FLUX September 2022 Update – Poised to Potentially Benefit from Inflation Reduction Act

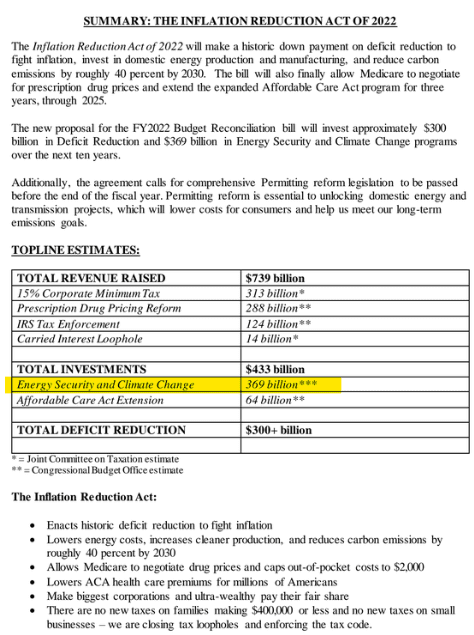

On August 16, 2022, President Biden signed the Inflation Reduction Act (“IRA”) into law. The legislation allocates $369 billion to investment in “Energy Security and Climate Change”; Sec. 13502 of the IRA provides for Advanced Manufacturing Production Credit (Section 45X). We believe Flux Power, Inc. (NASDAQ: FLUX) is poised to potentially benefit from this recent legislation, providing a tailwind for a company already generally benefiting from the secular shift towards greener energy.

FLUX September 2022 Update – Poised to Potentially Benefit from Inflation Reduction Act

On August 16, 2022, President Biden signed the Inflation Reduction Act (“IRA”) into law. The legislation allocates $369 billion to investment in “Energy Security and Climate Change”; Sec. 13502 of the IRA provides for Advanced Manufacturing Production Credit (Section 45X). We believe Flux Power, Inc. (NASDAQ: FLUX) is poised to potentially benefit from this recent legislation, providing a tailwind for a company already generally benefiting from the secular shift towards greener energy.

Figure 1. Inflation Reduction Act of 2022 Summary. Source: Business Insider.

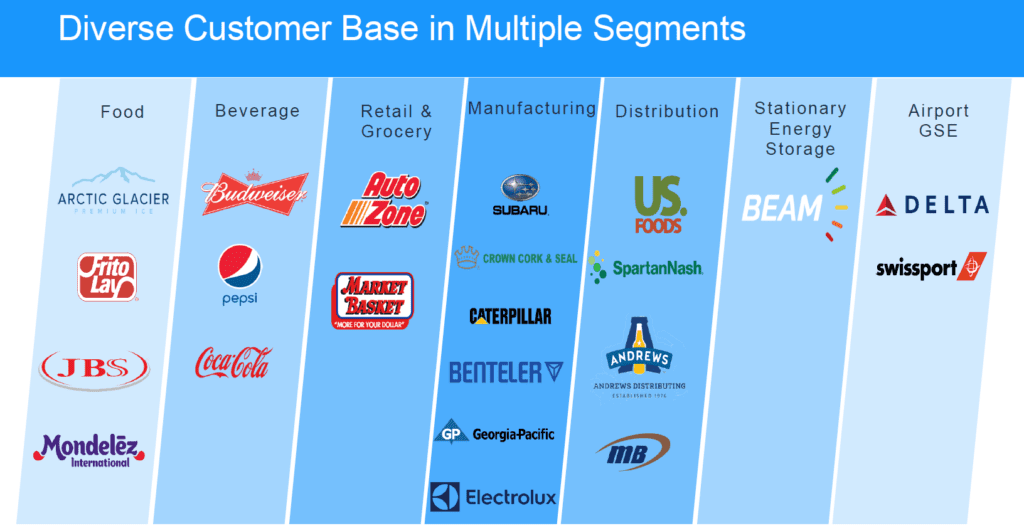

Since our last update in October 2021, FLUX has achieved exceptional top-line growth. If you look around your house, it is easy to see why. Virtually everything you see has been on a forklift at some point; FLUX provides materials handling solutions, i.e., forklift batteries and peripherals. Moreover, it provides a cleaner, lithium-ion solution as opposed to dirtier, internal combustion power. Fortune 500 customers are increasingly adopting the Company’s products, and with only about 5% market share for lithium-ion-powered forklifts versus a $2.5 billion addressable market, the opportunity for the Company remains sizable:

Figure 2. FLUX Customer Base. Source: August 2022 Company Presentation.

