November Update: Reversion to the Meme

Puns: They are seldom funny. Neither are memes. However, we combine the two this quarter and hope, as we see in math, that two negatives make a positive.

Our title pun combines reversion to the mean, a concept wherein a statistic unmoored from its historical average, i.e., its mean, tends to revert toward that level, with meme. For those who may not know, a meme is defined by Oxford as “a humorous image, video, piece of text, etc., that is copied (often with slight variations) and spread rapidly by internet users.”

Distraction

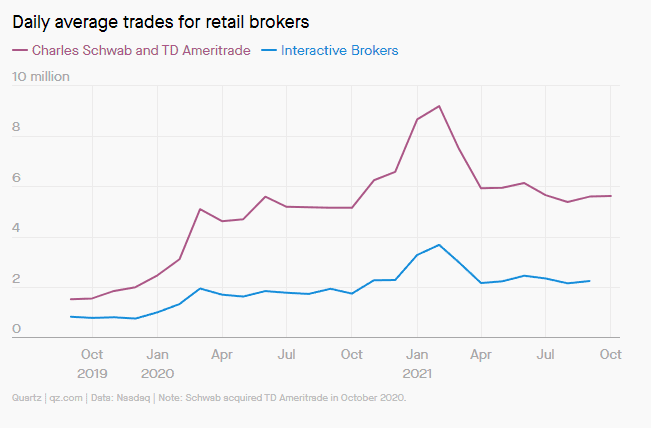

Hertz was arguably the first meme stock, from all the way back in July 2020 when retail investors bid it higher despite bankruptcy proceedings, during which the company attempted to issue equity, only to be told “no” by the SEC. In early 2021, we had GameStop and AMC, among others, though since then, retail trading has cooled a bit.

The reason? In our view, it is the rise in a new form of meme trading, specifically in cryptocurrencies, as best illustrated by this:

There, we have gone from the tried-and-true bitcoin to the Elon Musk pumped dogecoin, perhaps the first meme coin, to now, a meme of the aforementioned meme coin, Shiba Inu coin. And now, these headlines, from October 29th and November 1st of this year, respectively:

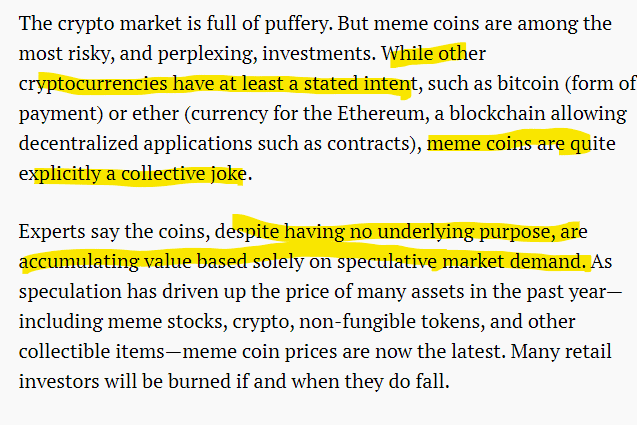

As mentioned in a prior newsletter, we believe there may be a use case for cryptocurrencies and blockchain technologies. Having said that, the unlimited nature of the x-axis, i.e., the potentially infinite number, makes any allocation to emerging currencies tantamount to a game of musical chairs. In other words, it is speculation, not investment, and not how we choose to allocate capital. Here is an excerpt from an article we found insightful:

Powerful Forces Unite

No investment newsletter is complete without a section on inflation, just like no meme list is complete without this, which takes its inspiration from one of the all-time great handshakes in movie history.

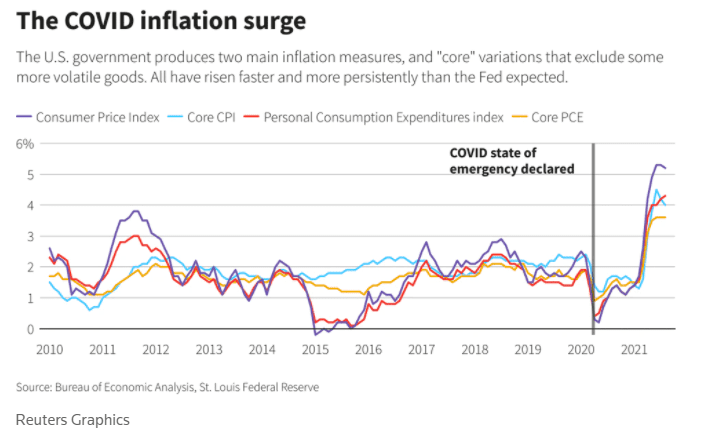

We have written extensively on the topic in the past, though we continue to accumulate more data points. The following summarizes the trend quite nicely:

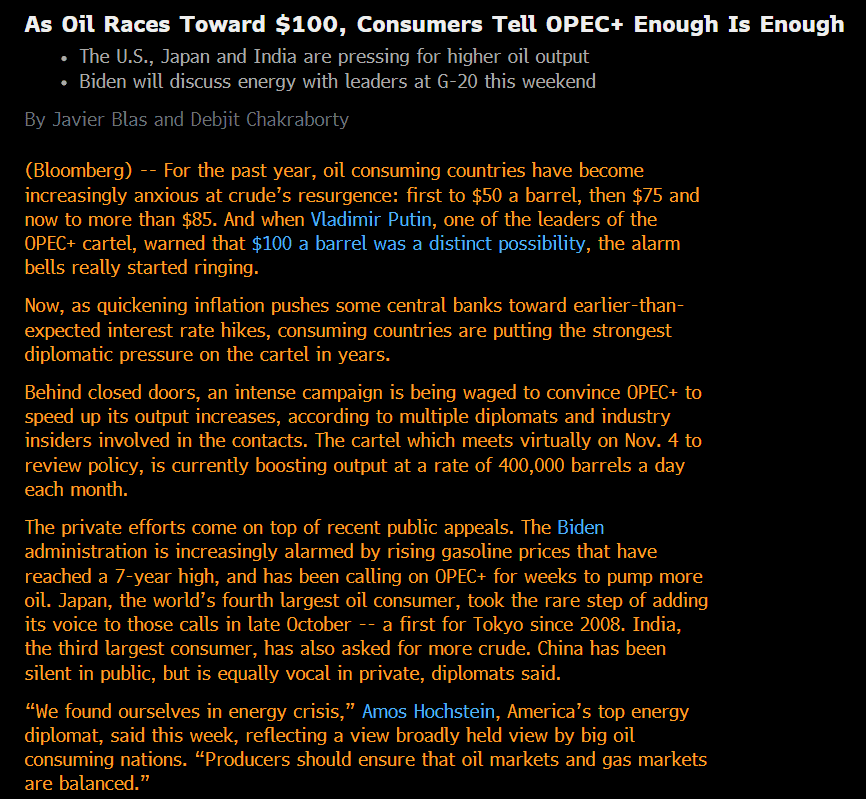

Cost-push is related to higher input costs. We are seeing this as commodity prices increase, not to mention the structural challenges associated with stretched supply chains. For an interesting first-hand account, this article provides tremendous insight as to the reasons why this may be a challenging matter to resolve. Energy consuming nations complaining to OPEC about higher prices does not seem to bode well for lower prices, either.

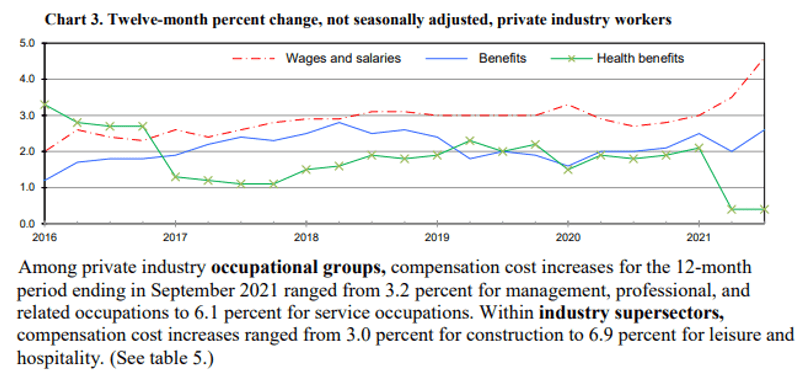

On the wage side, we have this from Reuters: “Strong inflation pressures were underscored by a separate report from the Labor Department on Friday showing the Employment Cost Index, the broadest measure of labor costs, surged 1.3% in the third quarter. The largest gain since the first quarter of 2001, when the government started tracking the series, reflected an increase across industries and followed a 0.7% rise in the April-June period.” Things like leisure and hospitality saw the largest increases, per data from the Bureau of Labor Statistics:

That brings us to demand-pull, where higher wages, combined with the continuation of fiscal stimulus and proposed infrastructure spending are moving the demand side of the equation.

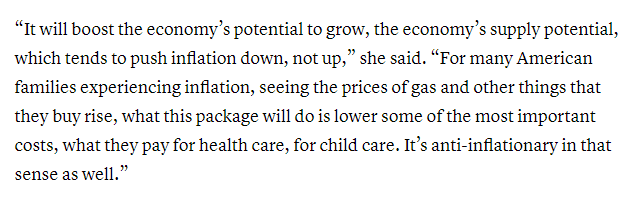

In a comment worthy of Orwell, Treasury Secretary Yellen explains how more spending is disinflationary:

Perhaps what Yellen and U2’s Bono are discussing here is destined to become a meme.

Self-Inflicted Wounds

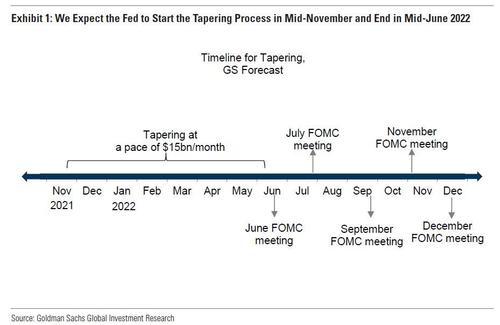

So, why does inflation matter? Mostly because it is part of the Federal Reserve’s dual mandate, along with employment. Given the employment picture has improved, albeit due to some structural reasons, e.g., higher asset valuations have made retirement feasible, many now see the Fed’s next move as an earlier tightening, whether from tapering its bond purchases or increasing rates.

