December 2023: Divorced. Beheaded. Died. Survived.

Part I – Summary

December Update: Divorced. Beheaded. Died. Survived.

We were in Memphis for Thanksgiving and saw the musical Six, which is about the wives of Henry VIII. Though a polarizing choice in the Eagleston house, we will use it as inspiration for this month’s update. I am going to refrain from putting in links to the songs for the mental health of our readers.

If you want to read Will’s From the Chair on the implications of oil prices and OPEC’s production cuts, click here.

Key Takeaways

- Divorced – Like Anne of Cleves, the picture painted by the S&P 500 Index hides an uglier reality.

- Investors had a rebound love affair with stocks worthy of Henry VIII in November.

- However, those celebrating a new bull market are missing the uglier reality.

- While the S&P 500 index is indeed up over 20% this year, the average stock is only around 5%.

- Beheaded – Bond vigilantes and stocks bears were in November.

- Bad economic data was greeted as a sign that the Fed is about to chop interest rates like Anne Boleyn (or Catherine Howard).

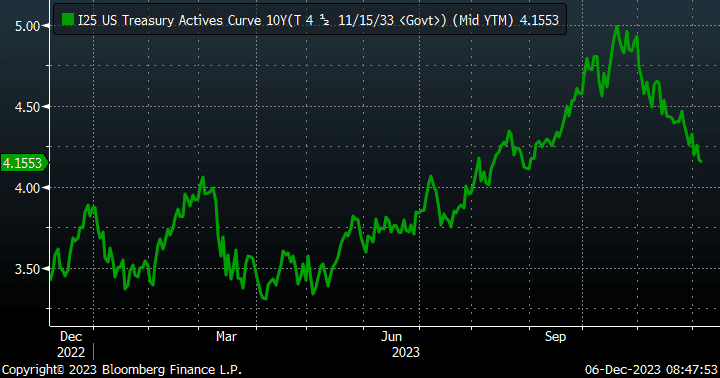

- After nearing 5%, yields on the 10-year U.S. Treasury moved rapidly into the lower 4% range in November.

- Major beneficiaries on the equity side were the most speculative stocks (high debt, high short, meme stocks).

- Died…or Survived?

