Gamma Squeeze. Who is Next?

Investors are seemingly always hunting for potential opportunities in the short squeeze space. However, what we have seen recently are short squeezes that are biblical in nature.

The reason for the amplification is the short squeezes are accompanied by gamma squeezes. We will describe the mechanics associated with these events. Gamma squeezes are fast and violent in nature but can conclude quickly. In the case of both AMC Entertainment (NYSE: AMC) and GameStop Corp (NYSE: GME), we have seen protracted periods of aggressive gamma squeeze behaviors multiple times over the last six months. Safe to say, this feels far from resolved.

What conditions make for this perfect storm? We begin with, aggressive, tactical investors looking for companies with large short interest positions. A short position is created by investors who are betting against the prospects of the company and hoping to capitalize on a decline in the price of that company’s stock. In proper syntax, the stock is first borrowed and sold at a price. The short seller is hoping the price will decline and he or she can buy it back at a lower price, i.e., sell high then buy low. The best example I have heard of this is that it is an inverted trade.

Gamma squeeze is a trading terminology and it refers to massive call buying that causes market makers to purchase the stock as they sell call options in order to create a neutral trade for the market maker. A call is a contract that allows an investor to purchase a stock at a specific price on a specific date. These purchases can become a self-fulfilling prophecy and lead to more purchases of calls as volume increases. The market makers’ purchase of the stock is antithetical to the goals of the short sellers and drives the stock price higher. The higher the stock goes, the more pain the short sellers feel.

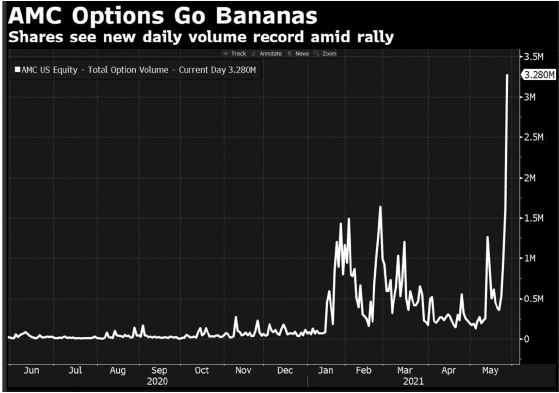

This puts the short sellers in a very precarious position, especially when call option activity is stratospheric. One need look no further than recent activity in AMC:

Coupled with other stock purchasers as well as option traders, this is a very dangerous and almost catastrophic set up for short sellers. Short sellers have unlimited downside so this can be extremely painful and sometimes devastating in nature.

We, at Formidable Asset Management,are typically long-only investors but we also try to identify targeted opportunities for specific investment purposes. Formidable conducts extensive research intended to identify meaningful mismatches in valuation of both publicly traded and privately held entities. Our research process includes scraping social media platforms, speaking directly with corporate executives, and closely reviewing relevant material from filings, media, publications, and private data rooms. Formidable also engages outside industry contacts for consulting purposes when appropriate. Overall, Formidable’s research process aims to pinpoint investment opportunities that may have been overlooked by the market.

Currently there are two stocks we believe have the qualities of a potential short and gamma squeeze. We have written about both companies in the past and the set up for both is particularly interesting because they have large short positions based on reported numbers. Additionally, both have what we believe to be very constricted share float properties, i.e., the actual exposure to a short squeeze is even higher, given the composition of the shareholder base. As the options trades are executed those transactions create demand for the underlying stock, which leads us to conclude they could become targets for gamma squeezes.

Flux Power Systems (NASDAQ: FLUX)