Central banks in Canada, the U.K., and elsewhere have been shifting toward more hawkish views as well.

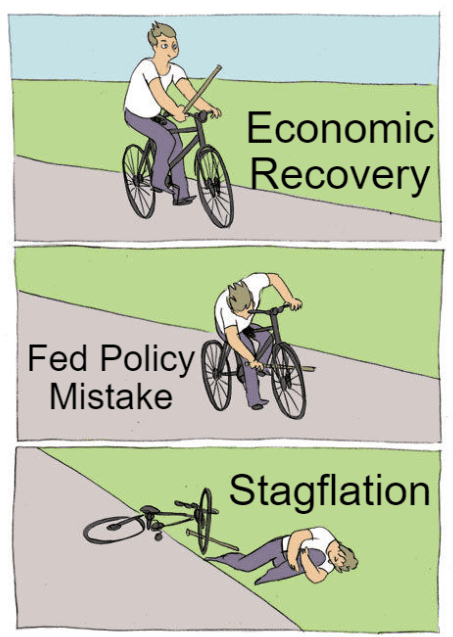

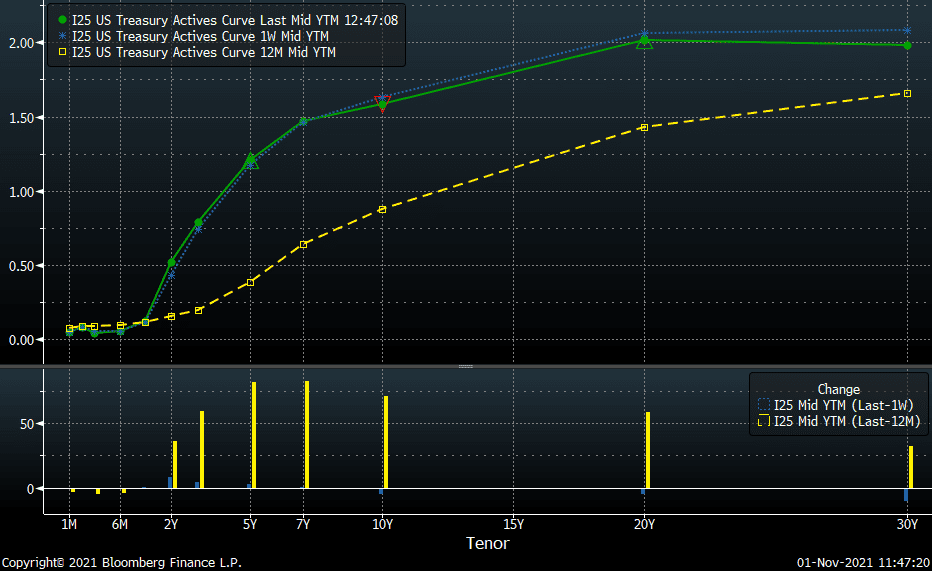

The market’s reaction, given the divergence between shorter and longer rates, seems to be this:

As the Fed’s transitory view around inflation has shifted, shorter rates have started to increase. At the same time, longer rates have fallen as the concern is economic growth will slow; this is known as the yield curve flattening and, when accompanied by narrow credit spreads, can portend an environment with higher inflation and lower growth, i.e., stagflation.

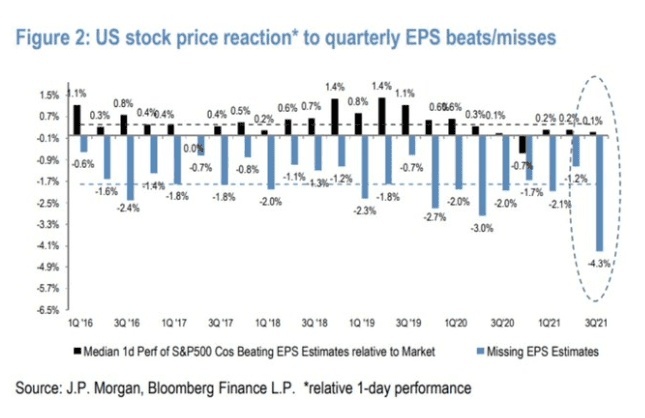

So, the effect on bonds has been mixed. For equities, we are amid earnings season, which has been bumpy at the individual equity level. Companies failing to meet expectations are suffering to a much greater degree than we have seen historically (declining over 4% this quarter versus the historical average of less than 2%):

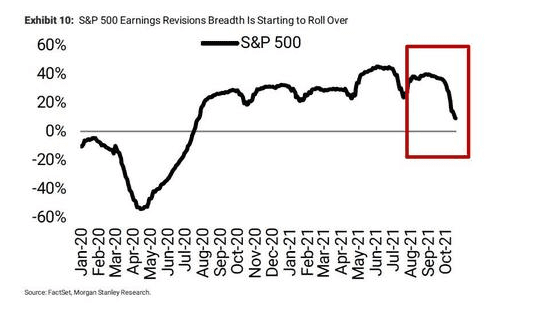

Poor earnings revisions have likely contributed to this weakness in companies that have failed to meet expectations.