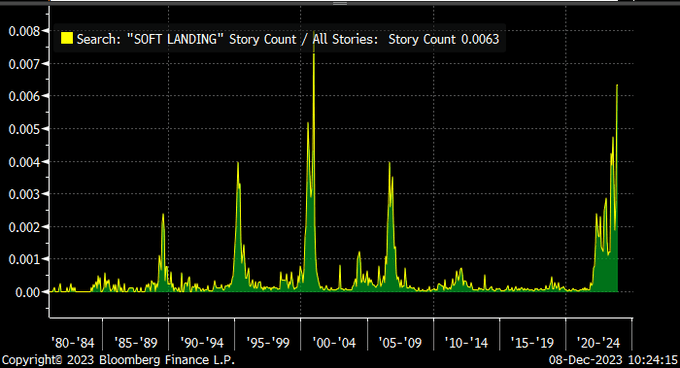

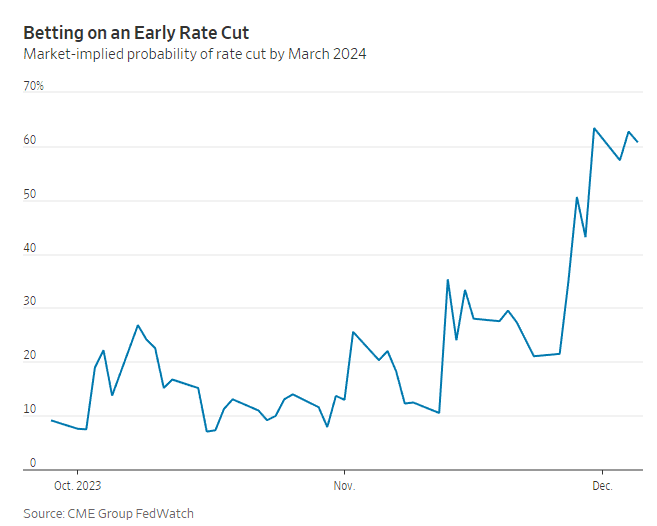

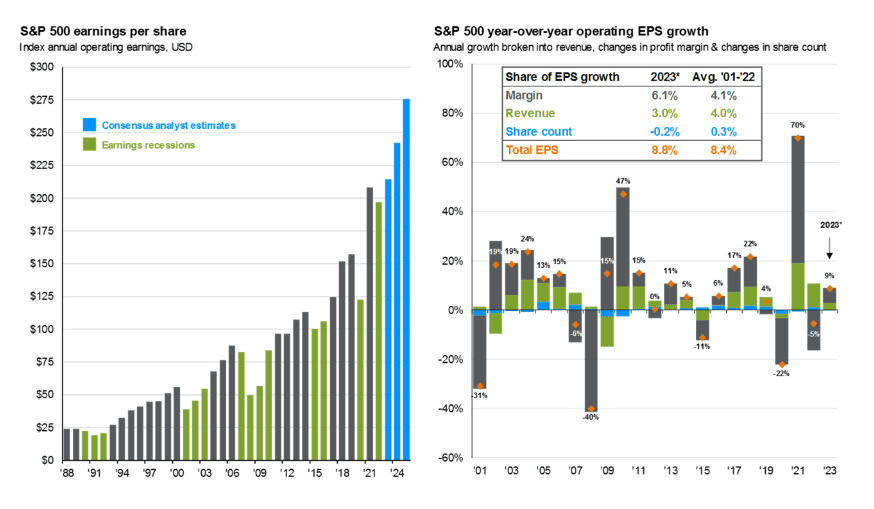

- There have been zero instances in the past 50 years where earnings have grown and the Fed has cut rates, and yet that is what the market is currently expecting.

- Can the market rally, in its recent narrow form, survive in 2024, or will it die of natural causes, i.e., economic contraction combined with overvaluation?

- We think the latter is more likely, but that does not mean there will not be opportunities to not just survive but thrive.

For those who prefer not to read further, before you close the email, please know these three things.

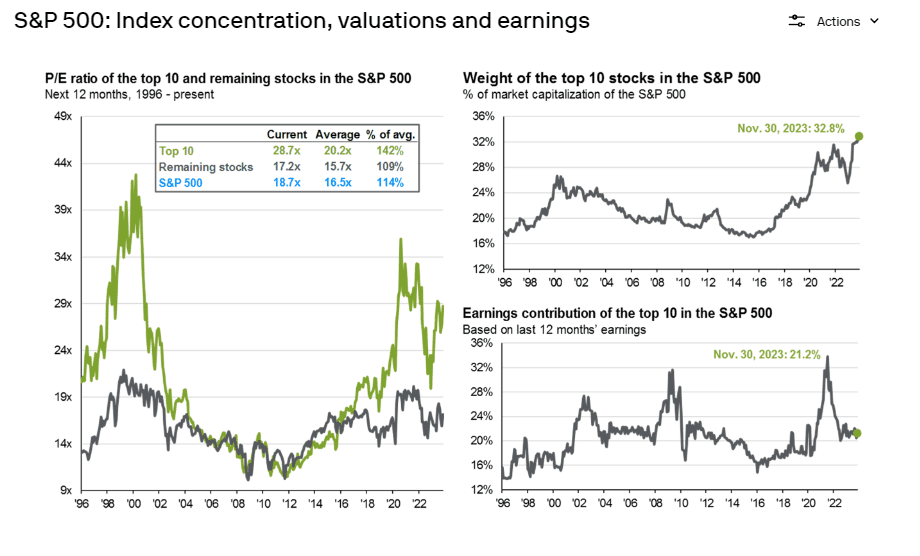

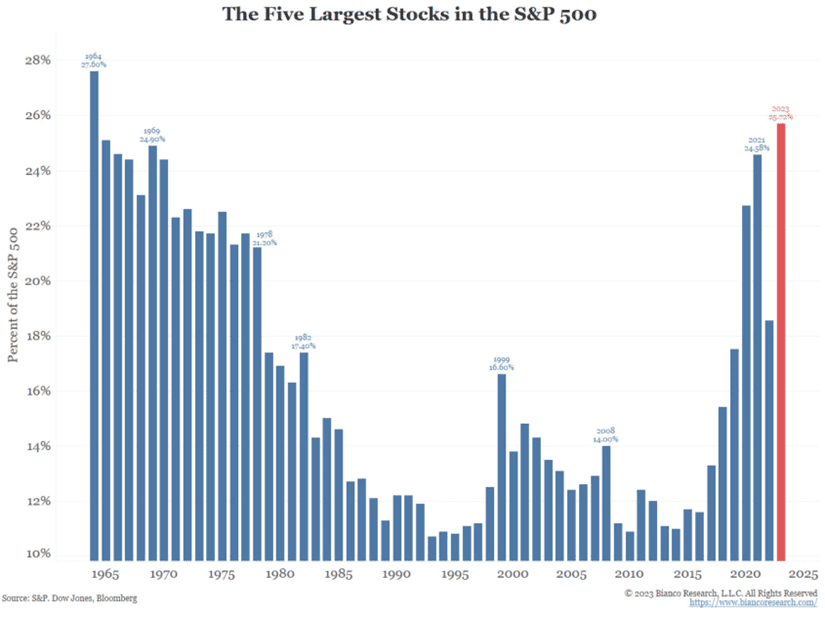

- The level of concentration in the S&P 500 is the largest it has been since the 1960s “Nifty Fifty” era, exceeding even the tech bubble.

- A mere five (5) stocks are 26% of the S&P 500 index.

- The ten (10) largest stocks trade at a price to earnings multiple of 29x, 66% higher than the rest of the index.

- Market expectations currently call for 12% earnings growth for the S&P 500 and five (5) Fed rate cuts. We think one or the other could happen, but this combination is highly unlikely and has zero historical precedent.