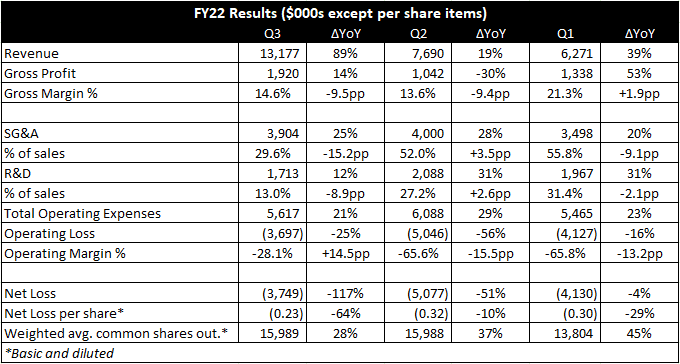

Conversely, ongoing, macro-driven supply chain and inflationary headwinds that remain largely out of management’s control have impeded the Company’s progress towards profitability. The following highlights FLUX’s successes and failures over the past nine months, including management’s cost-reduction and efficiency measures designed to mitigate losses and ultimately turn a profit.

Figure 3. FLUX financial results for the first nine months of FY22 (Sep. 30, 2021 – Mar. 31, 2022). Source: Company Filings.

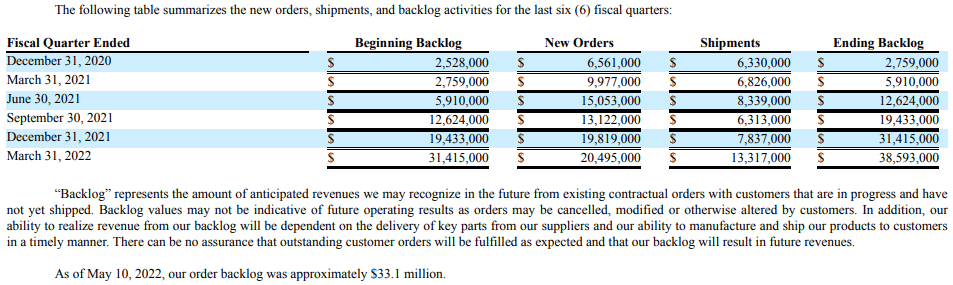

Figure 4. FLUX new orders, shipments, and backlog activities for the last six fiscal quarters. As reported in FLUX’s latest quarterly report, total backlog was approximately $33.1M as of May 12, 2022. Source: Company Filings.

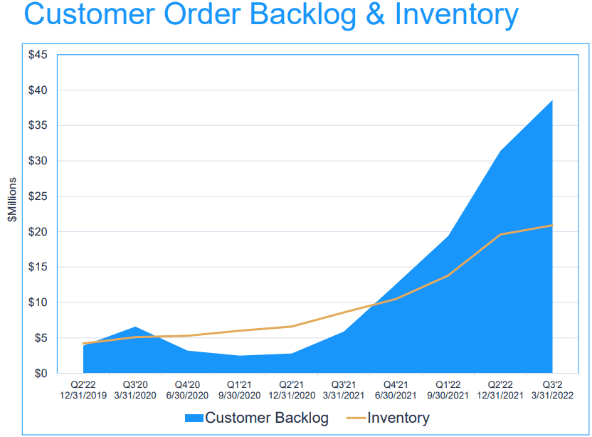

Revenue

Q3 FY22 marks FLUX’s 15th consecutive quarter of year-over-year revenue growth. As demand for lithium-ion battery packs among materials handling and other industries flourishes, FLUX strives to serve its customers amid a challenging supply environment. Management has achieved sales growth of 51% through the first three quarters of FY22 despite manufacturing and shipping delays. Customer order backlog more than tripled over that same time frame from $12.6M to $38.6M, which, considering FLUX’s robust sales growth, suggests consumer appetite remains strong. As of May 12, 2022, the Company had reduced its backlog to around $33.1M. Indeed, unfulfilled orders can accumulate in perpetuity and reveal a lack of productivity; this recent reduction in backlog is an early indication that FLUX is improving its ability to meet the elevated demand for its battery packs. As part of their efforts to address the backlog and sustain sales growth amid a lethargic supply environment, management has deliberately accumulated inventory over the past several quarters.

