February Update: The Constant

If you think our title sounds like an episode of the TV show Lost, you would be correct. Per Wikipedia, an always reliable source, “’”The Constant” is widely regarded as one of Lost’s best episodes, and arguably the best episode of television produced in the 21st century.” I encourage one of our readers to edit this incredibly hyperbolic entry.

Our actual inspiration is Einstein, but more on him later.

Key Takeaways

- After a dismal 2022, stocks rallied ferociously in January on hopes of a more accommodative Fed and a soft landing.

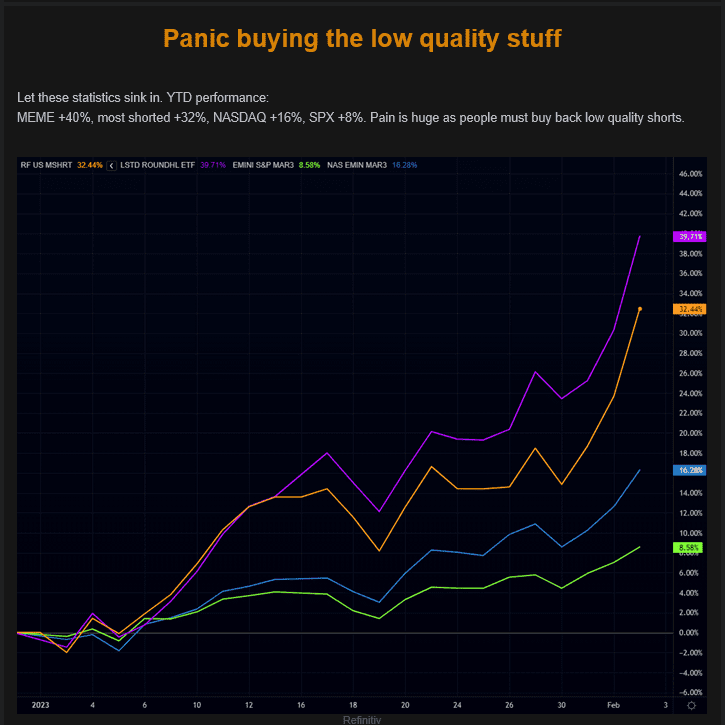

- Performance from a factor and company perspective did a 180-degree turn, with 2022’s worst performers the best so far this year.

- While encouraged by the rebound, the magnitude of the rally juxtaposed with what we have seen from corporate earnings does not change our outlook for a challenging 2023.

January Recap – Through the Looking Glass

Personally, I think Lost’s season three finale, “Through the Looking Glass”, was the best in the series, and it seems appropriate as we consider markets this month. As you may know, this is not just an episode, but, more famously, the sequel to Lewis Carroll’s Alice’s Adventures in Wonderland.

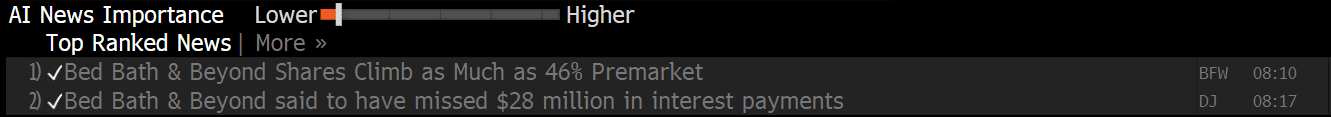

What happens to Alice when she goes through the looking glass is that everything is reversed, which is precisely what happened to markets in January. For us, it seemed eerily reminiscent of February 2021. Look no further than these headlines within seven minutes of one another on Bed Bath & Beyond, wherein shares rallied over 40% while the company was concurrently unable to make its interest payments.

This was congruent with the rest of the meme stock squad, which gained 40% in January. The most highly shorted names gained 32%, whereas cryptocurrencies gained approximately 45%.

Our personal favorite was Carvana gaining over 200% on the following key news items (note that there was no earnings report or other financial data from the company):

- Price target cut to $15 from $25 by JMP.

- Price target cut to $5 from $25 by Wells Fargo.

- Adopting a poison pill to avoid a hostile takeover.

- Cutting 4,000 employees.

- Selling $4 billion in loans.

- Sell recommendation from Jim Cramer.

