July Update: Myth Busting

Our son just turned eight. He has a keen interest in mythology, so I bought him a book on the topic, Mythos by Stephen Fry. Like any good parent, I figured I should give it a read before handing it off to him and am glad I did. It had been years since I had read the old Edith Hamilton mythology, so I had forgotten how salacious some of the stories were, and this book went out of its way to emphasize those aspects of the myths.

Many of the characters and stories reminded me of what we are facing today, so we shall use them as inspiration for a recap of a first half of the year ugly enough to turn anyone into stone.

Atlas Shrugged?

Likely the most well-known titan, Atlas, even in defeat, was so fearsome that Zeus punished him to hold the sky for eternity. One could argue that American consumers bear a similar burden for the U.S. economy.

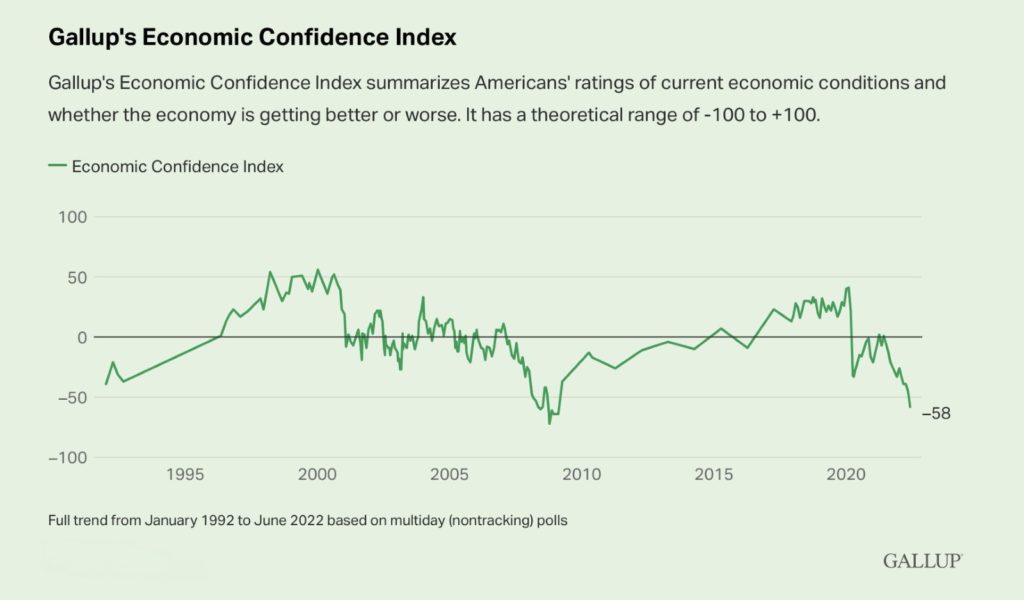

Unfortunately, we are seeing signs that the titanic efforts of the American consumer may have exhausted their efforts to continue to bear the burden. Some measures of consumer confidence, like the Michigan Consumer Sentiment survey, are at levels last seen during the financial crisis, though we believe that report has some flaws that make it prone to overreacting. However, even more measured approaches show confidence has significantly waned:

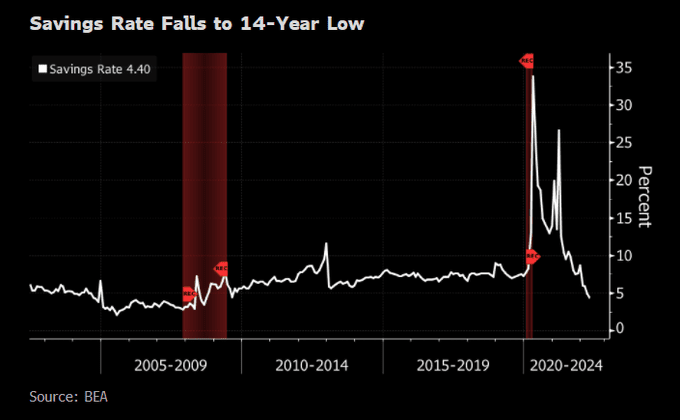

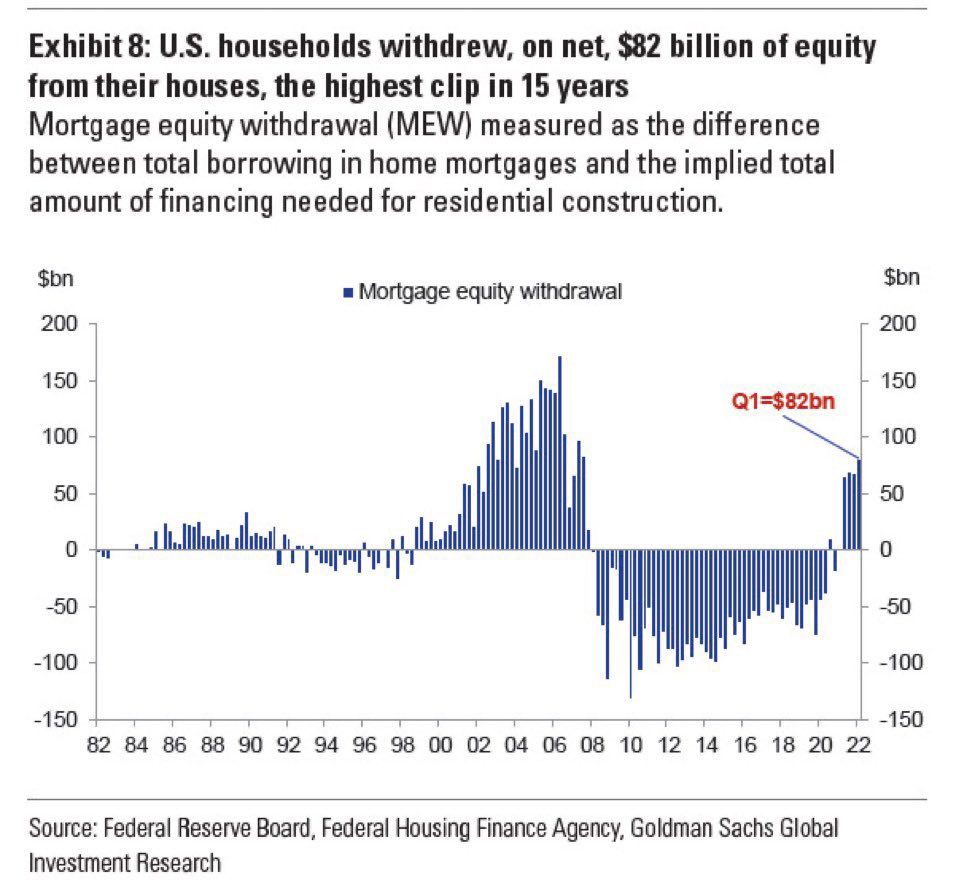

This lack of confidence is reflected in more than just feelings, as savings rates have plummeted. Moreover, consumer use of revolving debt, i.e., credit cards and home equity loans, has surged, along with, unfortunately, interest rates on this debt.

