February 2024: The Magnificent Sellers

The Magnificent Sellers

“In case you haven’t noticed it, and judging by the attendance, you haven’t, the Indians have managed to win a few here and there, and are threatening to climb out of the cellar.” – Harry Doyle in Major League.

“Climb out of the cellar”, well, I prefer the Sellers are climbing out…..”Climbing out of what?”, you may find yourself asking. They are climbing out of their hibernating slumber, awakened to the greatest largesse of perhaps their lifetimes. Valuations in the Nasdaq have reached the ionosphere, and only space is now left.

The “Magnificent Seven” – as titled for its illustrious performance in the stock market – has moved radically since October 2022. The Magnificent Seven as defined by the media contains the stock of Tesla, Amazon, Apple, Google, Meta, Microsoft, and of course Nvidia. These seven have ascended Olympus now as titans of market capitalization.

Price levels for these seven have turned from the Street of Dreams to a daytime nightmare for value investors. Everybody got it right and everybody is a genius. Harry Doyle might ask, “How can these guys lay off pitches that close?”. Well, some of us have seen this before, and now The Magnificent Sellers have emerged. Valuations are so gravely extended that corporate insiders, rather notable ones, have taken to selling some of their holdings. And like a man lost in the desert, investors are drinking the sand while they believe they are in an oasis.

JUST a bit outside

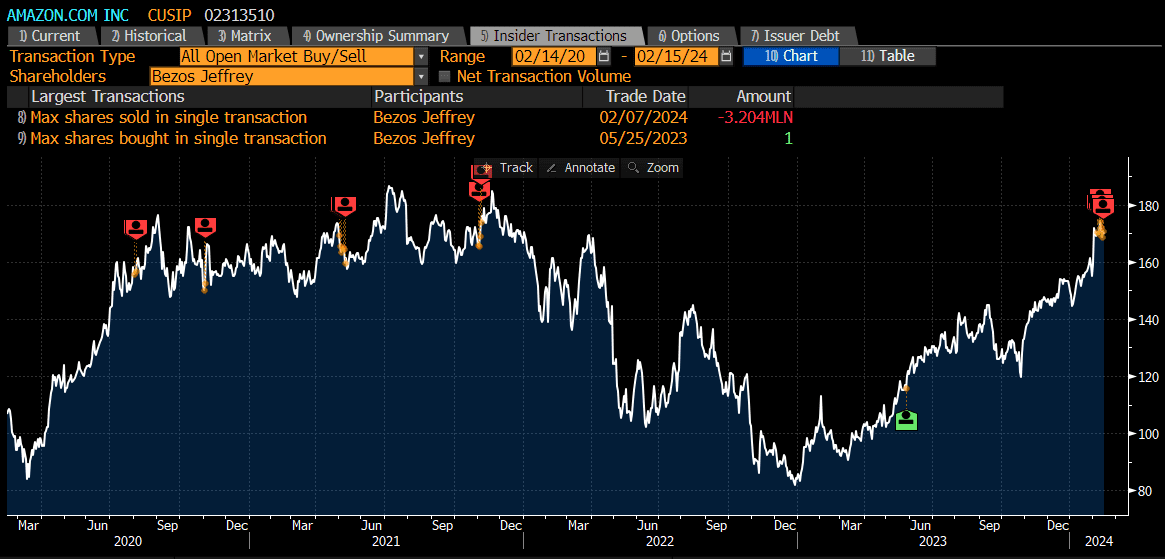

The first notable seller is Jeff Bezos, founder of Amazon, and he has dropped the hammer on the stock selling $6 billion worth of stock in the last week – this is noteworthy because it is a not a small portion of his ownership. Big enough might be a way to say this. Mr. Bezos has a history of catching the top of the market when selling, so we shall see.

Additionally, Warren Buffett’s Berkshire Hathaway recently disclosed on its year-end 13F filing that it had sold 10 million shares (almost $2 billion) worth of Apple. This is interesting because the stock has continued to drift with a tepid, subpar earnings report and the share price has continued to decline, begging the question, is Berkshire continuing to sell? The more conspiratorial among us might note a rare (and dubiously timed) upgrade of Apple by Bank of America, another large Buffett holding. Coincidence? Perhaps. Only next quarter’s filing will show if Berkshire has continued to sell.

