Flux Power Holdings: Operational Progress Does Not Match Share Price Weakness

Executive Summary

In our previous article on Flux Power Holdings, Inc. (NASDAQ: FLUX), we highlighted the advantages of lithium-ion batteries over their lead acid counterparts. From a productivity perspective, lithium-ion batteries can operate over longer intervals and lifespans compared to lead-acid batteries. From a safety perspective, lead acid batteries pose significant environmental and safety hazards. The battery can overheat from overuse or overcharging, and improper handling whilst watering the battery can expose an individual to toxic gases and liquids. On the other hand, a lithium-ion battery requires less frequent recharges, can operate at much higher temperatures, and functions as a sealed system, that does not require fluid management and avoids handling risks. Regarding non-battery solutions, we note the following disadvantages. Carbon emissions and high maintenance and refueling costs of internal combustion engines (ICEs) outweigh their cheaper upfront expenses and ease of refuel. In addition, hydrogen fuel cells, which are quite energy dense and can be quickly replenished, contain flammable gas that is both dangerous and expensive to operate, store, and transport.[i] In short, in our opinion, lithium-ion batteries are the most viable energy source for materials handling machinery.

Here, we will provide a quick reminder on how FLUX operates and how it has executed since our prior piece in late 2020. We will also perform a brief valuation comparison versus a few peers to show why we believe the stock should trade above its current level. As a reminder, we wrote about FLUX on November 5, 2020, when the stock was trading at a 3.51 P/S multiple (NTM). On September 16, 2021, the stock was trading at a 2.53 forward-looking P/S multiple.

Business Overview

FLUX designs, develops, manufactures, and sells advanced rechargeable lithium-ion energy storage solutions for lift trucks, airport ground support equipment (GSE), stationary energy storage, and other industrial and commercial applications. The bulk of FLUX’s products support materials handling equipment (e.g., forklifts), where safe, efficient energy sources are essential for operators to make full use of their equipment fleets. Competing energy sources include lead acid batteries (most widely used), internal combustion engines (ICEs), and hydrogen fuel cells, each of which present tradeoffs between safety and efficiency. We believe lithium-ion batteries are the most dependable, capable resources for serving these target markets.

Lithium-ion batteries, however, pose safety risks if not properly manufactured. From initial construction in the late 1980s to today’s widespread commercial applications, lithium-ion batteries have possessed a recurring flaw—thermal runaway. When the battery overheats, it releases energy to its surroundings in the form of heat, light (sparks), or sound (explosion). Examples include Nokia’s recall of 46 million batteries that could overheat or explode (2007), battery fires during transportation aboard Boeing 787s (2013), Samsung’s recall of 2.5 million Galaxy Note 7 smartphones that were prone to catch fire (2016), and more recently, a fire in Tesla Megapack’s utility-scale stationary energy storage facility on August 5, 2021[ii],[iii]. These examples are reminders that, despite ongoing improvements to battery monitoring and regulation, lithium-ion batteries are not without risk. This highlights the need for a trusted supplier who provides a readily available energy source that preserves the safety of both its users and the environment.

