Market Commentary – Do You Believe in Miracles December 2022

December Update: Do You Believe in Miracles?

In a pleasant surprise, the U.S. made it to the knockout stages of the World Cup. However, as widely predicted, they failed it make it any further. While winning the World Cup would have been truly extraordinary, in the history of American sports, nothing is likely to top the legendary 1980 hockey victory that inspired the titular quote. Such a victory was truly miraculous, at least according to the Oxford Languages dictionary, which defines a miracle as, “a highly improbable or extraordinary event, development, or accomplishment that brings very welcome consequences.” As an aside, we were shocked to learn there is not a Hallmark Christmas movie with this title, wherein “Miracles” is either a town or a dog.

While our focus is going to be on the miracles investors currently believe will happen, we will also highlight a few examples where the early 1980s are an unpleasant point of comparison (these will be in bold).

Normally, we address returns toward the end of our update, but we moved them to the front introduction this month to help frame the remainder of the discussion.

| Index | 1-Month | QTD | 3-Month | YTD | 1-Year |

| S&P 500 INDEX | 5.59 | 14.14 | 3.62 | -13.12 | -9.23 |

| NASDAQ Composite Index | 4.51 | 8.63 | -2.72 | -26.12 | -25.56 |

| Invesco S&P 500 Equal Weight E | 6.64 | 16.92 | 6.20 | -7.27 | -1.45 |

| Russell 2000 Index | 2.31 | 13.58 | 2.70 | -14.94 | -13.04 |

| MSCI EAFE Index | 11.29 | 17.28 | 6.41 | -14.01 | -9.59 |

| MSCI Emerging Markets Index | 14.85 | 11.30 | -1.70 | -18.71 | -17.11 |

| Bloomberg US Treasury Total Re | 2.68 | 1.25 | -2.25 | -12.01 | -12.46 |

| Bloomberg US Agg Total Return | 3.68 | 2.33 | -2.09 | -12.62 | -12.84 |

| Invesco DB Commodity Index | 1.47 | 6.61 | -0.89 | 22.67 | 30.85 |

Source: Bloomberg (as of most recent month end)

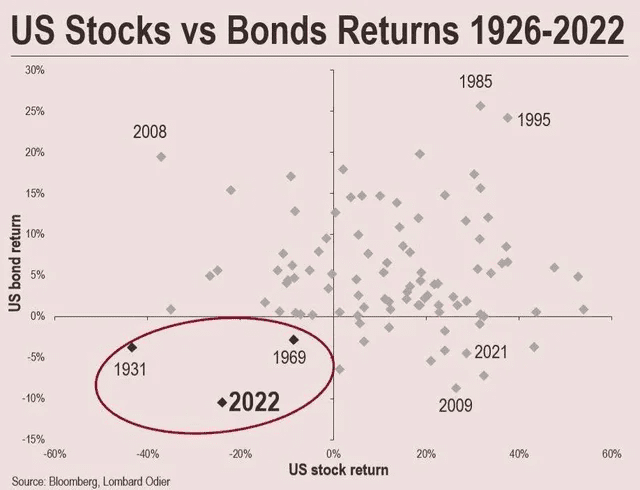

Two things we would note: First is the negative year-to-date performance for virtually all assets; the only exception is commodities. While some stocks (NASDAQ and emerging markets) have fallen more, in general both equities and bonds have declined by low double-digits, which is a rare phenomenon. We believe these declines reflect the market pricing the new cost of money set by the Federal Reserve as it has reset its policy in an effort to normalize rates and (belatedly) fight inflation. As a point of reference, the P/E multiple on the S&P 500 has contracted almost 18% this year.