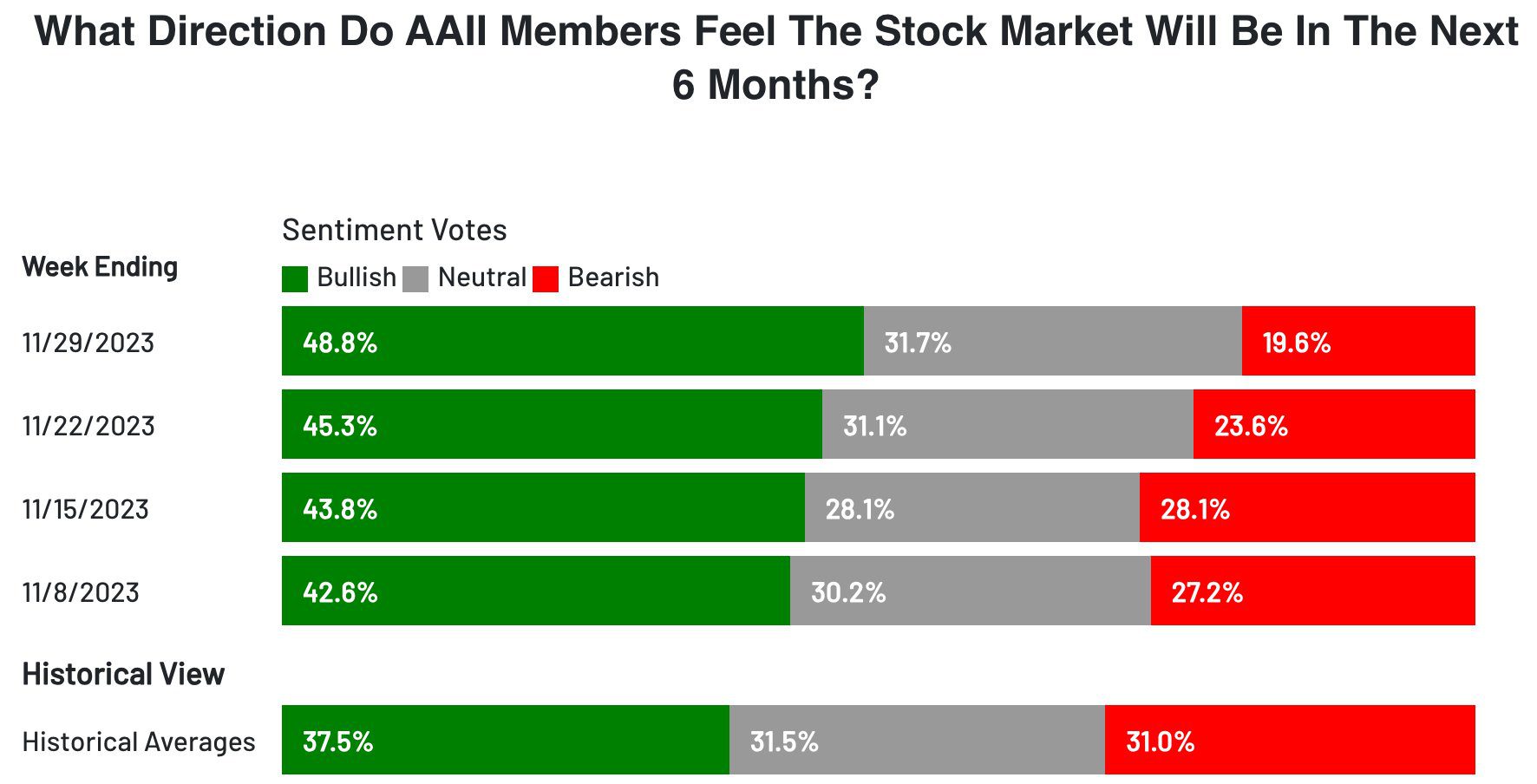

- The VIX index, a proxy for market fear, is at its lowest level since the pandemic, as is bearish sentiment, i.e., there is minimal concern about risk.

Part II

November Recap – Divorced

“You, you said that I tricked ya. ‘Cause I, I didn’t look like my profile picture.”

As a reminder, here’s how Henry VIII’s marriages went:

- Catherine of Aragon – Divorced.

- Anne Boleyn – Beheaded.

- Jane Seymour – Died.

- Anne of Cleves – Divorced (technically, annulled, but the opening song is far less catchy if we use it).

- Catherine Howard – Beheaded.

- Catherine Parr – Survived.

In the divorced camp was Anne of Cleves who, as we see in the intro lyrics, did not look like the painting Henry had seen of her (yes, this could be apocryphal or revisionist). This was like being hoodwinked on the match.com of the 16th century, except instead of a bad date, it’s a marriage.

