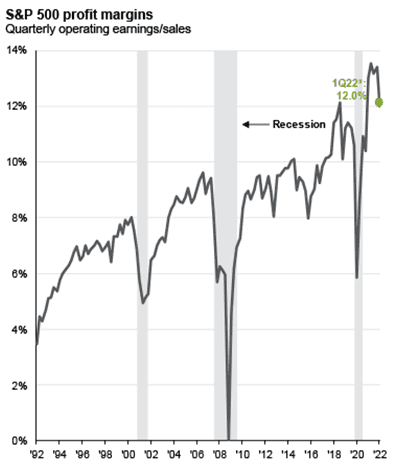

With corporate profit margins at all-time highs in 2021, a reversion toward the mean is an additional headwind one would expect in 2022 but has not found its way into estimates…yet.

His fitness report says it all. Flies by the seat of his pants, totally unpredictable.

The only thing more unpredictable than Maverick’s flying has been interest rates. The MOVE index, which tracks interest rate volatility, has been over one hundred since the end of March, its longest spell at such an elevated level since 2011 during the U.S. sovereign debt downgrade.

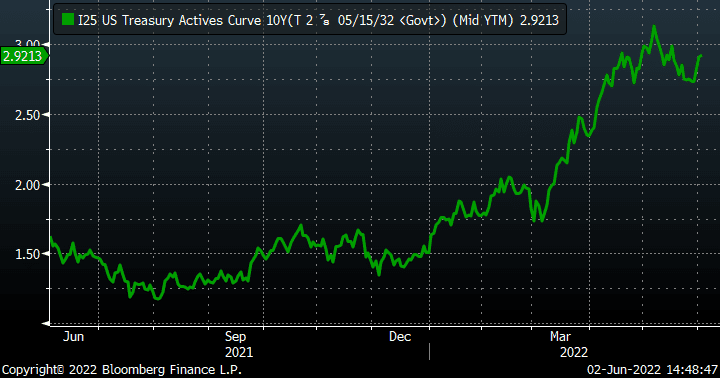

The yield on the 10-year Treasury, which is a key determinant in things like mortgage rates, has almost doubled in 2022:

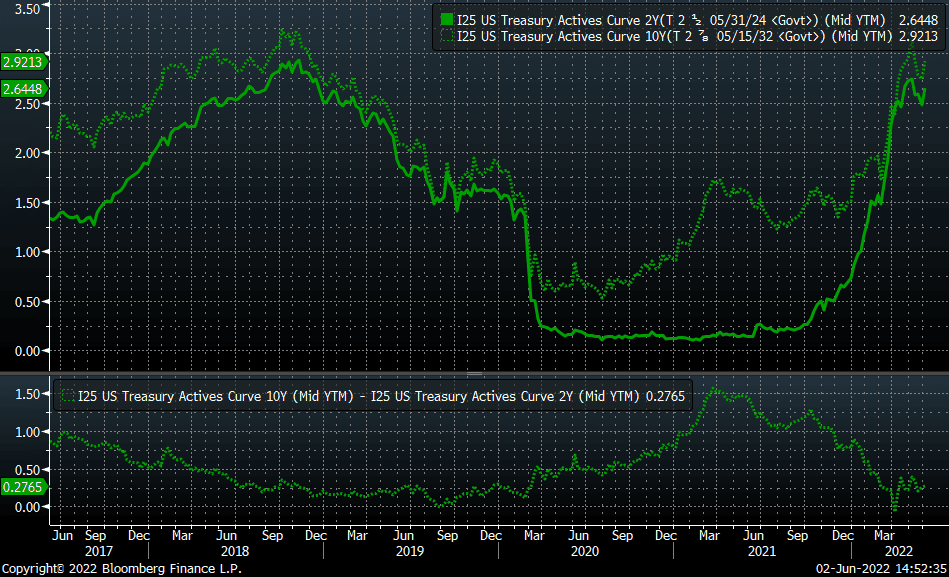

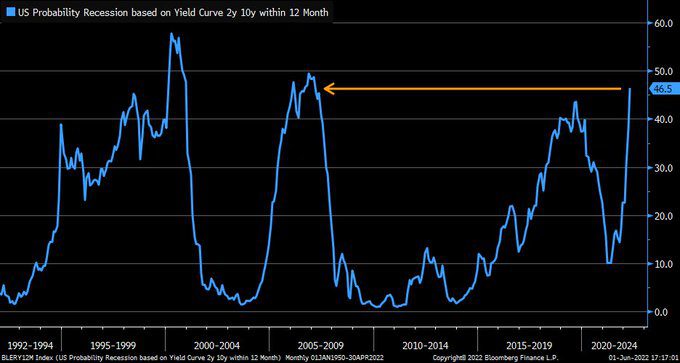

However, we have seen the spread between short (two-year) and long (ten-year) rates compress, from 75 bps at the start of 2022 to only 27 bps today. Those more astute observers will note this part of the curve was briefly inverted in early April.

This sort of flattening, historically, has tended to be an ominous portent, putting us at roughly a 50% chance of a recession within 12 months.

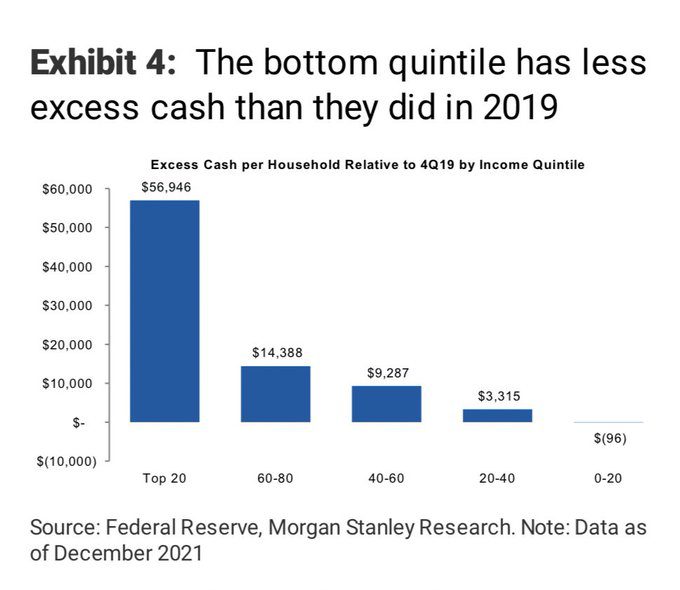

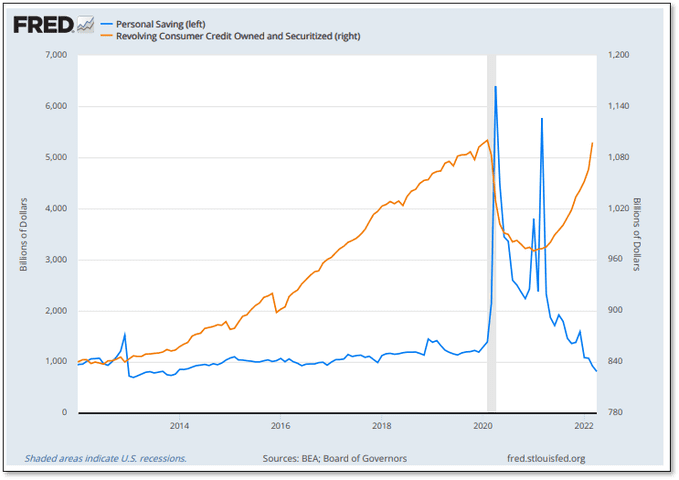

Recessions are unpredictable. The joke among investment professionals is that economists have predicted twenty of the last four recessions. However, if we do get a recession, consumers at the lower end of the income spectrum have exhausted their Covid surplus savings. Moreover, credit card usage is on the upswing in a big way and has returned to pre-Covid levels.