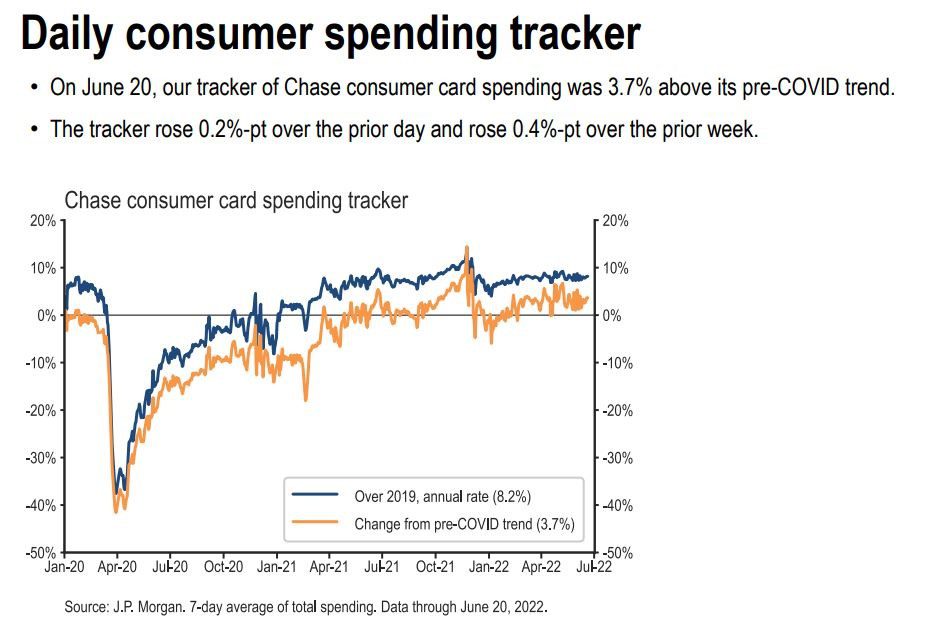

Consumer spending, in nominal terms, remains okay, though, adjusted for inflation, is declining:

Our Nemesis

We take for granted the impact myths have on so many words that have made their way into our vernacular; nemesis is a notable example. Eris, who famously started the Trojan War via a spat over an apple, had a sister named, Nemesis. Whereas in the parlance of our time it has come to mean an archenemy, and often one who gets the better of you, Nemesis, to quote Mythos, “was the embodiment of retribution, that remorseless strand of cosmic justice that that punishes presumptuous, overreaching ambition – the vice that the Greeks called hubris.”

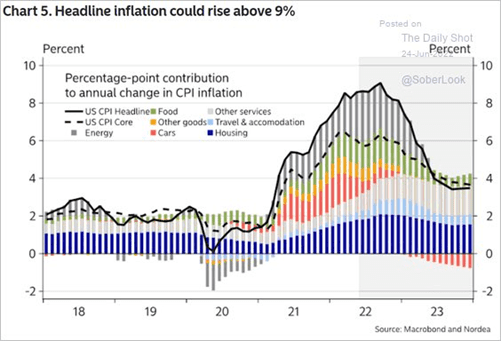

Inflation is proving to be the nemesis of all of us, in the more colloquial sense, though it can be argued its effect on the Fed is in more of the classical sense, i.e., in response to hubris as people like Chair Powell claimed it was transitory or easily managed.

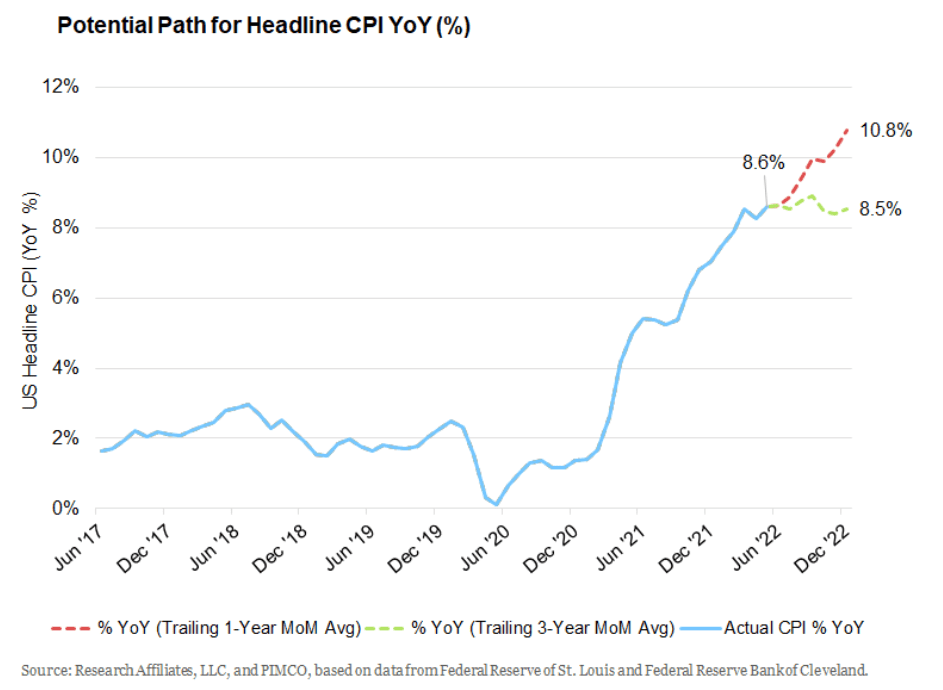

If inflation keeps running at the same monthly clip, it could reach 10.8% by the end of the year.

