Update: The Guns of August

After spending the last few months mired in pop culture, seems we should diversify this month and look to one of our favorite books, an underappreciated tome on an underappreciated topic: World War I. Generationally, many of us have a connection to World War II, and there has been much more ink and media committed to the sequel than to the Great War. Having said that, the seeds of WWII were planted on the fields of Verdun and the conference tables at Versailles.

The Guns of August focuses on the lead-up and first month of the war. While almost everyone cites the assassination of Archduke Franz Ferdinand on June 28, 1914 as the casus belli (it is the extent of most people’s knowledge of WWI to be fair), a conflagration among Europe’s great powers was inevitable for reason’s far beyond the death of the Austro-Hungarian heir to the throne.

Not to mix metaphors (and books) but Ed Thorpe is a little known yet legendary investor (not to mention the father of card counting who was run out of multiple casinos); who stated in his memoir, A Man for All Markets, “(I)t’s always hard to know when you are in a bubble, and if you are in a bubble, when it is going to pop. It’s a lot like the chaos theory image of dripping sand onto a little pile that’s shaped like a cone on the beach. The pile gets higher and higher and finally suddenly there will be a little avalanche.” To pile on (pun intended), more famous (and prickly) economist Nassim Taleb stated in his book, Fooled By Randomness, “It could be said that the last grain of sand is responsible for the destruction of the entire structure. What we are witnessing here is a nonlinear effect resulting from a linear force exerted on an object.”

In retrospect, the assassination is the easily identifiable proximate cause of the war. However, decades of stress over borders, colonial holdings, domestic politics, access to resources, etc. built the tenuous geopolitical structure that collapsed in the summer of 1914.

We tend to eschew hyperbole here, but we do want to look at the geopolitical, social, and market conditions we see at present and what impactful grains of sand may be lurking.

Delta Variant

Coincidentally, one insidious by-product of WW I, specifically its crowded and unsanitary camps along with mass troop movements across the theater (and the globe), was the Spanish Flu outbreak (reminder: it was known as the Spanish Flu due to propaganda efforts by the primary combatants in the conflagration, of which Spain was not one). That virus hit in 1918, regrouped, then struck again in 1919. Sound familiar?