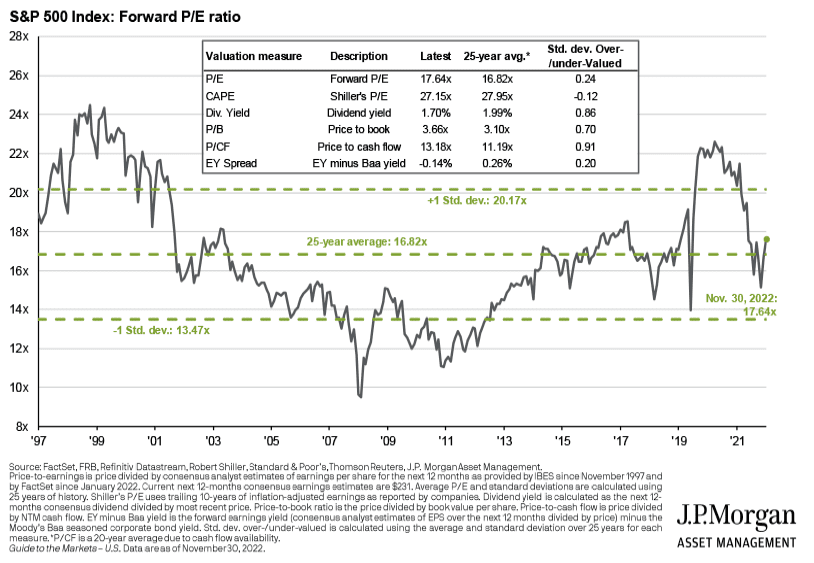

The second is the recent rebound so far in Q4 (the QTD column in the above table). Foreign stocks, as measured by the MSCI EAFE, have almost entered a new bull market (defined as up 20%). Most U.S. indices are up over 10%, on track for their best Q4 gains since 1999. While a welcome respite for weary investors, such strength is bewildering to us. Specifically, according to financial data firm FactSet, “Since the end of the third quarter (September 30), the price of the index has increased by 10.4%, while the forward 12-month EPS estimate has decreased by 2.5%.” In other words, multiples for the index have expanded this quarter, which we see in the below graph; moreover, multiples are no longer cheap, but in-line with the last 25-year average.

Earnings

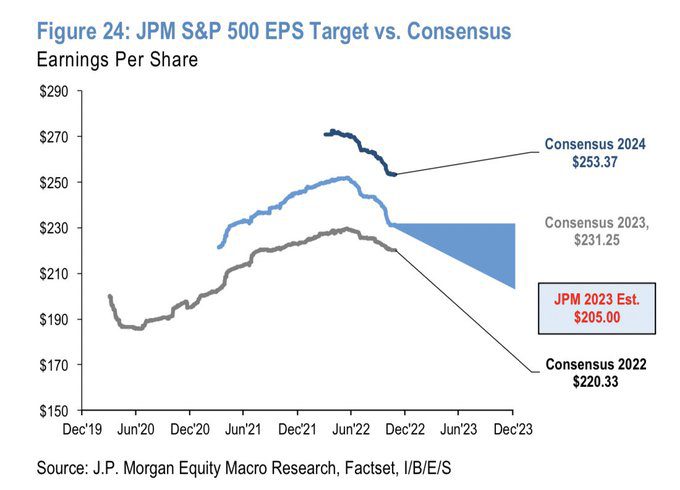

Earnings are the reason we are dubious over the sustainability of this market rally. Here are the current expectations for earnings. The market tends to be forward-looking, and consensus earnings for 2023 would indicate the market is fairly valued at its current level of around 4,000 on the S&P 500. However, it is important to note that consensus earnings of $231 assumes 5% earnings growth in 2023; this compares to 3.2% earnings growth year-to-date in 2022.

