Market Commentary January, 2021 – War Games

What is clear is that this year has been widely regarded as “unprecedented”, an overused term. Recently, we have seen many instances of “unprecedented” behavior and this last two weeks of market trading is another chapter in this unprecedented time. In order to enjoy this “meal of information” we are going to now “set the table,” and try to explain what is happening in the stock market.

We begin with the “do it yourself” platform Robinhood which has erupted since Covid hit, both in size and power, primarily due to massive amounts of worldwide stimulus and a societal need for entertainment and money, in this order. This new interest in the stock market by young people has led to the “gamification” of the stock market, which puts aside business acumen, mathematics and sanity…… not in that order.

Robinhood was poorly named until recently, and now, it would appear, that the masses of the traders and individuals have taken to heart their own rallying cry. Steal from the rich (hedge fund managers) and give to the poor (masses, day traders, do it yourselfers). Ironically, many hedge funds manage monies for pensions, which, as one might expect, serve the very masses that are causing this “market disturbance in the Force.” That said, nobody is going to feel sorry for hedge funds.

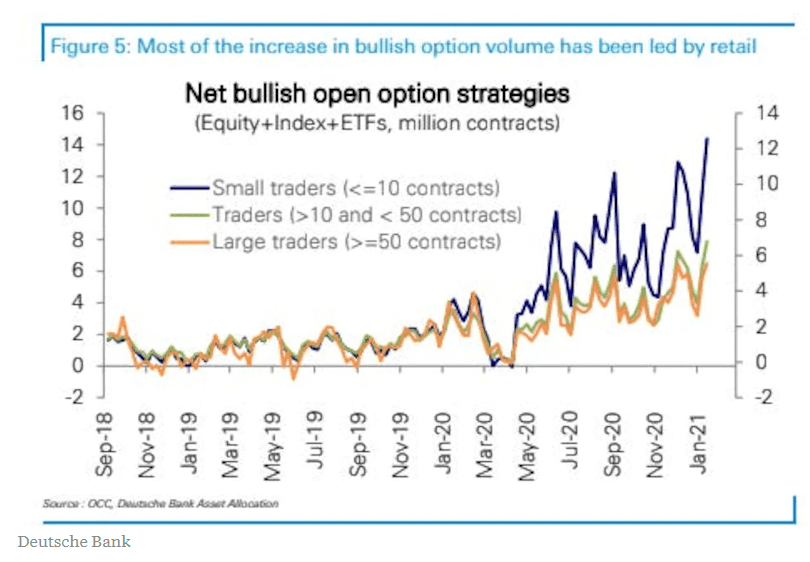

From an investment perspective, the mechanics of the volatility are the following. The options market, which, in ordinary circumstances, is a fraction of the size of the stock market, has grown to be larger than the stock market through the participation of individual new investors (small traders on the following graph). Based on their trading behavior and social media posts, the vast majority are unsophisticated investors, (newbies) and are utilizing trading instruments that they simply do not understand. And this will end very badly for them, of that we are certain.

The options (primarily calls, which are contracts that give the owner the right, but not the obligation, to purchase a stock at a price and time that is predetermined by the contract) they are trading are causing stock dealers, in this case the “middleman,” to purchase large swaths of the stock underlying the call as the options are purchased. This is a hedging strategy for the dealer but also creates structural bullish behavior in the stocks targeted by the options traders. Hence, the huge intraday moves in companies like GameStop.

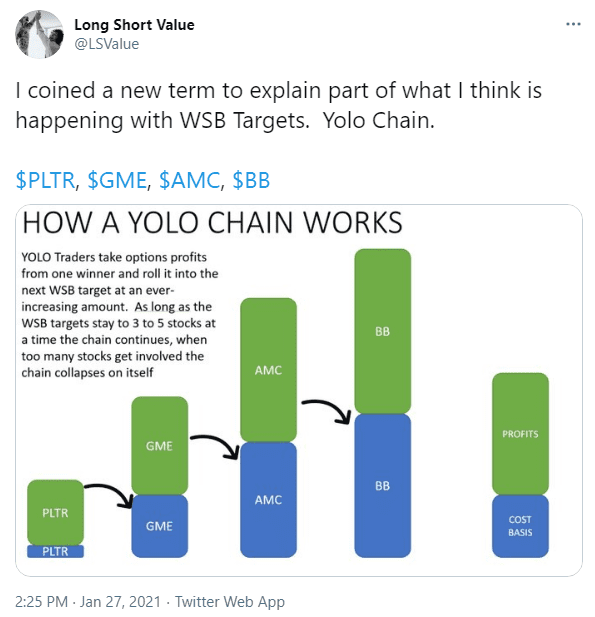

This situation is very much like musical chairs, and believe you me, you do not want to be the one left standing. These traders have been organizing on a social media platform called Reddit and the most visible platform within Reddit is wallstreetbets….cute. They are sharing information, and are acting, disjointedly, as a unit in specific stocks. All things equal, this seems permissible. Stock manipulation is illegal, but this seems like a bunch of investors banding together to share ideas. Could there be something nefarious here? TBD. Right now it appears to be a concerted effort aimed at a few stocks, cleverly dubbed a “YOLO Chain” by one of our Twitter follows, as in “you only live once,” so bet big:

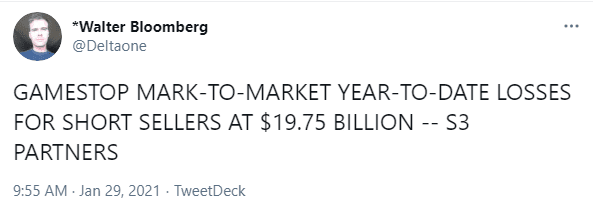

The options traders and masses have been targeting companies that they believe are being unfairly treated by hedge funds who have sold short the stock (selling short is an investment strategy that benefits the investor when a stock’s price decline). These types of investments are for highly skilled, sophisticated investors, because the risk, in theory, is exponential and never ending. To put it bluntly, if a short position goes badly enough against you there is no limit to how much money you can lose. As a result of this trading the volumes in companies like GameStop, AMC, Bed Bath and Beyond have gone absolutely bonkers, making these stocks (in our estimation) incredibly mispriced and detached from economic reality. The targets of these option buyers are forcing the hand of the short sellers to buy back their shares, lose huge amounts of money, and drive the stocks to dizzying valuations from a price perspective. Rob the rich, to the tune of almost $20 billion, so far:

Because of the volatility many brokerages have started to limit the trading of the securities. The masses are not happy about this—and view it as any attack on the individual, retail investor. There are structural reasons and potential justifications for some of these actions, but some of the motivation at least appears to be due to pressure and visibility in the government. Whether this nefarious or incompetence on the part of Robinhood is unclear, but we at FORMIDABLE believe this to be categorically and unequivocally wrong. Not only is it disastrous to interfere in free market capitalism, but the hedge funds and other asset managers who have positioned their investments with these types of risk strategies are professionals and need to face the consequences of their decisions. If you’re a hedge fund that fails to hedge—you deserve what you get. This current activity, albeit is at the hands of a bunch of purpose-driven day traders. Nowhere in our democracy or any of the securities laws of which I am aware, is there an inherent protection for institutional capital. What we should hope for is that trading will resume and this storm, although possibly protracted, will pass.

A word of caution.

Anyone trying to trade into this type of environment, especially with the securities that are the targets of these types of activities, are simply gambling. What we, at FORMIDABLE, try to avoid are binary event driven investments, specifically, due to its “pass/fail scenario.” Simply, we prefer to have multiple opportunities for success, and find this to be a safer strategy.

Do it yourself options trading currently is much like the roulette table; worse, maybe Russian roulette. Adrenaline junky plays are not investments and are simply speculative bets. As the owner of a call, you must be right about the stock (bet on the correct number), overcome what you pay the seller (the price for the option, which is tied to the stock’s volatility and accordingly at record levels), and get it right before the clock expires on your option. Those are three squeezes on the trigger.

If history is an analog to how this is going to play out, there will be a river of tears at the end of this and many individual investors will be mortally wounded in the process. And it will be awful.

Our advice for anyone considering jumping into this end of the pond, would be to seek financial guidance, and not participate. Oftentimes the risks we do not take are just as, or more valuable than, the risks we do.

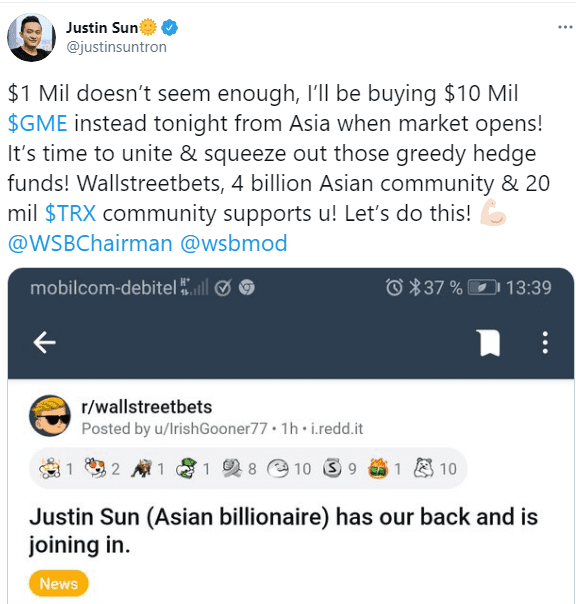

In reading the comments posted by the Reddit crowd, this has ceased to be about financial gain, and represents the evolution of the Occupy Wall Street movement to a “Defeat Wall Street Using Its Own Tools Against It”. A few of recent tweets show this to be the case and are not from random Twitter users but “blue check marks” with over 2 million followers each.

In other words, the party on the other end of a trade may not be a rational economic actor.

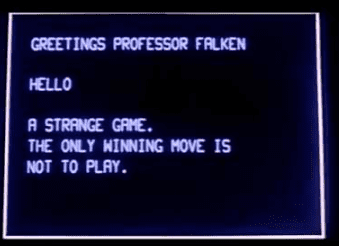

In this case, it is better to not participate at all and let what has become an Uncivil War in the financial services and stock market solve itself. It reminds us a little of the movie War Games, which ends with the computer threatening to destroy the world via global thermonuclear war reaching this conclusion:

The same holds true for speculating in the stocks and options on the front lines of the war between hedge funds and the army of retail traders raging against the machine.

If history repeats itself, the Robinhooders will be annihilated. This happened after the rise of the day traders during the tech bubble, and as Helmet and House of Pain so eloquently sang, we fear the day traders will be “Just Another Victim” again.

READY TO TALK?