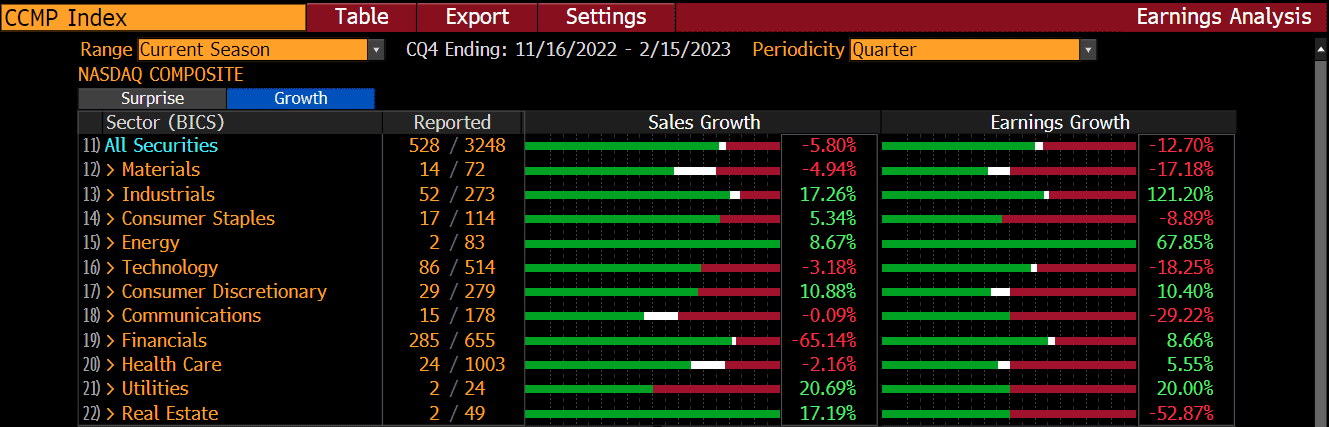

The NASDAQ, the worst performer among major indices in 2022, was up 11% in January and another 5% the first two days of February, while the S&P 500 gained 6%. Perhaps surprisingly strong earnings have buoyed the index, one might reasonably theorize. That theory would be false. Sales have been negative, despite a tailwind from a broad increase in prices (i.e., high inflation) and earnings have declined sharply, especially for larger sectors like technology and communication services.

And yet, in the spirit of old man yells at cloud, no one except us seems to care.

It is incredible how quickly fear has been replaced by the fear of missing out. Look no further than these two data points:

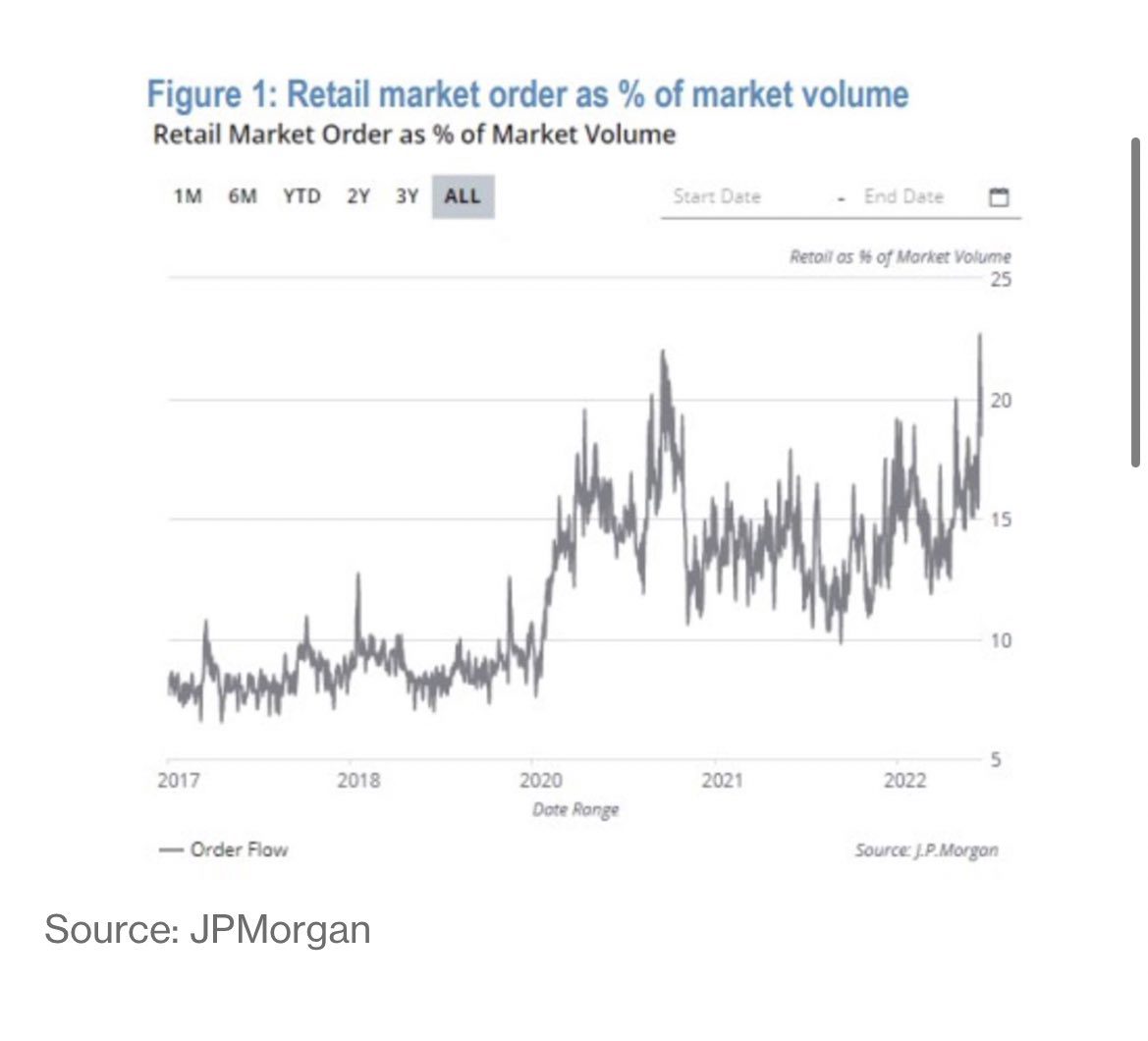

- One, despite suffering sizable losses in 2022, retail investors returned with a vengeance in January, breaking records set in 2020 at the onset of the Robinhood day trading with stimulus money phase of the market cycle:

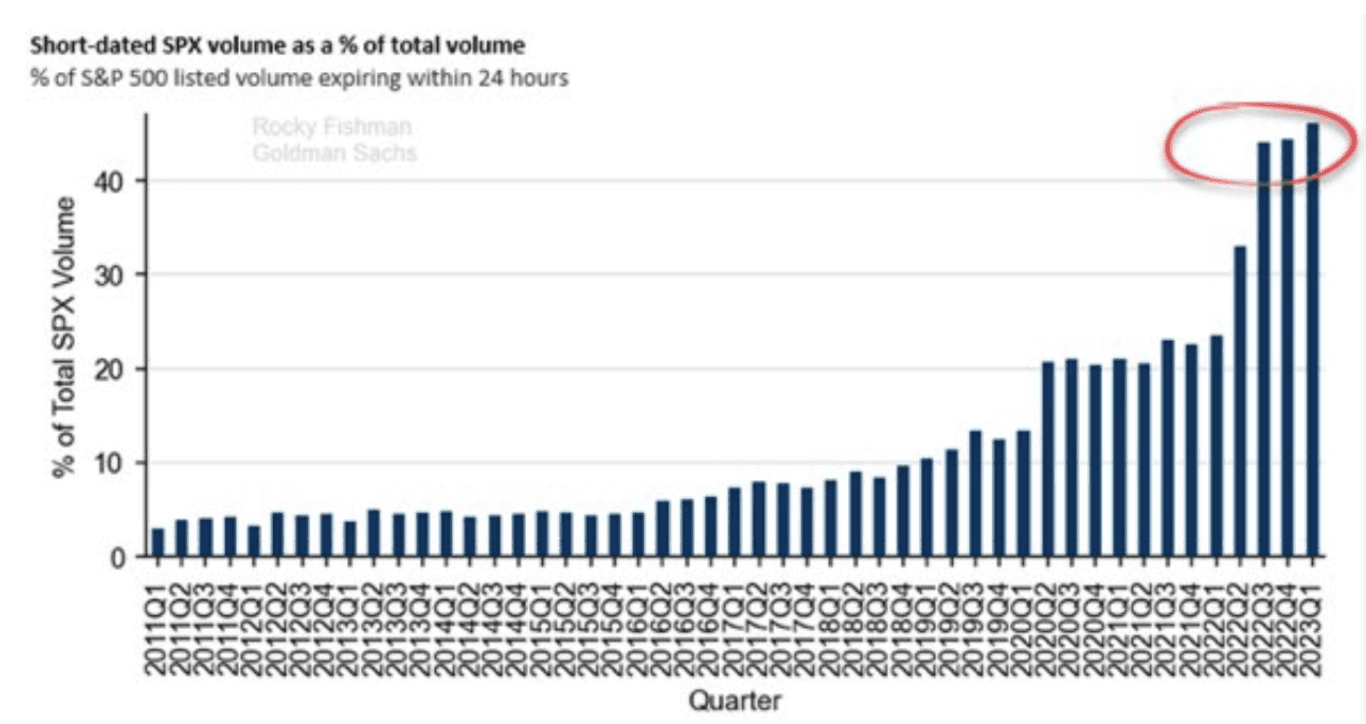

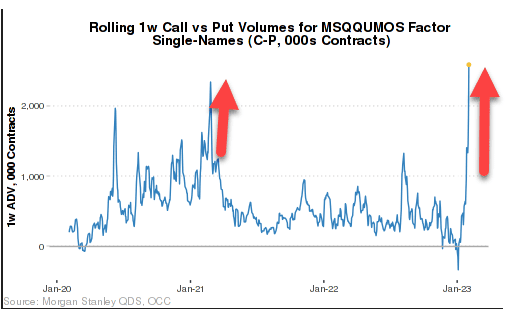

- Second, and more importantly, institutions have found a new way to circumvent pesky things like margin requirements. This new phenomenon is trading in options that expire the day they are bought, so called zero day to expiry (0DTE) options. February 2nd saw the largest U.S. equity option volume ever. 40 million calls were traded, with the two most active contracts near-the-money calls on the S&P that expired on February 2nd.