The risk of a policy mistake has entered the conversation within fixed income markets, but not for equity investors. However, the risk remains that a sizable move in nominal rates and/or reduction in bond purchases could remove some of the support equities have received against the backdrop of fixed income not being a viable alternative at current interest rate levels.

What matters to markets?

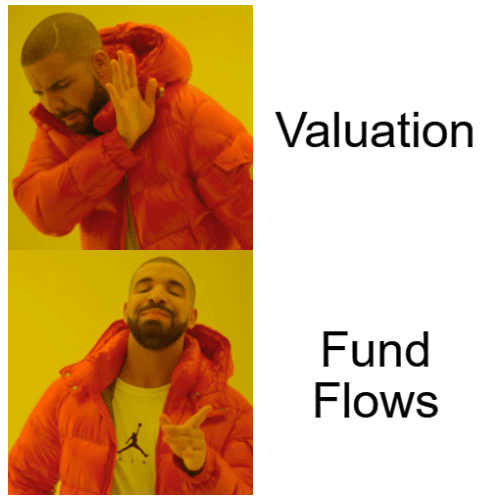

Why do equity investors not care right now? Drake, a famous performer, best summarizes this issue:

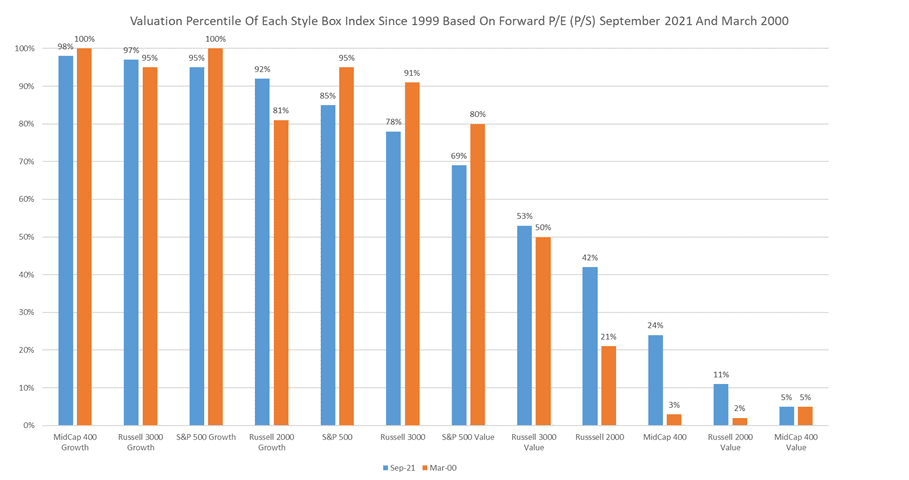

Here we see where valuations are versus history.

Source: Raymond James

The orange bar represents the height of the tech bubble; the blue bar September 2021. Given the appreciation in the market, this may understate valuations just a bit. Be that as it may, we see the S&P 500 is in the 85th percentile, so a little cheaper than its prior peak valuation. However, growth-oriented names, irrespective of market cap, are generally as elevated as they have ever been. Small caps and value names are relatively inexpensive, but it has not really mattered. An interesting piece of trivia is that within each index, the largest companies have been the best performers by a wide margin. While there is not a clear reason, our hypothesis is that retail investor flows into ETFs may drive the larger names, which is a nice segue into what really matters to markets: fund flows.

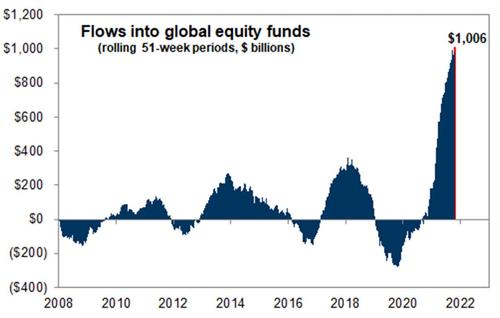

Inflows are at over $1 trillion during the last 51 weeks; the prior record was less than $400 billion.

The result? Massive gains almost across the board from an equity perspective, with emerging markets, the worst equity category, returning a mere 17%. Fixed income has been a source of funds, with the aggregate bond index flat and U.S. Treasuries negative.

| Index | 1-Month | 3-Month | YTD | 1-Year |

| S&P 500 INDEX | 7.01 | 5.13 | 24.03 | 42.89 |

| Invesco S&P 500 Equal Weight E | 5.30 | 3.71 | 25.08 | 48.90 |

| NASDAQ Composite Index | 7.29 | 5.80 | 20.89 | 43.07 |

| Russell 2000 Index | 4.25 | 3.44 | 17.18 | 50.77 |

| MSCI EAFE Index | 2.47 | 1.35 | 11.54 | 34.87 |

| MSCI Emerging Markets Index | 1.00 | -0.42 | -0.14 | 17.29 |

| Bloomberg US Agg Total Return | -0.03 | -1.08 | -1.58 | -0.48 |

| Bloomberg US Treasury Total Re | -0.07 | -1.33 | -2.56 | -2.45 |

Source: Bloomberg (as of most recent month end)

