Lithium Americas

“What You Need to Know About Batteries, Lithium and Lithium Americas”

Click above to read the original whitepaper.

Lithium Americas: After Approval, What’s Next?

In September, 2020, we initially presented our thesis on Lithium Americas (NYSE: LAC), which was on sale thanks to Battery Day. Much has changed with the story, punctuated by the Bureau of Land Management (BLM) approval of LAC’s Thacker Pass project in Nevada (https://eplanning.blm.gov/public_projects/1503166/200352542/20033308/250039507/Thacker_Pass_Project_ROD_signed_2021-01-15.pdf.

Subject to any successful appeals by those opposed, the project has a green light to advance. As we look back to the three catalysts referenced in our initial research, this checks one of the three boxes; for a refresher, these were:

- Favorable legislation – The possibility of a “Green New Deal” is being widely discussed as part of the Biden campaign. Government programs at aimed reducing emissions and incentivizing the shift to EVs would also be a positive for LAC. In the event of a Republican victory, strategic concerns may provide additional impetus to domestic production.

- Spotlight on supply constraints – Despite the puffery at Tesla’s battery day, lithium is a potential chokepoint for achieving the vision many have for renewable energy, LAC is in a prime spot, both from an industry perspective as well as geographically.

- Approval of Thacker Pass – Perhaps the market is ignoring the company’s battery potential as it is just that: potential. Approval of the plan, including the proposed battery facility, may be a transformative event, and the clock is ticking.

The other two are in the process of coming to fruition as well. In terms of favorable legislation, the incoming Administration is emphasizing fighting climate change as a key component of its policy initiatives: https://buildbackbetter.gov/priorities/climate-change/.

We have written extensively on our enthusiasm for lithium, and what we see as the supply/demand dynamics: https://www.forbes.com/sites/forbesfinancecouncil/2020/12/04/why-lithiums-salad-days-are-ahead/?sh=1689b30d6058. Supply constraints have also been in the news, with Tesla agreeing to another supply deal; https://www.streetinsider.com/Reuters/Chinas+Yahua+agrees+five-year+deal+to+supply+lithium+to+Tesla/17763237.html

There have been other positive developments for the company, including divestment of LAC shares by Bangchak Corporation, which owned approximately 15% of LAC at the time of our initial paper. This selling pressure, which kept a lid on the stock in December, has now abated, with Bangchak now at less than 1% https://www.marketscreener.com/quote/stock/BANGCHAK-CORPORATION-34591812/news/Bangchak-Divestment-of-Shares-in-Lithium-Americas-Corp-LAC-32065210/

. LAC also raised capital through an ATM in Q4 as well to meet capital needs, modestly increasing its share count. On balance, the increase in free float makes the company more investible, not to mention opening a seat at the board table for a potential strategic partner on Thacker Pass, as we have seen with Ganfeng at LAC’s other project, Cauchari in Argentina.

We were disappointed to see the company remove its proposed battery plant from its mine plan of operation filed with the BLM; we thought this endeavor had the potential to truly transform the company from a valuation perspective. However, perhaps its omission portends a future strategic partnership for Thacker Pass is already in the works with a major player:

Valuation – More Visibility and Enthusiasm Leads Us to Increase Our Targets

As we revisit valuation, we look again to comparable companies and our own estimates of net present value. First, comparable companies. The closest comp is the current valuation being ascribed to Piedmont Lithium, Ltd. (NASDAQ: PLL), which carries a market cap of $569M. For those who may remember, it was PLL’s deal with Tesla, combined with the comments about the ease of producing lithium, that sank most lithium producers (excluding PLL) post Battery Day. Like LAC, PLL has assets located in the United States (in North Carolina, to be precise) making it attractive as the U.S. moves toward insourcing critical raw materials. However, PLL’s project has not yet been approved, and accordingly carries a higher risk profile. Moreover, the company recently made an acquisition viewed by lithium industry experts we respect as being, perhaps, ill advised. Regardless, based on our back of the envelope math, its valuation is roughly equivalent on a proposed production basis to the Wodgina acquisition we mentioned in our original LAC thesis; recall the Wodgina acquisition was made at a time when lithium prices were at their peak. (source: https://d1io3yog0oux5.cloudfront.net/_6f86137dbf0fe15ab0e8643c4e3c2daf/piedmontlithium/db/299/2639/pdf/2146123.pdf

It is important to note PLL’s project has yet to clear the regulatory hurdles cleared by Thacker Pass, has a shorter life (25 years), and is smaller (targeting 23k tons of lithium hydroxide per year). Applying LAC’s metrics for Thacker (41 years useful life and 60 ktpa) and using the valuation ascribed to PLL’s proposed output, we get a $2.3 billion valuation for LAC, or approximately $26, just for Thacker Pass. Cauchari, which is substantially de-risked and should begin production in early 2022 is worth about 1/3 of this value, when discounting for its joint ownership, political risk, and brine-based process. Just the same, this would put LAC’s value at approximately $35.