Why does this matter? Reflexivity. The more the market rises, the more of the underlying index market makers must buy, which prompts more traders to buy calls, which prompts more buying. Essentially, we have a gamma squeeze in the index and individual names are fueled by these options.

Whereas last year almost everything was negative, in January everything was positive. For all the talk of bear markets, only the NASDAQ now has a decline of more than 10% over the past 12 months:

| Index | 1-Month | 3-Month | 1-Year |

| S&P 500 INDEX | 6.28 | 5.75 | -8.23 |

| NASDAQ Composite Index | 10.73 | 5.70 | -17.92 |

| Russell 2000 Index | 9.75 | 4.99 | -3.41 |

| MSCI EAFE Index | 8.12 | 20.45 | -2.21 |

| MSCI Emerging Markets Index | 7.90 | 22.16 | -11.86 |

| Bloomberg US Treasury Total Re | 2.51 | 4.71 | -8.54 |

| Bloomberg US Agg Total Return | 3.08 | 6.39 | -8.36 |

| Invesco DB Commodity Index Tra | 0.89 | -0.40 | 11.60 |

Source: Bloomberg (as of most recent month end)

2023 Outlook – The Constant

Finally, we get to Einstein. In his equations for general relativity, Einstein found that there was an imbalance implying that the universe was expanding, which could not be the case in his mind. Accordingly, he added a constant, what one might pejoratively call a plug number, to get the equation to balance.

Well, as you probably know, Edwin Hubble, the namesake of the space telescope and, according to sources, a surprisingly decent basketball player who led the University of Chicago to a Big 10 title in 1907, came along and proved that Einstein’s original equation, which mathematically predicted an expanding universe, was actually accurate. Einstein called his decision to modify the equation with the constant his “greatest mistake”.

In our January update, we wrote extensively about our outlook for 2023. Looking at the market’s stunning rebound vs. our less enthusiastic perspective based on our equations, it would be easy to argue that we need to add a constant. We take solace in knowing that even Einstein gets it wrong sometimes, or at least once.

The following table reflects our expectations of the most likely way each factor may affect returns in 2023:

| More Negative | Neutral | More Positive | |||

| Inflation | ≈ | ||||

| GDP Growth | ≈ | ||||

| Fed Policy | ≈ | ||||

| Interest Rates | ≈ |

||||

| Credit Spreads | ≈ | ||||

| Stock Multiples | ← | ||||

| Earnings Growth | ≈ | ||||

| Deteriorating | ← | ||||

| Status Quo | ≈ | ||||

| Improving | → | ||||

Let’s look at each factor briefly.

- Inflation – Negative but not worsening. We will get to the Fed momentarily, but Powell’s frequent (eleven by our count) references to “disinflation” at his press conference on February 1st might end up being the 2023 version of “transitory”. Many in the disinflation camp point to the unprecedented negative year-over-year growth rate in money supply, but this fantastic piece by the “Inflation Guy” explains why the velocity of money is likely to provide a lagged (and profound) upward bias on inflation regardless of the growth rate.

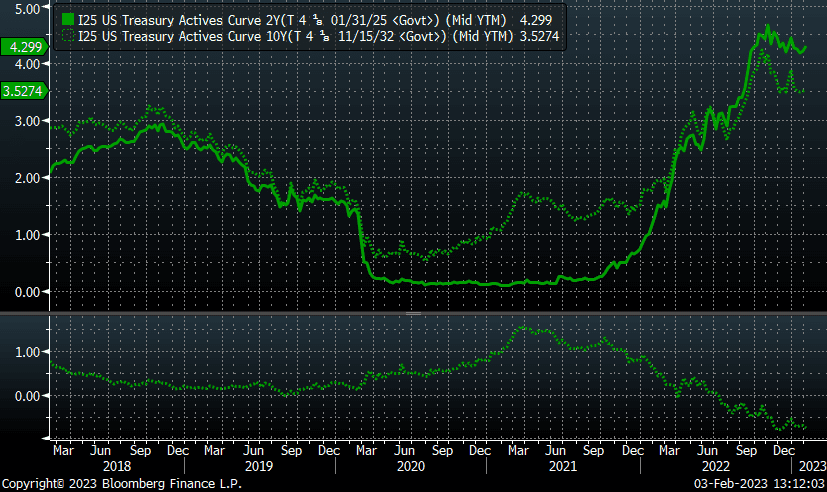

- GDP Growth – Negative but not worsening. Real GDP increased 2.1% in 2022, down from 5.9% in 2021. Given the lagged effect of interest rate increases, it seems unlikely 2023 would see stronger growth. The inversion of the yield curve (a sizable 0.78% on the 10-2 curve), in both magnitude and breadth, typically coincides with worsening GDP growth and/or a recession.