Per FLUX’s Q4 FY21 earnings call last September, CEO, Ron Dutt, remarked, “That’s our job as a company is to buy inventory, because we don’t know what’s happening right now [with supply chains]. So we’re going to run a little larger on inventory [and] hope to drop that down in the next couple of quarters. But yes, it’s going to be there for a little bit, because our job is to protect our customers.”

Figure 5. FLUX backlog & inventory from Q2FY20 – Q3 FY22. Source: August 2022 Company Presentation.

Inventory accumulation may be necessary to protect customers, but excess inventory can become a burden. For example, if demand for such stored materials or finished products slows, a company might be forced to sell these items at a significant discount. FLUX began taking steps to reduce its inventory this past quarter, including by improving inventory turnover, i.e., the rate at which it sells its inventory, by 25%. The Company expects inventory to decline as it aggressively delivers its backlog over the next several quarters and supply chains begin to normalize; such an inventory reduction has the potential to improve the company’s cash flow metrics.

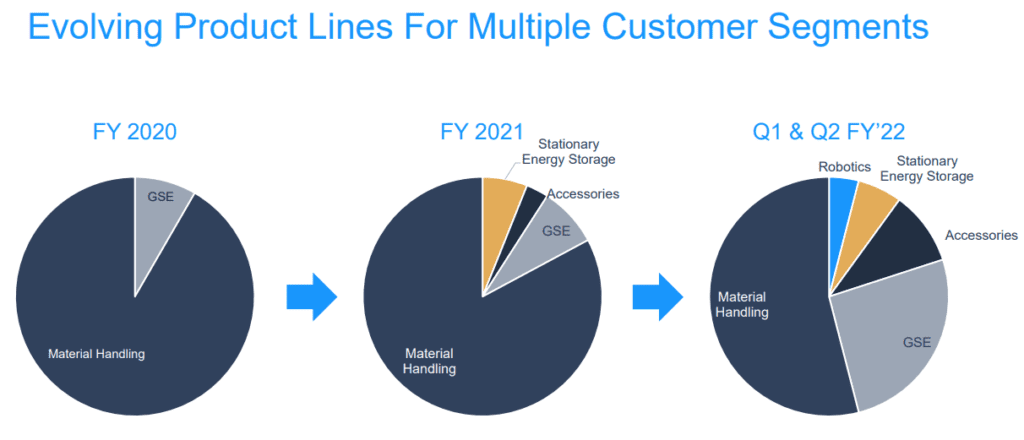

Another revenue highlight is FLUX’s product mix. Per the Q3 FY22 earnings call, Dutt states FLUX’s product mix has shown a “very definite trend” towards larger, higher-priced battery packs. This has seemingly driven top-line growth over the past three quarters. As we’ve discussed in prior papers, just four years ago, FLUX offered only two battery packs, which are now among the smallest products in its current portfolio. Today, the Company offers several larger packs across a range of applications, including materials handling, airport ground stationary equipment, and stationary energy storage—all boasting higher price tags.

Figure 6. FLUX product portfolio. Source: August 2022 Company Presentation.

FLUX continues to launch both novel and revised battery packs to adapt to customer needs and enter new markets. In March 2022, the Company unveiled three new products at the MODEX 2022, the world’s largest manufacturing and supply chain tradeshow: the L36, the C48, and the high-capacity S24 battery backs. The L36 pack is a novel pack designed for three-wheel forklifts in narrow aisle warehouses, while both the C48 and S24 packs are upgrades of prior models. The 210 amp-hour S24 pack for walkie pallet jacks holds double the capacity of FLUX’s prior model to support more strenuous workloads. The C48 pack for automated guided vehicles (AGV) and autonomous mobile robots (AMR) possesses an improved design that allows for easier servicing and lower cost of ownership. The C48 pack is particularly interesting as warehouses and distribution centers increasingly demand AGVs and AMRs due to labor shortages. FLUX seeks to expand to emerging markets like AGVs and AMRs as well as high-voltage applications to continue its growth trajectory. FLUX’s product diversification, which drives both revenue growth and stability, is illustrated below:

Figure 7. FLUX product mix. Source: August 2022 Company Presentation.