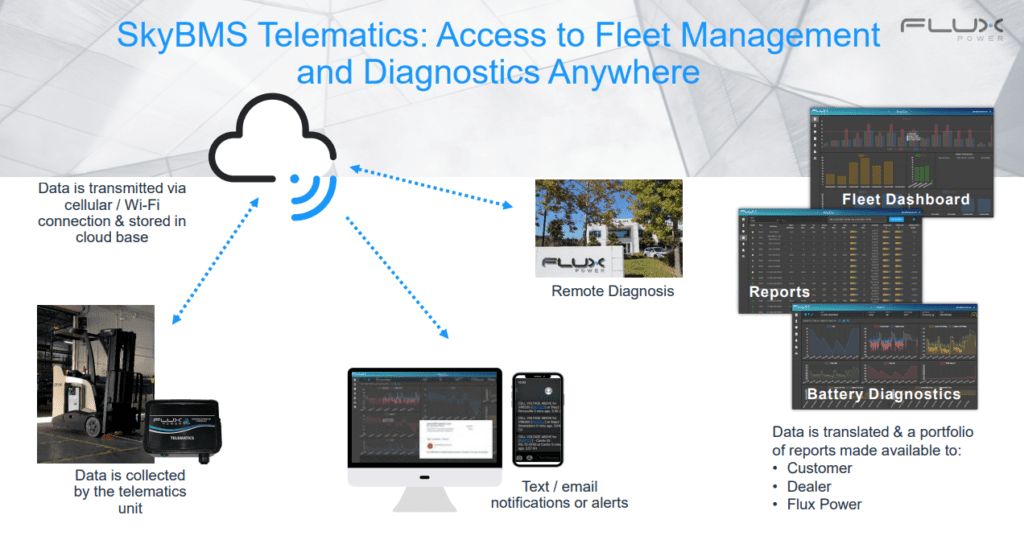

FLUX differentiates itself by developing quality products and services. The company devotes extensive resources to ensuring its LiFT Packs are properly designed, maintained, and consistent with both major OEM equipment and relevant safety guidelines. FLUX’s patented, proprietary battery management system (BMS) is the “brain” of its products, that manages cell balancing, monitoring, charging, and discharging, and communication with machinery to prevent batteries from operating at unsafe capacities. In December 2020, FLUX filed additional patent applications for three BMS capabilities: (1) increasing battery life by optimizing charging cycles, (2) educating users on battery health, and (3) applying artificial intelligence (AI) to predictively balance cells for optimal performance. To complement the BMS, FLUX provides telemetry services, known as SkyBMS Telematics, that transmit and store BMS data through Amazon Web Services and can be used for remote battery diagnostics, reports, alerts and notifications, and other fleet management solutions.

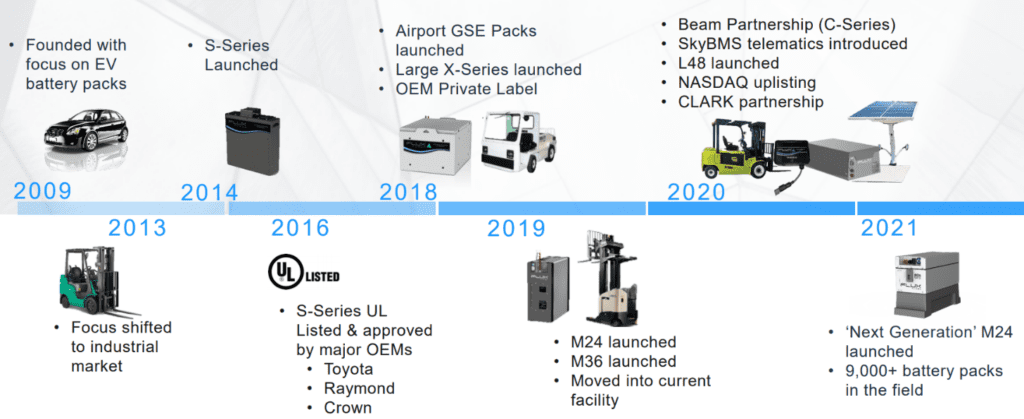

Figure 1. Source: June 2021 Company Presentation

Regarding pack validation, FLUX has obtained (or is in the process of obtaining) certifications for its LiFT Packs through global safety science company, Underwriters Laboratory (UL). Based in 43 countries and affiliated with clients in over 100 countries, UL conducts testing, inspection, and certification (CIT) training, advisory, and risk management services to ensure companies and products comply with rigorous safety standards. Each UL standard (most are American National Standards) is governed by a Standard Technical Panel (STP) comprising of various interest groups—product developers, suppliers, retailers, consumer advocacy groups, government organizations, inspectors, testing and standards organizations, and other interested parties. When stress testing batteries, engineering technicians in UL’s Illinois-based testing lab push batteries and cells to their breaking point—often testing them in tandem with the products they power—to ensure the technology meets UL’s safety standardsii. FLUX also works with large OEMs like Toyota Material Handling USA, Inc., and Crown Equipment Corporation to secure “technical approval” for its packs with their equipment. Ensuring compatibility with major OEMs instills further confidence in FLUX’s products. Finally, FLUX partners with battery and forklift equipment dealers to provide local support to large customers to mitigate machinery downtime in the event a battery fails. It strives to expand this service nationally.

FLUX’s battery pack technology is its primary asset. It is both modular and scalable in design, which allows for swift production. In addition, the company can modify its existing technology to generate novel products. In fact, each of its current packs includes components from prior models. For example, FLUX’s battery packs for Class 1-3 lift trucks, airport ground support equipment (GSE), and (emerging) warehouse robotic solutions (e.g., small autonomous mobile robots) were all developed by refashioning the configuration of FLUX’s original, and smallest, product, the Class 3 Walkie Pallet Jack. In addition, the company repurposes old forklift battery packs to construct C-series packs to power solar electric vehicle charging stations. FLUX capitalized on this capability when it became Beam Global’s sole supplier of lithium-ion battery packs in 2020. Management defines this strategy of altering previous designs to produce novel products across a variety of applications as “natural product extension.” FLUX believes this is the driver of the company’s growth and sustainability[iv].

FLUX sources battery pack components from different suppliers—battery cells from China, and remaining parts from the US—and performs final pack assembly, testing, and shipping in its sole manufacturing facility located in Vista, California. The company sources chargers from US suppliers and sells them alongside its packs. As mentioned previously, the packs include FLUX’s built-in proprietary BMS, which is supplemented by a remote management application, i.e., telemetry, to ensure proper battery usage.