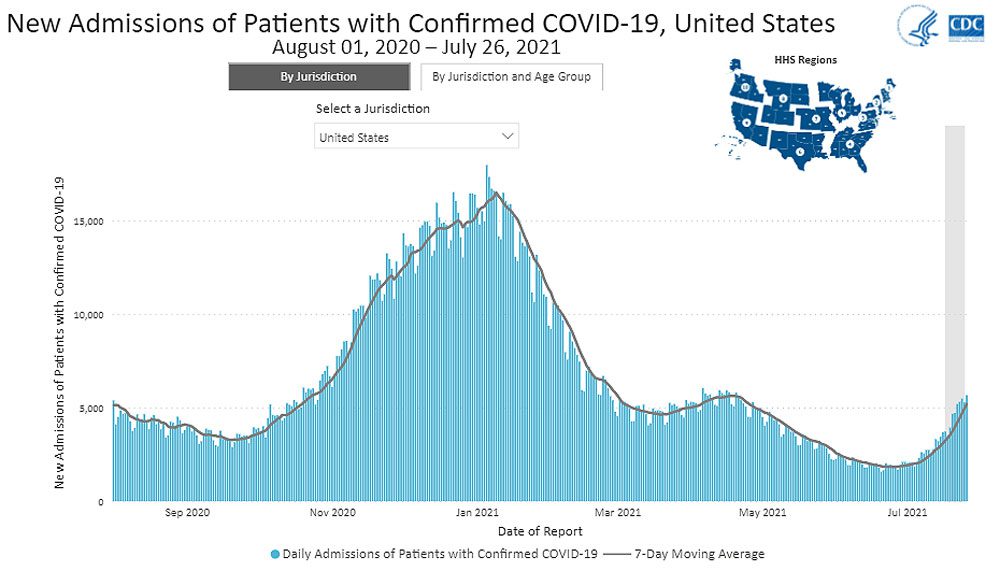

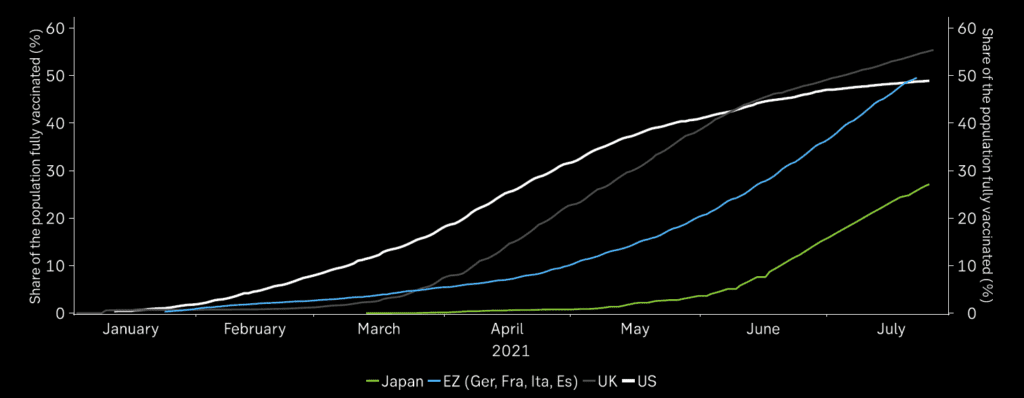

What we are seeing with the Delta variant is certainly reminiscent. We talk at length about the topic on a recent podcast (and have been sounding the alarm for months in our newsletters). To this point, we have felt like the boy who cried wolf. However (spoiler alert) the wolf does appear…eventually. Domestically, we see worrying trends and the main curve flattening is, unfortunately, that of vaccinations.

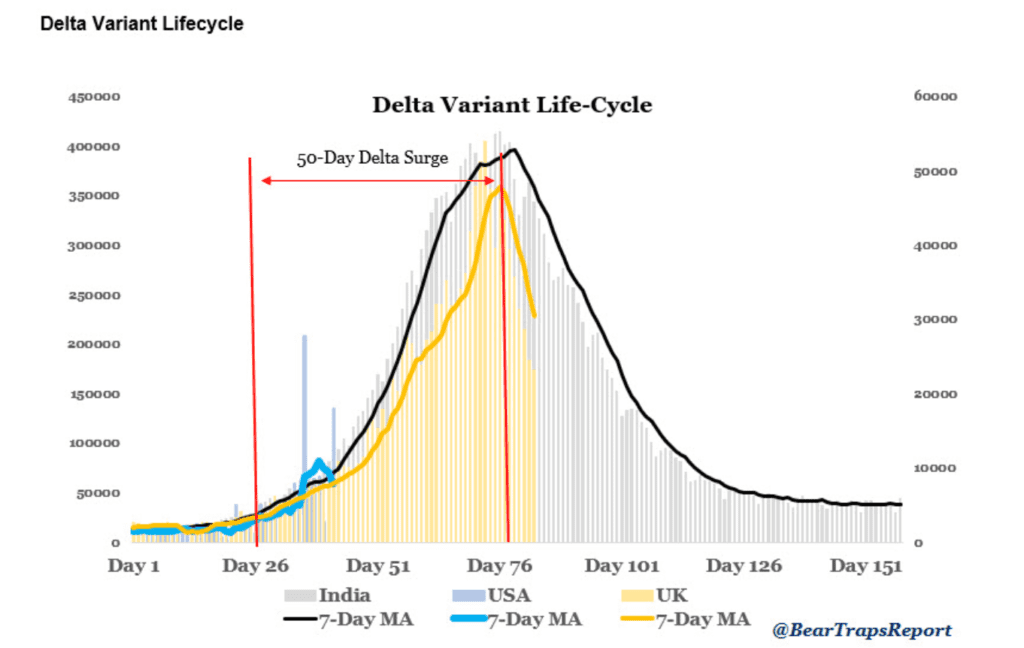

If we look to India and the U.K. as analogs, we have a way to go before things improve:

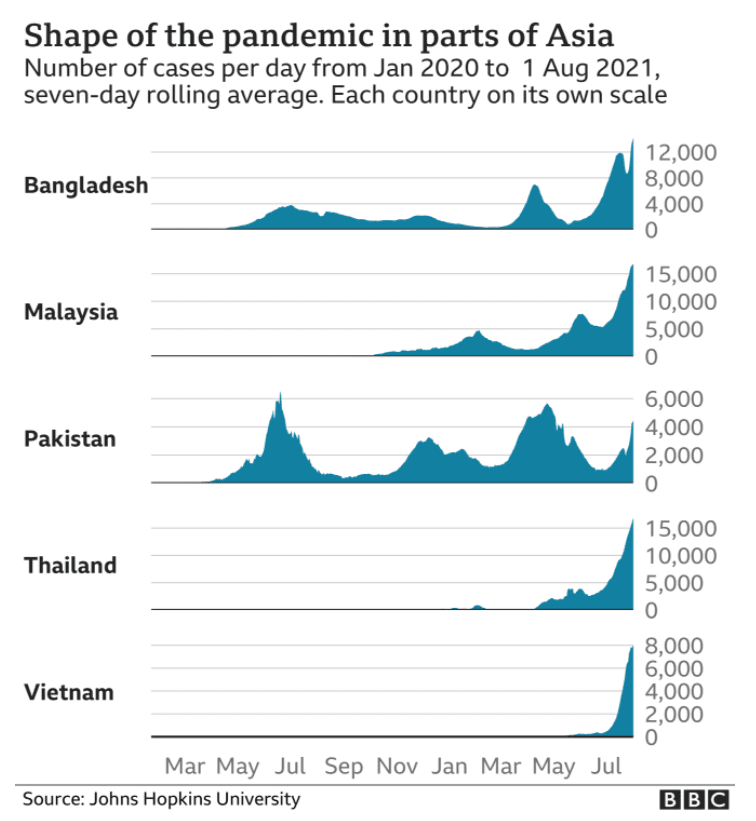

Worryingly, the outbreak in parts of Asia is rampant, and even China has begun to reimpose lockdowns.

The velocity of the Delta-variant’s infective and transmission rate is such that all the U.S. will have some biological immunity by December of this year, based on the current velocity of positive test results. Simply, if one is infected with any variant, whether it be Delta, Lambda, or Covid Proper, etc., biologically it would be expected that some resistance is built around this exposure. The cumulative consequences of these engagements by humans are undetermined. In other words, we could see a significant subsector of our society with long haul symptoms, and/or significant elevation in mortality. Sadly, this will likely occur after the tsunami of cases that is currently building in our communities. Shakespeare’s Witches of Macbeth seemingly are making an appearance here “by the pricking of my thumbs, something wicked this way comes.”

In addition to the human cost, the variant is stressing societal institutions, medical care, and supply chains globally. In reading through earnings reports and talking with companies, these supply chain issues are becoming more impactful and are paradoxically causing demand destruction and inflation.

Geopolitics

The world in 1914 was a tinderbox. While it would be hyperbolic to say things as are as contentious now, there is certainly simmering tensions between the West and China. The U.S., U.K., and Germany have all been active in patrolling the contested South China Sea , while the Chinese have simulated military drills associated with an invasion of Taiwan, and proclaimed China’s sovereign rights over the island. The Japanese have also been more aggressive in their involvement with mutual defense pacts, causing the Chinese consternation.