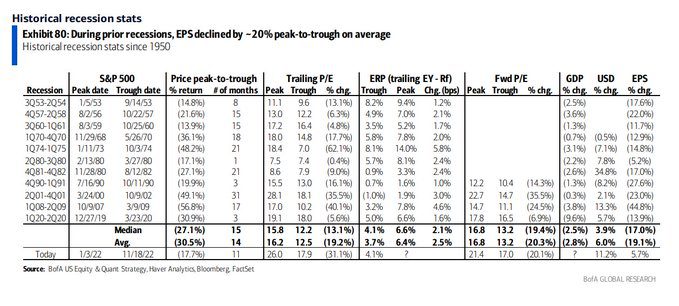

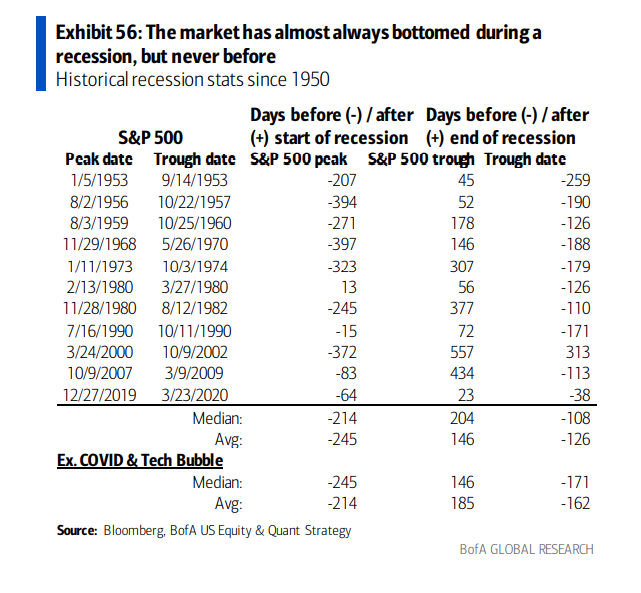

EPS growth has averaged around 9% over the last 20 years, so 5% growth is not a stretch. However, it is most definitely a stretch if there is a recession, with the smallest EPS decline in a recession around 5% (early 1980s, though this was closely followed by another 17% drop). The median decline is 17%:

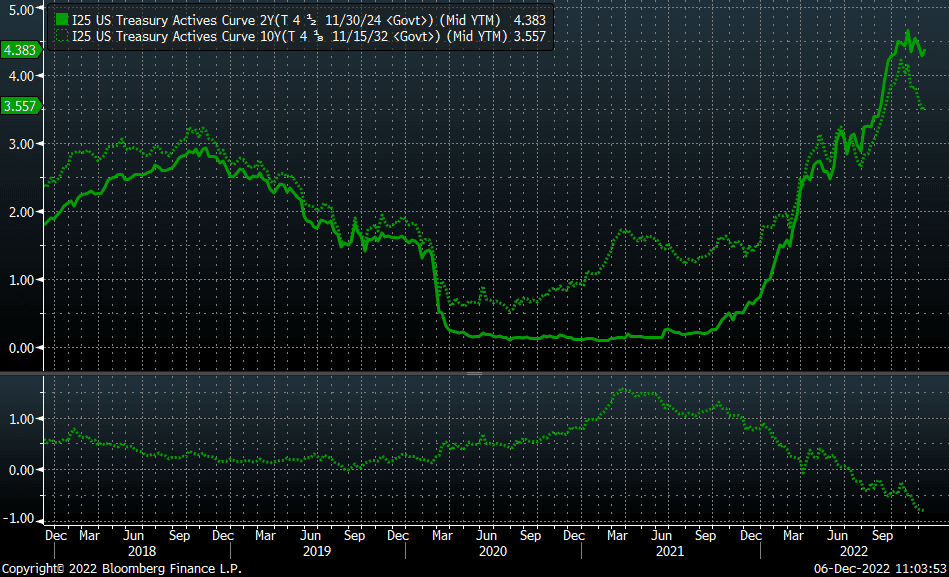

Fixed income markets are flashing recession warning lights. Our preferred metric, the 2-year versus 10-year Treasury curve, is currently inverted by 0.83%, the deepest inversion since 2000, which was the lead-in to the bursting of the tech bubble:

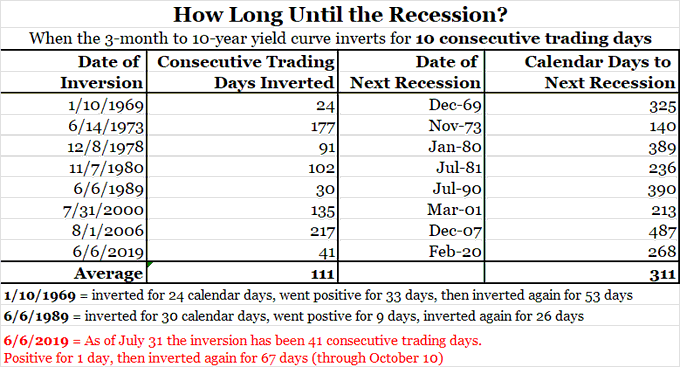

The Fed has historically leaned on the 3-month versus 10-year curve, which inverted on October 25th. This metric has excellent predictive ability, and has only been more inverted than the current 0.68% thrice before: 1973-74, the early 1980s (twice?), and 2000-2001).