He’s in a flat spin

Broad indices were in May. Despite massive turbulence, there was little change from the prior month. Tech stocks, as measured by the NASDAQ, were down a little less than 2%, while everything else was just slightly positive.

| Index | 1-Month | 3-Month | YTD | 1-Year |

| S&P 500 INDEX | 0.18 | -5.16 | -12.76 | -0.32 |

| Invesco S&P 500 Equal Weight E | 1.00 | -3.04 | -8.11 | -0.10 |

| NASDAQ Composite Index | -1.93 | -11.95 | -22.52 | -11.49 |

| Russell 2000 Index | 0.14 | -8.67 | -16.58 | -16.96 |

| MSCI EAFE Index | 0.88 | -4.84 | -10.99 | -9.81 |

| MSCI Emerging Markets Index | 0.46 | -7.22 | -11.72 | -19.59 |

| Bloomberg US Agg Total Return | 0.64 | -5.86 | -8.92 | -8.22 |

| Bloomberg US Treasury Total Re | 0.18 | -5.94 | -8.33 | -7.50 |

Source: Bloomberg (as of most recent month end)

Just as on a year-to-date basis, the only major outperformer for May was energy; must be all that jet fuel. However, on a serious note, we are starting to see shortages of refined products, and prices at the pump are nearing record levels even at

You can be my wingman anytime.

Our role, at Formidable, is to be your wingman. Not in the colloquial sense, but as described by actual fighter pilots, who describe a good wingman as, “A wingman does his homework, asks questions, listens, and is always eager to learn. There’s an unspoken bond between us and I know he’s always got my back and when we fly home, he’s always there.”

During times like this, we serve this function by being commited to our process and keeping in mind our goal is to help you achieve your long-term goals while taking on an appropriate amount of risk. With inflation at its current levels, we need to ackowledge that one of the key risks we face is a loss of purchasing power, and balance that with the risk of near-term drawdown potential for both equity and bond markets.

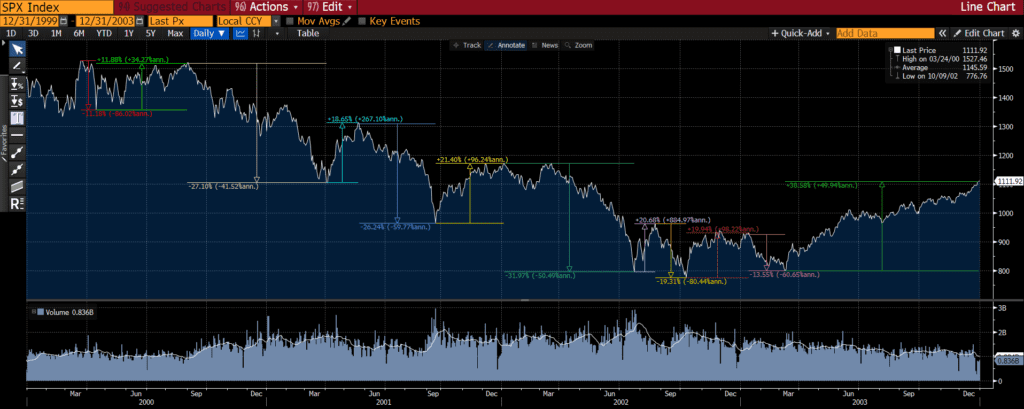

We see similarities between now and the unwinding of the tech bubble. One thing many forget about that period is that there was a lengthy process of finding a bottom for the market, with at least five (5) bear market rallies interspersed among sizable drawdowns. The rapid rebound associated with the Covid crash was a market anomaly, not the norm.

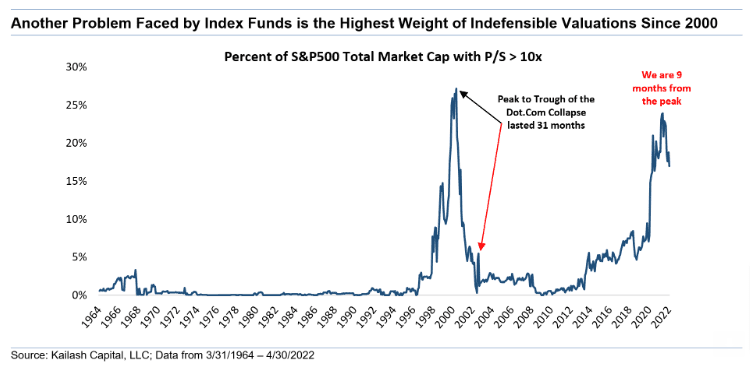

Excellent research by Kailash shows the dotcom bubble “burst” was more like a deflation over 31 months; we are around nine (9) months from the peak S&P 500 valuation in terms bubbly companies, i.e., those with price/sales over 10x. Over 15% of the S&P 500 Index is comprised of these types of companies.