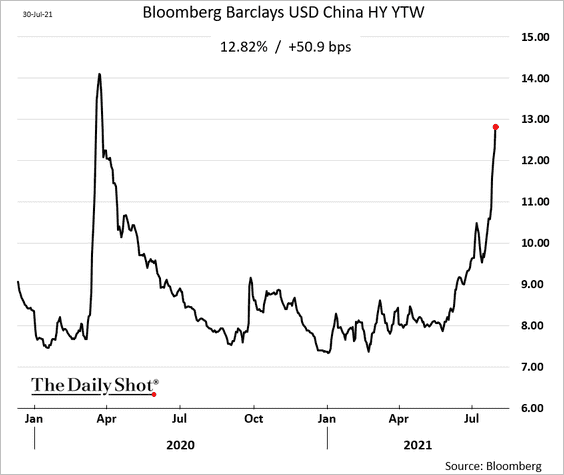

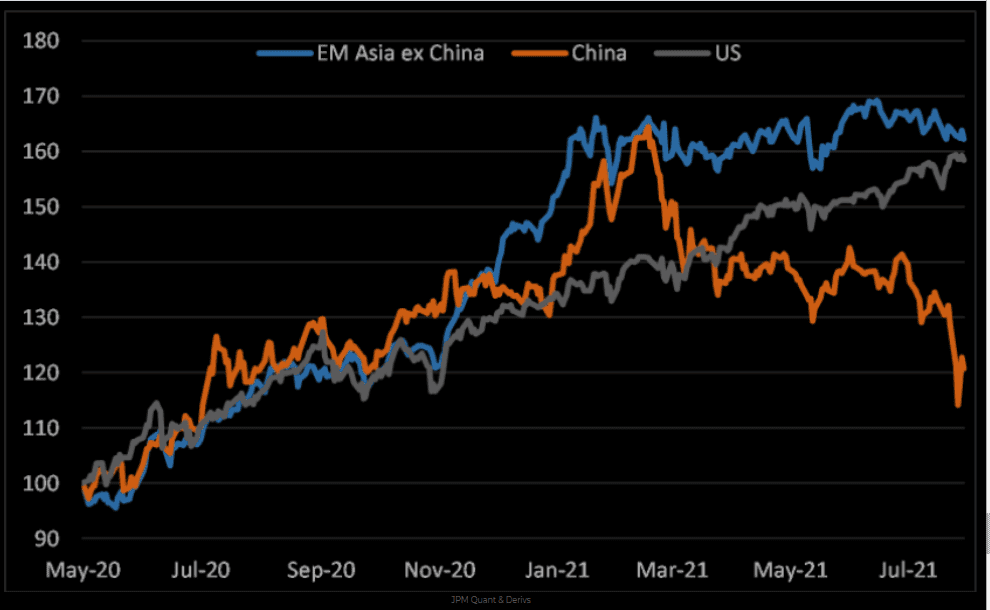

Moreover, China has taken regulatory action regarding several of its U.S.-listed companies, specifically involved in for-profit education, though the collateral damage has vaporized billions of dollars in shareholder value. Given the largest holders of most of these names are American investors, we doubt the politburo is overly concerned. This action has exacerbated what was already a struggling market for Chinese equities since their peak in February of this year. Chinese corporate debt, specifically in the high yield sector, has also been weak, approaching its COVID-level highs in terms of yield. This is an ominous portent, especially when combined with high levels of margin debt in the equity market.

However, we have not seen fragility in China’s currency; any significant stress in the yuan could be one of those grains of sand that exposes the fragility we mentioned previously.

The long-term performance divergence between the U.S. and China since the financial crisis is staggering.

Ever-present issues in the neighborhood of the erstwhile Ottoman Empire are also at the fore, though so far nothing has transpired that might affect the supply of oil from the Persian Gulf.

Finally, frosty relations between the U.S. and Russia continue to degrade, with more diplomatic expulsions and heated rhetoric. At a speech in late July, Biden stated the U.S. could, “end up in a real shooting war with a major power,” and that Russia has “”nuclear weapons, oil wells and nothing else.” Call me old fashioned, but those are two things that might be helpful in damaging an opponent.

Divergence

At the start of WWI each side was convinced of an easy victory and myopically focused on their plan. For the Germans, it was the sacrosanct Schlieffen plan; the plan’s namesake allegedly stated on his deathbed”, “keep the right wing strong”, an allusion to the crushing blow intended to be delivered on the French left flank. The French, on the other hand, were fixated on smashing through the German middle.

Both sides were almost brought to ruin in August while dogmatically executing their respective plans. The French, especially, refused to see the risk associated with the German offensive until it was almost too late, with the Germans advancing within a few miles of Paris. Years of stalemate and trench warfare followed.

This brings us, finally, to markets. If we were to simplistically bifurcate investors into two warring factions, equity and fixed income, we would see each has a singular fixation.

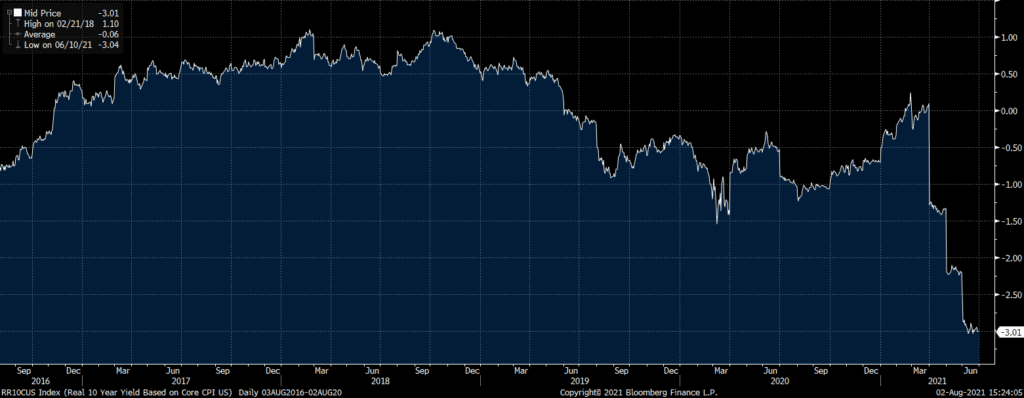

Bond investors have driven the yield of the 10-year Treasury down to 1.17%, roughly in-line with where it was in January. A non-event, right? Not exactly. Compared with inflation (at least as measured by the Consumer Price Index “CPI”) real, i.e., inflation-adjusted, yields have not been this low since the early 1980s. The expectation, at least as we see it, is that inflation is not only proven transitory, but also precedes deflation.