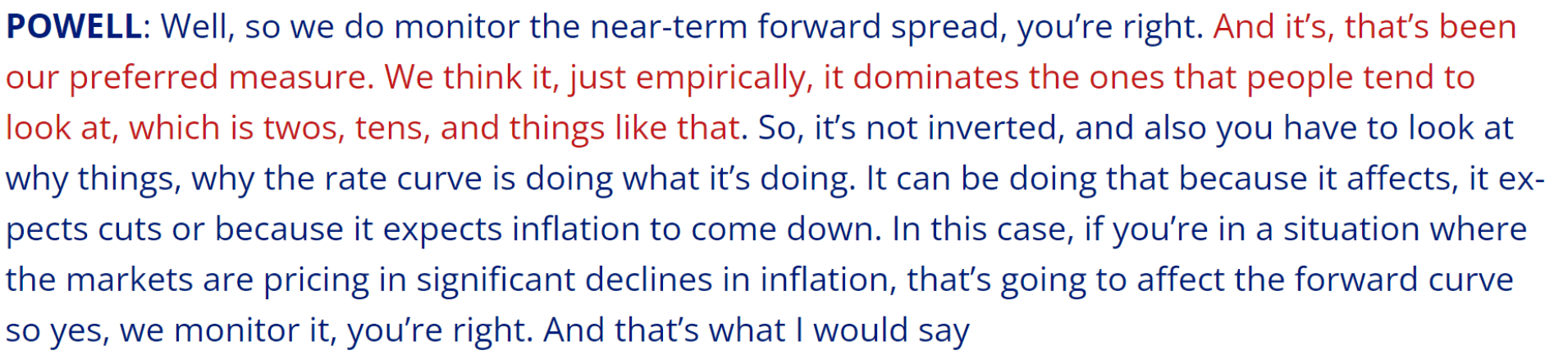

Unfortunately, the Fed has recently dismissed this metric as not being nuanced enough and is using a new indicator that is indicating no problems.

The only thing less reliable is TV personality Jim Cramer, and he confidently states no recession is imminent (cue George Costanza) because of his faith in the Fed:

Inflation

No commentary is complete without an inflation take, given this is the key determinant of Fed policy. At a recent Brookings Institution speech, Chair Powell said the following, “Monetary policy affects the economy and inflation with uncertain lags, and the full effects of our rapid tightening so far are yet to be felt. Thus, it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down. The time for moderating the pace of rate increases may come as soon as the December meeting. Given our progress in tightening policy, the timing of that moderation is far less significant than the questions of how much further we will need to raise rates to control inflation, and the length of time it will be necessary to hold policy at a restrictive level. It is likely that restoring price stability will require holding policy at a restrictive level for some time. History cautions strongly against prematurely loosening policy. We will stay the course until the job is done.”

Investors anchored on the green verbiage, ignoring the yellow, sending equites higher by over 3% on the last day of November.

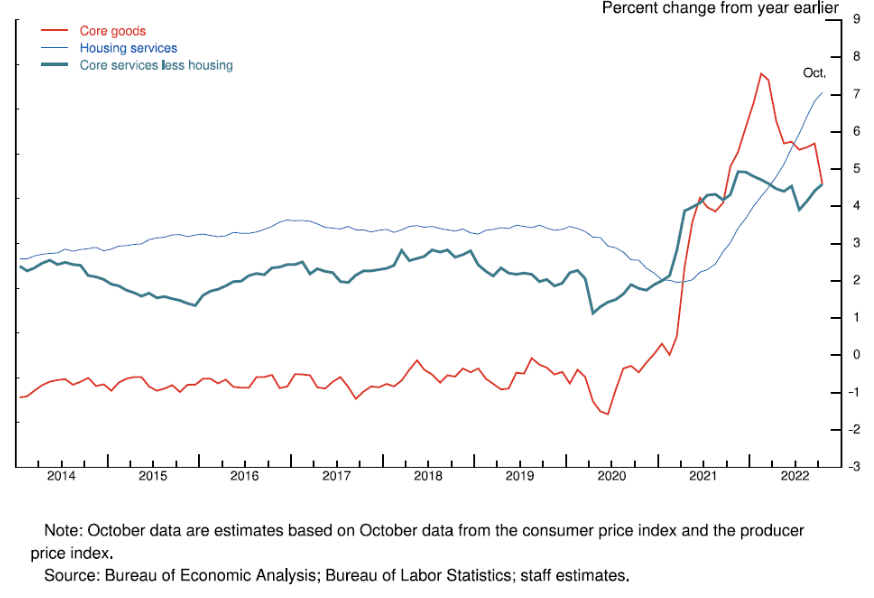

Powell also spent a lot of time talking about labor markets and wage inflation. Wage inflation tends to find its way into the services component of inflation, which has taken the baton from goods as a source of consternation:

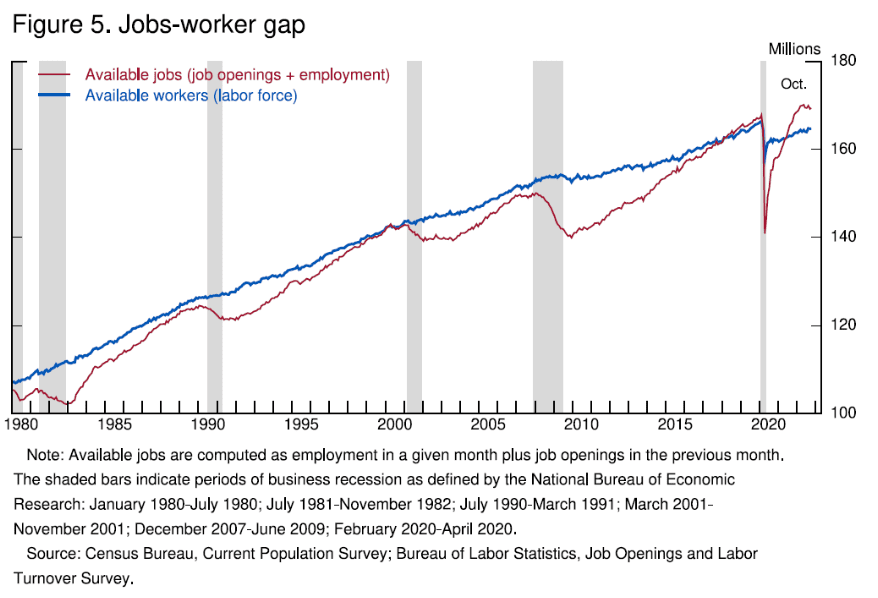

Unfortunately, as Powell acknowledged, the supply side of the labor force is outside the bailiwick of Fed policy and continues to be hampered by both the direct (long Covid) and indirect (excess retirements) consequences of the pandemic. Moreover, structural demographic issues and restrictive immigration policy are also not bolstering the labor force.

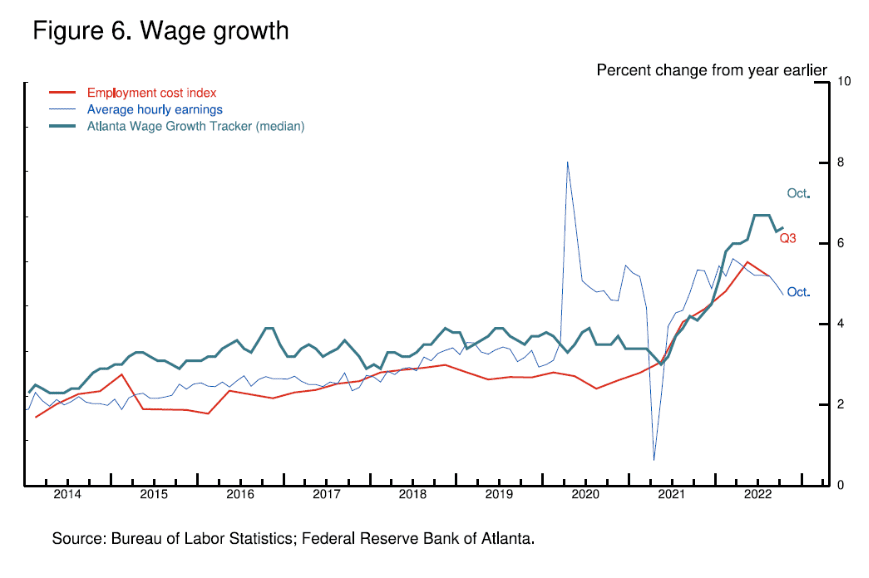

Accordingly, the only way to dampen wage inflation, which is running between 4% and 6% per the various metrics the Fed tracks, is to bring balance to the equation on the demand side by reducing employment. The Fed is serious in its efforts to control wage inflation, given the current run rate exceeds the Fed’s 2% target and is one of the ways inflation becomes entrenched in an economy.