Battery packs are typically sold separately from lift equipment and through a variety of channels. FLUX delivers its products to OEMs, private labels, lift equipment dealers, battery distributors, and directly to customers. The company keeps a modest inventory of small packs on hand to meet shorter customer time requirements, and it aligns larger pack inventories with historical OEM patterns. The company delivers larger packs on a four-eight-week lead time and provides a six-month rolling forecast of orders to battery cell suppliers. In addition to ensuring product compatibility, gaining technical approval for its products with OEMs helps FLUX drive sales by forming relationships with OEM corporates sales forces and their respective dealers and battery distributors. The company prioritizes serving large fleets where it can build credibility (and revenue) through initial orders and secure additional opportunities within the company or with new customers through its heightened visibility.

Investment Thesis

FLUX has operated for over a decade. When the company was founded in 2009, it concentrated on developing rechargeable lithium-ion battery packs for commercial electric vehicles (EVs). In 2013, FLUX pivoted to constructing packs for industrial markets, namely materials handling equipment (e.g., forklifts), and has since maintained this as a primary focus.

To date, FLUX has achieved the following:

- it has created a reliable product line and accompanying management; and servicing solutions to ensure optimal battery usage.

- It has made safety a priority by investing in UL certifications and other precautionary measures.

- FLUX’s technology is adaptable—able to be modified on an assembly line with minimal effort (and presumably low costs) to create an entirely new product.

- Its sales and marketing strategy has earned relationships with Fortune 500 companies, leading materials handling companies, and other providers to enhance FLUX’s credibility, form ongoing commitments, and improve visibility to potential customers (Figure 1).

- It has operated against the backdrop of a global electrification movement that has fueled production and demand for lithium-ion batteries and plummeted cell prices by over 97% since commercial introduction in 1991[v].

The product, strategy, and environment all show potential for lasting success.

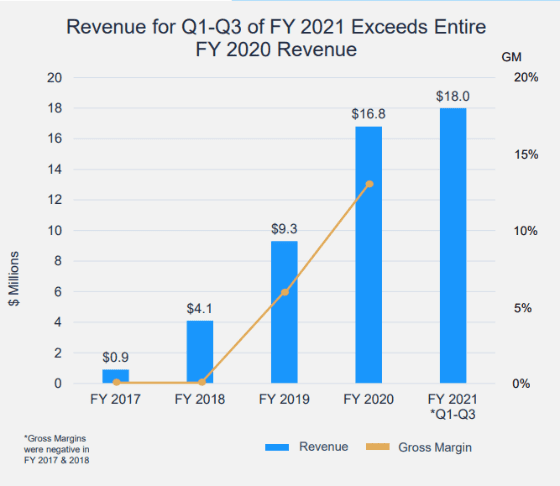

Figure 2. Source: June 2021 Company Presentation

While FLUX’s recent efforts have translated into favorable revenues, we believe the company must execute in two key areas to realize its full potential.

Key #1: Reduce Costs

|

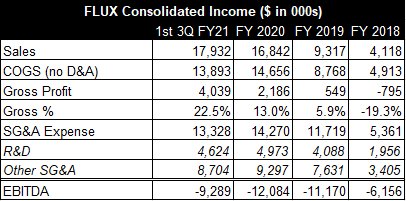

FLUX has achieved impressive revenue growth since its 2017 fiscal year (June 30, 2016 – June 30, 2017), including nearly doubling sales in each of the previous two fiscal years. The company has surpassed its FY2020 sales by $1 million in the first three quarters of FY2021 and is on track for approximately $25 million in total FY2021 revenue, or roughly a 45% increase. This includes setbacks to airline GSE revenues as the global pandemic crippled the industry. Management notes seasonality, or reduced orders, during the months of July, August, and December (Q1 – Q2), should not affect Q4FY2021 revenue.

To gain a sense of FLUX’s growth trajectory, we can look at total units sold since the filing of last year’s 10-Kiv. As of June 30, 2020, the company sold “over 7,000 packs to customers.” On July 31, 2021, FLUX announced the sale and shipment of “over 10,000 battery packs to customers”—a 43% increase in just over a year[vi]. Of course, we cannot individually identify or price the 10,000+ battery packs sold in aggregate, but this activity reveals FLUX’s commitment to scaling production and revenue.