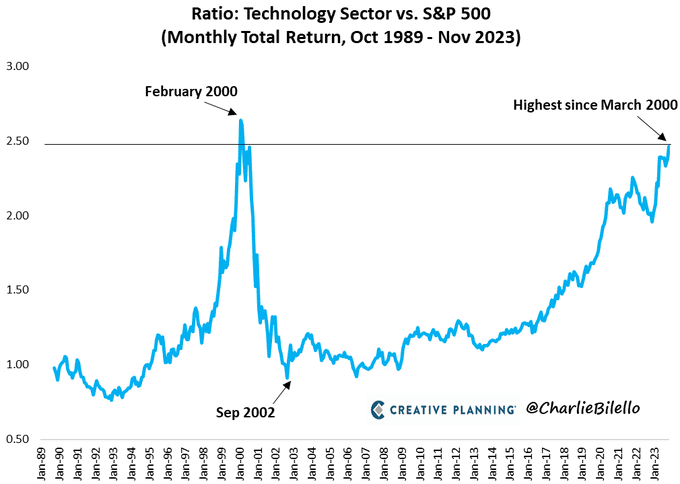

In the same spirit, investors may be forgiven for being similarly hoodwinked by the sizable year-to-date returns of the S&P 500 Index. “New bull market” some may ballyhoo, but that exuberance is not warranted when looking at the equal-weight S&P (+6%) or small cap stocks (+4%) so far in 2023. The year-to-date outperformance by the S&P 500 (large caps) has been seen only two other times in the last 30 years: 1998 (tech bubble) and 2021. After the former, we saw a bursting of the bubble and a massive, persistent reversion trade. After the latter, we suffered a sizable drawdown in 2022, though, unlike after the tech bubble, investors have piled back to the same megacap names.

| Index | 1-Month | 3-Month | YTD | 1-Year | 2-Year |

| S&P 500 INDEX | 9.13 | 1.74 | 20.79 | 13.81 | 3.32 |

| Invesco S&P 500 Equal Weight E | 9.18 | -0.65 | 6.44 | 1.44 | -0.03 |

| NASDAQ Composite Index | 10.84 | 1.57 | 37.00 | 25.14 | -6.85 |

| Russell 2000 Index | 9.03 | -4.39 | 4.14 | -2.62 | -15.32 |

| MSCI EAFE Index | 9.30 | 1.38 | 12.93 | 13.05 | 2.21 |

| MSCI Emerging Markets Index | 8.01 | 1.15 | 6.01 | 4.58 | -13.31 |

| Bloomberg US Treasury Total Re | 3.47 | -0.04 | 0.67 | 0.14 | -12.33 |

| Bloomberg US Agg Total Return | 4.53 | 0.26 | 1.64 | 1.18 | -11.81 |

| Invesco DB Commodity Index Tra | -2.45 | -2.77 | -3.00 | -5.63 | 23.48 |

Source: Bloomberg (as of most recent month end)

As we have discussed ad nauseum, the reason is the massive outperformance by current kings of the investing world, the Magnificent VII. Stock market royalty, these companies have effectively founded their own religion, which is rooted in AI. Today’s top article on Bloomberg is long on buzz and short on reality, i.e., no one really knows if/how AI becomes effectively monetized, but right now what matters are the underlined words:

So, where we stand is a market more concentrated than during the tech bubble, with valuations for the top ten 42% more expensive than their own average and 67% more expensive than the rest of the S&P 500.

One of our advisors, David Henning, recently wrote a great piece juxtaposing the Magnificent Seven with an investment in real estate. It does an excellent job comparing the relative risk and reward of these names; please click here to learn more.

If we take a longer view, all the way back to the 1960s, we see the last time we had this level of concentration. How does the market become less concentrated? Either other names begin to participate (this would be our preferred way to achieve greater diversification in the index) or the stratospheric valuations of the biggest stocks normalize, which is what happened during the Nifty Fifty era in the 1970s here.

December Outlook – Beheaded

“Sorry, not sorry about what I said. I’m just trying to have some fun. Don’t worry, don’t worry. Don’t lose your head. I didn’t mean to hurt anyone LOL, Say Oh, well.”