Our base case tends to show it flattening somewhat, but remaining elevated, giving the Fed the impetus to proceed with its rate increases.

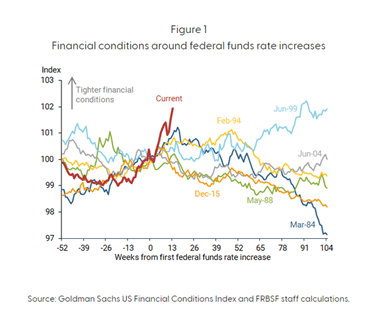

So far, the Fed has been as aggressive as it has ever been in the quest to tame inflation, with financial conditions tightening as quickly and severely as at any time since the 1980s:

In terms of interest rates, the Fed has raised 1.5% so far; expectations are for seven more 0.25% hikes, which would put the Fed Funds rate at 3.25%. Moreover, the Fed has started to reduce the size of its balance sheet.

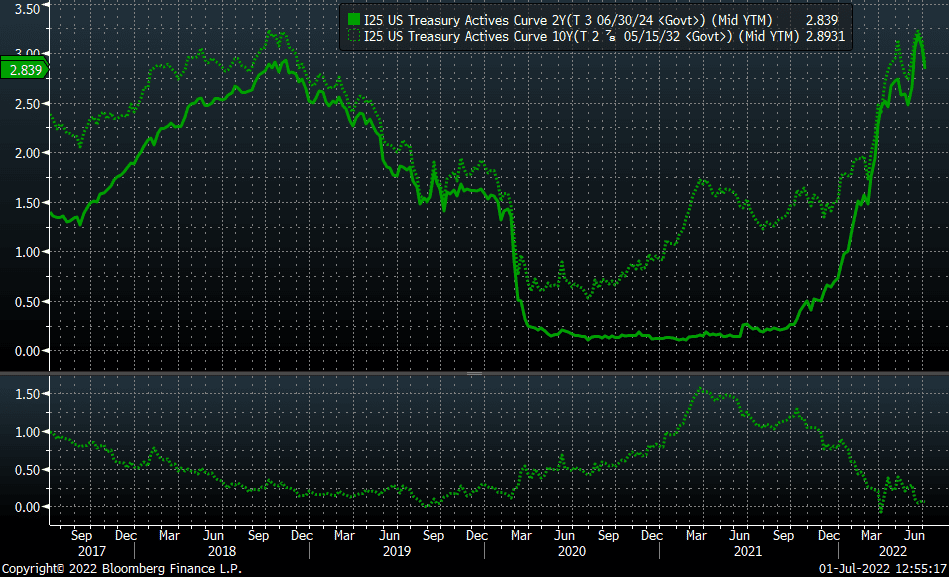

Unfortunately, the market, us included, is looking at the Fed’s actions as a policy mistake, based on the shape of the yield curve, where we have seen the difference between the yield on the 10-year Treasury and the two-year Treasury compress to almost zero.

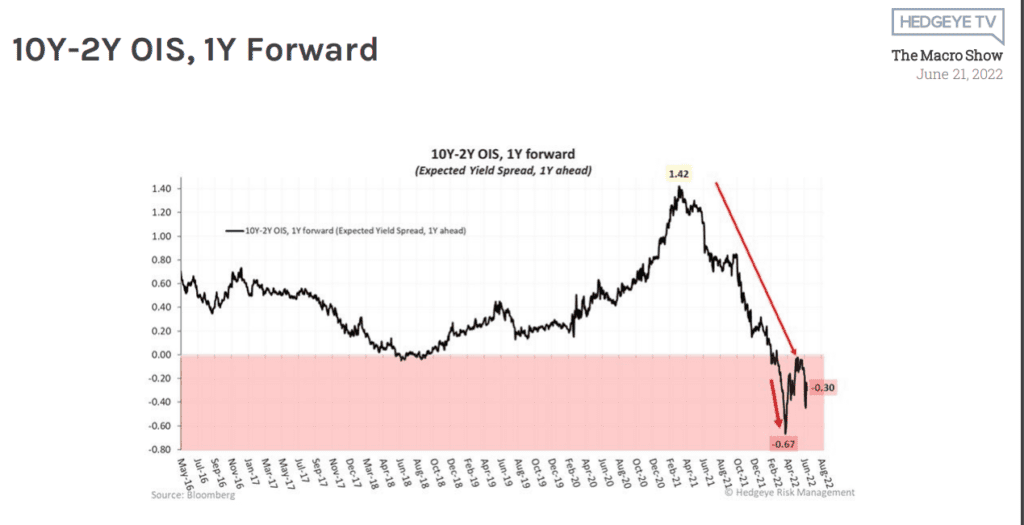

In fact, using forward estimates of this spread shows that the market anticipates this spread to be negative in 12 months.

Let us look at another myth to see why this is happening.

Eos & Tithonus

This duo was ½ immortal (Eos, goddess, actually titaness, of dawn) and ½ mortal (random handsome man). Unfortunately, Eos had been cursed by Aphrodite and unable to find a lasting relationship, until now. Since Tithonus was mortal, Eos sought out Zeus’ assistance and requested her lover be made immortal. Zeus asked if she was sure, Eos said yes, and Zeus granted the wish. After a few years, she noticed Tithonus starting to become a little less handsome. She returned to Zeus, who stated, you said immortal, not eternally youthful. So, Tithonus aged, and aged, and aged, until eventually Eos turned him into a grasshopper. The whole episode ended tragically, inspiring a Tennyson poem that contains the line, “The Gods themselves cannot recall their gifts.”