As we noted earlier, certain transactions may lead to follow-on revenues with existing clients as well. This potential is apparent in FLUX’s recent delivery of its X48 packs (for large, Class 1 counterbalanced forklifts) to two new customers with fleets totaling 2,000-plus and 500-plus forklifts, respectively[vii]. We do not know how many units were delivered in either transaction, but we do recognize the value of FLUX’s relationships with large customers and the opportunities these initial orders can create. Typically, companies replace their fleet batteries over time as the useful life of the prior lead acid battery ends, so we expect orders from these customers to continue to add meaningfully to volumes. In the past, FLUX relied heavily on a few large customers for the bulk of its revenue, leaving it vulnerable to one or more complications with a major client. Since FY 2019, management has diversified its customer base to avoid this overdependency and to secure additional relationships that may result in future transactions. In FY 2019, the company served just four major customers comprising 87% of its total revenue. As of the end of Q3 FY2021, FLUX relies on three major customers representing 59% of its total revenue. The company announced a backlog of $13.7 million—its largest backlog to date—on July 22, 2021, and its California-based manufacturing facility can support revenue capacity of up to $100 million. All in all, FLUX has executed well in obtaining sales and is well-positioned for revenue growth.

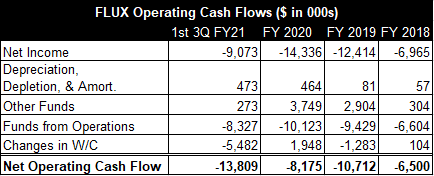

While consistently elevating revenue is a sign of growth, a company’s top line provides no indication of its financial health. If a business cannot mitigate costs and optimize operational performance, it will burn cash until shareholders and creditors can no longer provide capital. It is a losing game. This is often a reality, and perhaps an expectation, for early-stage, high-growth companies. In theory, as the budding company mitigates costs and scales production over time, it will generate organic cash flows and rely on fewer external financers to sustain operations. Despite FLUX’s impressive revenue, its inability to concurrently produce cash through operations is reprehensible. This deficit is growing and will likely nearly double in FY 2021 compared to FY 2020 (See Figure 6. Operating Cash Flow).

This raises the question: Is FLUX a new company?

FLUX was founded in 2009. Sure, FLUX pivoted from serving cars to forklifts in 2013, but that was eight years ago. The company has had time to adjust from the transition. But what did it accomplish during the four-five years following the transition? Why did FLUX fail to achieve $1 million in sales until its 2018 fiscal year? Should we give management a pass on its net losses and cash burn and chalk it up to the growing pains of an emerging business? We think—yes.

Company progress over the past few years indicates FLUX has reincarnated from a plateauing entity to a growing business. FLUX’s core operations (materials handling applications) are ramping sales, and its flexible technology has been, and holds additional potential to be, applied to additional products and markets that rely on lithium-ion batteries. We believe a change in management sparked this turnaround. First, current management was not present prior to the second half of the 2018 calendar year (end of FY 2018). The directors of sales, manufacturing, engineering, and business development, the chief operating officer, and current President and CEO are all recent hires. (Ronald Dutt, CEO, has worked for FLUX for nine years but did not assume his current role until mid-2019). While revenue began climbing just before their arrival, new management achieved the considerably more difficult task of augmenting revenue at a much larger scale. In addition, new management radically expanded FLUX’s product offerings, which impacts both near-term and long-term sales. Before 2018, FLUX sold a mere two products—the S-Series Class 3 Walkie Pallet Jacks, which are the smallest and lightest of FLUX’s current battery packs.

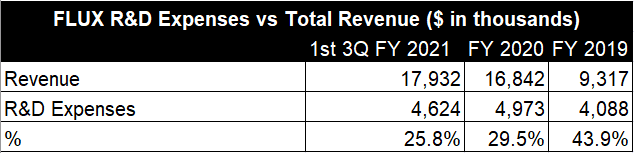

Since new management arrived, FLUX has developed ten new products, including airport GSE and solar stationary energy storage packs. Management accomplished this by boosting capital expenditures as well as research and development, among other measures. Capital expenditures from 2014 through 2018 fiscal years (five years) totaled $172,000, while capital expenditures (Capex) in the 2019 fiscal year (June 30, 2018 – June 30, 2019), alone, was $275,000. Research & Development soared following the second half of 2018. Furthermore, FLUX released its SkyBMS Telematics service in 2020 to turn battery & fleet management virtual. It has also formed relationships with Fortune 500 companies and top materials handling manufacturers (e.g., Clark Material Handling), planting the seed for longer-term commitments and additional product expansions. Over the past few years, FLUX has revitalized itself from a stagnant, one-dimensional player to a dynamic, reputable force that instills confidence in its clients and grows larger each quarter.

Figure 4. Source: June 2021 Company Presentation

Nevertheless, we do see operational costs as a near-term issue for FLUX. Historically, management has issued equity to offset its losses. Following the $12.4 million raise to become NASDAQ-listed on August 2020, FLUX filed a shelf registration (S-3) on October 16, 2020, for $50 million to support future capital needs, which includes $10 million available for At-The-Market offerings of common stock. As of May 27, 2021, FLUX had raised $9.25 million under the ATM. In addition, management converted all outstanding short-term debt ($2.4 million) into equity during Q3 FY2021. We urge management to begin issuing debt to finance operations as it currently possesses a $0 credit balance. FLUX may access up to $16 million in available credit, of which $12 million (senior revolver) and $4 million (short-term revolver) mature on November 8, 2021, and September 30, 2021, respectively.