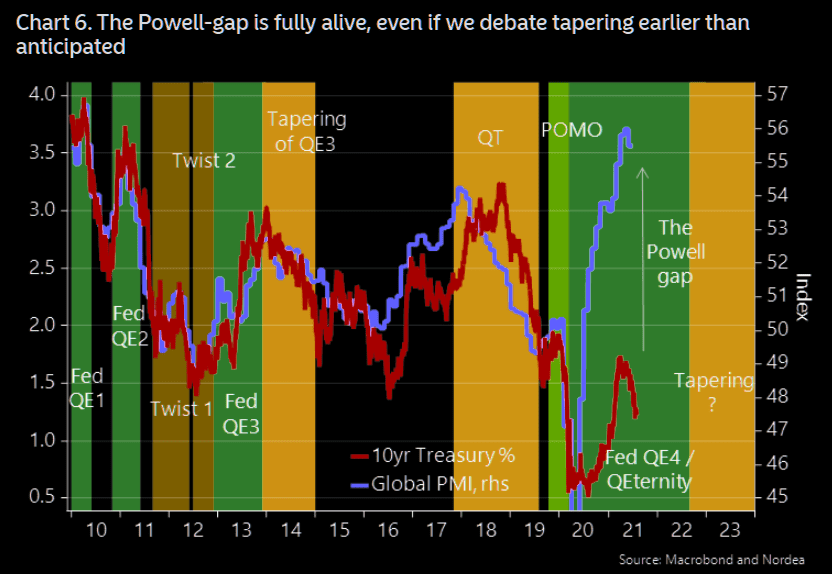

Look no further than this colorful divergence between global PMIs (a measure of economic activity) and 10-year rates:

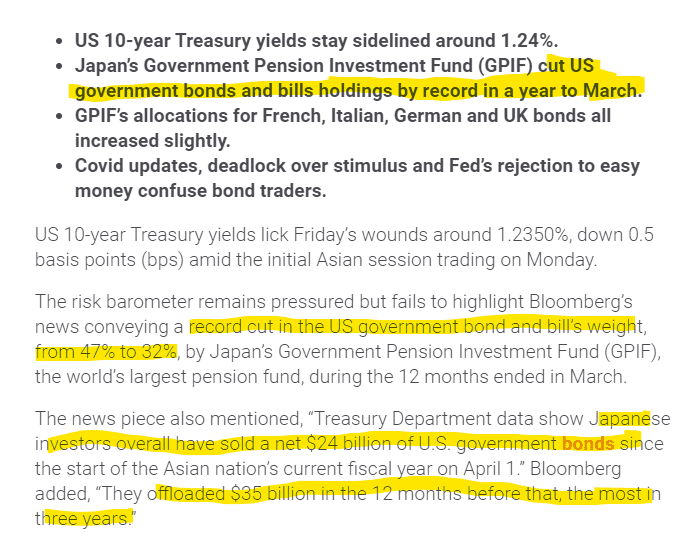

Also, the climb earlier this year may have been the result of Japan’s national pension fund cutting its exposure to U.S. debt.

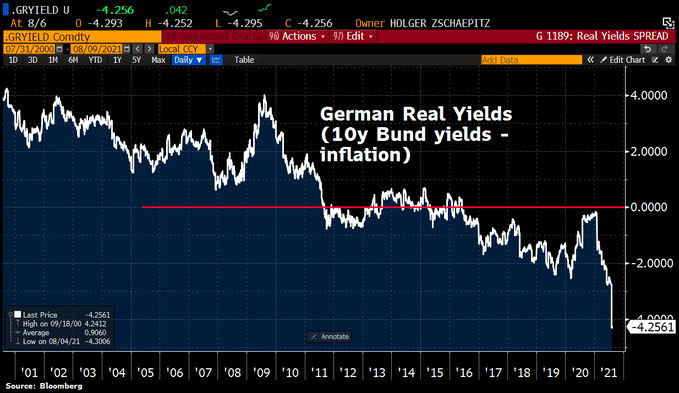

For bond investors, the fixation is the Fed’s balance sheet and seeming willingness to control the yield curve through incessant balance sheet expansion, with the current size in excess of $8 trillion. In other words, quantitative easing “QE” in perpetuity is the base case for fixed income investors, and it is not just the case domestically. German bond yields (in real terms) are even lower:

Equity investors are like the French here, focused, in this case, on earnings growth, perhaps unaware of the risk on their flanks from rate normalization or cessation of QE. Earnings for Q2 are on pace to show over 20% year-over-year growth for the S&P 500, the largest such increase ever, with expectations for 2021 earnings now above their pre-pandemic levels, which is a shocking statistic.