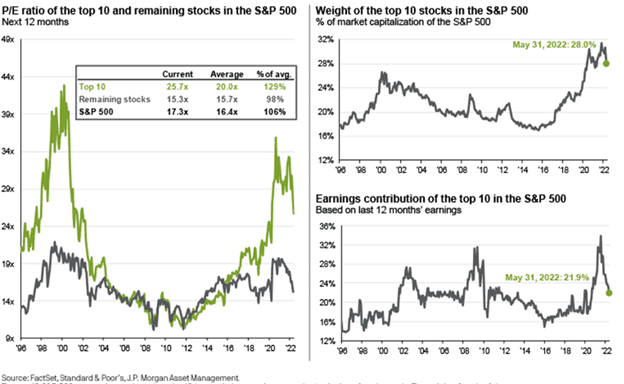

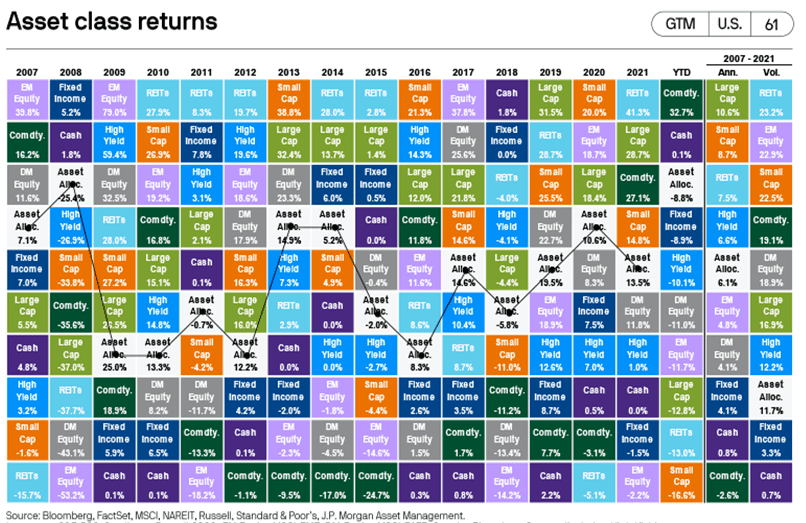

What do investors in the index get? For the S&P 500, it is not real diversification, with ten (10) companies accounting for 28% of the index. Moreover, index investors are overpaying (in terms of valuation) for the privilege of owning these ten stocks; the P/E of the top 10 is 26 versus 15 for the remaining 490.