Issuing debt provides an inflow of capital and is necessary for growth, but it does not solve a company’s underlying inefficiencies. In FLUX’s case, cost of goods sold (COGS), sales, general, and administrative (SG&A) expenses, and negative funds from operations are considerably high. Indeed, gross margins have improved 9.5% (from 13% to 22.5%) in the first nine quarters of FY 2021 compared to the first nine quarters of FY 2020, but a 22.5% margin cannot hold up against SG&A expenses (including R&D) that are three times larger. SG&A expenses have increased due to new hires and sales commission, insurance expense, board compensation, accounting and legal expenses, and facility related expenses. R&D increases are attributable to new product developments, UL certifications, and staff/labor expenses. The following are relevant metrics for the first three quarters of FY 2021 (June 30, 2020 – June 30, 2021) and for FY 2020, 2019, and 2018:

|

|

Per FLUX’s most recent 10-Q[viii] (March 31, 2021), management declared the following initiatives to reduce COGS: design improvements, volume purchases, supplier sourcing, and general economies of scale. Regarding sourcing, the company did declare a (unnamed) lead supplier for battery cells in that same filing, which may presumably lower costs.

However, management notes introducing new cells into certain battery packs will require further UL certification and/or OEM technical approval and may delay sales. Our biggest critique is FLUX’s product design/development costs. The company boasts its ability to create new packs through “natural product extensions,” which “typically require only minor design effort to work in different applications,” (per Q2 FY2021 Earnings Call). One would think these product extensions, namely, FLUX’s ability to repurpose forklift battery backs that have reached their end/warranty lives into packs for solar stationary storage with only minor refurbishment, should lower production costs. However, this is not reflected in FLUX’s financials. While we credit new management for ramping production and expanding its clientele, we are concerned that a technology developed in 2014, that has evolved over a series of natural product extensions, requires significant production costs in 2021. Management’s continued assurances that its products are “modular” and “scalable” may be true for ramping production, but we have yet to see meaningful reductions in expenses related to battery pack design and development. One potential cost reduction strategy would be to simplify battery pack designs to limit the number of outsourced components, as mentioned in our recent conversation with management.

About one quarter of SG&A expenses are related to necessary research and development. We view increasing R&D as an indicator of growth as it consists of UL certifications and new product development. The remaining three quarters of SG&A expenses, however, require refinement. Executive compensation accounted for just 8.1% of non-R&D SG&A expenses for FY 2020, reportedly due to executives not exercising stock awards/options for that year. Sales compensation, professional fees, and rent expense accounted for the majority of FY2020 SG&A costs. We believe a significant portion of such fees were associated with new hires and sales commissions due to the ramp in revenue, and we are hopeful management will adjust sales compensation to a more sustainable level moving forward. On balance, SG&A as a percentage of total revenues has reduced from 83% in FY2019 to 58% in FY 2020, so we believe management is headed in the right direction.

The inefficiencies describe above seem surmountable, and we believe FLUX should issue debt in the near-term to sustain itself as it continues to refine operations.

Key #2: Double down on materials handling & solar energy storage—keep an eye on new opportunities

FLUX’s core business—battery packs for materials handling applications—is in a pivotal position. Management’s commitment to product quality and strategic relationships has begun translating into material revenue, with plenty more up for grabs. In our previous paper, we estimated a TAM for lithium-ion batteries in materials handling applications to be approximately $11 billion. Moving forward, FLUX should retain a focus in this area by ramping production and sales whilst lowering sourcing, development, and transactional inefficiencies.

Modest product extensions will continue to play a role in diversifying FLUX’s offerings within the materials handling and energy storage markets. FLUX’s cooperation with Beam Global as its sole battery pack supplier is a perfect example. Management believes this partnership strategy will drive future growth, though it has not alluded to any new developments. In addition, FLUX will implement product extensions to refine dated products, which is apparent in the company’s recent release of a next-generation M24 battery pack for Class III forklifts to replace the 2019 model.