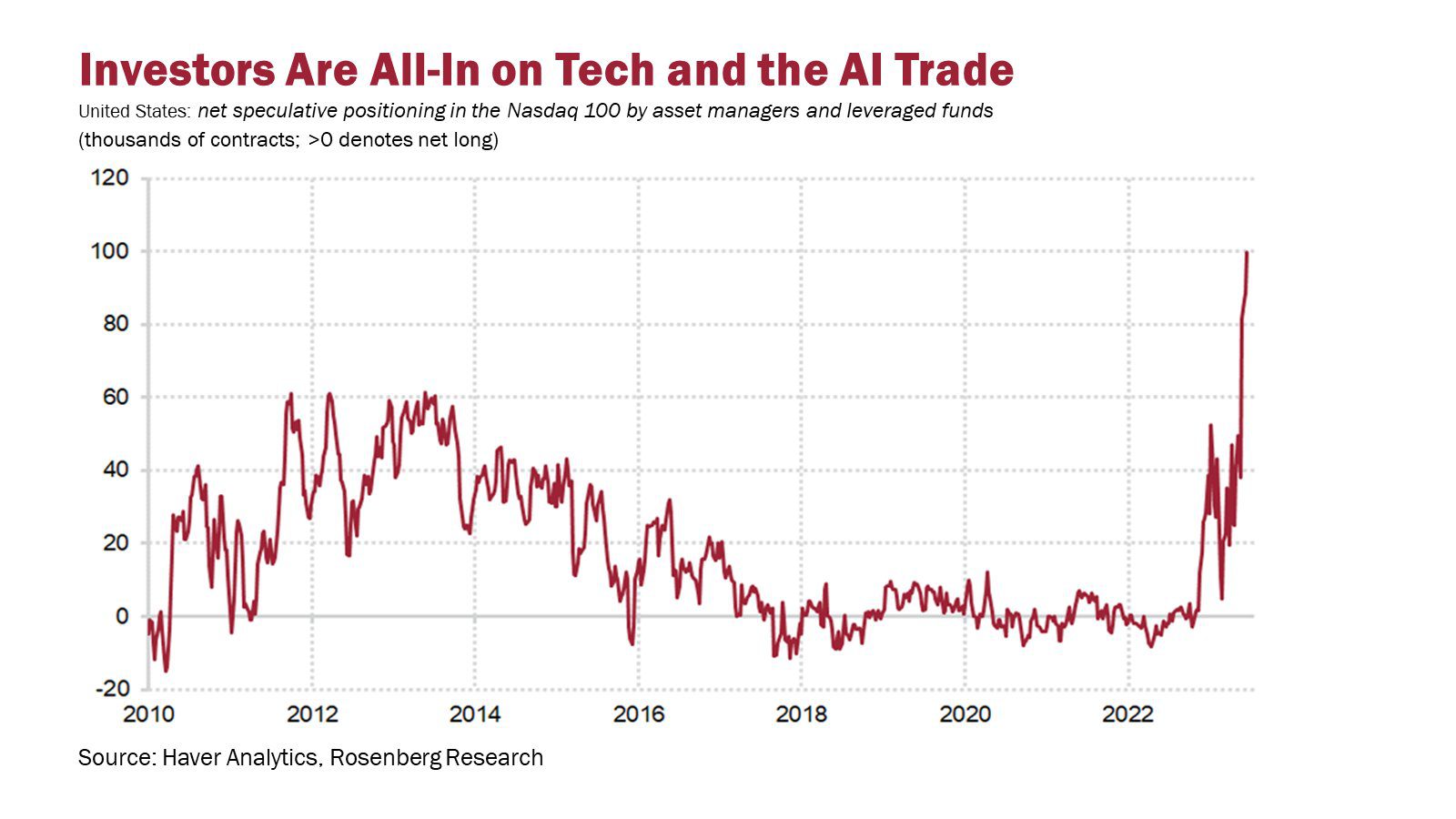

Arguably the most famous of Henry’s wives was Anne Boleyn, whose lyrics are above. Investors, clearly, are looking to have some fun, with bullish sentiment well above average and bearish readings at post-Covid lows. Are they losing their heads? While not physically, emotionally they are, with fear of missing our running rampant. Look no further than the $3.5 billion XLK, the technology sector ETF, has taken in over the last month, breaking its prior record of around $1 billion according to Bloomberg ETF guru Eric Balchunas.

The most fun, as we have discussed, is in the AI/technology sector, which has outperformed at levels last seen during the tech bubble. In fact, things are so fun, the first ever quadruple levered S&P 500 fund launched this week.

The reason? Ten-year bond yields have fallen sharply as recent economic data has pointed to weakening. In other words, bad news is good news:

Additionally, highly shorted stocks have roared higher. The most highly shorted stocks gained 18% between the end of October and December 8th, while meme stocks are up 32%. However, according to Raymond James, “…the market has used a lot of fuel from short covering to achieve its performance the past 30 days, and it cannot last forever as there is a finite amount of fuel. We are about at the point where that short covering fuel ran out in the last 2 rallies.”

We track a like number of key factors, and although we note no material changes versus last month aside from the slight respite from higher interest rates, it is worth recapping (summarized below):

| More Negative | Neutral | More Positive | |||

| Inflation | ≈ | ||||

| GDP Growth | ≈ | ||||

| Fed Policy | ≈ | ||||

| Interest Rates | → | ||||

| Credit Spreads | ≈ | ||||

| Stock Multiples | ≈ | ||||

| Earnings Growth | ≈ | ||||

| Deteriorating | ← | ||||

| Stable | ≈ | ||||

| Improving | → | ||||

Conclusion – Died…or Survived?

“You can build me up. You can tear me down. You can try but I’m unbreakable. You can do your best. But I’ll stand the test. You’ll find that I’m unshakable.”

Higher rates (staggering move in personal interest payments, even when adjusting for higher incomes). Geopolitical turmoil. Chinese property market crash. Soaring interest costs. The S&P 500 has proven unshakable.