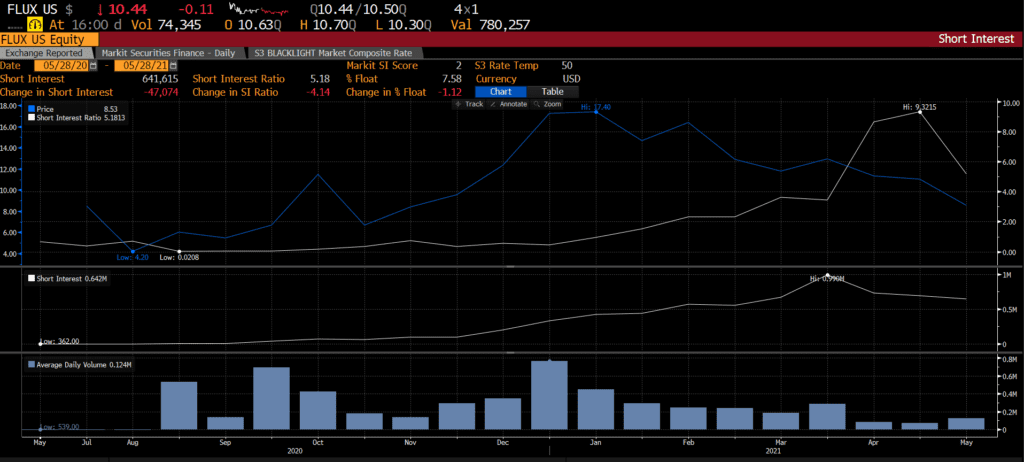

The first company we would highlight is Flux Power Systems (NASDAQ: FLUX). Outside of the company’s delivery of solid results and sequential earning beats, we believe it is ripe for a short squeeze. According to Bloomberg, short interest is 7.5% of the float, or around five (5) days to cover.

Shares short we know: 641,000. In this case, what we would define as true float is incorrect. There are 13.3 milion shares outstanding according to Bloomberg, with 8.5 million shares in the float. The adjustment here is to remove Michael Johnson and other insiders. Bloomberg accounts for this correctly as it calculates short interest as a percent of float, not shares outstanding.

What Bloomberg misses is the number of shares that, although they may be available for borrow, would be relatively price insensitive, i.e., they would not likely be sold as the price of the underlying stock increases. By our math, there are approximately 1.9 million shares held by passive and sector funds; these vehicles are designed to buy FLUX by rote. Moreover, firms like Formidable, i.e., those that may be longer term focused, own another 1.6 million shares by our estimation. So, in total, that is 3.5 million, making the actual float for the company closer to 5 million shares.

Then, there is volume. The average daily trading volume (ADV) is provided by the exchange. For FLUX, the figure is approximately 124,000 shares. However, this is skewed by a single day, so a more realistic view of liquidity is its median ADV for the quarter, which is a mere 89,000 shares.

Following is our analysis:

| FLUX Short Interest | Bloomberg | FAM Estimate |

|---|---|---|

| Float | 8,478,967 | 8,478,967 |

| Passively Held | 1,900,000 | |

| Long-term Owners | 1,600,000 | |

| “Actively Traded” Shares | 8,478,967 | 4,978,967 |

| Shares Short | 641,600 | 641,600 |

| ADV | 123,861 | 89,095 |

| Days to Cover | 5.2 | 7.2 |

| % Float Short | 7.6% | 12.9% |

Importantly for FLUX, those looking to squeeze shorts have a new weapon at their disposal, call options, which only recently began trading on the company. Curiously, beyond Formidable’s trading, we have observed volume in the company’s options complex that could be evidence of an emerging increased appetite for the options. This permits the gamma squeeze to amplify the impact traders can have.

PetMed Express (NASDAQ: PETS)

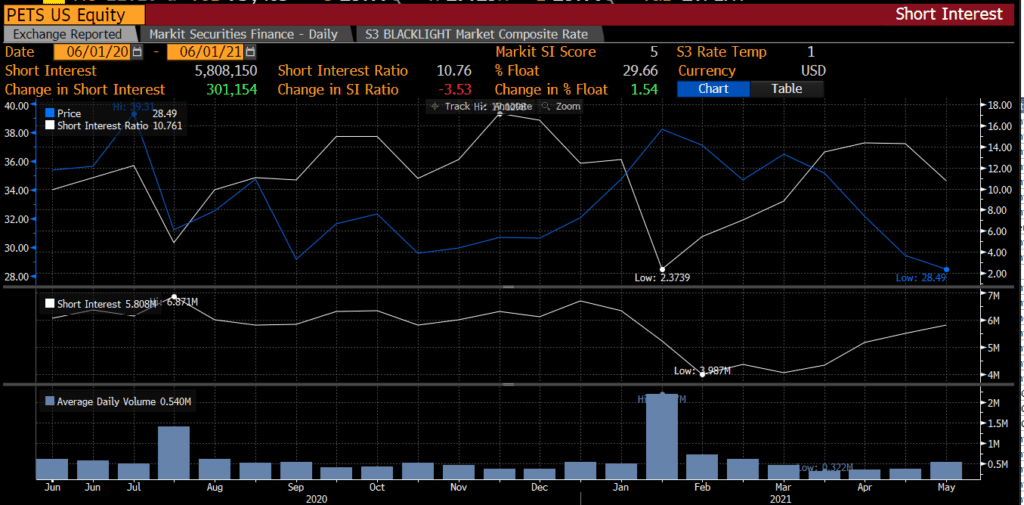

We believe there is a similar set-up for PetMed Express (NASDAQ: PETS). We have written about the company in the past and believe the fundamental case for the company remains (low valuation, underlevered balance sheet, lack of management/board initiative).