As a final note on FLUX’s recent revenue success and the increasing global appetite for lithium-ion technology, the Company secured a multi-year letter of intent (LOI) from one of its largest customers to purchase battery packs as part of its ongoing fleet conversion to lithium. The LOI is non-binding and is therefore not included in FLUX’s backlog. Per FLUX’s Q3 FY22 earnings call, management notes the opportunity is a possible two-year, “low eight-figure dollar” per year (at least $20M) order. This LOI demonstrates the potential merits of FLUX’s strategy to build lasting relationships with prominent customers. Large customers possess diverse fleets of equipment that require a variety of battery packs, and they may seek FLUX’s diversified product line to ensure efficient, reliable operations as well as to avoid the need for several suppliers. What’s more, FLUX can leverage these large clients and their relationships to acquire additional customers. The potential downside to this strategy is customer concentration. FLUX continues to generate most of its revenues from relatively few customers, and the risk of loss of one of its three or four biggest customers cannot be overlooked. One of FLUX’s 2022 priorities is to expand its customer base among Fortune 100 and 500 companies. In any case, FLUX’s growth story is positive, and management expects momentum to continue as it leans on its core competencies.

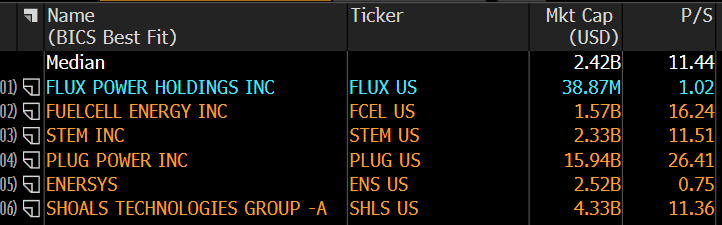

We’ve noted in the past that the broad investment community might overlook FLUX’s strong growth for any number of reasons, depicted in its relatively low price to sales multiple versus peers. To help communicate its top-line success, FLUX engaged international investor relations specialist MZ Group in December 2021. MZ is leading a comprehensive program that includes coordinating roadshows and investment conferences as well as generating awareness through various financial and media platforms. FLUX recently hosted its first investor day at its California manufacturing facility.

Earnings

Despite record revenues, FLUX has not reported meaningful earnings improvements over the prior three quarters. Gross margin percentage has significantly dropped as a result of high steel, electronics parts, and other materials costs. Operating margin remains negative due to both high outbound shipping costs, personnel-related expenses, insurance premiums, and sales and marketing expenses as well as ongoing elevated R&D costs to support new product development and certification. Management has been focused on cost reduction measures and has noted a “modest” improvement to its supply chain as of Q3 FY22, driven primarily by the Company’s internal initiatives. In other words, management is making progress, but the external environment remains troubled.

FLUX’s efficiency/margin improvement initiatives include the following: (1) increase prices (both in Q1 and Q2 FY22), (2) simplify product designs to reduce costs and improve serviceability, (3) transition to more reliable, lower-cost cell technology, (4) improve manufacturing capacity and productivity, and (5) leverage increased sales volume to identify more favorable suppliers and carriers. Notably, increased pricing has yet to have a material impact as FLUX must first fulfill its order backlog, the majority of which contains lower pricing. FLUX will enhance its manufacturing capabilities by implementing lean manufacturing (reducing waste) and adding both a second shift and an additional production line. Regarding the use of a new lithium cell, while it may reduce costs over the mid-long term, FLUX must secure additional UL listings (safety certifications) and original equipment manufacturer (OEM) approvals for the new technology, which will raise near-term research and development costs. In terms of FLUX’s supplier base, the Company currently sources components from both China and the United States, and it eyes Mexico as a potential lower-cost provider. Supplier concentration risk is modest, with three suppliers comprising 48% of Q3 FY22 purchases and one supplier accounting for 32% of Q1 – Q3 FY22 (nine months) purchases.

In addition to the above measures, FLUX appointed a new independent director to its Board, Cheemin Bo-Linn, effective January 14, 2022. Recognized as one of the “Top 50 Directors” in the United States in 2019 by the National Association of Corporate Directors (NACD), Dr. Bo-Linn is the current Chief Execute Officer of Peritus Partners, Inc., which provides consulting and operations expertise in software (SaaS), internet of things (IoT), mobile, and digital (analytics, marketing, e-commerce, supply chain, cyber security).

Balance Sheet/Outlook

As FLUX moves forward with its growth and efficiency plans, it faces another challenge, capital, which is common for smaller companies in a rapid growth phase. FLUX has historically been unable to generate sufficient cash to support its operations and has sought external equity funding to sustain itself.