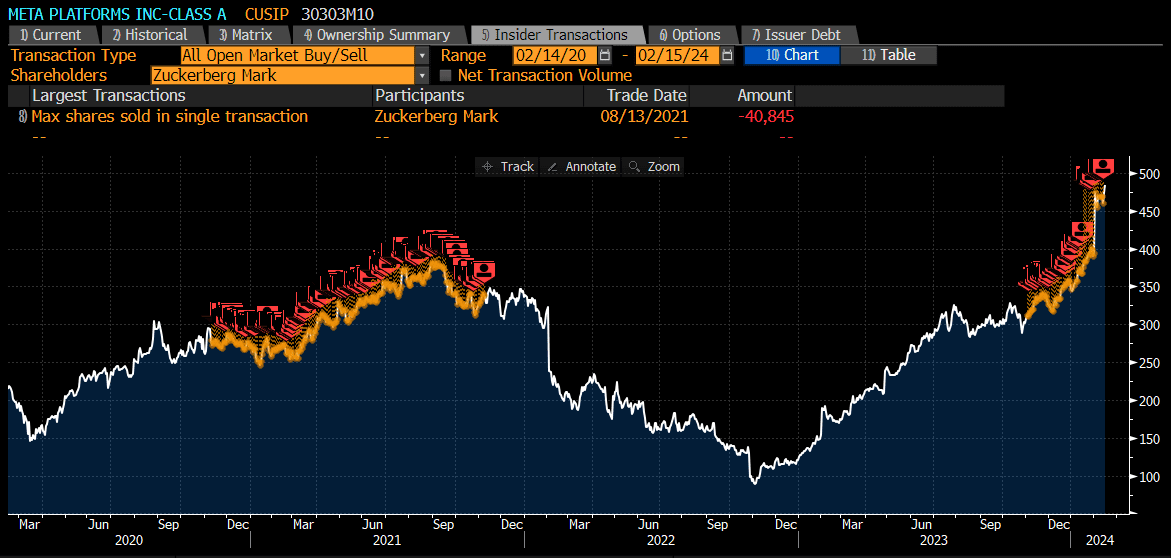

Honorable mention goes to Ernest Garcia for selling $1.8 billion worth of Carvana shares which is jaw-dropping in every direction. (Adam Eagleston would say that owning one share is too much of Carvana.) Mark Zuckerberg – a name a lot of people would know – has divested $1.6 billion dollars worth of Meta for ‘philanthropic reasons’. However, he did lock in that valuation and, lo and behold, he has been a pretty consistent seller around this range (and below).

Reed Hastings, the CEO of Netflix has recently been reducing his position and has sold $334 million of Netflix shares out of his $5 billion in net worth. And the chairman of Estée Lauder, Leonard Lauder, has sold $1 billion worth of shares in cosmetics giant, Estée Lauder.

So, what do they know that we don’t?

Could it be that they understand that the businesses they run are simply overvalued by the market as it stands? Could it be that they believe that taking some of the money they’ve made from these great companies is worth keeping? We will find out, as time is the arbiter of valuation. To paraphrase the wildly unpopular (in today’s climate) value investor Ben Graham, the market is a voting machine in the short term and a weighing machine in the long term.