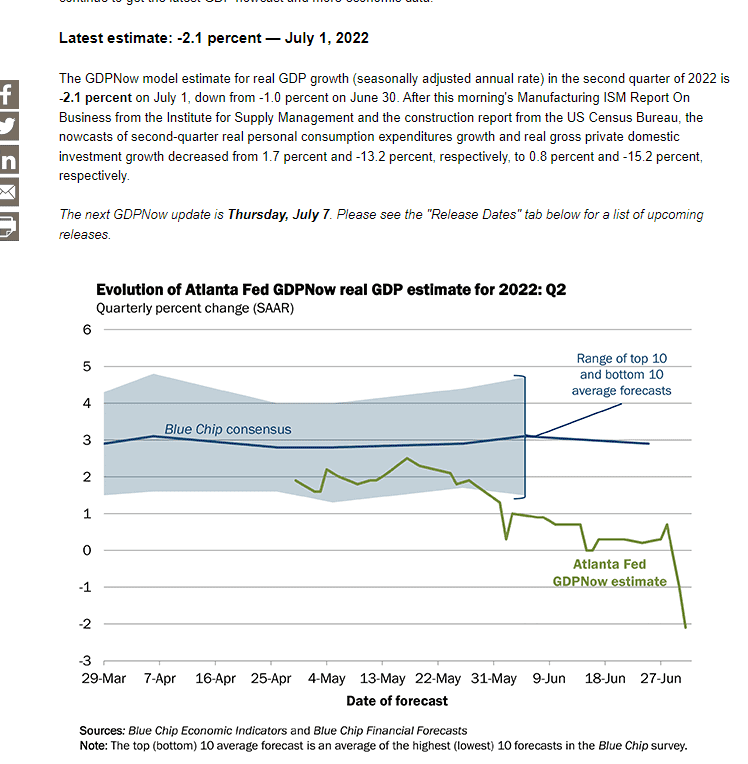

This is a long way of stating that sometimes having our desires fulfilled leads to unintended consequences. For Eos, it was the fading of her man’s youthful beauty; for the Fed, its desire to cease the rampant rise of inflation is the fading of economic growth. Look no further than estimates from the Atlanta Fed, which is now estimating negative growth in Q2 for the U.S. economy.

The aforementioned flattening/inversion of the yield curve is telling us that the Fed is making a mistake. Why is that important?

Sisyphus

Unlike the prior duo, Sisyphus is well known, doomed to roll a rock uphill for eternity.

However, there are a few things most do not know about him. One, Sisyphus married his niece, and if that is not bad enough, he married her out of spite. Two, he was widely regarded as one of the craftiest men alive. Three, using this craftiness, he cheated death not once, but twice, hence how he ended up with the rock rolling gig.

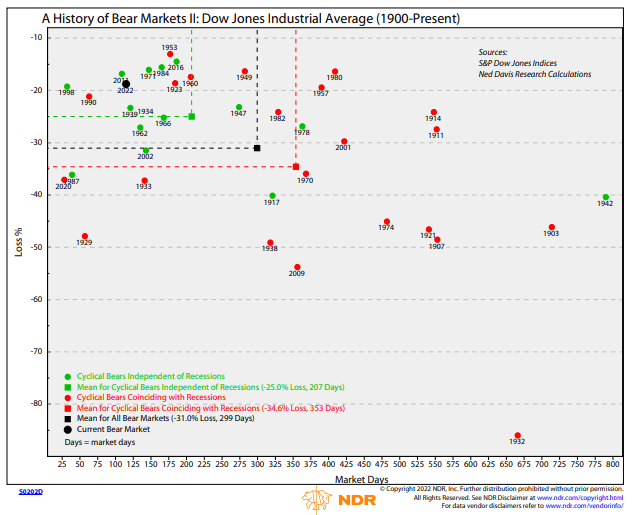

This, somehow, brings us to why whether fixed income markets getting a recession call is important or not. In a graph as confusing as the family tree of the Greek gods (if you thought the Sisyphus niece marrying thing was bad, you should avoid this topic), here is perspective on where the current bear market ranks in magnitude (less severe) and duration (shorter) versus history. The green box shows the average non-recessionary bear market while the red box is the average bear market when we have a recession; the black box is just the average as a whole. If we avoid a recession, we may cheat death here; if not, that rock is likely to roll farther downhill.

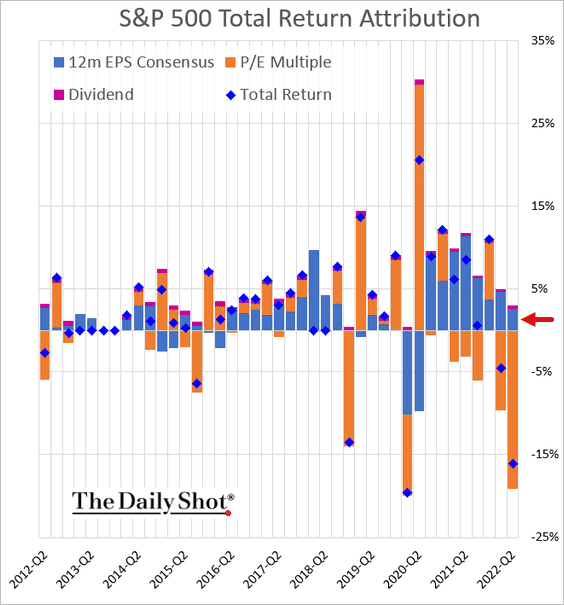

It may seem like a lot of damage has been done in the equity markets, and that is indeed true. However, if we look at the components of returns, a cornerstone of Formidable’s investing framework, we will see that a decline in earnings, something that almost always accompanies a recession, has not been the source of the decline:

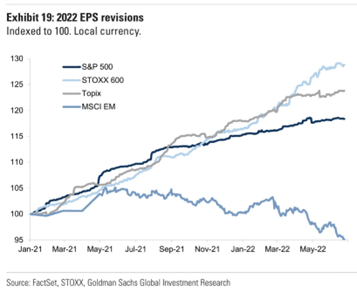

While we have seen earnings growth slowing, it has not declined, and EPS revisions for developed markets, including the S&P 500, remain remarkably resilient in light of the recession risks:

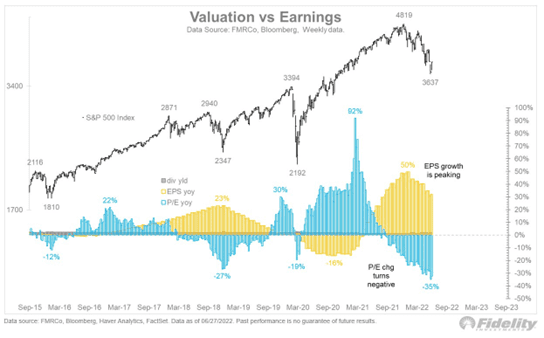

In terms of how valuation and growth wax and wane, this is a helpful graphic, showing that although we have seen more multiple compression than in prior drawdowns, the multiple expansion in the wake of the aggressive stimulus during the Covid crisis was even more elevated.