Why? Everyone is all-in on a soft landing:

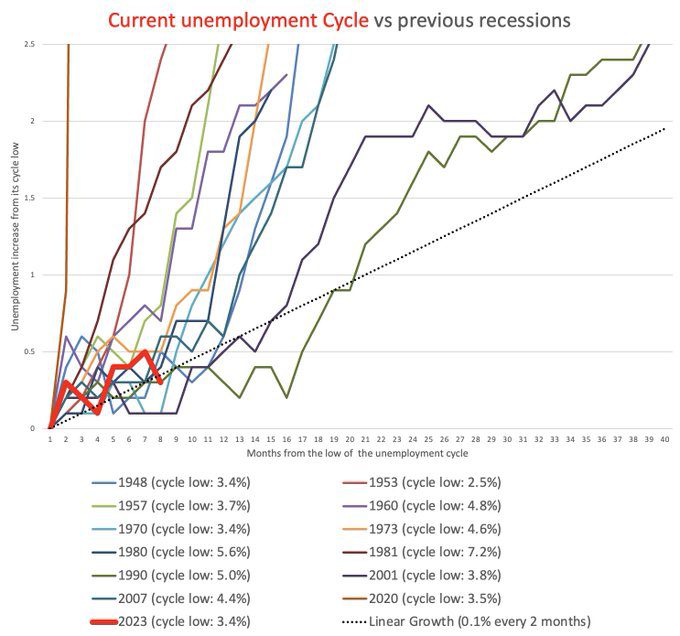

However, as we have discussed previously, employment is a lagging indicator, and, when it breaks bad, it does so quickly. The current cycle low (the red line here) was made eight (8) months ago. Maybe this time is different…

The most important conclusion we reach by analyzing all of the data points we track is that there is an enormous paradox facing investors. It is kind of like when Henry requested a divorce from the pope: he could get a divorce, or remain a Catholic, but not both. Similarly, as we look ahead to 2024, the market is expecting five (5) rate cuts (starting soon) and 12% earnings growth. Based on our research, we could get a large number of rate cuts (this would likely be unwelcome in reality), or see strong earnings growth (both margin and revenue remain elevated versus history), but both happening concurrently does not have a historical precedent according to our research.

We have thrown around a lot of numbers here:

- Five – rate cuts expected in 2024.

- Six – wives of Henry VIII.

- Seven – Magnificent (overvalued) stocks.

- Eight – number of Henrys who were king of England.

One number worth remembering is 10; that is how old Henry VIII was when he became heir to the throne after the unexpected death of his brother, Arthur, who was married to Catherine of Aragon (yes, the same one who became Henry’s first wife/ex-wife). Henry became king at the age of 17, after the death of his father.

Our point here is that whether for actual or stock market royalty, the unexpected can happen. If we were writing this a year ago, the Magnificent Seven would have been in the midst of a 47% drawdown and VIX would be in the low 20s, but how quickly some (most) forget and want to chase the hot, new thing (again). Our job is to find investments we can marry (hopefully) that help our investors achieve their long-term objectives without taking on undue risk. It may be worth sharing a piece we wrote for Forbes not too long ago.

The three most important takeaways from this article for investors are:

- Focus on your goals and objectives.

- Be aware of risk.

- Find a reasonable benchmark.

As a CFA charterholder, I look to the CFA Institute’s standards when thinking about benchmarks. Its criteria state a benchmark should be, among other things, appropriate. (The acronym I use to remember these criteria is “SAMURAI,” which is consistent with the historical period of Henry VIII, but since we have been focused on the other side of the world and don’t have space for another historical tangent, we will have to leave this for another time).

With 33% of the S&P 500 Index in just ten (10) companies, it has become a benchmark that may no longer be appropriate for many investors. What will the fate of this top-heavy index be in 2024? We see four possible scenarios:

Divorced – Investors decide other parts of the market (anything except megacap tech) are more attractive but the Magnificent Seven don’t suffer any ill effects.

Beheaded – Same but investors decide to cut off the heads of these seven and valuations revert back to something non-stratospheric.

Died – Fed has overdone it, and an economic contraction hits all stocks hard. Will has written a nice piece on this topic, citing oil and OPEC as the canary.

Survived – Status quo intact. Magnificent Seven see multiples levitate further. Other U.S. stocks languish.

To quote the stage version Catherine of Aragon, “there’s n-n-n-n-n-n-no way” we know which of these scenarios will transpire, but we remain convinced that over the long term focusing on things like lower valuation, higher quality, and dividends will help keep our investors from losing their heads.

From the Chair – Why are we worried?

Will Brown, CEO and Managing Partner

Look no further than the opportunistic and predatory group of oil producing nations known as OPEC for your compass on where the economy may be headed. We are worried because OPEC has cut production twice this year, and yet prices continue to drift lower. Not exactly a ringing endorsement for expanding demand in the economic complex.

Now, there can be arguments made that some of this pressure is being exerted from the adoption of electric vehicles, but the effect of EVs has yet to be felt because of limited adoption to this point. Regardless of EV cannibalization, the scope and scale of the demand complex for fossil fuel remains enormous. Simply put, the world remains far too reliant on them, and OPEC cutting production as a policy position would appear to us to indicate the potential for a large economic contraction.