Value investing and Anakin

This summarizes how value investors have felt over the last few years:

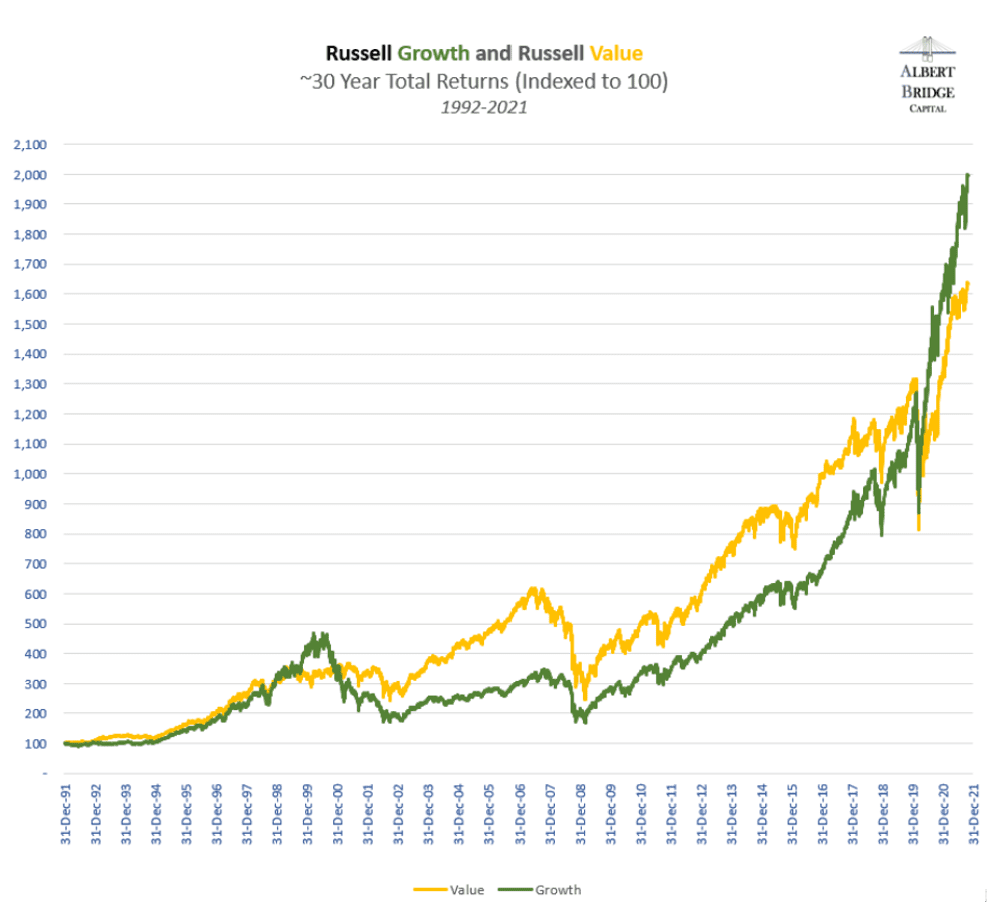

According to research by Albert Bride Capital, the longstanding finance orthodoxy of value investing has been overturned, with growth stocks now outperforming value over a 30-year period. The stark divergence post-COVID is the primary reason.

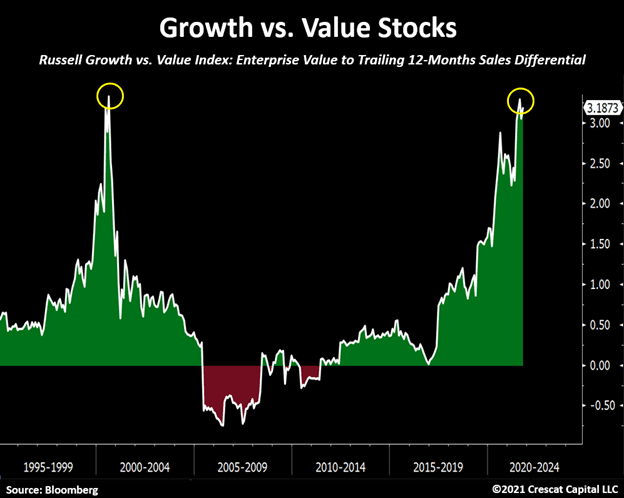

From a valuation perspective (I know, we just talked about how that does not matter) growth stocks have never been more expensive versus value, at least when judged on enterprise value to sales.