Phaeton

As previously mentioned, family trees in mythology were problematic, and in the case of Phaeton, sources vary as to whether his father was Apollo, the sun god, or Helios, the sun titan who was supplanted by Apollo. Regardless, Phaeton’s father was not involved with his upbringing, i.e., he never saw him, given the whole pulling the sun across in the sky in a chariot every day part of the job.

Anyhow, Phaeton got tired of being bullied by his classmates and boldly bragged he was taking on the family business. He showed up at Apollo’s work, guilted him into granting a wish that Apollo swore an oath he would grant, then made that wish driving the chariot. Apollo begged him to choose another, but the proud and headstrong Phaeton refused. Gods, for all their faults, took their oaths seriously, so he let Phaeton drive. It all started well enough, then Phaeton lost control, in turns plummeting too close, thereby forming the Sahara, and at other times soaring so high the seas froze. Unable to tolerate such a disaster, Zeus struck the chariot with a lightning bolt, killing Phaeton.

We mentioned valuations in the last section. Investors are often as headstrong (and inexperienced) as Phaeton, and animal spirits, like the horses that pulled the chariot, similarly push valuations toward extremes. Unfortunately, it is typically easier to see these extremes only in retrospect.

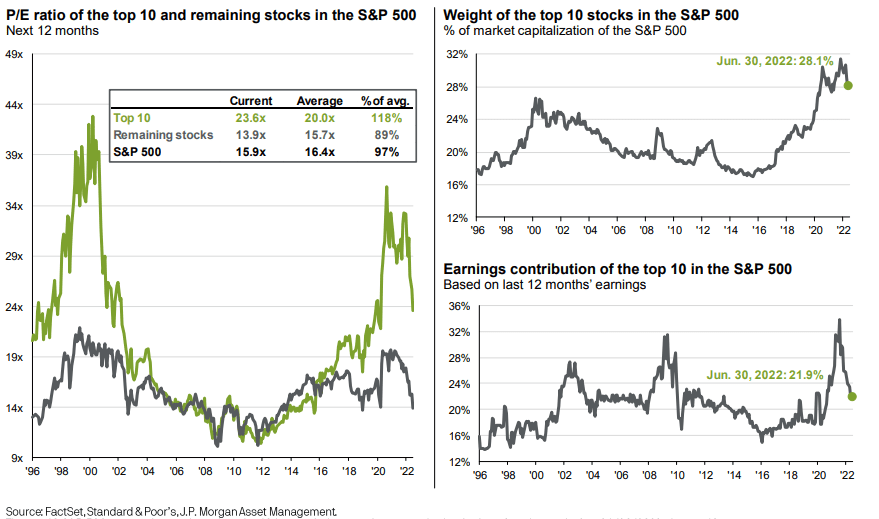

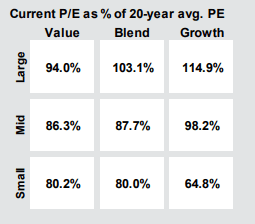

As it stands now, the S&P 500 is roughly in-line with its long-term average valuation. As we have noted ad nauseum in past letters, the largest stocks have been (and remain) overvalued, though the magnitude of the overvaluation has declined to a mere 18%. These stocks comprise almost 30% of the index.

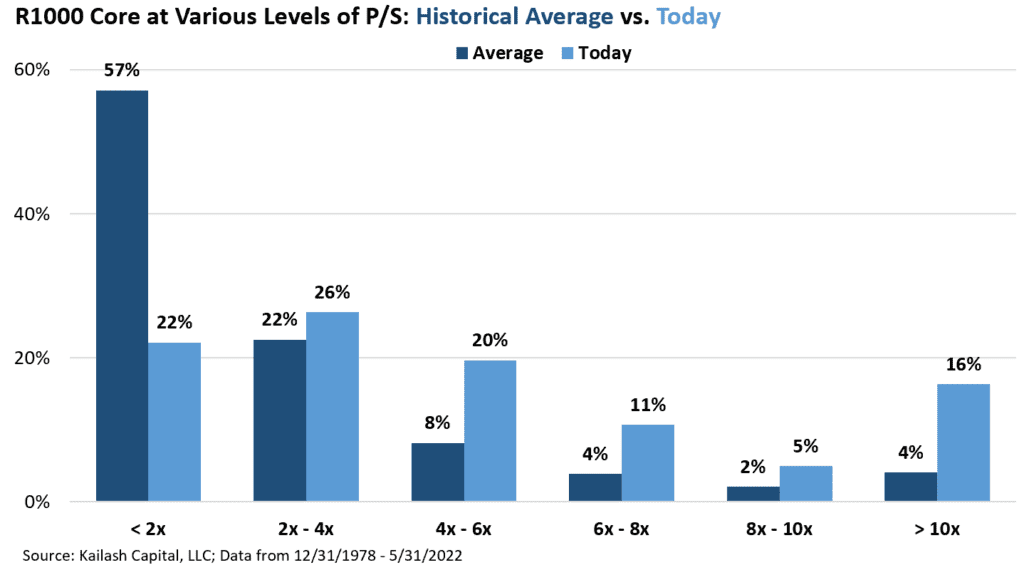

Kailash Capital does tremendous work from a historical perspective, and looking at a broader universe of stocks, i.e., the largest 1,000 in the U.S., shows index investors continue to have relatively elevated levels of exposure to stocks with elevated price/sales multiples. Versus historical averages, there are four times as many stocks with a price/sales ratio over ten, and far fewer in the “cheap” end of the spectrum.