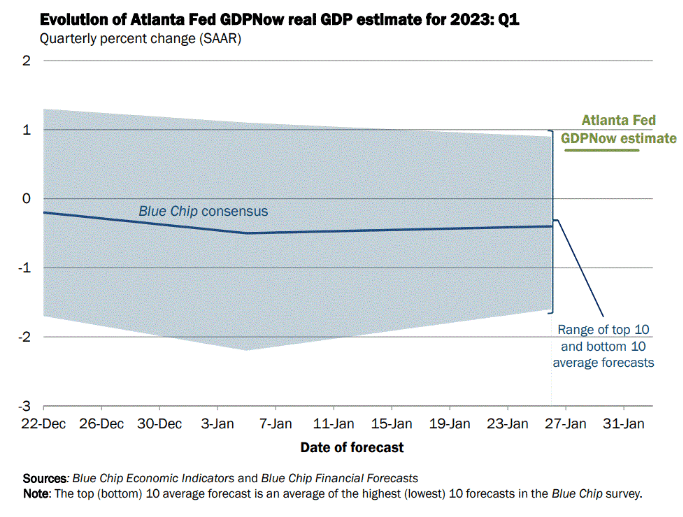

While the Fed is projecting tepid growth, forecasters are looking for a modest decline in GDP:

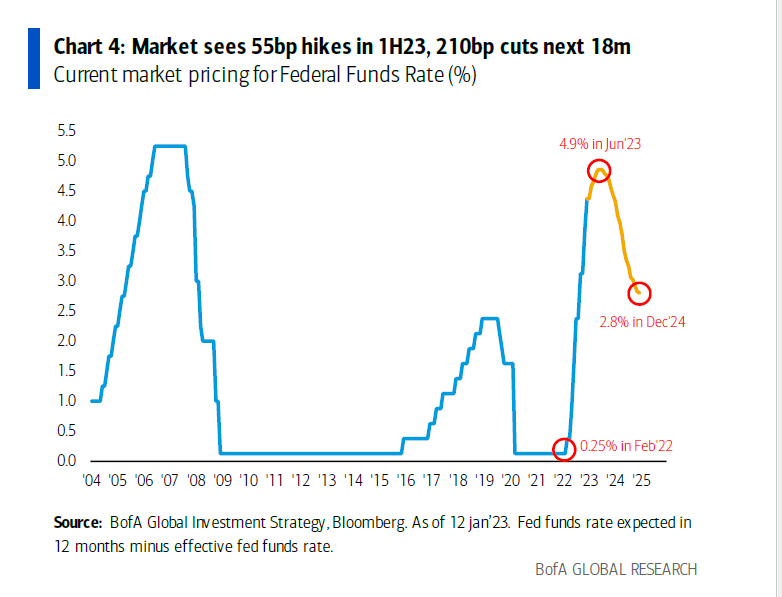

- Fed Policy – Negative but not worsening. This is where we seem to disagree with the market, given the response to the Powell press conference (risk on, rates lower). Over the last 30 years, the market has never priced in rate cuts while the Fed was still hiking, until now.