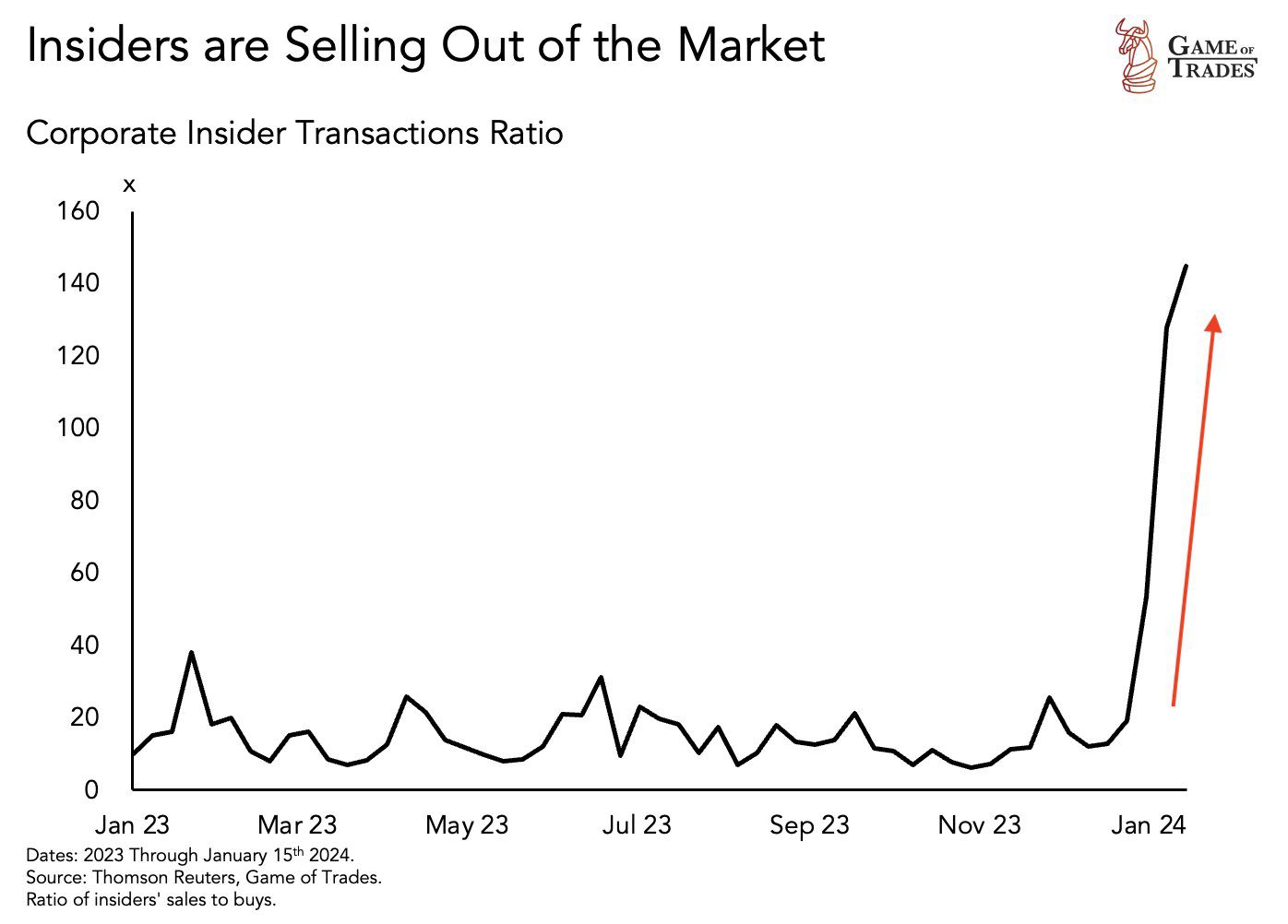

At Formidable we believe investors need to understand that when insiders of this magnitude are walking away from some of their ownership to give it to the public markets, the public would be wise not to buy it. However, the $60 billion that has flooded into equities, much of it tech, in the past four weeks represents the biggest buying by retail in two years, indicate few are considering from whom they are buying these shares.

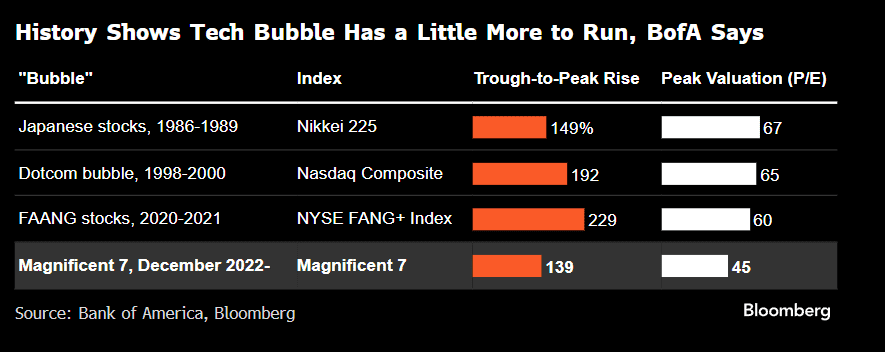

The reality is that the markets are extended in every direction imaginable. There is a blatant disregard for valuation and an incredible amount of hubris relating to how these Magnificent Seven companies are valued on a going-forward basis. My father, the English teacher, would tell me the word “untenable” comes to mind. Can it continue? If prior bubbles are any indication, the answer is yes, though the Magnificent Sellers may be showing us that they simply agree that the prices for their stocks have moved too far, too fast.

READY TO TALK?