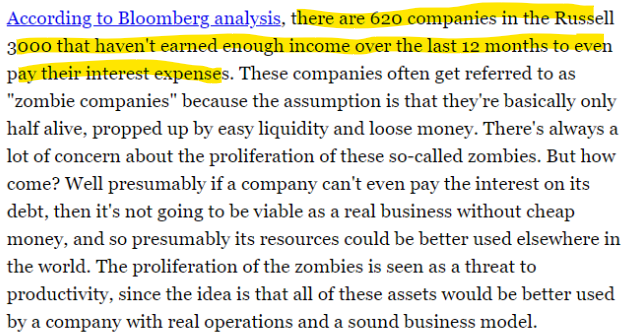

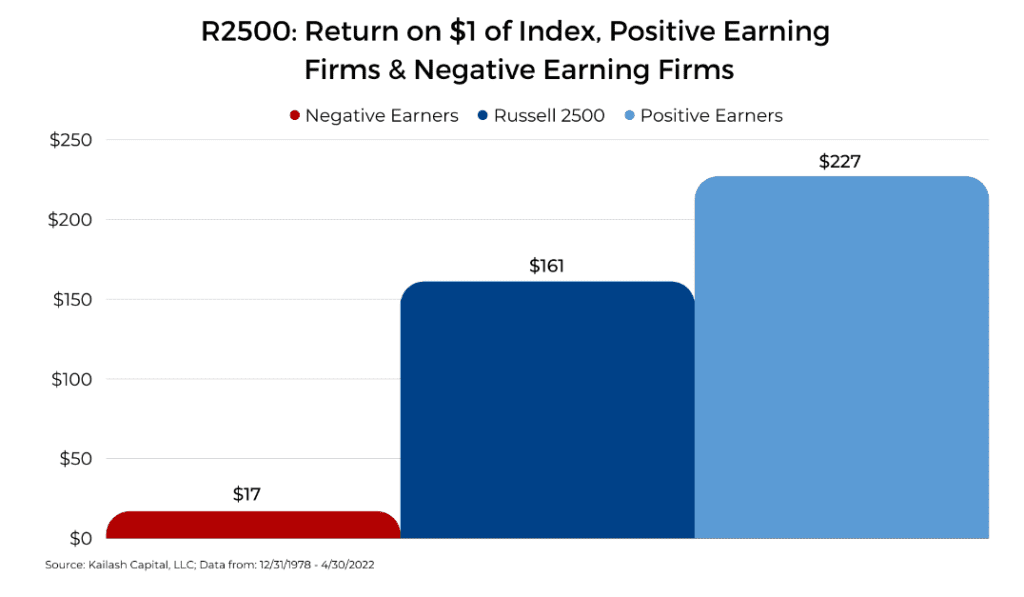

More broadly, it is even worse, as the passive landscape is littered with what one might call zombies. Around 20% of the Russell 3000 Index of U.S. stocks cannot even cover their interest expense, while almost 40% of the non-S&P 500 companies do not generate positive earnings.