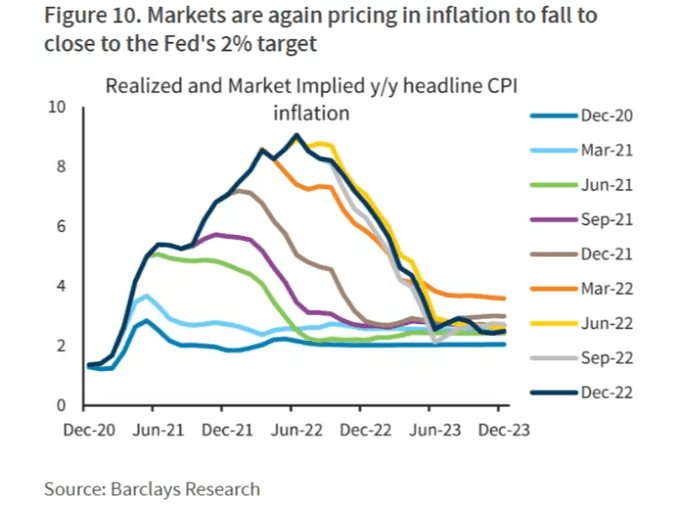

November’s slightly cooler CPI reading also gave the markets cause to rally. However, investors have been consistently wrong about inflation reverting towards its prior 2% trend line.

Consumers

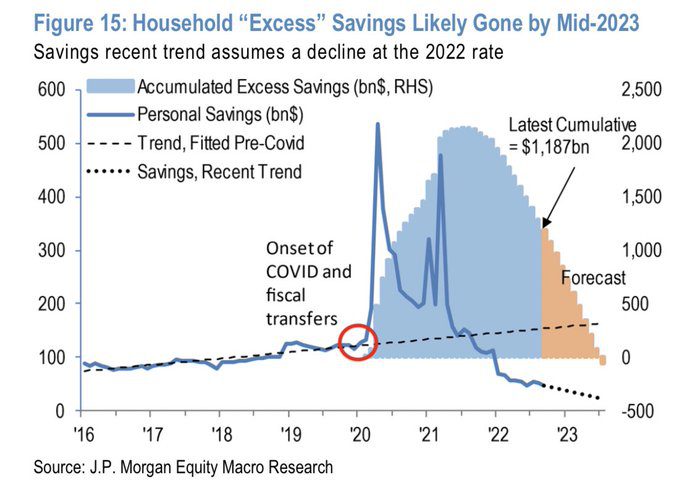

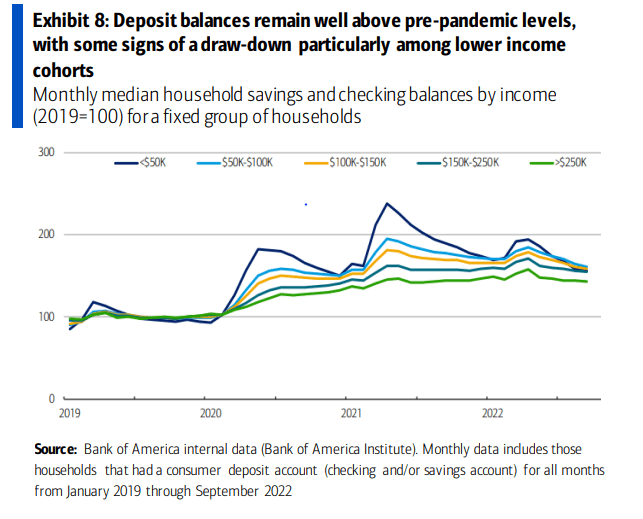

The other piece of the inflation equation has been the deluge of cash thrown at the economy in response to Covid. However, what we are seeing is the rapid decumulation of the excess savings, specifically for the lower income households, where wage growth has been strong but not strong enough to keep pace with inflation.

Inflation is certainly part of the reason for the rapid decline, with consumers forced to dip into savings as wages, although rising, have failed to keep pace with inflation.