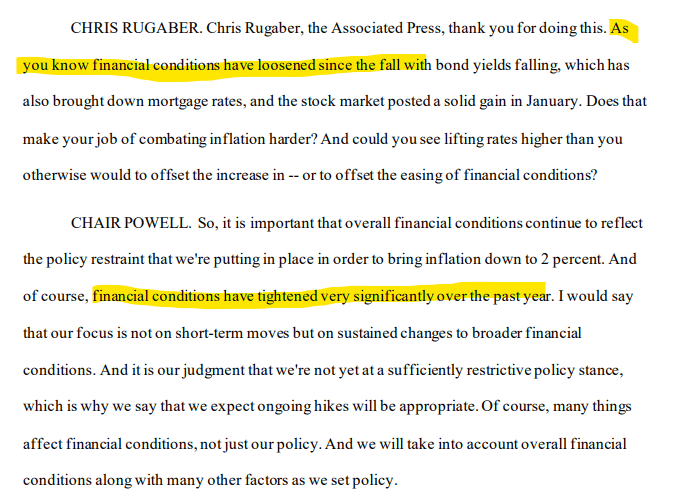

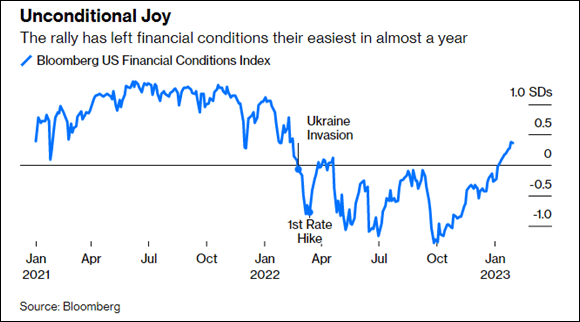

The key assertion (delusion may be the better word) was Powell repeatedly stating that financial conditions have tightened since the Fed began raising rates:

The reality is that conditions are easier than:

- Before the Ukraine invasion.

- Before the first rate hike last March.

- The average over the last decade.

Powell, at one point, was seen as the reincarnation of legendary inflation slayer Paul Volcker. However, if we believe his comments from the press conference he may, in fact, be more akin to Arthur Burns, infamous for not finishing the fight against inflation in the 1970s .

- Interest rates – Negative but not worsening. The key factor here is that mortgage rates, which hit 7% but have declined to around 6%, are congruent with the 10-year Treasury and its new home around 3.5%. We are seeing some damage inflicted on the housing market, but the knock-on effects on employment have not appeared. Yet. In fact, payrolls for January surged and the unemployment rate hit a 53-year low.

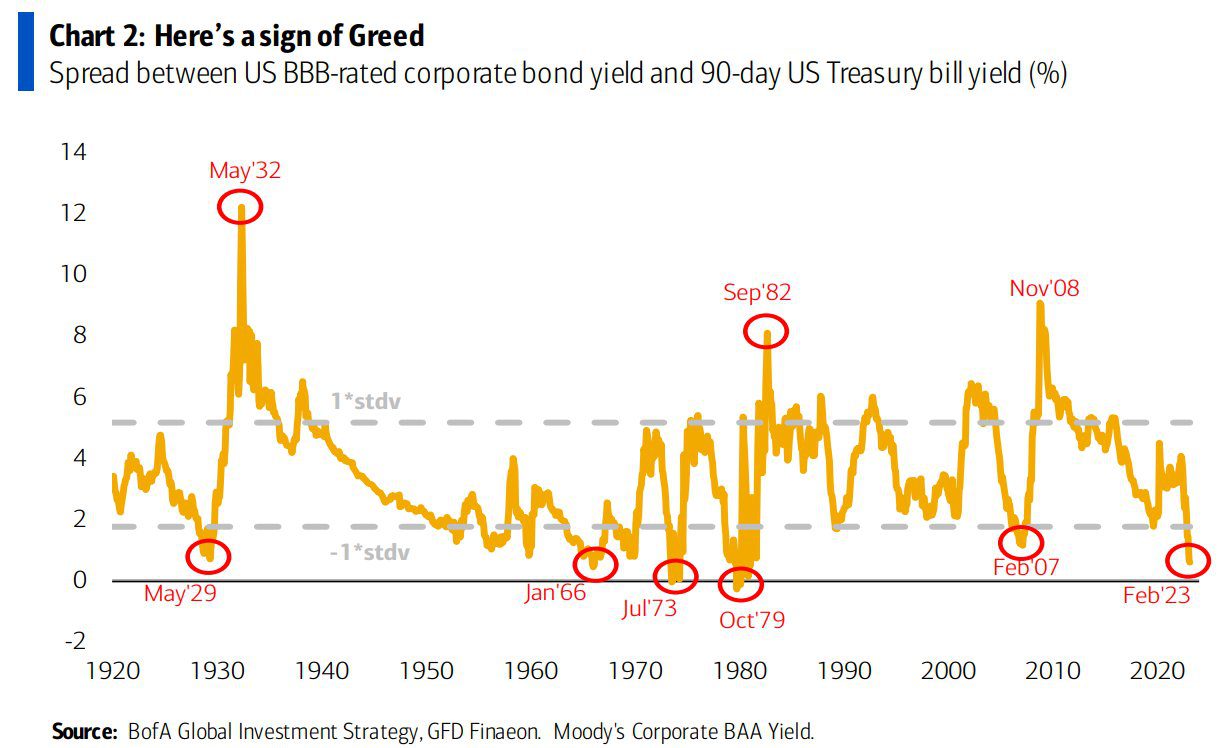

- Credit spreads – Negative but not worsening. Spreads do not reflect the likelihood of an economic slowdown. High-yield spreads are below their long-term average and have tightened this year. The spread between the risk-free rate (90-day Treasuries) and BBB credits is approaching zero, indicating a tremendous appetite for risk.