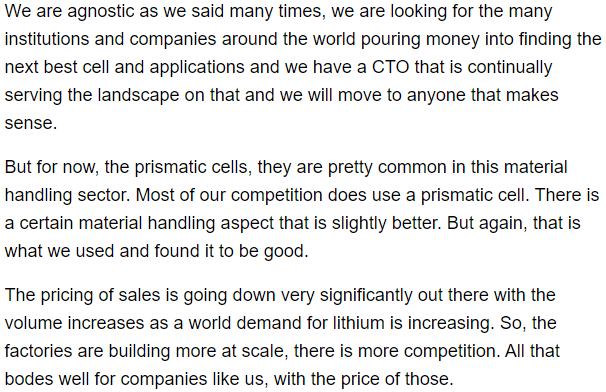

Regarding opportunities to adapt its technology to serve new automotive, portable, and stationary applications, management has provided no indication of any such efforts. For example, in FLUX’s Q2 FY 2021 earnings call, management was asked about expanding to the uninterrupted power supply market (a subset of stationary storage), which includes battery backup devices to provide electricity in the event of electrical power failures. CEO Ronald Dutt responded:

Figure 7. Source: Q2 FY 2021 Earnings Call.

FLUX believes it possesses a clear advantage in its current offerings and seeks to capitalize on those strengths in the near-term. Once the company establishes itself as a go-to supplier for large materials handling fleets, management may consider branching out to new markets. We believe FLUX’s battery packs have the potential to do just that.

FLUX’s technology holds a unique capability: its battery packs (including BMS) are chemistry agnostic, meaning they are not reliant on one specific battery composition. To understand what this means, it is important to recognize that there are multiple battery types, each comprising of different chemical components[ix]. FLUX’s battery packs contain lithium-ion batteries, which are further differentiated by their chemical makeup. The most common lithium-ion battery types include the following:

- Lithium iron phosphate (LFP)

- Lithium nickel manganese cobalt oxide (NMC)

- Lithium cobalt oxide (LCO)

- Lithium manganese oxide (LMO)

- Lithium nickel cobalt aluminum oxide (NCA)

- Lithium titanate (LTO)

Battery characteristics, including specific power (output intensity), specific energy (output duration), safety, lifespan, cost, and performance; vary across lithium-ion battery types. Specific power and specific energy typically work in contrast as generating a high degree of energy (specific power) cannot be sustained for long periods of time (specific energy) and vice versa. For example, a portable cell phone or laptop battery operates at a lower output over a longer period compared to a high-intensity, cordless power tool that requires frequent charging.

In the case of materials handling applications, FLUX notes that LFP and NMC chemistries are predominantly used. While LFP batteries are not as powerful as NMC, FLUX utilizes LFP cells in its battery packs due to their enhanced safety, durability, and extended lifespans. NMC batteries are energy dense, enabling them to fuel higher-power applications like electric vehicles (cars, bikes, buses) and cordless power tools. The increased performance, however, leads to higher risk of overheating (thermal runaway)[x]. In addition, mining of one of the main elements in NMC cells, cobalt, is both expensive and bears considerable human rights and environmental concerns[xi]. Nations, including the United States[xii], are calling for a reduction in cobalt usage in lithium-ion batteries. EV giant, Tesla, has also begun searching for cobalt-free alternatives for its vehicles, including an initiative with the Chinese government to manufacture cars equipped with LFP batteries[xiii]. CEO Ronald Dutt affirms FLUX’s commitment to LFP batteries in its Q2 FY 2021 earnings call:

Figure 8. Source: Q2 FY 2021 Earnings Call.

Nevertheless, FLUX is capable of designing packs that are compatible with new battery chemistries should a viable opportunity arise.

Lithium-ion batteries contain structural differences as well, including cylindrical (most common), prismatic, and pouch bag cells. FLUX’s battery packs use prismatic battery cells. Similar to battery chemistry, FLUX can adapt its battery packs to employ additional cell structures:

Figure 9. Source: Q2 FY 2021 Earnings Call.

Whether FLUX extends its products to new markets—either through minor alterations to its LFP-powered packs or complete changes to battery chemistry or structure—remains to be seen. We note FLUX’s noticeable R&D expenses in recent years as a potential indicator of ongoing developments, though allocations to specific research areas is unknown. R&D expenses do include UL certifications for current products (which would not indicate new advancements):

Figure 10. FLUX’s R&D Expenses.

Whatever management decides, FLUX’s flexible technology will be its most valuable asset. We believe FLUX’s materials handling business and emerging solar storage will fuel near-term growth as management actively pursues additional energy storage opportunities. Potential battery applications include:

- Automotive

- Starter batteries for internal combustion engines (ICEs), EVs, e-bikes, wheelchairs, golf carts, military equipment, industrial machines

- Portable

- Mobile phones and computers, power tools

- Stationary Storage

- Uninterrupted power supply, telecommunications, grid level storage

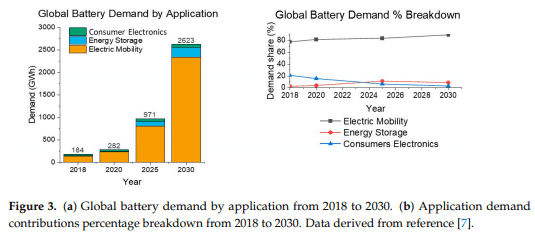

In 2019, lead acid and lithium-ion batteries comprised 95.6% of the global battery market. From 2016 to 2019, lithium-ion battery usage grew 25% compared to a 10% decline in lead acid battery use. Due to their heightened and extended energy output compared to other battery types, combined with dwindling cell prices, lithium-ion batteries are rapidly becoming a vital source for energy storage. According to the World Economic Forum and the Global Battery Alliance, the global battery market is forecast to grow 25% per annum to 2.6 GWh in 2030, driven by a surging demand for electric vehicles and significant demand for energy storage[xiv].