Once again, mega cap U.S. stocks were the best performers, with a handful of companies leading the charge. Retail call buying in these mega cap favorites resembles the call buying we have seen in meme stocks like AMC and GameStop, calling into question the durability of this phenomenon. Diversification into smaller stocks or non-U.S. stocks has detracted from investor performance so far in 2021, especially lately.

| Index | 1-Month | 3-Month | YTD | 1-Year |

| S&P 500 INDEX | 2.38 | 5.50 | 17.98 | 36.43 |

| NASDAQ Composite Index | 1.19 | 5.27 | 14.26 | 37.59 |

| Russell 2000 Index | -3.61 | -1.54 | 13.29 | 51.94 |

| MSCI EAFE Index | 0.77 | 3.00 | 10.05 | 30.97 |

| MSCI Emerging Markets Index | -6.69 | -4.31 | 0.28 | 20.97 |

| Bloomberg Barclays US Agg Total | 1.12 | 2.16 | -0.50 | -0.70 |

| Bloomberg Barclays US Treasury | 1.36 | 2.36 | -1.25 | -3.01 |

Source: Bloomberg (as of most recent month end)

Fixed income has generally detracted from returns over the past year as well. Any counterattack by the bond vigilantes or hint of tapering from the Fed has the potential to cause meaningful carnage, given the low absolute level of yields. The Fed’s policies are starting to draw attention from at last one legislator, U.S. Senator Joe Manchin, who stated in a letter to Fed Chairman Jerome Powell “ …I am increasingly alarmed that the Fed continues to inject record amounts of stimulus into our economy by continuing an emergency level of quantitative easing (QE)…”

Valuation

Valuation is typically not the grain of sand that causes a precipitous market decline, but rather is one of those things that is a structural source of instability. While one could argue that inflation is running abnormally hot right now, adjusting the earnings yield (the inverse of the P/E ratio) for inflation puts us at a level from which market returns tend to be less than scintillating.