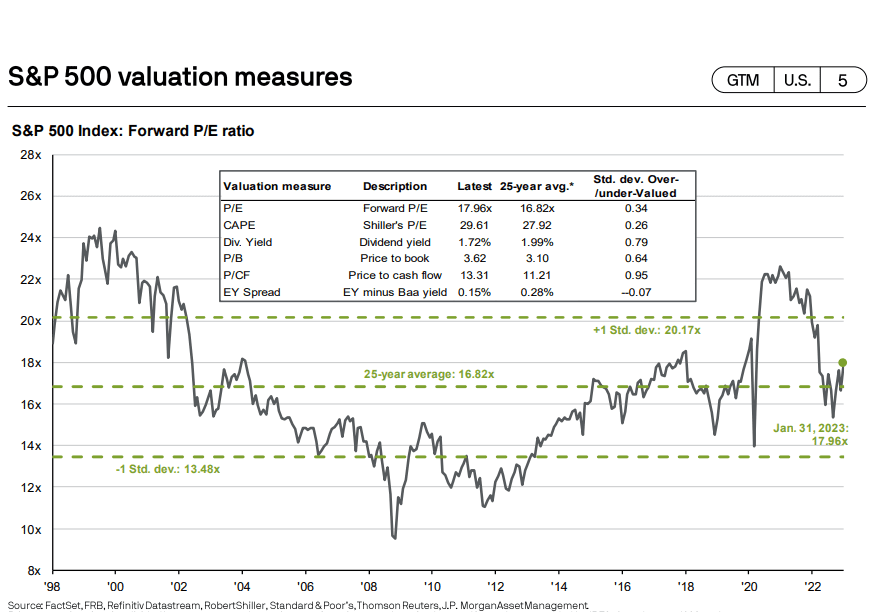

- Stock multiples – Deteriorating to negative. After an 18% decline in 2022, multiples for the S&P reflected a fair valuation as of year-end. However, its January bounce puts it back into the overvalued, albeit slightly, camp. Anyone who states stocks, in aggregate, are “cheap” at this point is simply delusional. On a P/E basis, only two sectors (energy and communication services), are cheap versus their longer-term averages.

- Earnings growth – Negative but not worsening. We referenced the NASDAQ’s earnings disappointments earlier. It is a similar story for the S&P 500. With ½ of the index having reported, sales have grown 5% while earnings have declined over 3%.

Conclusion – Impossible Things and Gravity

Whereas physics is governed by the laws of science, markets are governed, at times, by the psychology of crowds. From our perspective, the only thing that moved, as far as our process, is that market valuations moved from neutral to a slight headwind, given that the market rally was not accompanied by earnings growth.

It reminds us of this exchange between Alice and the Queen:

“Alice laughed: “There’s no use trying,” she said; “one can’t believe impossible things.”

“I daresay you haven’t had much practice,” said the Queen. “When I was younger, I always did it for half an hour a day. Why, sometimes I’ve believed as many as six impossible things before breakfast.”