Figure 11. Source: Global Battery Demand Forecast 2018 – 2030.

Valuation

Valuing a company like Flux is a challenge. As mentioned, though at first glance Flux is a mature company, in fact its shift in focus places it more in the emerging growth category. When looking at companies we might broadly consider competitors, we see Flux is incredibly cheap in terms of price /sales:

| FY 2021 Sales ($M) | Market cap ($M) | P/S | |

|

FLUX |

26 |

106 |

4.1 |

| PLUG |

495 |

14,783 |

29.9 |

| BLNK |

16 |

1,345 |

84.1 |

| FCEL |

72 |

1,910 |

26.5 |

| ENS |

3000 |

3,446 |

1.1 |

| BEEM |

11 |

254 |

23.1 |

| Average |

28.1 |

||

| Median |

24.8 |

||

| FY 2022 Sales ($M) | Market cap ($M) | P/S | |

| FLUX |

34 |

106 |

3.1 |

| PLUG |

755 |

14,783 |

19.6 |

| BLNK |

29 |

1,345 |

46.4 |

| FCEL |

120 |

1,910 |

15.9 |

| ENS |

3300 |

3,446 |

1.0 |

| BEEM |

22 |

254 |

11.5 |

| Average |

16.3 |

||

| Median |

13.7 |

Admittedly, Flux has lower projected growth for 2022 than most of its peers, though with only two analysts covering the company, we take this with a grain of salt.

| YoY Growth | |

| FLUX |

31% |

| PLUG |

53% |

| BLNK |

81% |

| FCEL |

67% |

| ENS |

10% |

| BEEM |

100% |

Even if the company trades at a multiple 50% below the peer median, i.e., at 7x sales, we derive a stock price of approximately $21 per share, assuming the company slightly exceeds the $34M in projected revenue for 2022:

| P/S vs. 2022 Revenue |

30 |

40 |

50 |

60 |

|

3 |

6.77 |

9.02 |

11.28 |

13.53 |

|

5 |

11.28 |

15.04 |

18.80 |

22.56 |

|

7 |

15.79 |

21.05 |

26.32 |

31.58 |

|

9 |

20.30 |

27.07 |

33.83 |

40.60 |

|

11 |

24.81 |

33.08 |

41.35 |

49.62 |

|

13 |

29.32 |

39.10 |

48.87 |

58.65 |

The company’s current stock price is giving it no credit for the growth it has achieved, the strong momentum it is building with high-profile customers, or its diversified product suite. We understand FLUX struggles with profitability, but management has proven over the last few years that it is capable of addressing and overcoming fundamental issues. If FLUX can progress towards generating positive free cash flows and ultimately achieve this critical milestone, it will be a stalwart player in the proliferating green energy environment.

[i] Wertheimer, Elliott. “Lithium-ion Batteries vs Hydrogen Fuel Cells in Electric Vehicles”, FuroSystems, June 20, 2018. https://www.furosystems.com/news/hydrogen-fuel-cells-vs-lithium-ion-batteries-in-electric-vehicles/

[ii] “On the Mark – The Lithium-Ion Battery Issue, Vol.1”, UL LLC, Fall 2018. https://collateral-library-production.s3.amazonaws.com/uploads/asset_file/attachment/11925/OnTheMark_Magazine_Volume_1.pdf

[iii] Kolodny, Lora. “Tesla Megapack Fire Highlights Issues to be Solved for utility ‘Big Batteries’”, CNBC LLC, August 5, 2021. https://www.cnbc.com/2021/08/05/tesla-megapack-fire-highlights-early-stage-issues-with-big-batteries.html

[iv] “Form 10-k”, United States Securities and Exchange Commission, September 28, 2020. https://www.fluxpower.com/hubfs/investors/sec-filings/10K/Form10-k%2009-28-2020.pdf

[v] Castelvecchi, Davide. “Electric Cars and Batteries: How Will the World Produce Enough?”, Nature, August 17, 2021. https://www.nature.com/articles/d41586-021-02222-1