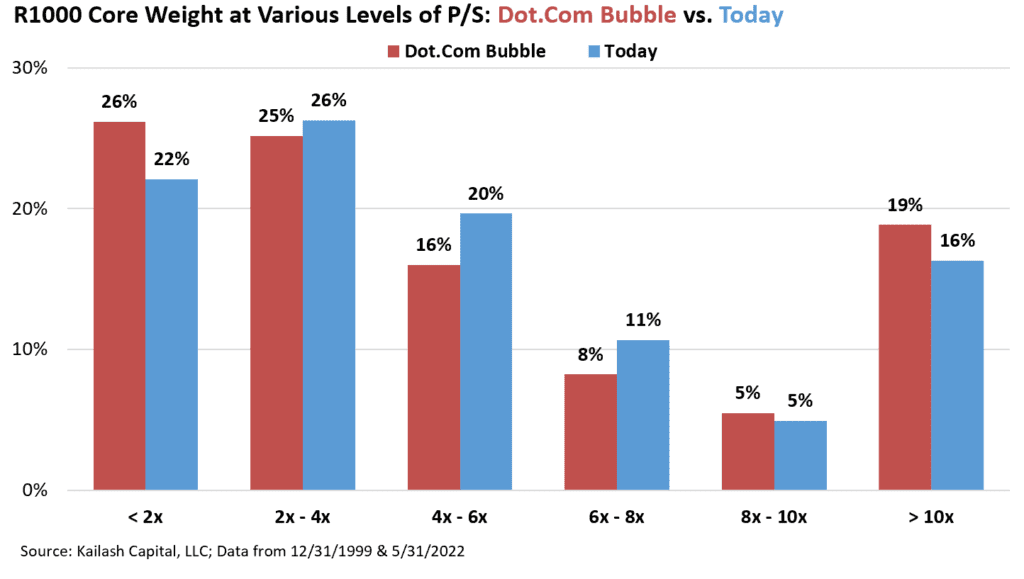

In fact, the distribution today (well, as of the end of May) looks more like height of the tech bubble as opposed to the long-term average.

For those of us who have been doing this for a while, it was possible to generate positive returns from these valuation levels in the early 2000s. It was simply harder, and one had to look beyond the index; the same setup applies today, with smaller and mid cap value the least expensive parts of the market:

Hades

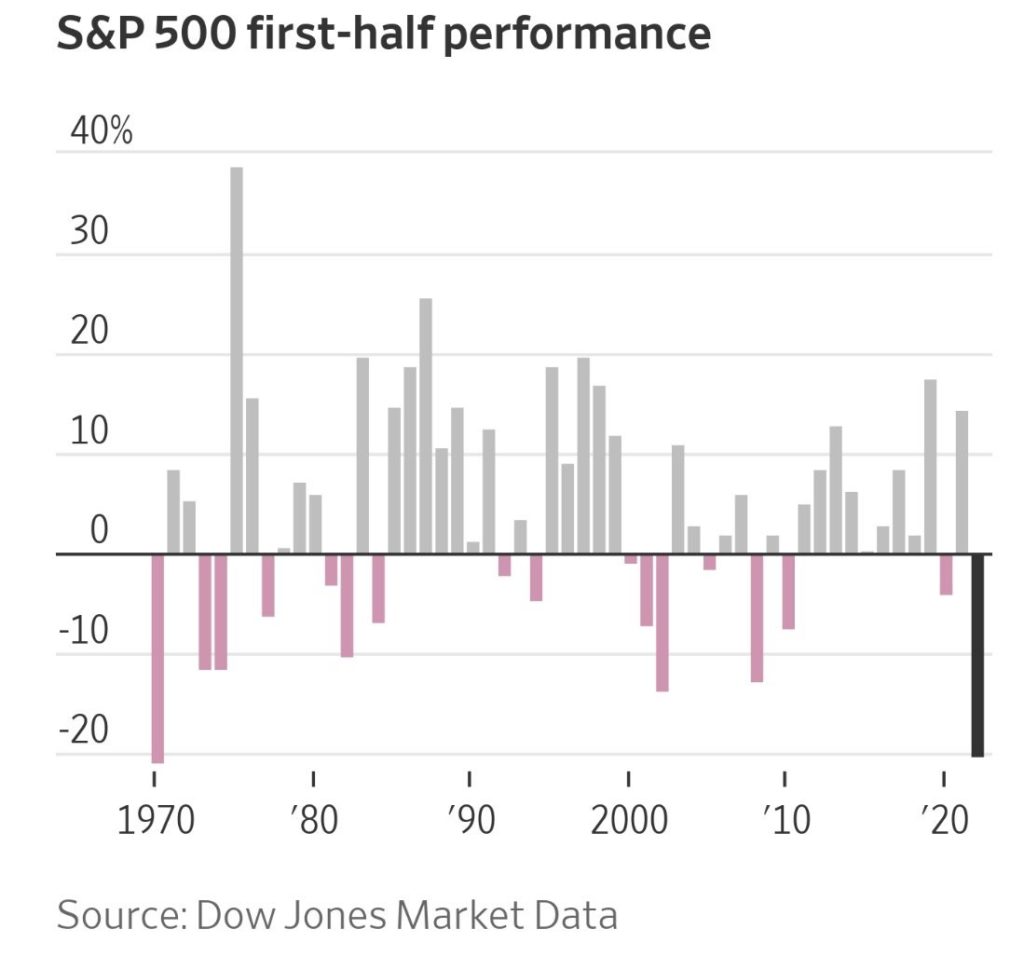

The god of the underworld seems appropriate inspiration as we look at returns. For the S&P 500, Q2 was the third worst in history, and we have seen the worst first half in over 50 years.

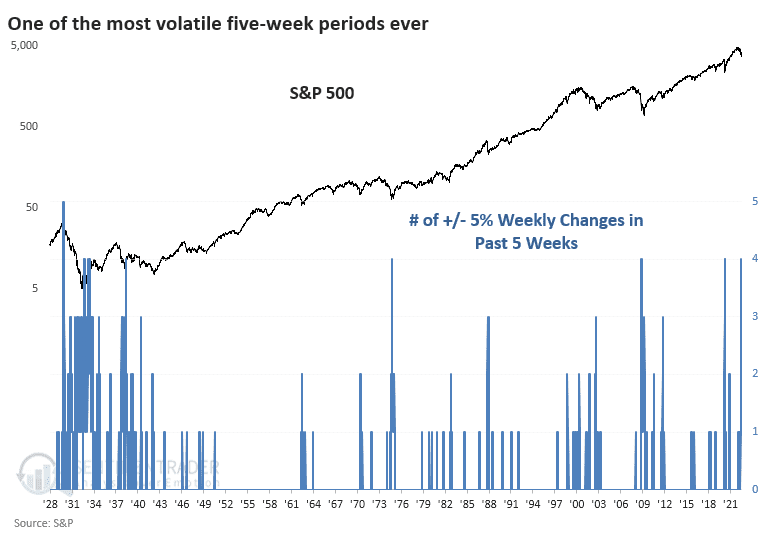

The last month-plus has been one of the most volatile in history, matching the Covid crisis and financial crisis, yet lagging the Great Depression:

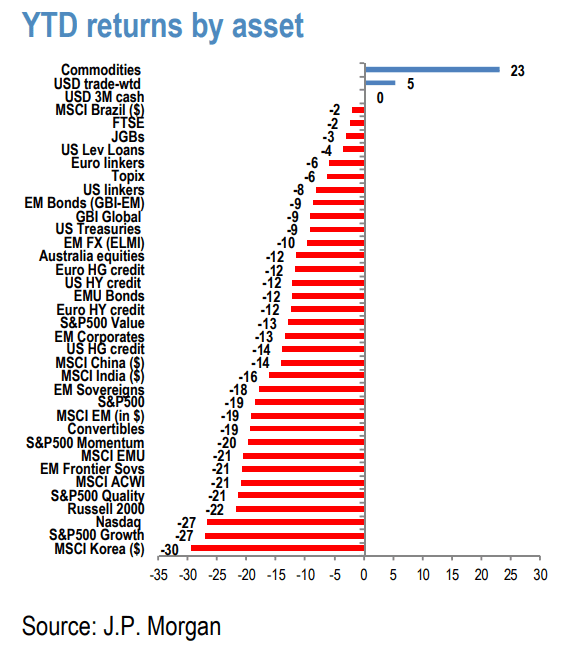

Just as no one could hide from Hades (Sisyphus tried, but we already discussed how that went), there has been nowhere for investors to hide. Both bonds and stocks show negative returns over every period within the past 12 months. Tech stocks, as measured by the NASDAQ, beloved as 2022 began, suffered the largest year-to-date decline among major indices, posting their worst quarter since the tech bubble burst.

| Index | 1-Month | 3-Month | YTD | 1-Year |

| S&P 500 INDEX | -8.26 | -16.11 | -19.97 | -10.64 |

| Invesco S&P 500 Equal Weight E | -9.39 | -14.44 | -16.74 | -9.50 |

| NASDAQ Composite Index | -8.65 | -22.27 | -29.22 | -23.40 |

| Russell 2000 Index | -8.23 | -17.21 | -23.45 | -25.24 |

| MSCI EAFE Index | -9.26 | -14.32 | -19.23 | -17.26 |

| MSCI Emerging Markets Index | -6.63 | -11.40 | -17.57 | -25.08 |

| Bloomberg US Agg Total Return | -1.57 | -4.69 | -10.35 | -10.29 |

| Bloomberg US Treasury Total Re | -0.88 | -3.77 | -9.14 | -8.90 |

Source: Bloomberg (as of most recent month end)

A broader look from an asset class perspective shows commodities and the U.S. dollar the only assets positive year-to-date, though the former has started to struggle recently.

Pandora’s Jar?

No, that is not a typo. The concept of Pandora’s box results from a poor translation by Erasmus; guess even the man who cobbled together Greek and Latin to create unified New Testament makes a mistake occasionally. The “gift” was not a box (pyxis in Greek) but a jar (pithos).

While the vultures removing his liver daily would come later, the jar was another punishment aimed at Prometheus. The gods, in a rare spirit of cooperation, collaborated to create Pandora, the woman, and sent her to Prometheus’ brother, along with the jar. She and Epimetheus fell in love and lived happily until curiosity got the better of her, at which time she opened the jar, releasing a cavalcade of “mutant descendants of the dark and evil children of both Nyx and Erebus;” pain, lies, war, you name it.

Given what we have described heretofore, it is easy to become fixated on the ills Pandora released. However, there was one item left in the jar, hope, and here are data points that make for optimism.

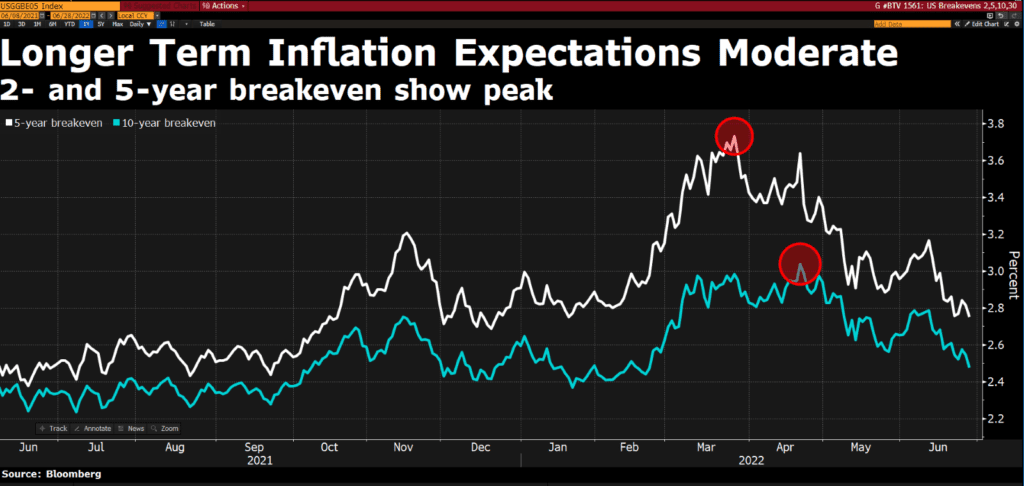

First, fixed income markets believe inflation will settle in a manageable range between 2% and 3%. Is this in accordance with the Fed’s 2% target. No, but is it manageable and, from a rate of change perspective, a significant improvement over the rate we see now? Absolutely.