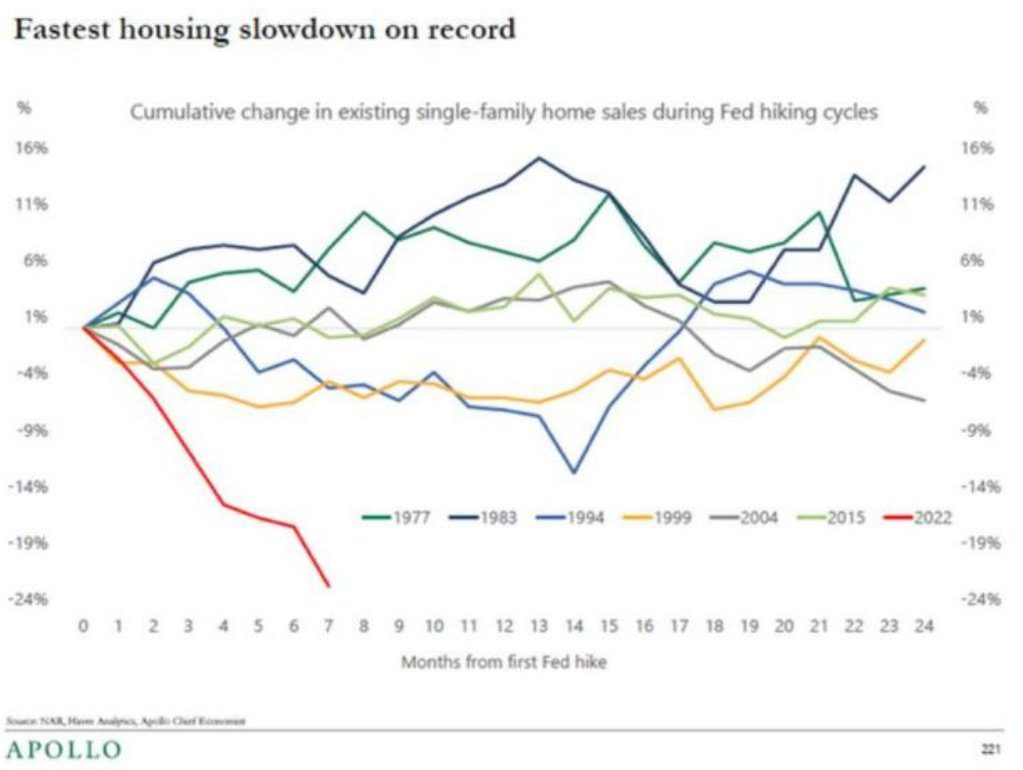

Pain is also being felt on the housing front, which is typically at the leading edge of any economic decline. Sales of single-family homes have fallen at a historic pace, thanks to mortgage rates that crested above 7%.

Do you believe in unlikelihoods?

While it is hyperbole to say the market is expecting a miracle from the Fed, perhaps we can quote another classic of American sports, Dodgeball, and ask ourselves if we believe in unlikelihoods.

The market currently assumes the following is true:

- The economy avoids a recession:

- The implication here is that the Fed successfully engineers a soft landing, avoiding a recession.

- Earnings growing 5% in 2023 and more in 2024 can realistically only occur in the absence of a recession, given:

- Since 1950, earnings have always declined in a recession.

- Avoiding a recession would also indicate the end of the bear market, given:

- Inflation moderates to 2%, allowing the Fed to cut rates

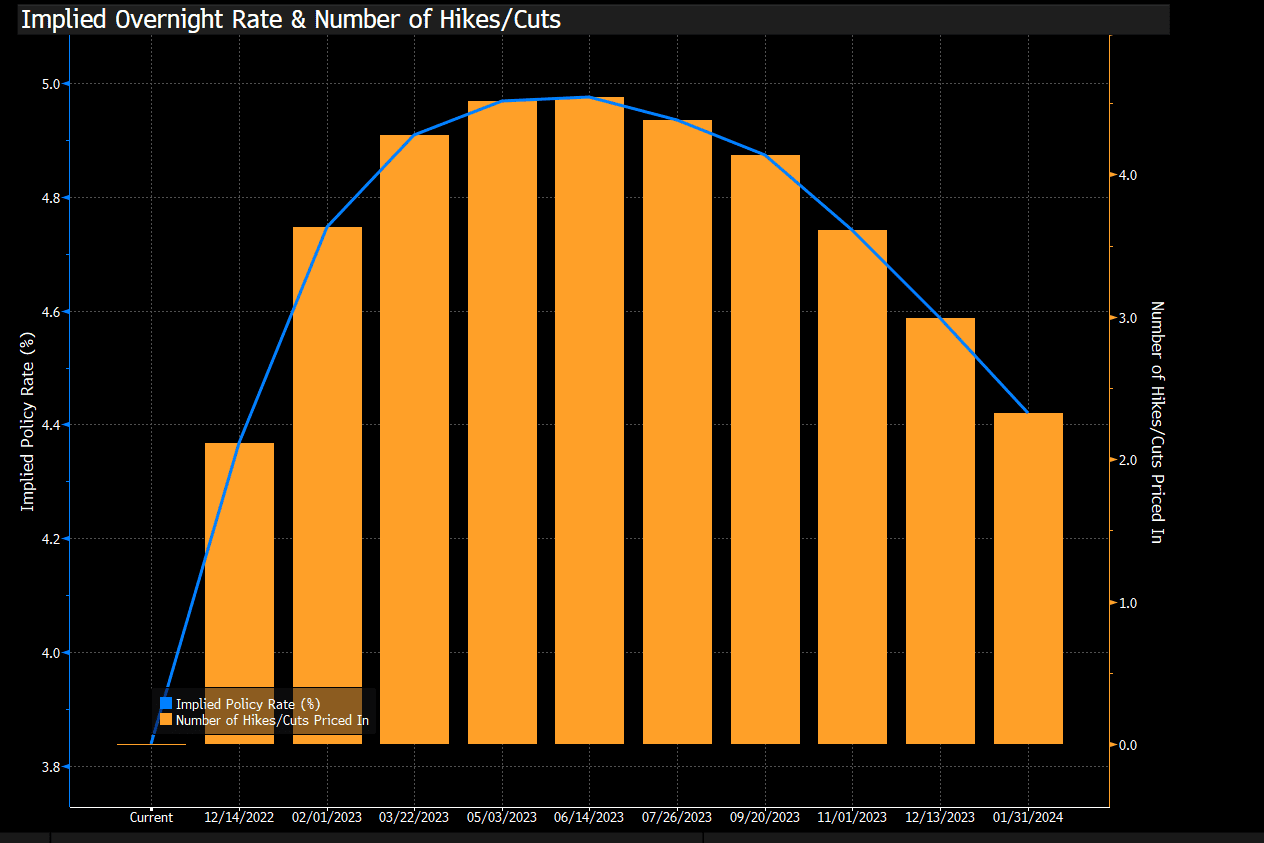

- Expectations for future Fed funds rate anticipate four (4) hikes in the first half of 2023 before we get two (2) cuts in the latter half of 2023

In other words, the Fed will quickly pivot (despite what Powell stated in the previous yellow highlighting) due to inflation cratering, not due to economic weakness, which is the typical cause for such a rapid reduction in rates. This scenario resides somewhere between unlikely and a miracle in our estimation.

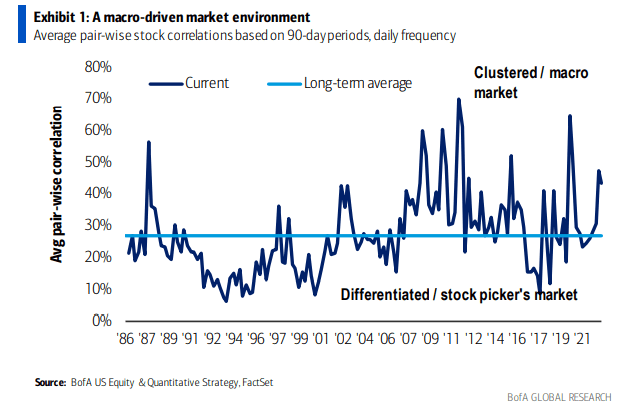

However, in the spirit of the holiday season, hope remains. First, we think that, going forward, there will be a greater ability to differentiate returns based on stock fundamentals, not macroeconomic conditions, which have been about twice as important as average post the onset of the Covid crisis:

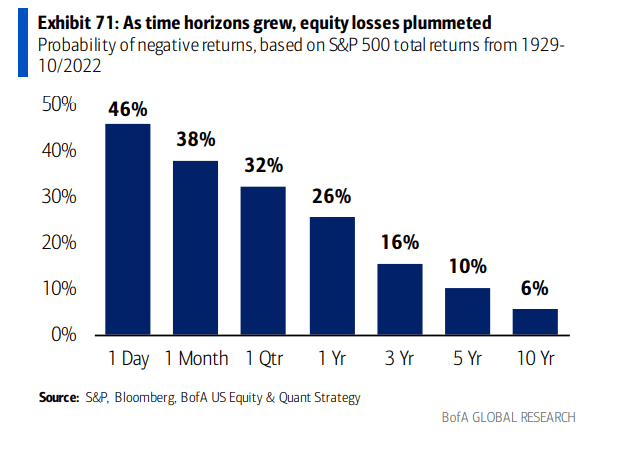

Second, as investors, not speculators, we build portfolios with an emphasis on achieving each investor’s unique, long-term goals. Over any given month, quarter, or year, the odds are not always in our favor, but over longer periods of time, we think remaining invested for the long-term and actively managing portfolios with an emphasis on managing risks will make our investors less reliant on miracles, and more reliant on math.

READY TO TALK?