There are many Wall Street wags who will give you a litany of reasons as to why this is happening….structural, geopolitical, economic…you name it. But at the end of the day, OPEC is an opportunist and they are seeing dwindling demand. Simultaneously, the freight industry is contracting at a clip that is largely what one could consider to be biblical. Bankruptcies are piling up, and fire sales and exits are as ubiquitous as Colonel Sanders. Be a freight, be very afreight, might be a good description.

The reality is that when the energy sector contracts at the magnitude that we are seeing and the response from OPEC is this strong, one could deduce that the economic contraction is far more profound than stock markets are now showing. Personally, I would argue that OPEC’s behavior indicates a leading indicator of where the economy is headed.

Separately and importantly, OPEC has cut production to the point where it almost can’t cut anymore. This is profoundly telling because every industry in some form or fashion is reliant upon fossil fuel. It touches almost every sector of the economy, and every business. So, when you see the largest provider of fossil fuels pulling back the reins because of dwindling demand, the question that you need to ask is “How big is this contraction?”

If you look at the NASDAQ and the nosebleed multiples of the Magnificent Seven (GOOG, TSLA, META, AMZN, MSFT, NFLX AAPL), there is no contraction….everything is fine….all is well. The Seven have become the Kevin Bacon of Investments. The technicals on the Magnificent Seven are beginning to tell another story. They are highly vulnerable to sector rotation, multiple compression, short selling and are priced for perfection. Apple has already provided earnings commentary that they expect a “sluggish holiday season”.

The Seven now look like they are beginning to acknowledge the pressures that are being applied to their businesses by higher interest rates on credit cards and mortgages, student loans that require service, mortgage deferments that have come back into place, and a partridge in a pear tree. The United States Federal Reserve has overshot the mark to the point where they have made a large number of financial institutions in the United States technically insolvent. Furthermore, interest rates currently are unsustainable as the interest cost of debt service to the government is becoming an anvil in a very deep lake.

Investors are currently anticipating five rate cuts in 2024, and while we agree it is likely that the Fed will cut very soon, the gradual, orderly decline anticipated is, in my opinion, unlikely, given the room is running out of oxygen, and OPEC is shouting this from the rooftops.

Real Estate Investing and the Magnificent Seven Stocks

David Henning, CFP, Senior Portfolio Manager

Executive Summary

Many investors have been looking at the media darlings of the investment world, the so-called Magnificent Seven, comprised of NVIDIA Corp., Meta (Facebook), Alphabet (Google), Apple, Microsoft, Tesla, and Amazon. These seven companies represent 39% of the weight of the S&P Index and have skewed the index’s returns significantly. How much have these securities affected the Index’s returns? It’s helpful to look at it from a perspective that is a little less esoteric than stocks: real estate.

Lessons in Real Estate

Suppose you were interested in buying investment real estate. Ultimately, your goal is that the rental income of the property combined with the appreciation in value of the property when it is time to sell will hopefully make you a nice profit in the long run.

You set out with a friend (realtors are too curmudgeonly) to find a property, and they steer you toward condos. The prices of condominiums have skyrocketed, increasing over 100% over the last year, and they tell you that this will only continue. Conversely, single family homes have not gone up in value much at all. Your friend insists that you need to get in on the condo train now or you are going to miss out.

Being a smart investor, you would focus on price per square foot. Your target is to pay about $170 per square foot, which is the long-term average for investment real estate. The average condo is selling for $489 per square foot. The cheapest condo is selling for $292 per square foot. The most expensive is selling for over $900 per square foot. $292 doesn’t sound too bad, but it is 70% over your budget. $900 is 430% over your budget. Buying things that are overpriced doesn’t work for most people whether they are shopping for real estate, groceries, or stocks. You know that buying something on sale makes sense even when others are spending foolishly.

The long-term goal is to make money on your property investment. You can only charge so much for rent and if you pay too much for the property, then your income won’t cover the mortgage payment. Secondarily, the likelihood that price per square footage on condos comes back down closer to the average per square foot makes selling the property at a profit at some point in the future much less likely.

You check on some of the properties that you already own, and they haven’t gone up very much in value this year and start to wonder if your friend is right. There have been 500 properties sold in your city this year and the average price, according to the Board of Realtors, has gone up by over 18%. Yours are up, but not that much. What’s wrong?

Lessons in Math (Ugh)

In this case the Board of Realtors is using a weighted average to calculate the average price increase. The larger the property, the bigger impact it has on the average.

Let’s use a simple example, two properties were sold, one was 1000 square feet, and the other was 10,000 square feet. The smaller property increased in price by 2%, but the larger one, a condo like the one your friend is recommending, went up by 200%.