The Company has taken steps to mitigate the need for additional equity capital. In May 2022, FLUX added a subordinated line of credit totaling up to $5M, to which lenders have committed $4M as of May 12, 2022. FLUX also possesses a senior credit facility from Silicon Valley Bank with $2.5M (out of $6M) available. Prior to securing the former, FLUX added a “Going Concern” clause to its Q2 FY22 filing, which revealed the Company’s substantial doubt about its ability to operate over the next twelve months. Following the $4M commitment, and in consideration of the Company’s recent progress towards its strategic initiatives, FLUX removed the “Going Concern” clause from its financial statements.

As of May 12, 2022, FLUX anticipates its existing cash balance of $3.8M and additional funding available under its two lines of credit of $2.5M and $4M, respectively, are sufficient to sustain its operations over the next twelve months (per Q3 FY22 Form 10-Q). Given the poor market reaction to FLUX’s equity issuance on September 27, 2021, which occurred at a much higher share price, a future equity raise would be detrimental to shareholders and remains a risk. The Company can prevent another equity issuance by executing on its growth plan and better managing liquidity. Avoiding an equity raise is of paramount importance, in our opinion.

FLUX’s growth outlook is good, but capital constraints remain a challenge. While the macro-environment remains difficult, the Company benefits from a secular tailwind as its green solutions continue to gain traction with Fortune 500 clients. The backlog remains strong, with recent declines as the Company delivers product and works down inventory a positive. Moreover, the Inflation Reduction Act recently signed into law has the potential to act as an accelerant for demand for FLUX’s sustainable materials handling solutions.

Management is actively looking to optimize supply chains and rationalize expenses in its efforts to mitigate cash burn. Next quarter’s results will be pivotal as they reveal whether FLUX’s efficiency initiatives are headed in the right direction. Management appears to be taking the necessary steps to inch closer to profitability.

The shares trade at a depressed price to sales multiple of a little over one (1). Juxtapose this with the peer group used by Bloomberg, which trades at a median price/sales ratio of 11x, and it is easy to see the upside potential if the Company is able to execute on its efficiency efforts and continue growing sales.

Figure 8. FLUX peer group. Source: Bloomberg Intelligence.

* * *

DISCLOSURES AND IMPORTANT INFORMATION

Formidable Asset Management, LLC (Formidable) is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. Although taken from reliable sources, Formidable cannot guarantee the accuracy of the information received from third parties.

The opinions expressed herein are those of Formidable and may not actually come to pass. This information is current as of the date of this material and is subject to change at any time, based on market and other conditions. Any index performance cited or used throughout is intended to illustrate historical market trends and performance. Indexes are managed and do not incur investment management fees. An investor is unable to invest in an index. The performance shown may not reflect a Formidable portfolio.

Past performance is no guarantee of future results.

Reader should assume that future performance of any specific investment or investment strategy (including the investments and/or investment strategies discussed in these materials) made reference to directly or indirectly in these materials will be profitable or equal the corresponding indicated performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable. Historical performance results for investment indices and/or categories generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results.

Specific Securities

The mention of specific securities and sectors illustrates the application of our investment approach only and is not to be considered a recommendation by Formidable. The specific securities identified and described above do not represent all the securities purchased and sold for the portfolio, and it should not be assumed that investment in these securities were or will be profitable. There is no assurance that the securities purchased remain in the portfolio or that securities sold have not been repurchased. Charts, diagrams and graphs, by themselves, cannot be used to make investment decisions. You may contact Formidable Asset Management, LLC for a full list of recommendations made during the preceding period one year.

Not an Offer

These materials do not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or any other product or service by Formidable or any other third party regardless of whether such security, product or service is referenced here. Furthermore, nothing in these materials is intended to provide tax, legal, or investment advice and nothing in these materials should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. Formidable does not represent that the securities, products, or services discussed here are suitable for any particular investor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your personal investment objectives, financial circumstances and risk tolerance. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation.

The opinions expressed here are those of Will Brown and Adam Eagleston are not intended as investment advice. They are also subject to change with changing market conditions. Clients of Formidable may have positions in securities discussed in this article. This writing is for informational purposes only; Formidable and the authors expressly disclaim all liability in respect to actions taken based on any or all of the information from this writing.

READY TO TALK?