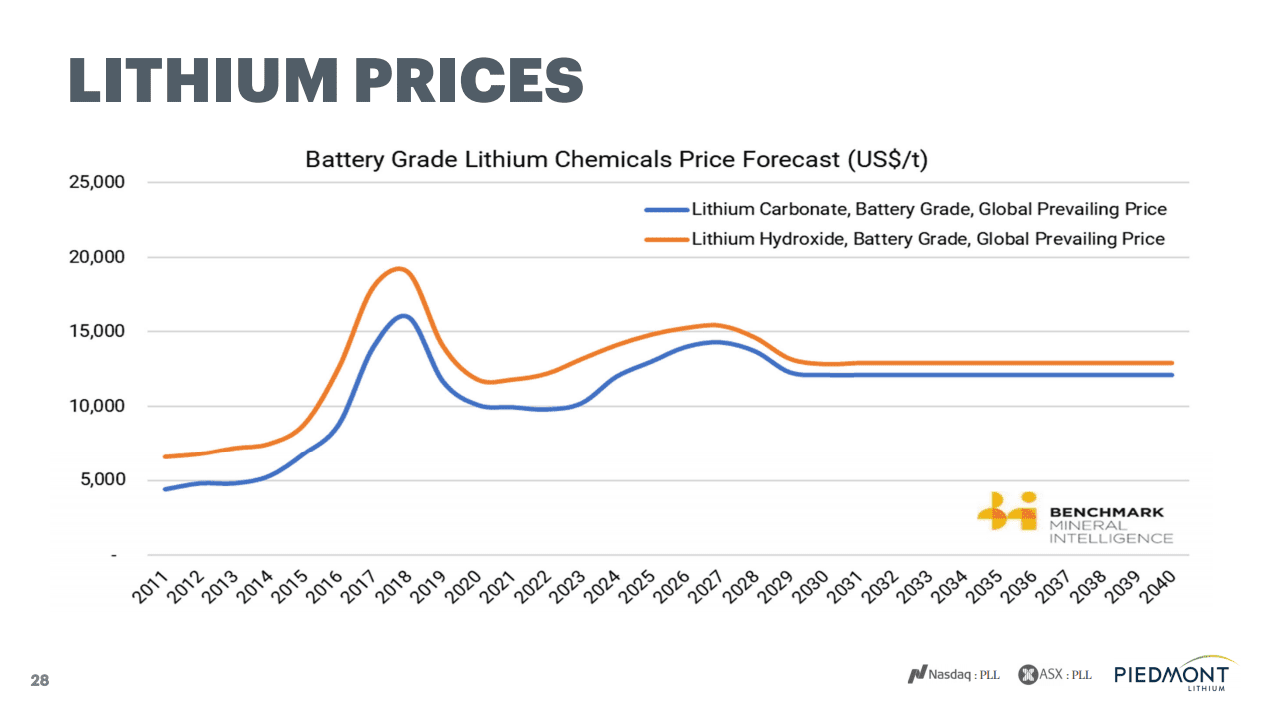

Using net present value of estimated future cash flows, we derive a conservative value of around $23 per share. The only major change from our prior estimate here was reducing the discount rate from 15% to 10%, given the reduced risk associated with BLM approval. We assume lithium prices at a stable $12k, in-line with the company’s assumptions as the price for lithium carbonate (as well as long-term assumptions per the Benchmark estimates in the preceding graph), which is well below the peak of $17k in 2018 though above current spot rates. We also assume LAC has to concede some of the economics from Thacker Pass to a joint venture partner, as it did with Cauchari; we assume 50% in our base case.