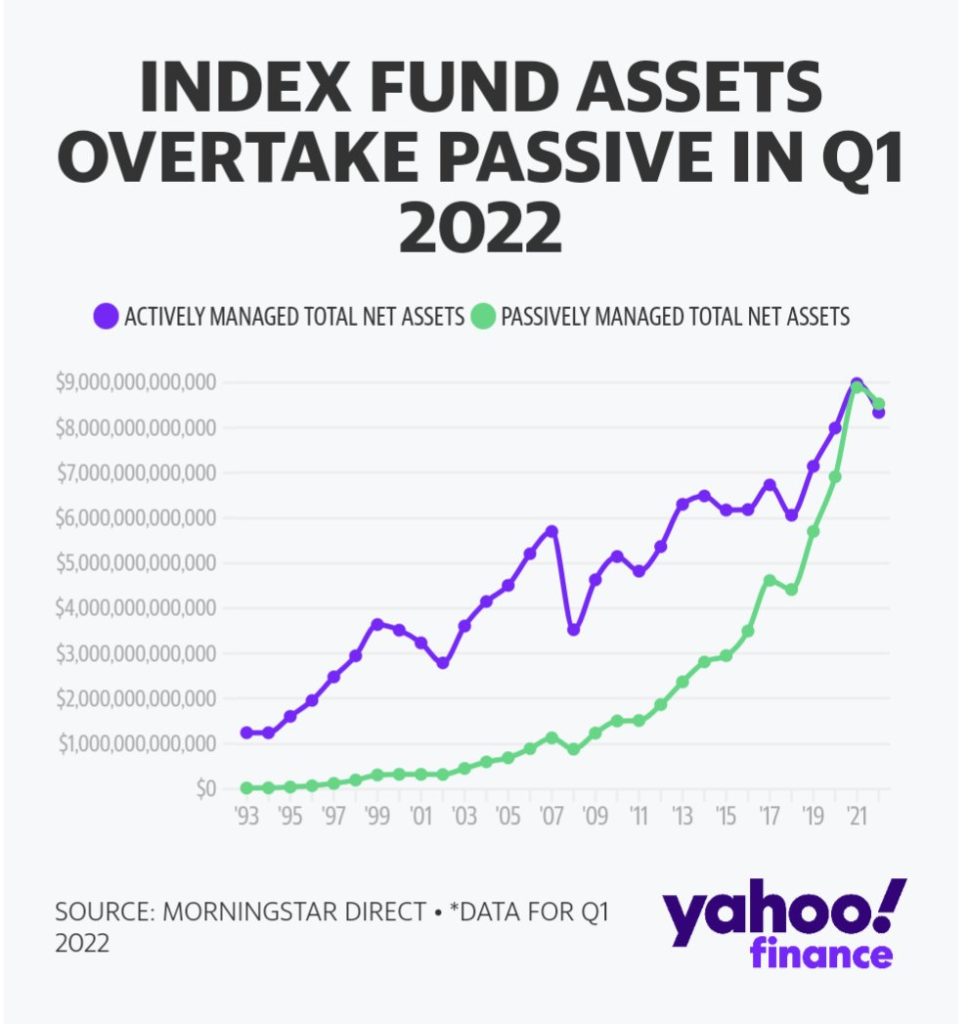

Despite these flaws, for the first time, assets in passive, i.e., index strategies, exceed those of active funds.

As an active manager, we see this as a tremedous opportunity to be different and source companies that are overlooked or unloved by the index and passive investors. Moreover, we can look to avoid companies that have the decked stacked against them, e.g., companies losing money, trading at excruciatingly high valuations, etc.

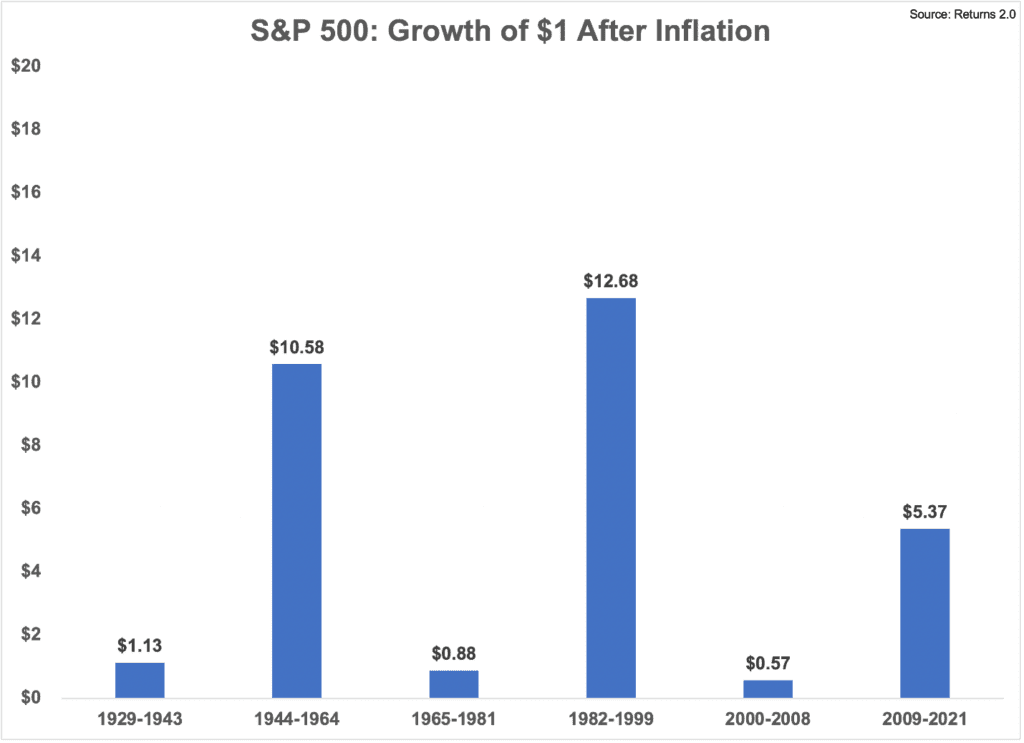

Arguably the most iconic quote from the original Top Gun is, “I feel the need, the need, for speed.”Unfortunately, this mantra is often used by “investors”, especially after a rambunctious bull market, as they hope the good times will return. However, sometimes it takes a decade or more for the sequel; in the interim, stocks, as measured by the index, do virtually nothing.

To be the top gun of the coming decade we think is going to take a maverick approach (the dictionary definition kind, not the reckless pilot kind). What worked during the last decade, buying large cap stocks, i.e., the S&P 500 Index, is not going to be enough. How are we going to do it? “It’s classified. I could tell you, but then I’d have to kill you.” Suffice it to say, despite elevated valuations for the market as a whole, there remains a target-rich environment for those willing to do the work.

READY TO TALK?