The current short squeeze potential for PETS is even more compelling if we properly evaluate its float and volume using the same framework as for FLUX:

| PETS Short Interest | Bloomberg | FAM Estimate |

|---|---|---|

| Float | 19,499,079 | 19,499,079 |

| Passively Held | 9,874,264 | |

| Long-term Owners | ||

| “Actively Traded” Shares | 19,499,079 | 9,624,815 |

| Shares Short | 5,800,000 | 5,800,000 |

| ADV | 537,037 | 377,389 |

| Days to Cover | 10.8 | 15.4 |

| % Float Short | 29.7% | 60.3% |

Using our metrics, PETS already high days to cover increases by almost 50%, and its short interest as percent of our adjusted float brings it to 60%. Likewise, given PETS has an active options market, the potential of a gamma squeeze exists for the stock. This could take the stock to levels we have never seen, even with limited investor participation. Curiously, the call buying within PETS is also showing signs of investor appetite. Our rationale and the current environment leads us to conclude short sellers are precariously positioned. PETS stock volume price sensitivity could cause an eruption of short covering. While GameStop and AMC continue to roar, we think this gamma squeeze virus is not only contagious but highly transmissible.

DISCLOSURES

General Firm

Formidable Asset Management, LLC (Formidable) is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. Although taken from reliable sources, Formidable cannot guarantee the accuracy of the information received from third parties.

The opinions expressed herein are those of Formidable and may not actually come to pass. This information is current as of the date of this material and is subject to change at any time, based on market and other conditions. Any index performance cited or used throughout is intended to illustrate historical market trends and performance. Indexes are managed and do not incur investment management fees. An investor is unable to invest in an index. The performance shown may not reflect a Formidable portfolio.

Past performance is no guarantee of future results.

Reader should assume that future performance of any specific investment or investment strategy (including the investments and/or investment strategies discussed in these materials) made reference to directly or indirectly in these materials will be profitable or equal the corresponding indicated performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable. Historical performance results for investment indices and/or categories generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results.

Specific Securities

The mention of specific securities and sectors illustrates the application of our investment approach only and is not to be considered a recommendation by Formidable. The specific securities identified and described above do not represent all of the securities purchased and sold for the portfolio, and it should not be assumed that investment in these securities were or will be profitable. There is no assurance that the securities purchased remain in the portfolio or that securities sold have not been repurchased. Charts, diagrams and graphs, by themselves, cannot be used to make investment decisions. You may contact Formidable Asset Management, LLC for a full list of recommendations made during the preceding period one year

Not an Offer

These materials do not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or any other product or service by Formidable or any other third party regardless of whether such security, product or service is referenced here. Furthermore, nothing in these materials is intended to provide tax, legal, or investment advice and nothing in these materials should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. Formidable does not represent that the securities, products, or services discussed here are suitable for any particular investor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your personal investment objectives, financial circumstances and risk tolerance. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation.

The opinions expressed here are those of Will Brown and Adam Eagleston are not intended as investment advice. They are also subject to change with changing market conditions. Clients of Formidable may have positions in securities discussed in this article. This writing is for informational purposes only—Formidable and the authors expressly disclaim all liability in respect to actions taken based on any or all of the information from this writing.

[1] Kalaygian, Mark: A Closer Look At Chewy’ Latest Earnings Report; Information accessed on January 25, 2021 via URL: https://www.petbusiness.com/blogs/a-closer-look-at-chewys-latest-earnings-report/article_8e6a693d-d8e7-5cce-9cd5-6bd7eedd62ee.html#:~:text=Expensive%20Customer%20Acquisition&text=In%20fact%2C%20Chewy%20went%20from,about%20%24148%20per%20new%20customer

READY TO TALK?