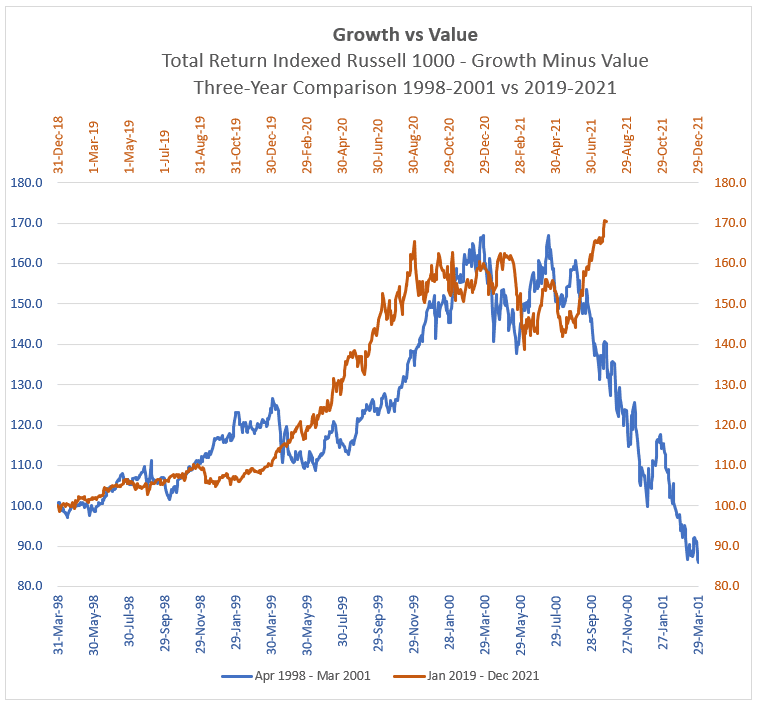

Generally speaking, the tech bubble started in 1998 and burst in March 2000. The following, also from Albert Bridge Capital, compares the current environment to the late 1990s. While we would not be so bold as to predict a similar fate for today’s high-growth stocks, we are reminded of that period, with one name probably coming the closest to encapsulating the zeitgeist of the post-COVID stock trader.

Admittedly, stock prices, over the long term, tend to be very much influenced by growth. Having said that, history teaches us that paying any price for growth is a recipe for failure.

Choose Wisely

We could have easily used any one of a number of memes inspired by or used by Tesla’s CEO, but we will instead use this, which is the decision tree for quite a few investors (hint: they normally go with the calls).