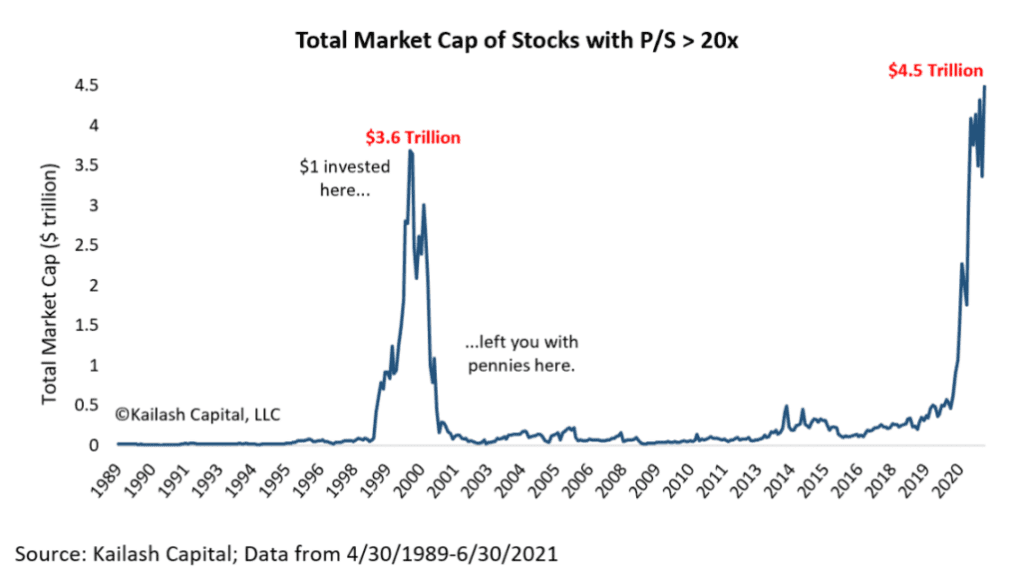

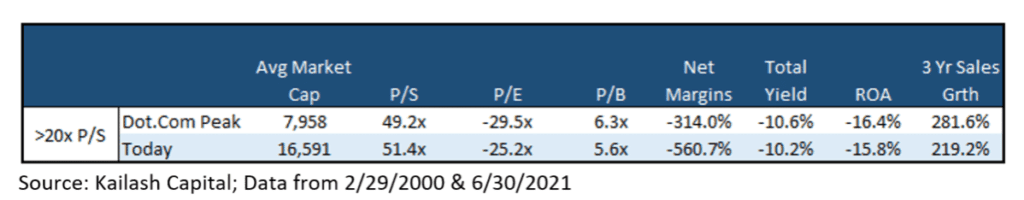

Moreover, the most speculative stocks (those with price to sales ratios over 20) are in a similar stratosphere to where they were during the tech bubble, according to data from Kailash Capital.

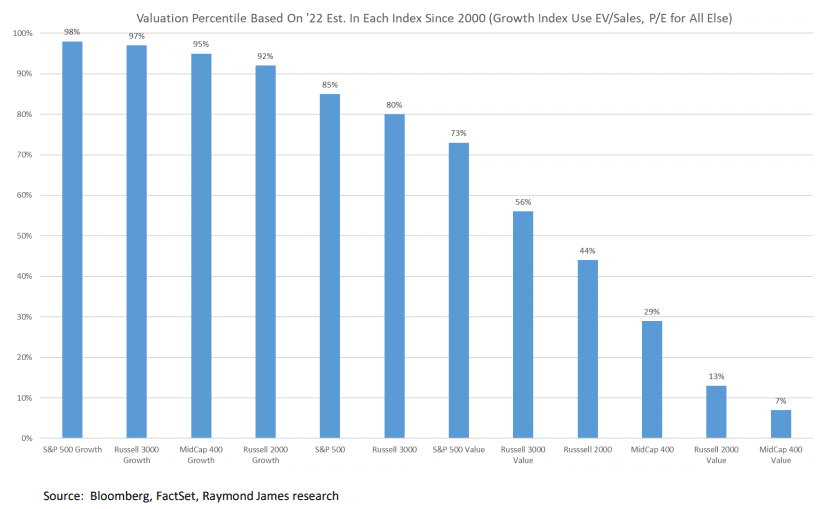

We see a similar pattern elsewhere, with growth indices among the most expensive they have been in history versus smaller cap and value indices, which are relatively inexpensive:

The Guns of August?

As with many conflagrations, the guns of August were coupled with esprit de corps from the troops and expectations of being home before the leaves fall. However, by the time the calendar turned, both sides realized the folly of their predictions of easy and quick victory.

Although WWI had its share of fatalities among higher ranking officers (legendary WWII generals like Montgomery, Rommel, and Patton were all wounded on the front lines in WWI), the rank-and-file infantry fared the worst.

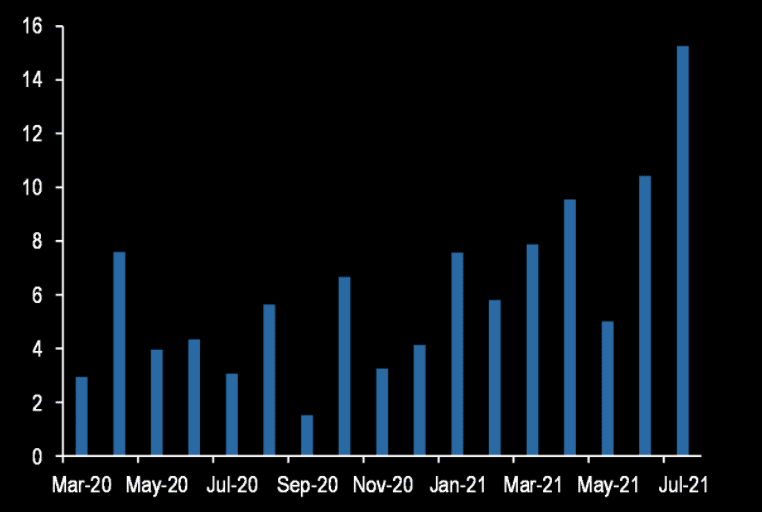

From a market perspective, our concern is that retail investors are like the rank-and-file infantry, and they are piling into equities in unprecedented fashion. The following shows year-to-date flows:

What gives retail investors the impetus to leave the trenches? Ongoing fiscal largesse which could be coming to an end, deferrals of certain obligations such as eviction moratoriums and student loan forbearance remain in place, and belief that equity market risk no longer exists.