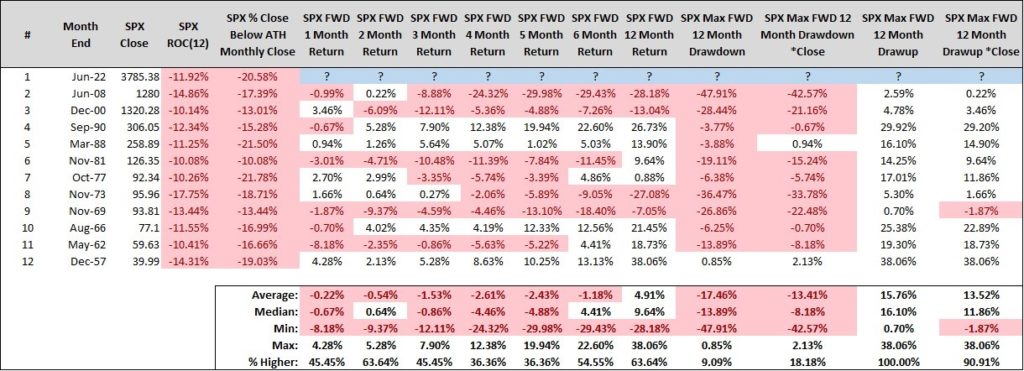

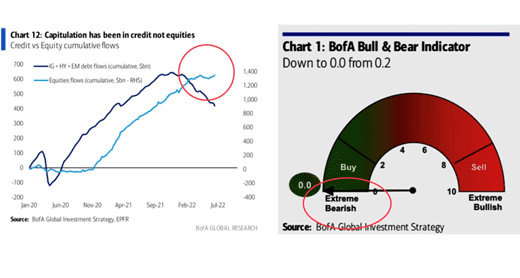

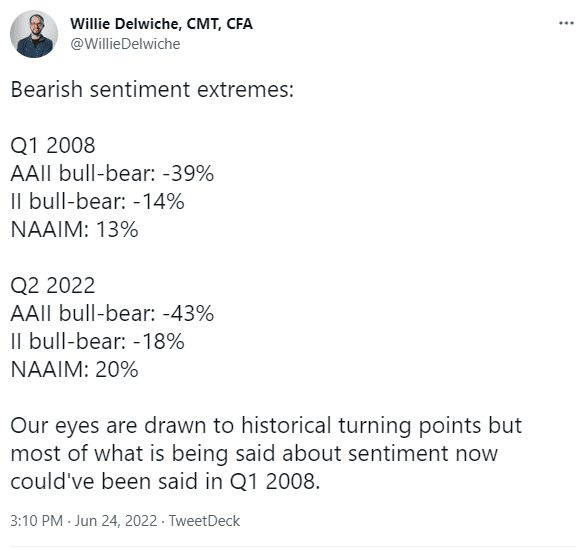

Second, although we believe the Fed is myopically focused on its dual mandate (inflation and unemployment), we have noted in the past that there seem to be certain financial trigger points it monitors. One is credit spreads; those are becoming elevated but not quite where we have seen the Fed blink. Another is equity returns over the past 12 months. Though we are in a bear market from the perspective of highs reached earlier this year, we are now at over a 10% loss over the last 12 months. Historically, this has been an area where we have seen a modicum of incremental dovishness. There have been times when things have eroded further from here, e.g., 2008, 2000, and 1973, though, on balance, the odds tend to be favorable over the next 12 months. Over 60% of the time, returns are positive, with the average gain around 5%.

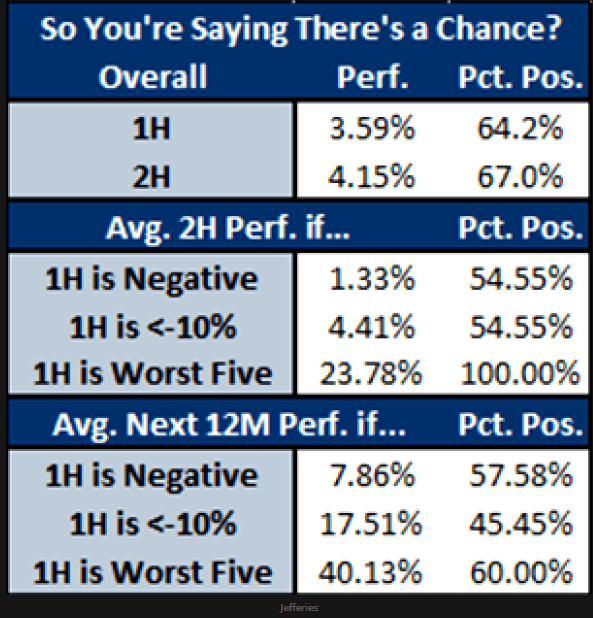

Along these lines, dreadful first half returns have historically portended strong subsequent returns. However, our enthusiasm is a bit tempered, given in three of the “worst five” scenarios the prior year was a double-digit loss versus 2021 being incredibly strong.

Cassandra

While these points provide a framework for optimism, hope is not an investment strategy. Deciphering the various pieces of data can be as confusing as trying to divine the will of the gods by examining entrails from a sacrificial offering and watching market prognosticators on CNBC can seem more like listening to the cryptic prophesies of the Oracle at Delphi.

At times like these, it is easy to become overly fearful (most investor sentiment readings show highly elevated levels of fear) or, paradoxically, overly greedy. Despite these elevated fear readings, retail investors continue to pile into equities, with highly speculative, retail-oriented funds seeing inflows as speculators try to “buy the dip.”

Whereas Chronos gobbling his children in fearful response to a prophecy of doom made sense, investors responding this way is incongruent with managing risk. Extreme sentiment is a necessary, though not sufficient, condition for a longer-term market bottom; looking at what investors are doing, not what they are saying, is the more salient reference point. The metrics we track are starting to show some indications of outflows from equities, which is another hopeful data point.

In Greek myth, in the beginning there was Chaos. From Chaos sprang Erebus and Nyx, darkness, and night; they gave us all those nasty characters hidden in Pandora’s jar. For investors, things at the moment may feel chaotic and dark. It is our job to help navigate through these challenging times by helping arm our investors with facts and data to (hopefully) overcome some of the behavioral biases that can hurt returns.

Perhaps the most famous prophet was Cassandra, who was cursed with an ability to accurately foretell the future while always being disbelieved. In other words, no one ever heeded her warnings. We have come across with no one near that level of accuracy. Accordingly, we adhere to our investment process. Right now, we are a little more defensive in portfolios but continue to look for opportunities the current selloff is providing. Though we are not prophets, one thing of which we are relatively certain is that the next market cycle is unlikely to look like the last one, which should be an advantage for our active approach.

As we close our mythology lesson, from Erebus and Nyx were also born Hemera and Aether, day and light. Markets are no different. It is from the depths of market declines that new bull markets are born, just as day follows night.

READY TO TALK?