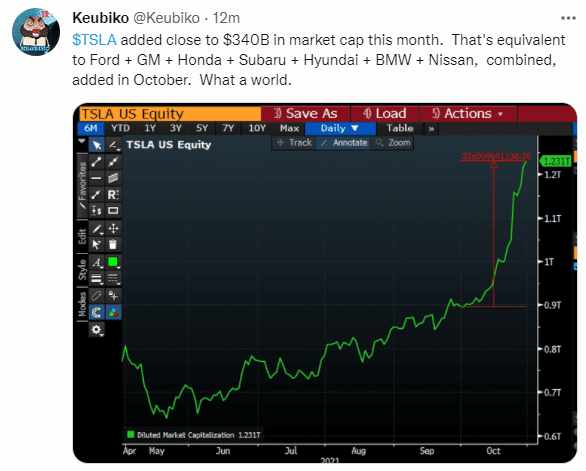

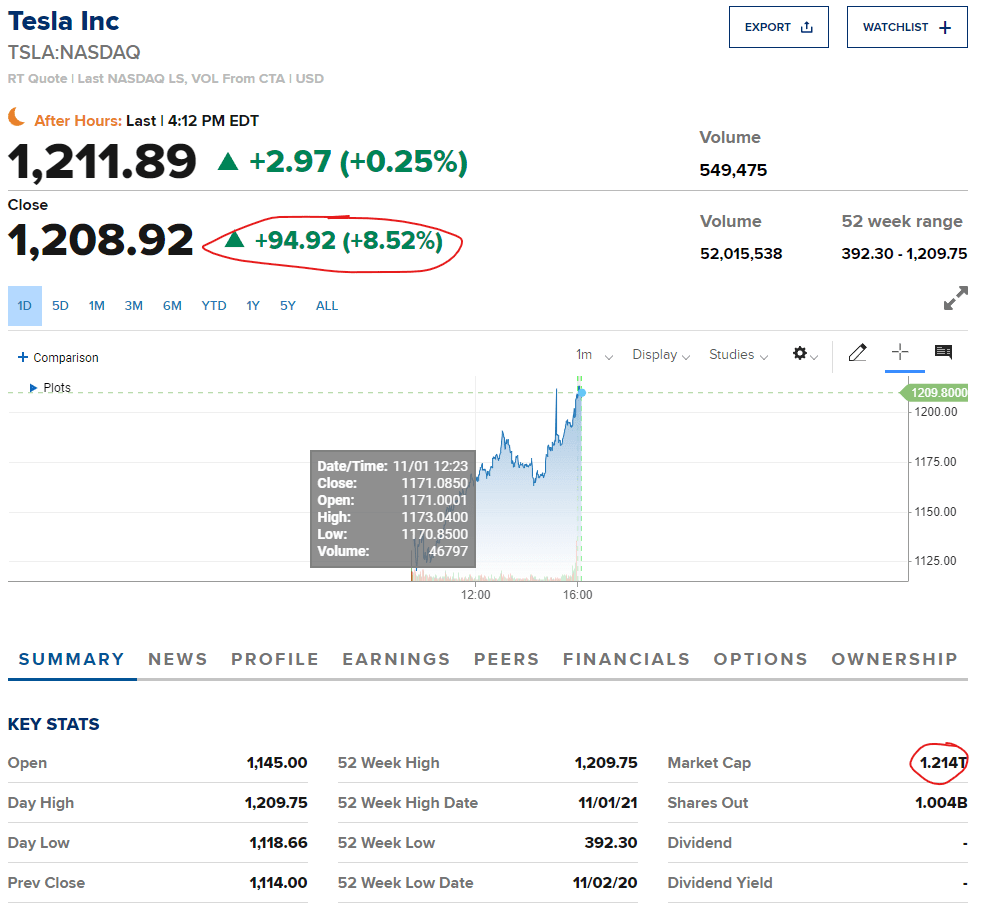

We are not here to opine on the company’s growth prospects, unit-lveel economics, viability of full-self driving, etc. but rather just to note the sheer magnitude of the change in the stock’s valuation based on manic option buying.

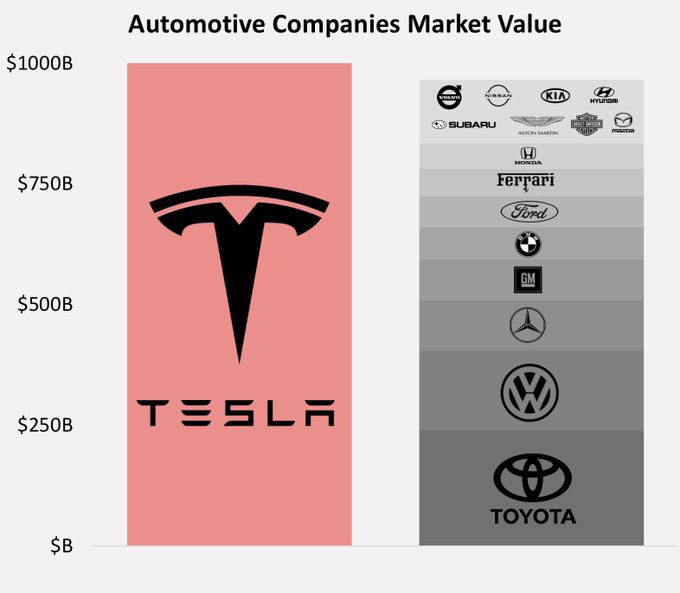

Tesla is now bigger than all the other automakers combined, and gained more market cap in a two-week period than almost the entirety of the smallest 480 companies in the S&P 500.

Bulls would cite that Tesla is more than a car company, solving insurance, artificial intelligence space (although SpaceX is a totally separate company), batteries, software, the list is almost endless. Also, it received an order for 100,000 cars from Hertz.

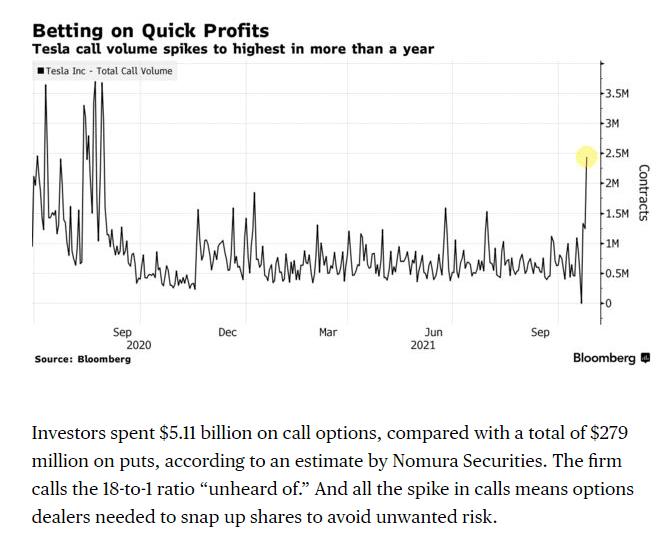

However, the real driver (bad pun, we know) was options trading, per Bloomberg:

Tesla is not the only stock where the options tail wags the stock dog, but such activity is unprecedented and introduces significantly more volatility for those stocks where retail options buying is the fuel on the fire. That’s not to say the stock could not go far higher, rather that a stock with a market cap of over one trillion dollars generally is unlikely to move almost 9% in a single day on absolutely no news for strictly fundamental reasons (from 11/1/2021).

This is fine.

Speaking of fire, this is one of our favorite memes.

So, we feel kind of like the dog right now. Valuations are hot, inflation is here, the Fed is likely going to taper, call options are driving speculative activity.