A simple average would indicate that prices went up 101% (2% + 200% = 202%, divide 202% by 2), but the weighted average went up by 182%. This is the math behind a weighted average. (Sorry for the math.)

| Square ft. | % increase | ||||

|---|---|---|---|---|---|

| House 1 | 1,000 | 2% | 20 | (1,000 X .02 = 20) | |

| House 2 | 10,000 | 200% | 20,000 | (10,000 X 2 = 20,000) | |

| 11,000 | 20,020 | Total | |||

| 182% | Average Weighted Price Increase | ||||

| (20,020 divided by 11,000 = 182%) | |||||

Back to the 500 properties sold. Seven large condos sold this year, and they went up dramatically in price. The seven are so big that they represent over 39% of the square footage sold and went up more than 127%. If we used a simple average on the 500 properties, the average increase would be less than 5%. However, the seven properties have skewed the square footage-based average, which shows an 18% increase. This means that the remaining 493 properties sold this year have increased by a little over 3% on an average.

The Magnificent Seven

Why are we going through this exercise? The 500 properties are the 500 companies represented in the S&P 500 Index (the 500 largest companies on the US stock market). The seven condos are the aforementioned Magnificent Seven. These seven companies represent 39% of the weight of the index and have skewed the index average just as the condos did in our real estate example. The price per square foot is analogous to the Price to Earnings ratio which we use as a valuation tool when analyzing a company.

The seven companies are all overpriced compared to the average of the market. They don’t pay much in dividends either. You can make a parallel between dividends and rental income. The average dividend of these seven companies is 0.19%. The average dividend of the remaining 493 companies in the index is about 1.9%. Without the dividend income, the only way you can make much money is when the stock prices increase, but if you have overpaid for them, you have greatly reduced your chances of that.

History Doesn’t Repeat—but Sometimes it Rhymes

I decided to follow my friend’s advice and bought the $1 million condo. Yes, I paid a lot, but it’s a great property in a great neighborhood. Now what?

First, I better hope my expenses are almost nil because these condos don’t generate any meaningful income. If I do need money, I better hope someone is willing to pay more than the well above average $489 per square foot I paid. Possible? Sure. Probable? Who knows.

Let’s assume these seven companies are similar: great companies in great industries. What is the risk of investing in them? Kind of the same as buying the $1 million condo. Very little income and an almost complete reliance on someone paying an even higher above-average price at some point in the future.

Fundamentally, these companies need to grow their businesses at above-average rates to justify the current price level; such growth is pretty much out of reach and mathematically quite difficult, given how large they already are. These valuations might be more palatable if the Federal Reserve had rates back at 0%, but that is not the case anymore. The risk is ever present that the seven companies return to a more normalized valuation. This collection of names lost 48% on average in 2022 (versus 12% for the average stock), so welcome to the rollercoaster ride.

We have seen this before in tulip bulbs, the Dot Com bubble, and the real estate bubble. While your friend might have advised you to buy the condo, an experienced Realtor would probably have noted some of the risks. As your financial advisor, our job is similar. This is why we have chosen to invest primarily in companies with solid valuations, strong balance sheets and for the most part above average dividend yields. Is it okay for some clients to have some exposure to these Magnificent Seven names? In some cases, yes, though allocating 40% of a portfolio, as the S&P 500 does, to this concentrated group of expensive names, is a risk that we are unwilling to take.

DISCLOSURES

General Firm

Formidable Asset Management, LLC (Formidable) is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation, or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. Although taken from reliable sources, Formidable cannot guarantee the accuracy of the information received from third parties.

The opinions expressed herein are those of Formidable and may not actually come to pass. This information is current as of the date of this material and is subject to change at any time, based on market and other conditions. Any index performance cited or used throughout is intended to illustrate historical market trends and performance. Indexes are managed and do not incur investment management fees. An investor is unable to invest in an index. The performance shown may not reflect a Formidable portfolio.

Past performance is no guarantee of future results.

Readers should assume that future performance of any specific investment or investment strategy (including the investments and/or investment strategies discussed in these materials) referred to directly or indirectly in these materials will be profitable or equal the corresponding indicated performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable. Historical performance results for investment indices and/or categories generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results.

Specific Securities

The mention of specific securities and sectors illustrates the application of our investment approach only and is not to be considered a recommendation by Formidable. The specific securities identified and described above do not represent all the securities purchased and sold for the portfolio, and it should not be assumed that investment in these securities were or will be profitable. There is no assurance that the securities purchased remain in the portfolio or that securities sold have not been repurchased. Charts, diagrams, and graphs, by themselves, cannot be used to make investment decisions. You may contact Formidable Asset Management, LLC for a full list of recommendations made during the preceding one-year period.

Not an Offer

These materials do not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or any other product or service by Formidable or any other third party regardless of whether such security, product or service is referenced here. Furthermore, nothing in these materials is intended to provide tax, legal, or investment advice and nothing in these materials should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. Formidable does not represent that the securities, products, or services discussed here are suitable for any particular investor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your personal investment objectives, financial circumstances, and risk tolerance. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation.

The opinions expressed here are those of David Henning and are not intended as investment advice. They are also subject to change with changing market conditions. Clients of Formidable may have positions in securities discussed in this article. This writing is for informational purposes only—Formidable and the authors expressly disclaim all liability in respect to actions taken based on any or all of the information from this writing.

READY TO TALK?