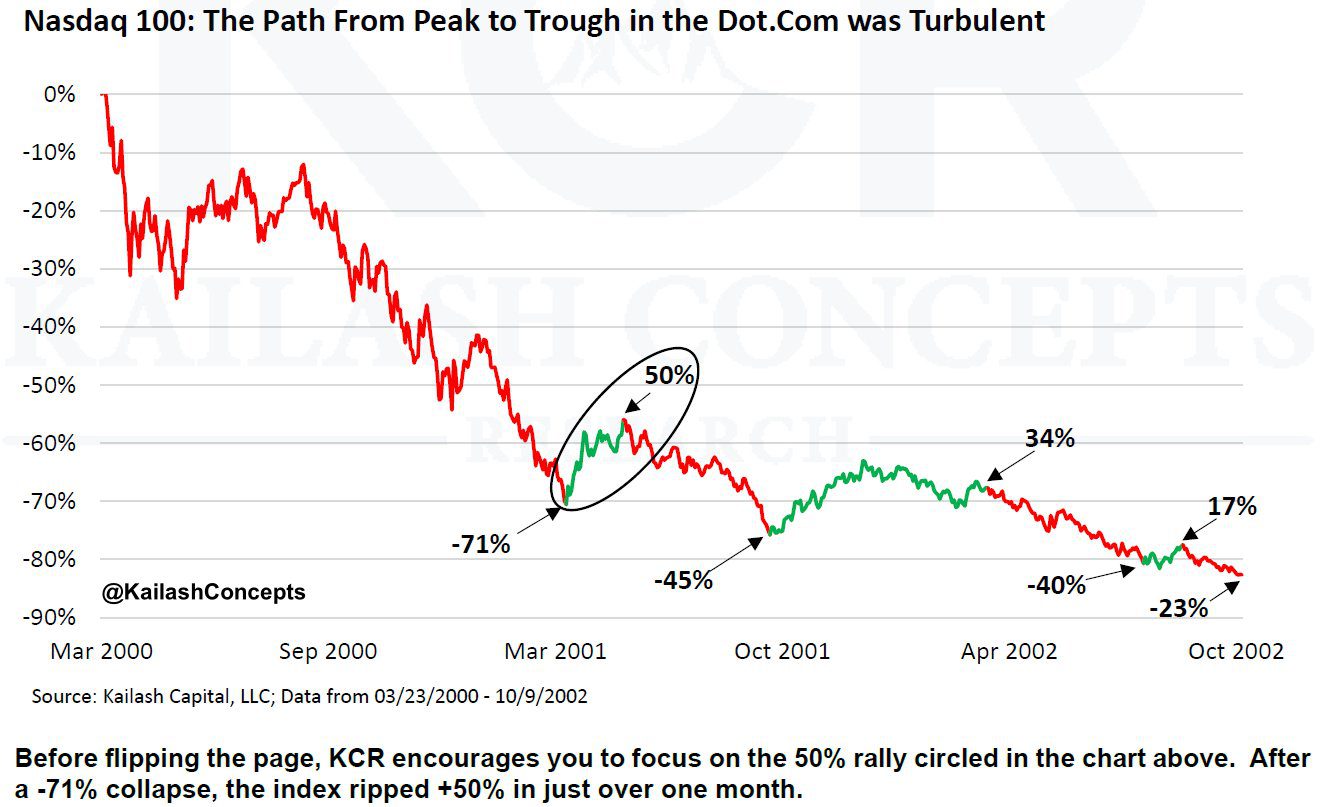

If you think it is impossible for this type of rally to continue, you need more practice. The unwind of the technology bubble had a 50% bounce in a little over one month at one point:

Cathie Wood’s self-proclaimed “new NASDAQ” (i.e., the ARK Innovation Fund) has bounced 42% this year, though remains 72% below its all-time high. Accordingly, she may want to familiarize herself with this chart before staking that claim and doing many more victory lap interviews.

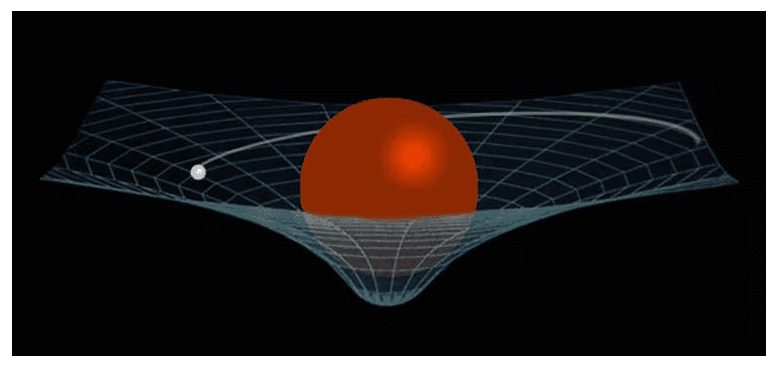

The best way to think about the current market environment is to consider gravity. Newton thought about gravity as a constant, instantaneous force that pulled things to the ground. He was brilliant but wrong here, as neither physics nor markets work this way.

Einstein got gravity right, with his notion of mass warping space (technically space-time, but we are going to leave that for another day, or never). Heavier objects warp space more.

Let’s say you have a trampoline. If you set a 6-pound bowling ball on the trampoline, it will warp space some; a 12-bound ball will warp it more. If we think of the market like this trampoline, the seven factors in our model are all incremental weight being added to the bowling ball. The marble is the market. All things being equal, these factors make it more difficult for the market to achieve escape velocity. However, as January proved, it is not impossible.

In an ironic though possibly apocryphal point of tangency, Newton is alleged to have said he could “calculate the motions of the heavenly bodies, but not the madness of people” in relation to the loss of a sizable investment in the South Sea Bubble of 1720. This ‘madness of people’ is akin to the Queen’s “impossible things” or, as our friends at Ruffer called it in a recent piece, cognitive dissonance. As they state, “This looks like a case of cognitive dissonance – believing several conflicting ideas at the same time. The stronger the economy, the stickier inflation is likely to be and the less likely the Fed is to cut rates. But stock markets are now assuming an almost impossible trinity of events: better growth and no recession, rapidly falling inflation, and interest rate cuts by the end of the year.”

One thing that will remain constant is our commitment to managing risk and looking for opportunities despite the gravitational pull of challenging macro conditions.

READY TO TALK?