[vi] Forbes, Justin. “Flux Power Reaches a New Milestone of 10,000+ Battery Packs Shipped to Customers”, Flux Power, July 30, 2021. https://www.fluxpower.com/news/flux-power-reaches-a-new-milestone-of-10000-battery-packs-shipped-to-customers

[vii] Forbes, Justin. “Flux Power Announces Increasing Traction of X-Series Lithium-ion Battery Packs with New Customers”, Flux Power, March 4, 2021. https://www.fluxpower.com/news/flux-power-announces-increasing-traction-of-x-series-lithium-ion-battery-packs-with-new-customers

[viii] “Form 10-Q”, United States Securities and Exchange Commission, May 13, 2021. https://www.fluxpower.com/hubfs/10-Q-05.13.2021.pdf

[ix] Battery types include lead acid batteries, lithium-ion batteries, nickel-cadmium batteries, nickel-metal hydride batteries, sodium high temperature batteries, and redox flow batteries. Stenzel et al., “Database Development and Evaluation for Techno-economic Assessments of Electrochemical Energy Storage Systems”, 2014 IEEE International Energy Conference, May 2014. https://ieeexplore.ieee.org/document/6850596

[x] Forbes, Justin. “Lithium-ion Battery Materials and Why Their Chemistry Matters”, Flux Power, November 27, 2019. https://www.fluxpower.com/blog/lithium-ion-battery-materials-and-why-their-chemistry-matters

[xi] Kelly, Annie. “Apple and Google Named in US Lawsuit over Congolese Child Cobalt Mining Deaths”, Guardian News & Media Limited, December 16, 2019. https://www.theguardian.com/global-development/2019/dec/16/apple-and-google-named-in-us-lawsuit-over-congolese-child-cobalt-mining-deaths

[xii] “National Blueprint for Lithium Batteries: 2021 – 2030”, Federal Consortium for Advanced Batteries, June 2021. https://www.energy.gov/sites/default/files/2021-06/FCAB%20National%20Blueprint%20Lithium%20Batteries%200621_0.pdf

[xiii] Morris, James. “Tesla’s Shift to Cobalt-Free Batteries is its Most Important Move Yet”, Forbes Media LLC, July 11, 2020. https://www.forbes.com/sites/jamesmorris/2020/07/11/teslas-shift-to-cobalt-free-batteries-is-its-most-important-move-yet/?sh=54b48c3146b4

[xiv] Zhao et al., “A Review on Battery Market Trends, Second-Life Reuse, and Recycling”, Sustainable Chemistry, 2021. https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&ved=2ahUKEwjwzNfW2MfyAhW_FFkFHe-AAOUQFnoECAUQAQ&url=https%3A%2F%2Fwww.mdpi.com%2F2673-4079%2F2%2F1%2F11%2Fpdf&usg=AOvVaw2dPQtbdUGSk0UNACzVM35b

DISCLOSURES

General Firm

Formidable Asset Management, LLC (Formidable) is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation, or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. Although taken from reliable sources, Formidable cannot guarantee the accuracy of the information received from third parties.

The opinions expressed herein are those of Formidable and may not actually come to pass. This information is current as of the date of this material and is subject to change at any time, based on market and other conditions. Any index performance cited or used throughout is intended to illustrate historical market trends and performance. Indexes are managed and do not incur investment management fees. An investor is unable to invest in an index. The performance shown may not reflect a Formidable portfolio.

Past performance is no guarantee of future results.

Reader should assume that future performance of any specific investment or investment strategy (including the investments and/or investment strategies discussed in these materials) referred to directly or indirectly in these materials will be profitable or equal the corresponding indicated performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable. Historical performance results for investment indices and/or categories generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results.

Specific Securities

The mention of specific securities and sectors illustrates the application of our investment approach only and is not to be considered a recommendation by Formidable. The specific securities identified and described above do not represent all the securities purchased and sold for the portfolio, and it should not be assumed that investment in these securities were or will be profitable. There is no assurance that the securities purchased remain in the portfolio or that securities sold have not been repurchased. Charts, diagrams, and graphs, by themselves, cannot be used to make investment decisions. You may contact Formidable Asset Management, LLC for a full list of recommendations made during the preceding period one year

Not an Offer

These materials do not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or any other product or service by Formidable or any other third party regardless of whether such security, product or service is referenced here. Furthermore, nothing in these materials is intended to provide tax, legal, or investment advice and nothing in these materials should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. Formidable does not represent that the securities, products, or services discussed here are suitable for any particular investor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your personal investment objectives, financial circumstances, and risk tolerance. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation.

The opinions expressed here are those of Will Brown and Adam Eagleston are not intended as investment advice. They are also subject to change with changing market conditions. Clients of Formidable may have positions in securities discussed in this article. This writing is for informational purposes only—Formidable and the authors expressly disclaim all liability in respect to actions taken based on any or all of the information from this writing.

READY TO TALK?