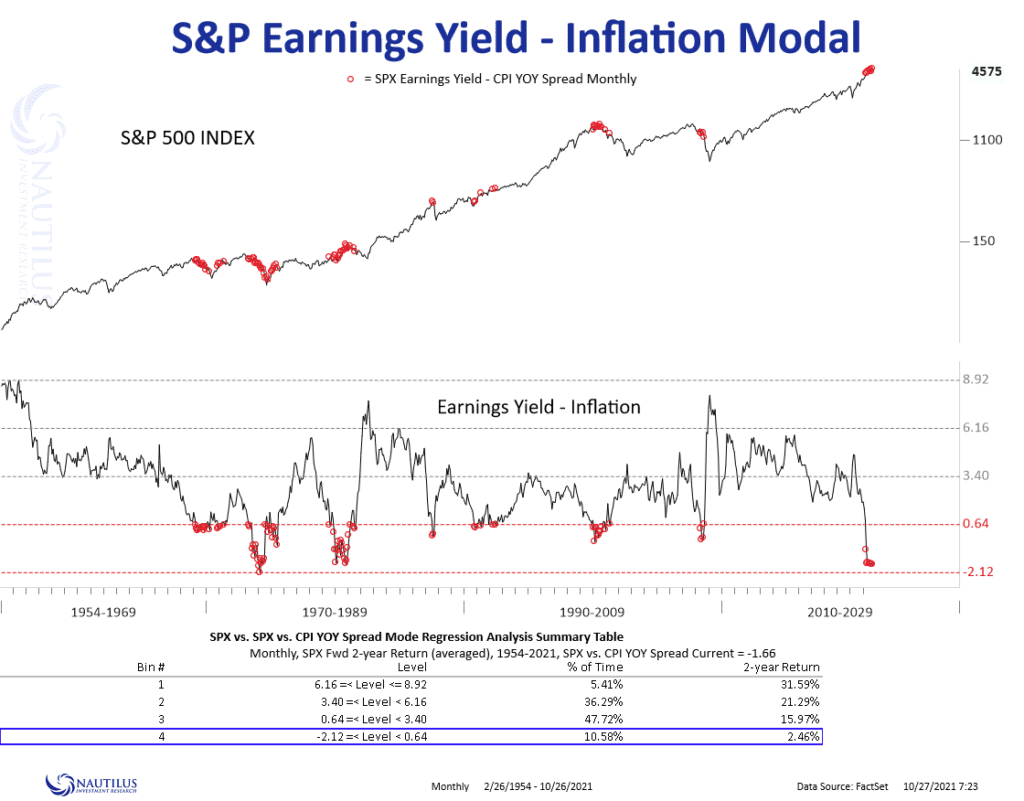

However, maybe this is fine. There are few who would argue valuations are anything but high. If we look on an inflation adjusted basis, we are in rarified air:

If you look closely, though, returns from this point, although paltry, are not negative. High valuations do not necessarily presage a protracted bear market. Also, let us not forget, as active managers, we look to add value during these more challenging periods, especially by investing in names off the well-worn U.S. large cap growth path.

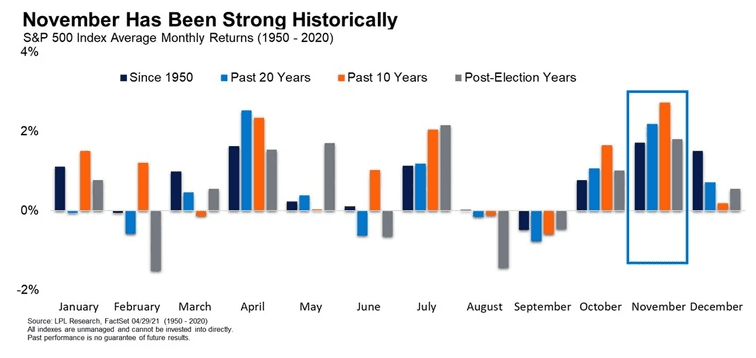

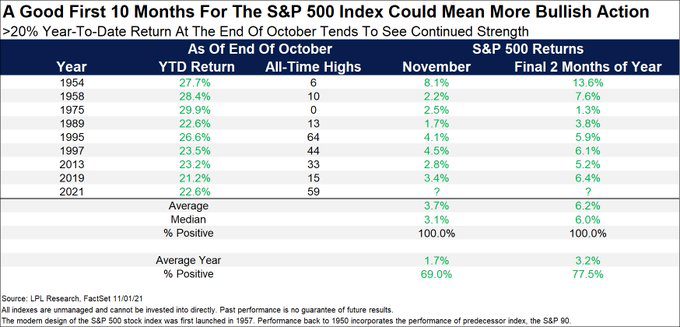

Moreover, from both seasonal and trend perspectives, we have some tailwinds, per research from LPL:

Of course, anything is possible, so we will continue to stay process-oriented and look for opportunities with what we believe are favorable risk/reward based on our investment framework. To return to the beginning, reversion to the mean tends to be a powerful force within markets, which may position more value-oriented and smaller cap names for success.

This is what the other side of the coin looks like (as a reminder, the Russell 3000 Growth Index trades in the 97th percentile from a valuation perspective, i.e., it has almost never been more highly valued):

However, given the seemingly unlimited appetite for uber-growth stocks and speculation in meme-driven assets, reality may diverge from history:

READY TO TALK?