However, this may be an overly pessimistic view. With the market’s enthusiasm for all things green energy related, LAC’s stock price is far higher than when it negotiated its deal with Ganfeng. This has reduced LAC’s cost of capital, so it has options. Moreover, it is in a stronger strategic position with Cauchari production imminent (revenue and cash flow are helpful, obviously) and Thacker Pass approved, and more important than ever, given its location.

Below, we look at different potential deal structures (equity raise based on LAC’s closing price as of 1/15/21) to go it alone on Thacker Pass versus a joint venture where LAC gives up revenue to a partner) at different price levels. We think dilution between 10% and 15% would likely be required to fund Thacker Pass.

| Lithium Price | Stock Dilution | |||

| (in k; LCE) | 5% | 10% | 15% | 20% |

| $10.0 | 25 | 24 | 23 | 22 |

| $12.0 | 34 | 32 | 31 | 29 |

| $13.5 | 40 | 39 | 37 | 35 |

| $17.0 | 56 | 53 | 51 | 49 |

| Lithium Price | JV Stake (Thacker) | |||

| (in k; LCE) | 10% | 25% | 33% | 50% |

| $10.0 | 24 | 22 | 20 | 17 |

| $12.0 | 33 | 29 | 27 | 23 |

| $13.5 | 39 | 35 | 33 | 28 |

| $17.0 | 55 | 48 | 45 | 38 |

| * Price estimates includes current economics of Cauchari | ||||

What we see is an asymmetrically skewed risk reward profile over the intermediate term, i.e., three to five years. As long as prices do not revert back to an oversupplied situation, i.e., $10k, LAC has upside. Even a small increase (10%) in LCE prices (up to $13.5) offers material upside for LAC’s share price. Were we to get a spike to prior highs (not without precedent and unable for the market to address with alacrity, given the lack of investment we have seen) there is significant additional upside for LAC. As Joe Lowry stated on a recent podcast regarding a mismatch between supply and demand, “I think we have the perfect storm coming.”

Clearly, there is a lot of good news in the stock price for LAC right now (as well as for most of the electric vehicle space and its supply chain). However, we have yet to see larger generalist institutions start to add exposure to names like LAC. Moreover, as investors shift toward more ESG-friendly stocks, demand may persist. Finally, should we get a spike in lithium prices as demand steadily increases and supply is unable to move as quickly, stock prices may show similar price action as investors extrapolate current prices well into the future.

DISCLOSURES

General Firm

Formidable Asset Management, LLC (Formidable) is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. Although taken from reliable sources, Formidable cannot guarantee the accuracy of the information received from third parties.

The opinions expressed herein are those of Formidable and may not actually come to pass. This information is current as of the date of this material and is subject to change at any time, based on market and other conditions. Any index performance cited or used throughout is intended to illustrate historical market trends and performance. Indexes are managed and do not incur investment management fees. An investor is unable to invest in an index. The performance shown may not reflect a Formidable portfolio.

Past performance is no guarantee of future results.

Reader should assume that future performance of any specific investment or investment strategy (including the investments and/or investment strategies discussed in these materials) made reference to directly or indirectly in these materials will be profitable or equal the corresponding indicated performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable. Historical performance results for investment indices and/or categories generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results.

Specific Securities

The mention of specific securities and sectors illustrates the application of our investment approach only and is not to be considered a recommendation by Formidable. The specific securities identified and described above do not represent all of the securities purchased and sold for the portfolio, and it should not be assumed that investment in these securities were or will be profitable. There is no assurance that the securities purchased remain in the portfolio or that securities sold have not been repurchased. Charts, diagrams and graphs, by themselves, cannot be used to make investment decisions. You may contact Formidable Asset Management, LLC for a full list of recommendations made during the preceding period one year

Not an Offer

These materials do not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or any other product or service by Formidable or any other third party regardless of whether such security, product or service is referenced here. Furthermore, nothing in these materials is intended to provide tax, legal, or investment advice and nothing in these materials should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. Formidable does not represent that the securities, products, or services discussed here are suitable for any particular investor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your personal investment objectives, financial circumstances and risk tolerance. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation.

The opinions expressed here are those of Will Brown and Adam Eagleston are not intended as investment advice. They are also subject to change with changing market conditions. Clients of Formidable may have positions in securities discussed in this article. This writing is for informational purposes only—Formidable and the authors expressly disclaim all liability in respect to actions taken based on any or all of the information from this writing.

READY TO TALK?