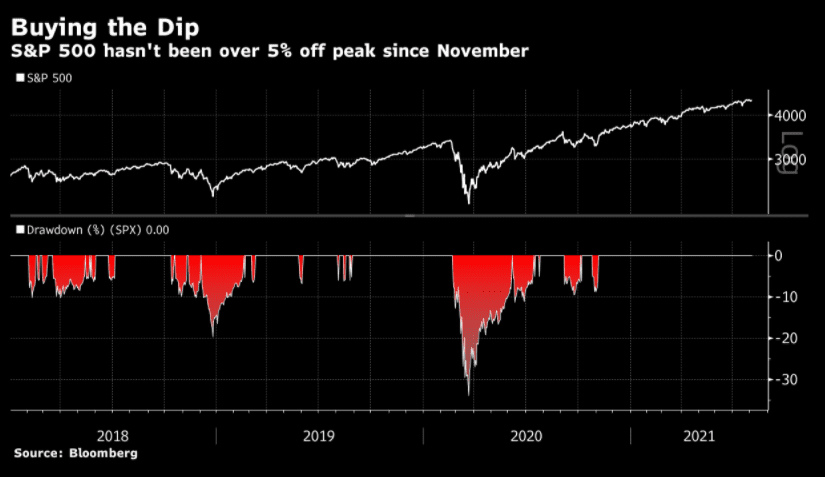

In addition to complacency about risk against a backdrop where there has not been a meaningful drawdown in over nine months, we are mindful of divergences. The current jaws opening between Manufacturing PMIs (a measure of economic strength) and bond yields gets our attention. The inference is that either we are due for a major economic contraction (white line falls to meet the blue line) or interest rates need to meaningfully rise (blue line rises to meet white). Either scenario would serve, in our mind, to upset the current market leadership and complacency.

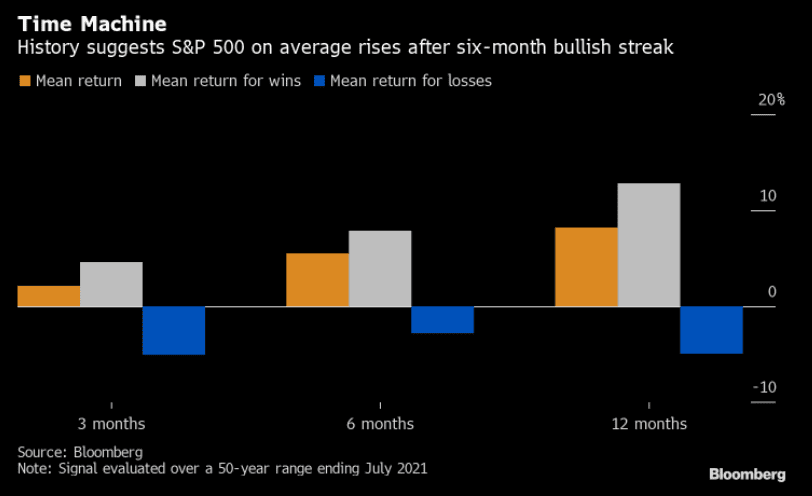

Perhaps this time is different; maybe the guns of August will be silent. Market history certainly tilts the odds in our favor as bullishness typically begets more bullishness.

Many of us who have been market participants for longer than we would care to admit tend to cite the late 1990s as being one analog for the current market. In reading More Money Than God, a history of hedge fund investing, perhaps the late 1960s is more appropriate. According to a passage on that era, “The new generation believed that financial turmoil would never rear its head again. The Fed was watching over the economy, the SEC was watching over the market, and Keynesian budget policies had repealed the tyranny of the business cycle.” That sounds awfully familiar.

Tuchman begins The Guns of August with a quote from Churchill’s The World Crisis, “the terrible ifs accumulate.” Those “ifs” are like the grains of sand we mentioned, their accumulation eventually causing a catastrophe. One of the things that made WWI such a calamity was the disconnect between the tactics and the technology, with generals using outdated tactics, given an opponent armed with machine guns, tanks, poison gas, and airplanes.

Maybe none of the ifs we have mentioned from a market perspective come to pass, or maybe they accumulate. Regardless, our portfolio construction, which relies on sophisticated, mathematical tools to control risk as opposed to outdated methods based historical relationship, is designed to avoid the type of tactical obsolescence that plagued Moltke, Joffre, and Haig.

READY TO TALK?